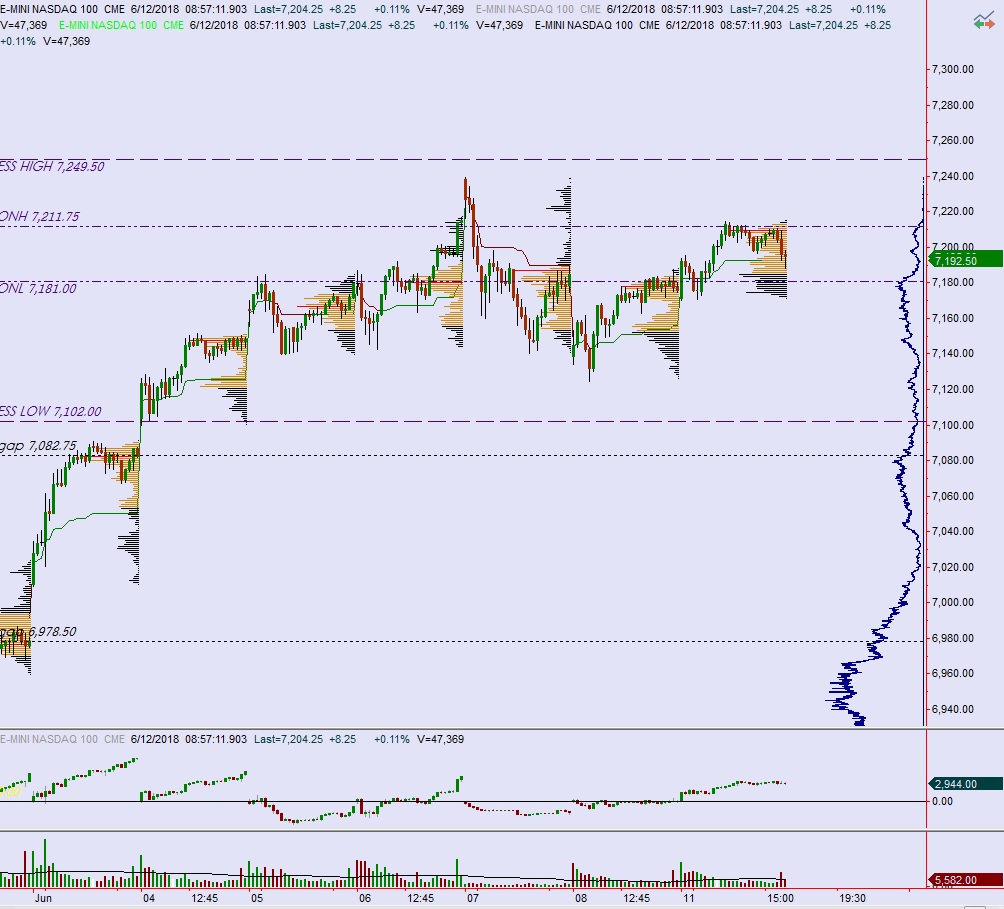

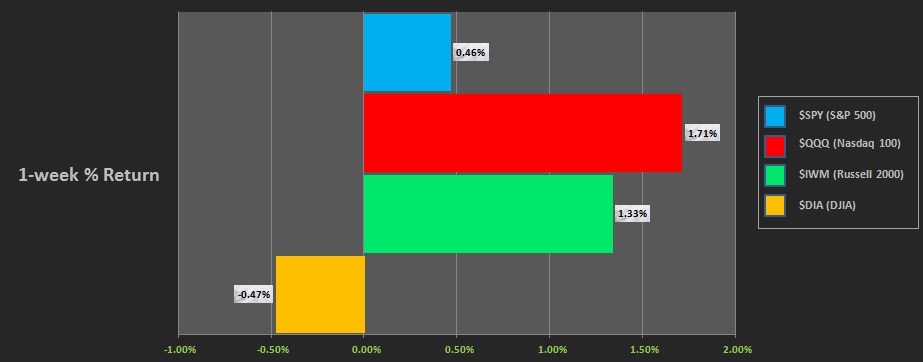

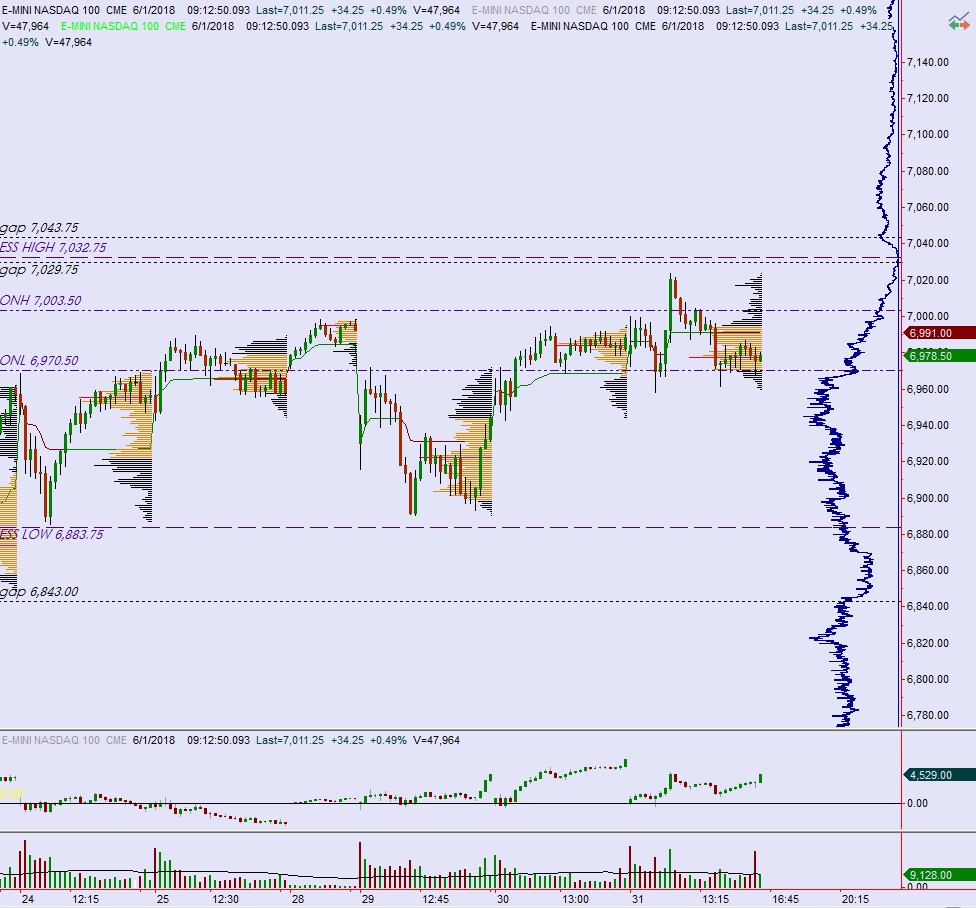

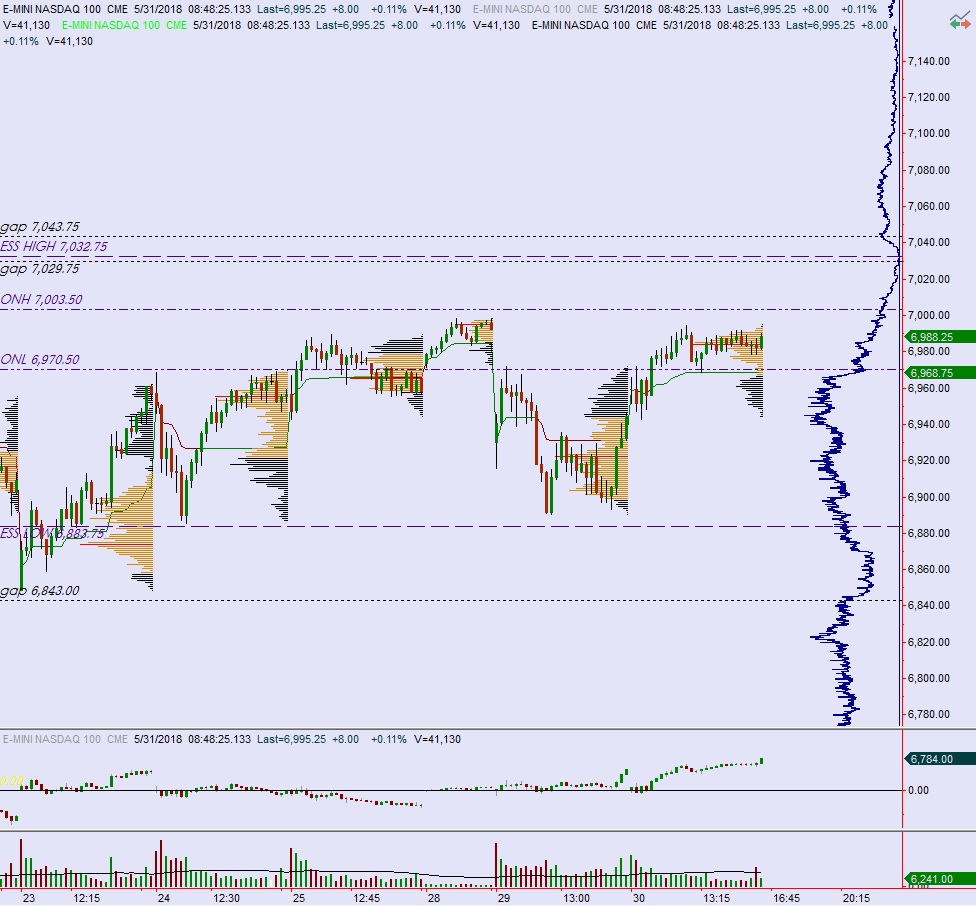

NASDAQ futures are coming into Tuesday flat after an overnight session featuring normal range on elevated volume. Price worked sideways overnight, holding Tuesday range during a balanced trading session. At 8:30am CPI data was inline with expectations.

Also on the economic calendar today we have a 4-week T-bill auction at 11:30am, a 30-year bond auction at 1pm, and a monthly budget statement at 2pm.

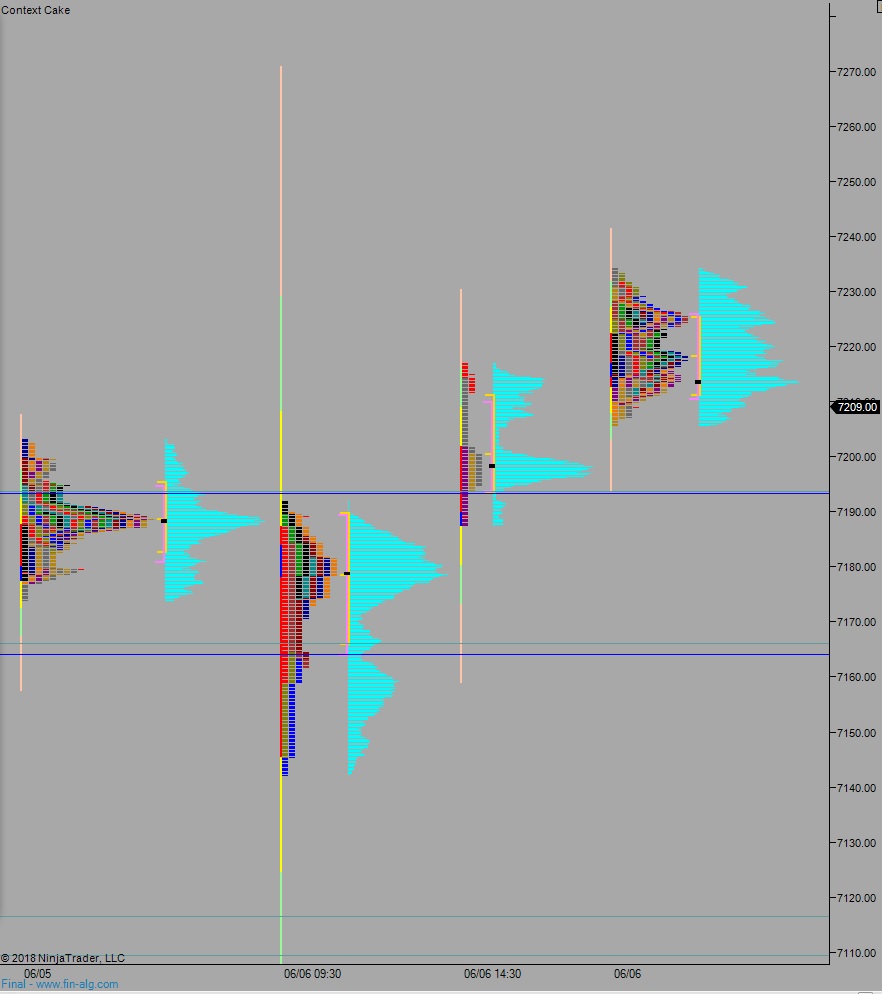

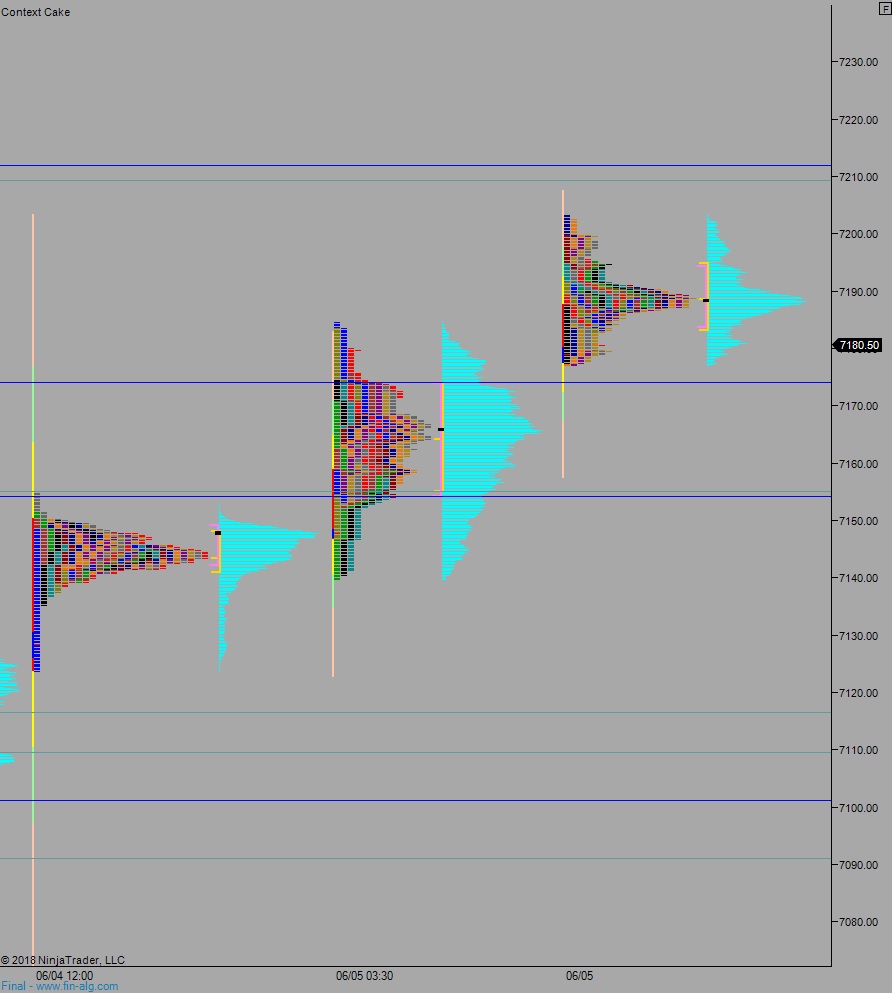

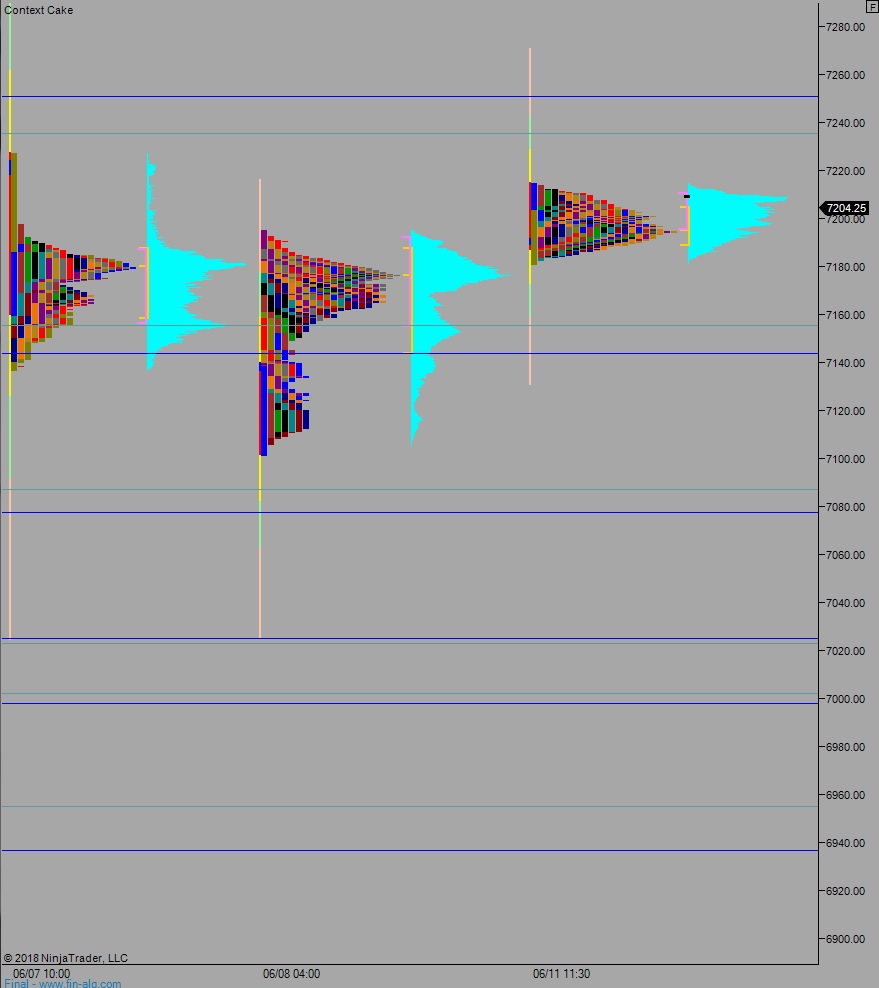

Yesterday we printed a normal variation up. The day began with a slight gap down and buyers quickly driving up into it. Then, after a consolidation drift lower was unable to take out IB-low, a secondary, initiative wave of buying stepped in, pushing us RE up. We spent the rest of the day churning along the 7200 century mark.

Heading into today my primary expectation is for buyers to work up through overnight high 7211.75 setting up a move to target 7235.75 before two way trade ensues.

Hypo 2 sellers push down through overnight low 7181 setting up a move to target 7155.50 before two way trade ensues.

Hypo 3 stronger buyers press up to 7250 before two way trade ensues.

Overall not expecting much movement with the FOMC meeting beginning today. We are likely to enter a holding pattern until the Wednesday afternoon Fed rate decision.

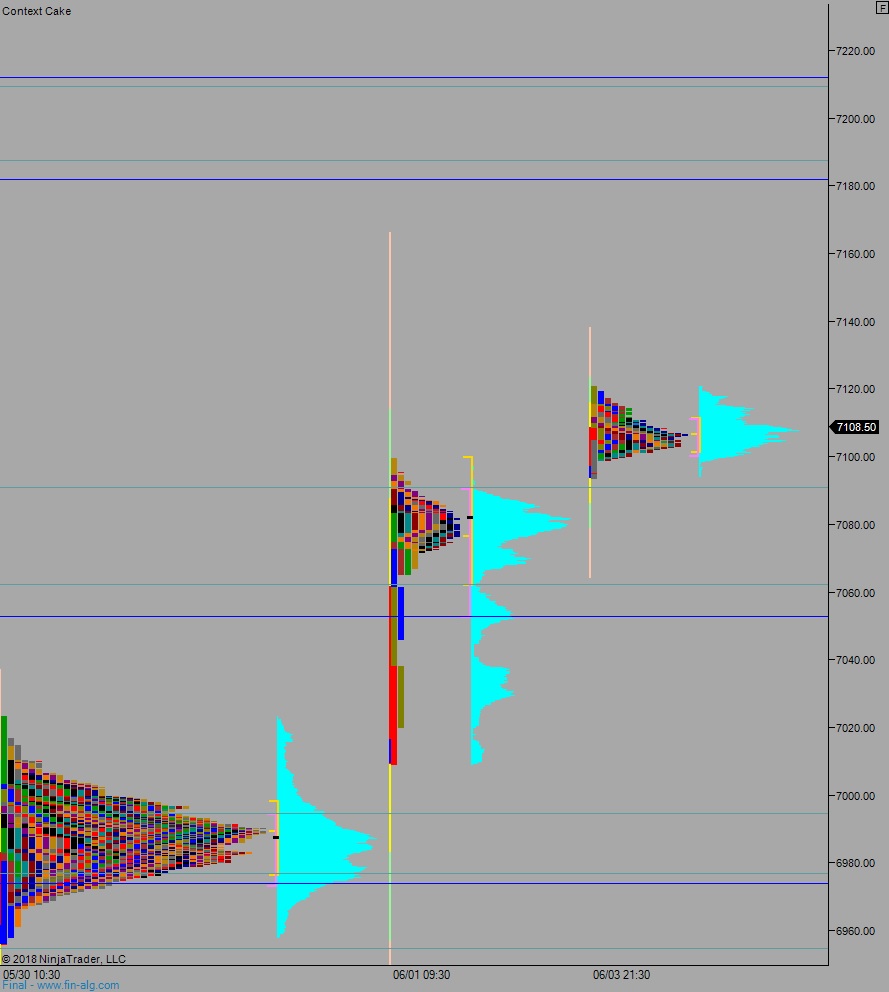

Levels:

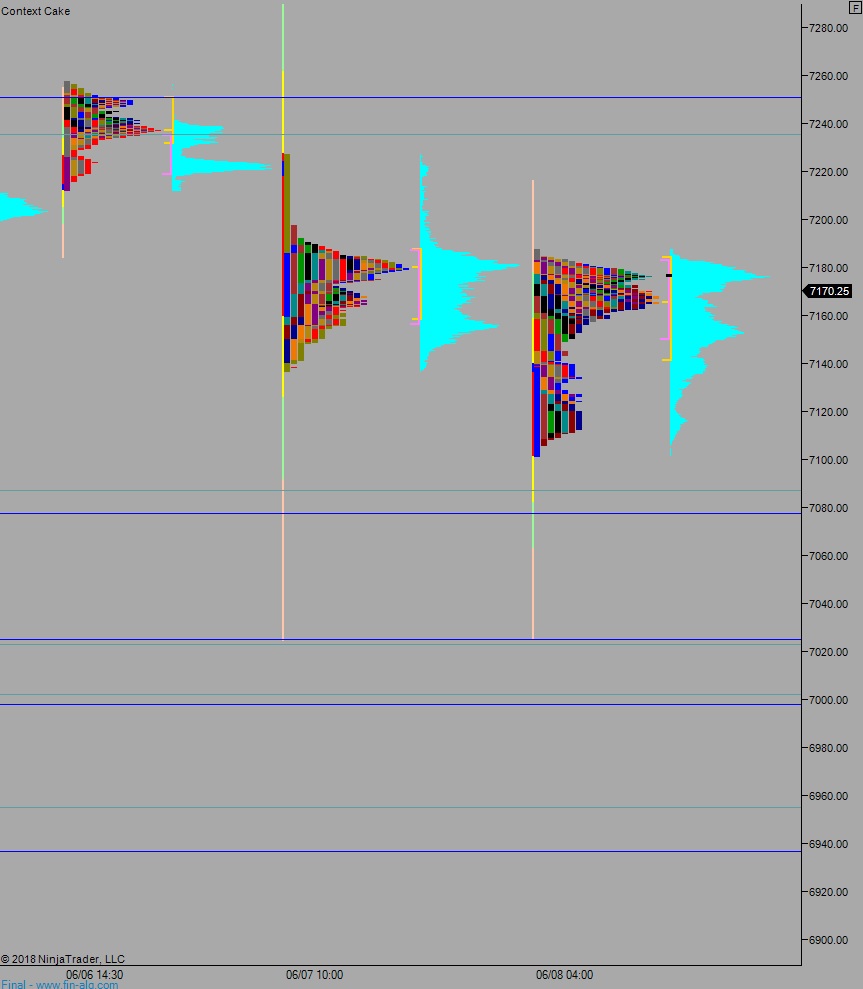

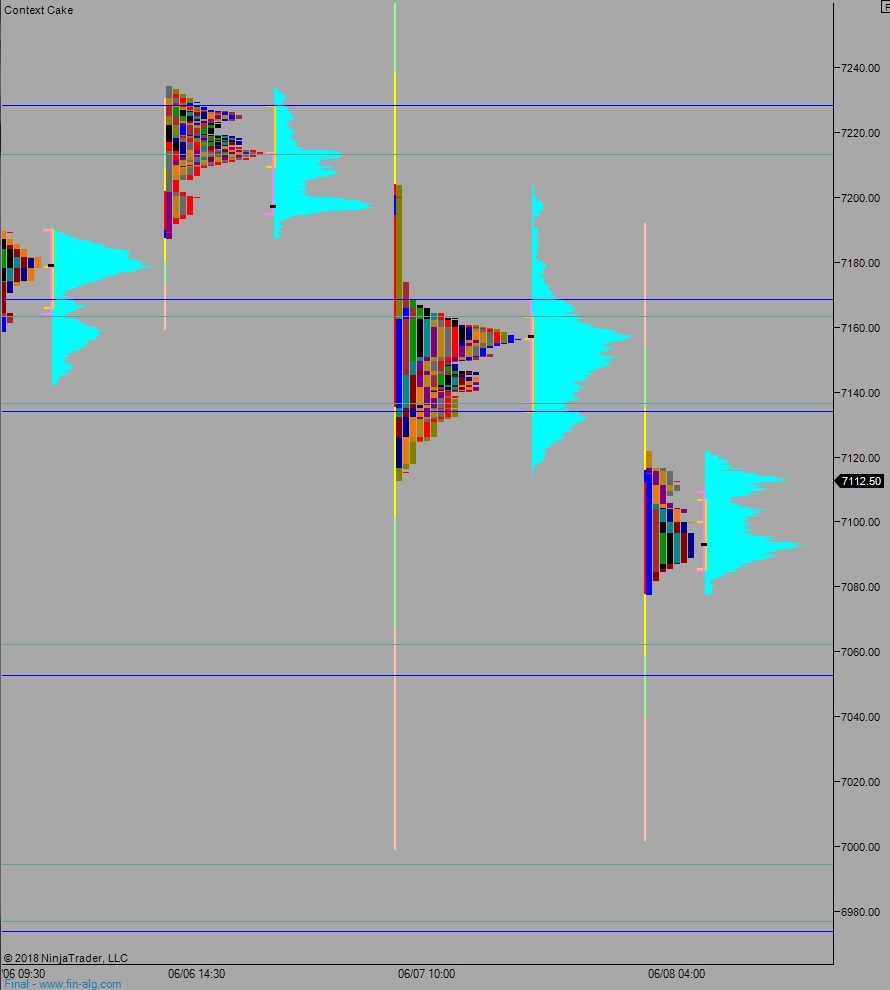

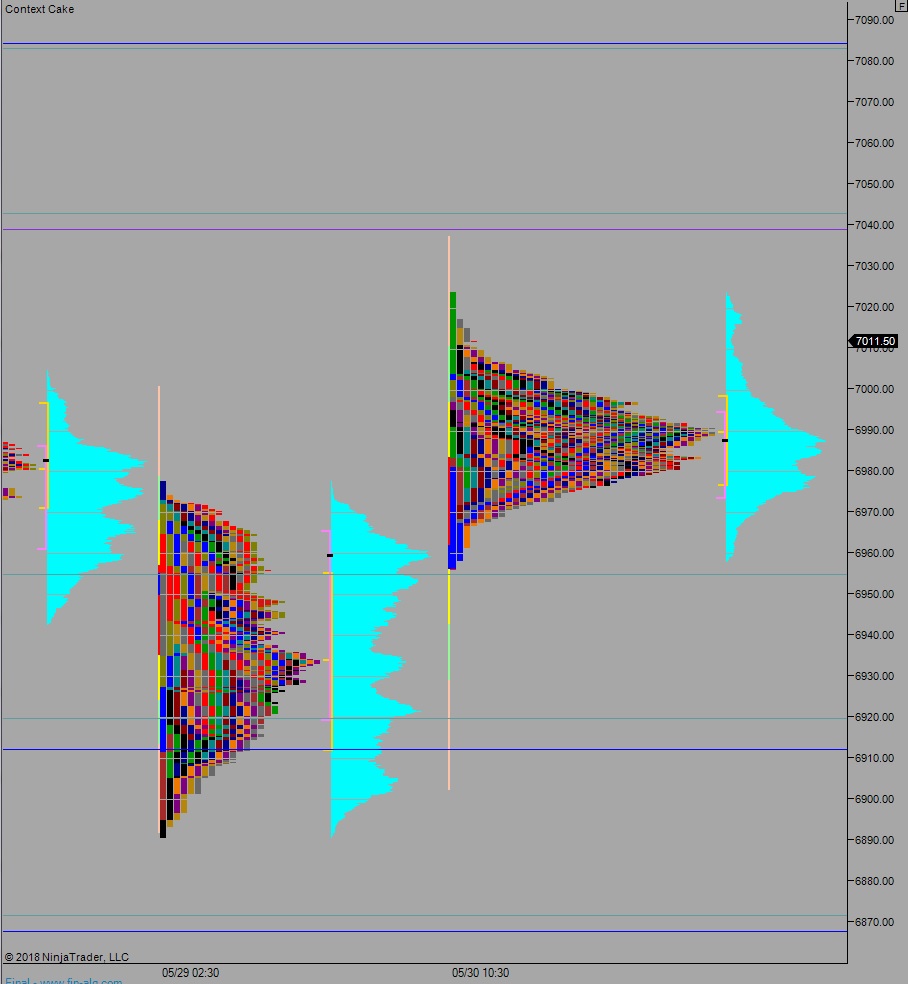

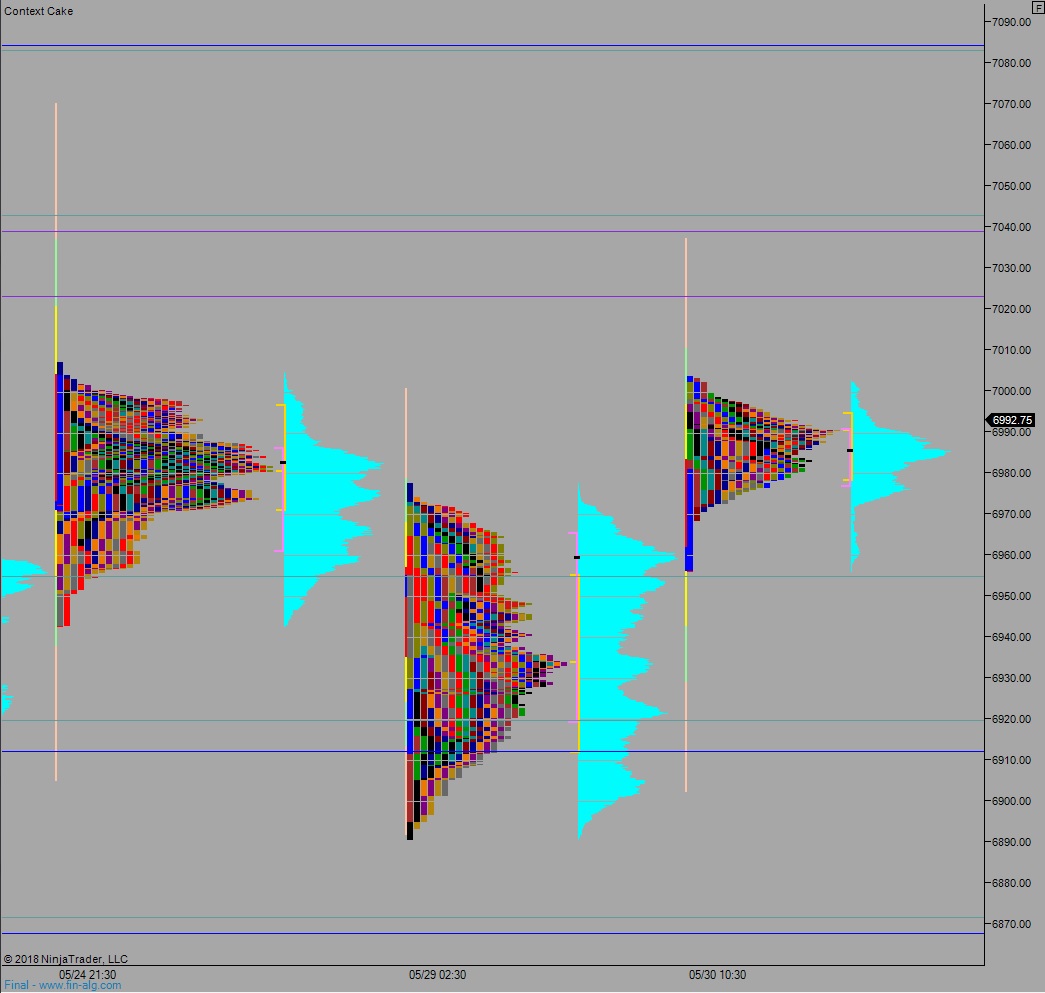

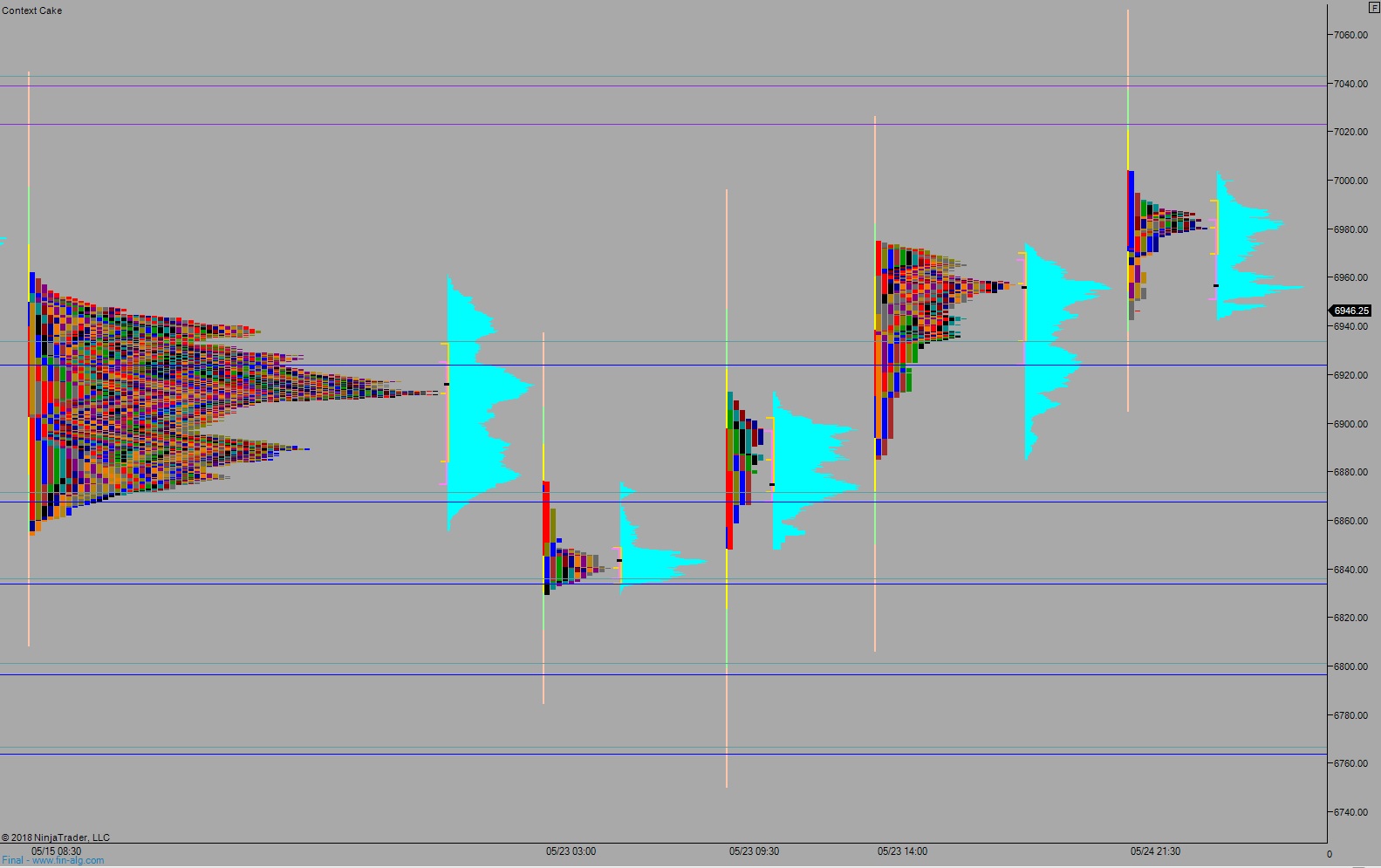

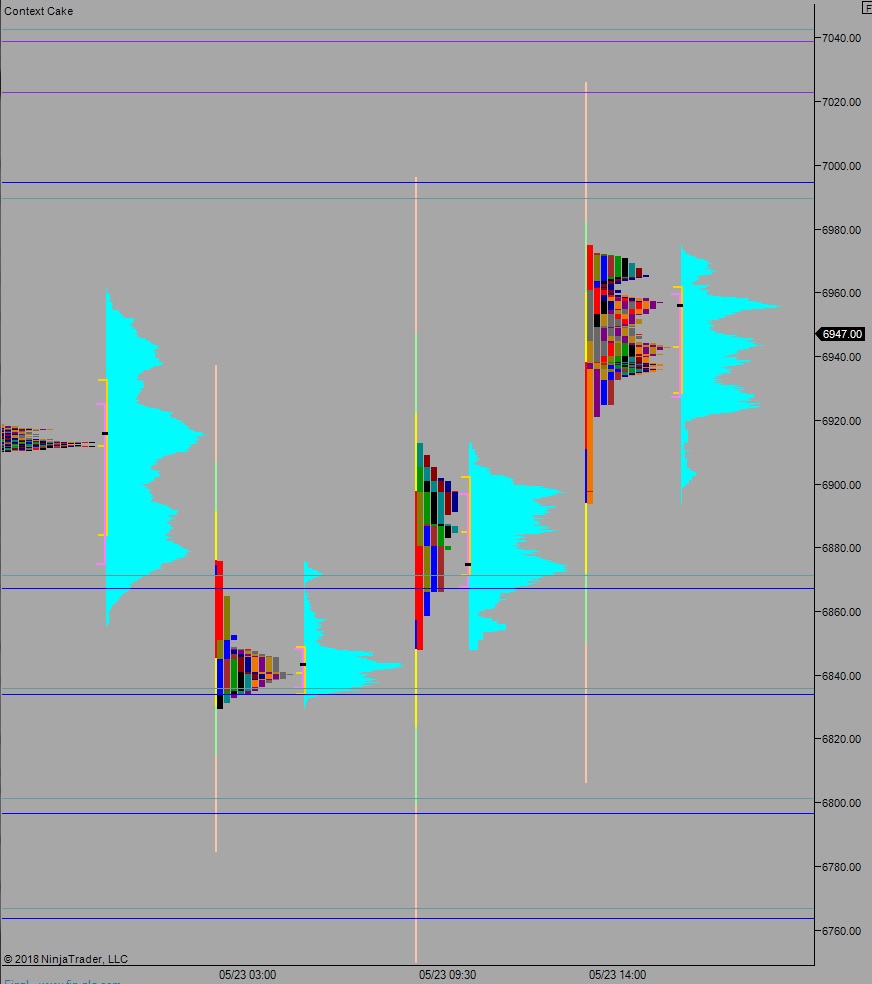

Volume profiles, gaps, and measured moves: