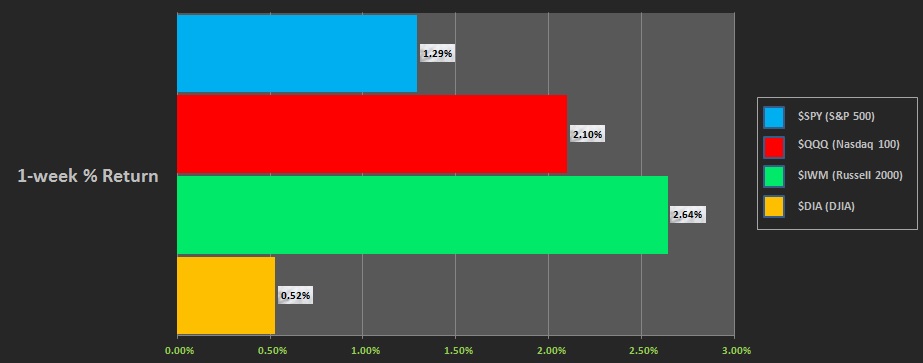

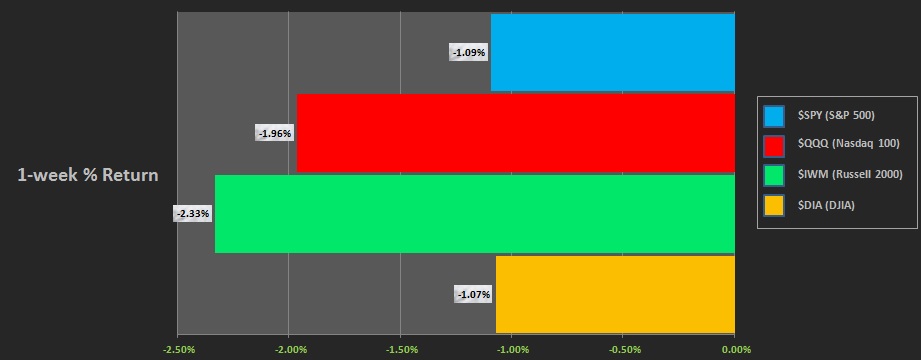

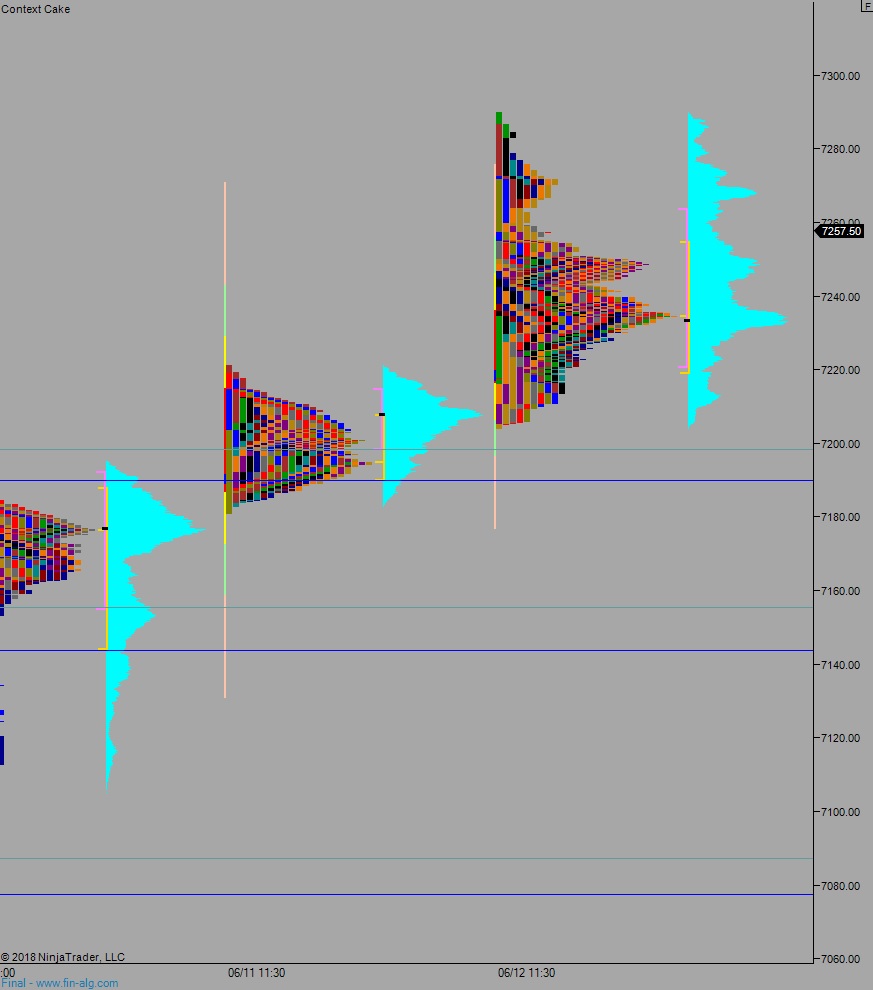

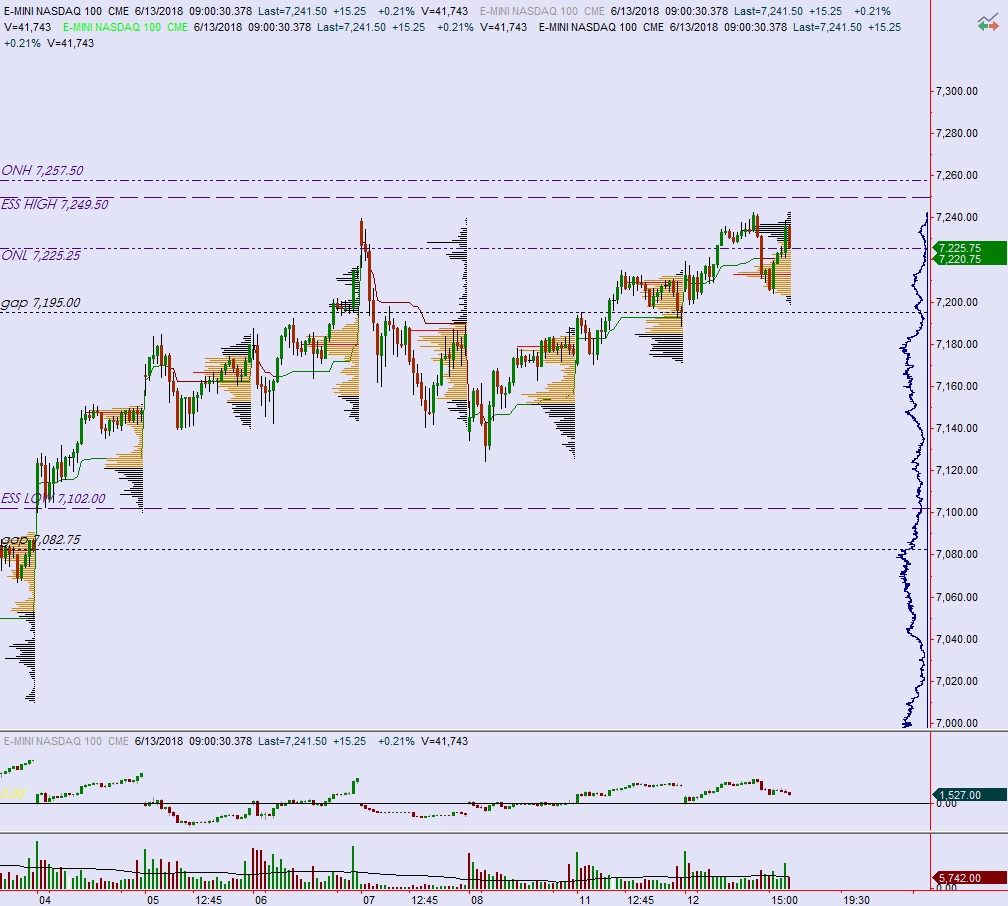

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring elevated range and volume. Price worked higher overnight, stopping just one point shy of making a new record high. As we approach cash open, price is hovering above the Monday range.

On the economic calendar today we have a 4-week T-bill auction at 11:30am and a 3-year note auction at 1pm.

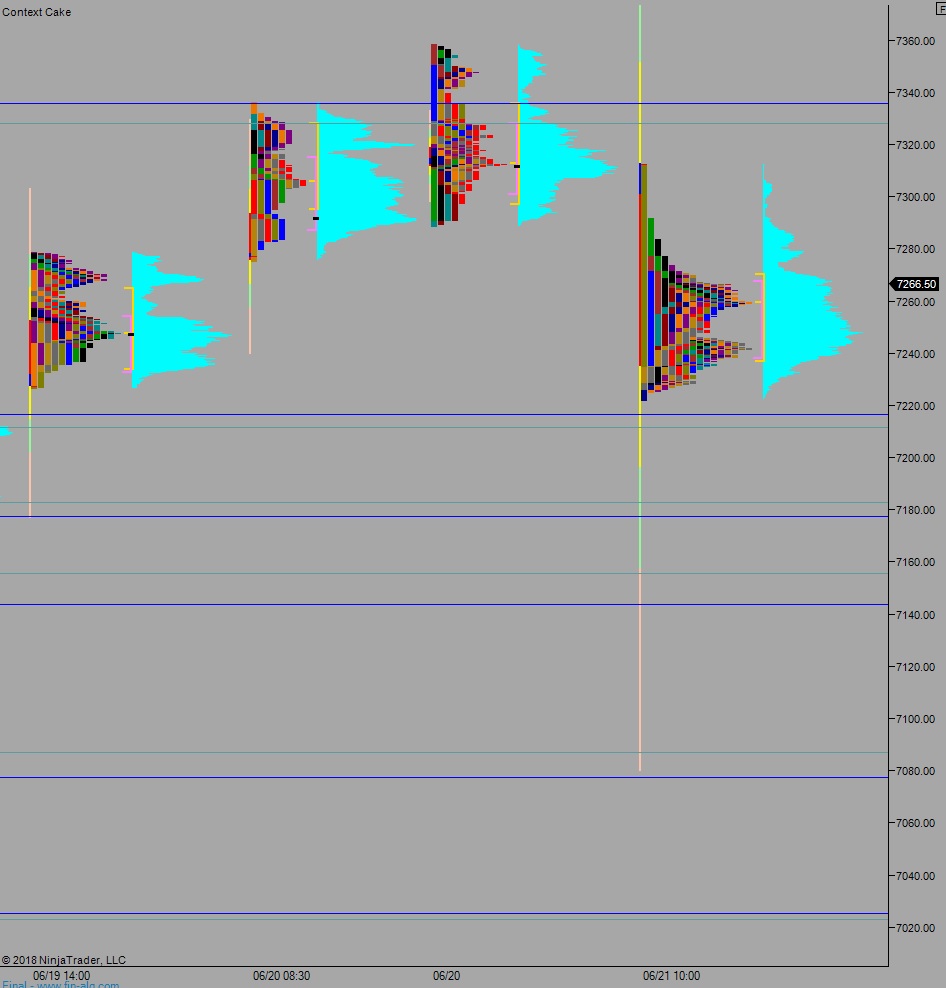

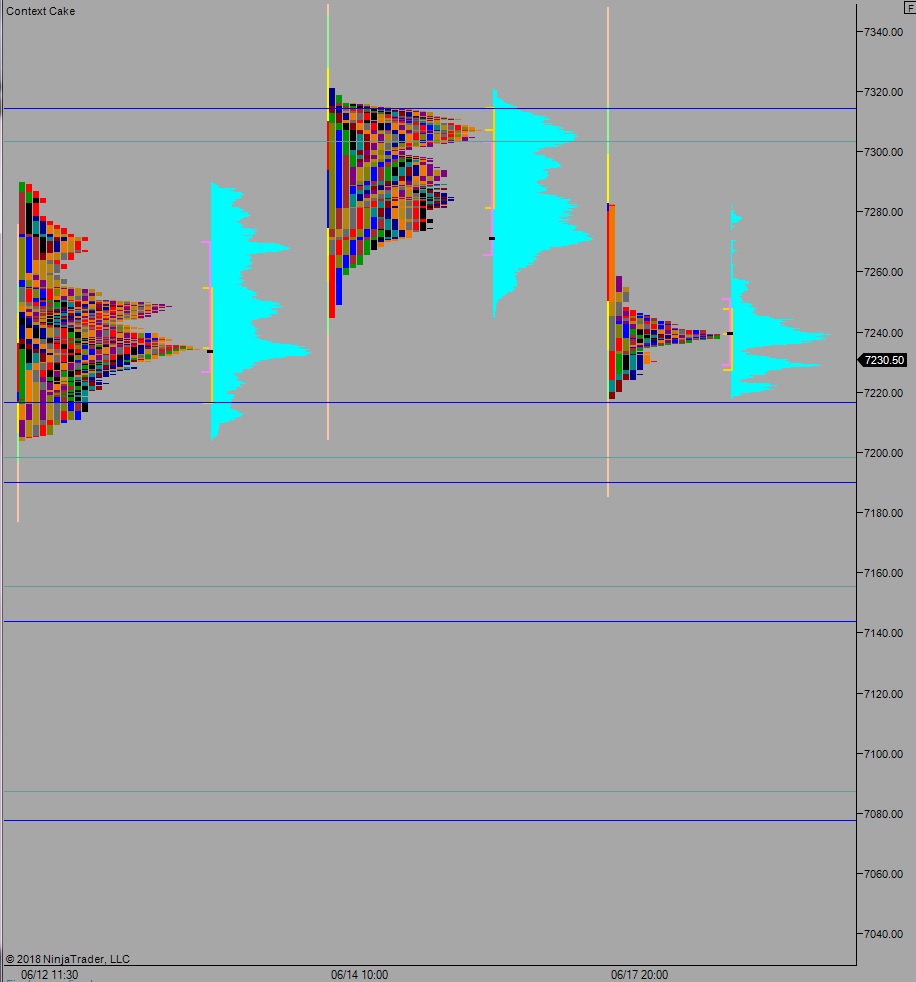

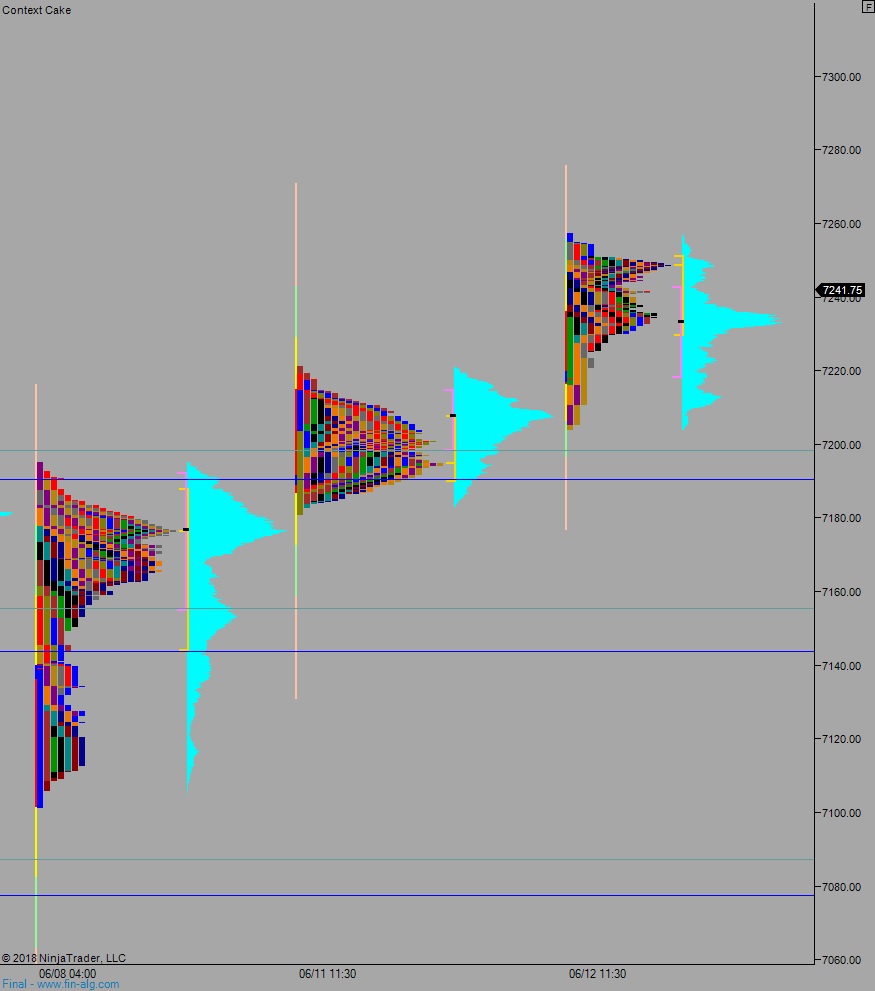

Yesterday we printed a normal variation up. The day began with a gap up-and-out-of range which sellers pushed into after a morning two-way auction. Sellers were unable to reclaim the Friday range though, instead responsive buyers (responsive relative to the Monday open, initiative relative to the Friday close) rejected the attempt well ahead of Friday’s range. We then spent the rest of the day auctioning higher trading into the upper quadrant of 6/21’s liquidation day.

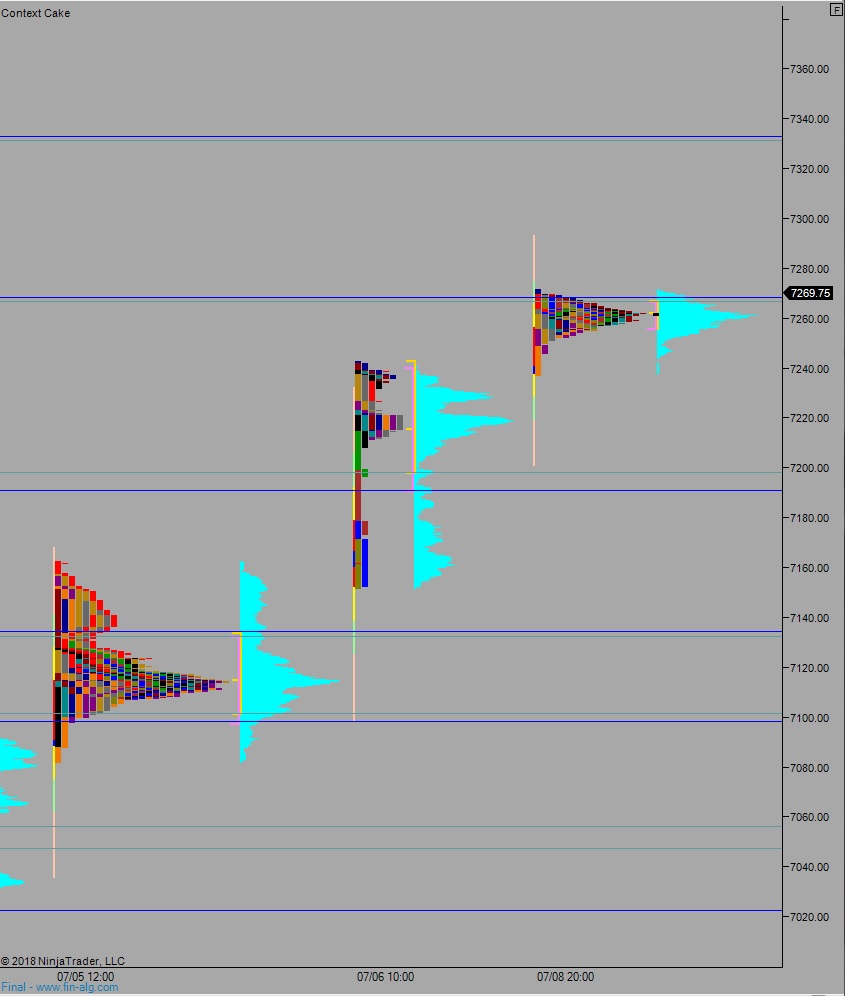

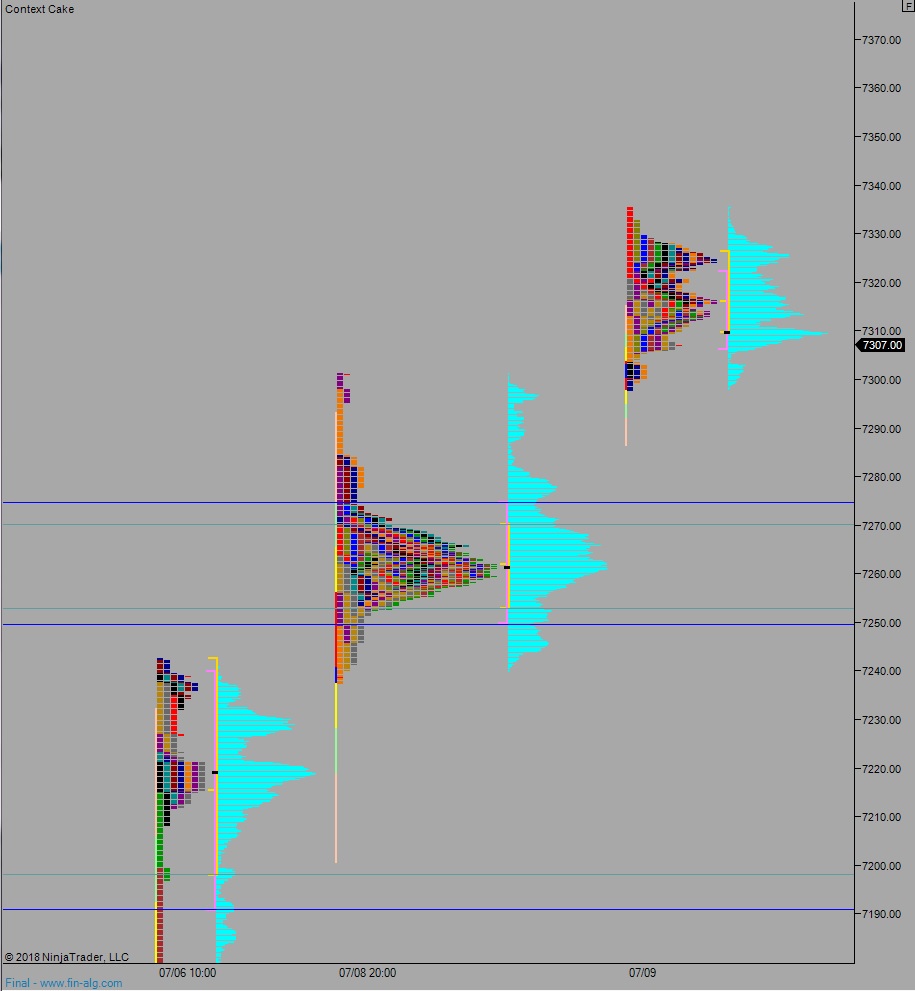

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7301. From here we continue lower, down through overnight low 7295.25. Look for buyers down at 7274.75 and two way trade to ensue.

Hypo 2 buyers reject an attempt to close the overnight gap, setting up a move to take out overnight high 7335.50. Look for sellers up at 7338.25 and two way trade to ensue.

Hypo 3 strong buyers sustain trade above 7338.25 setting up a move to target 7400.

Levels:

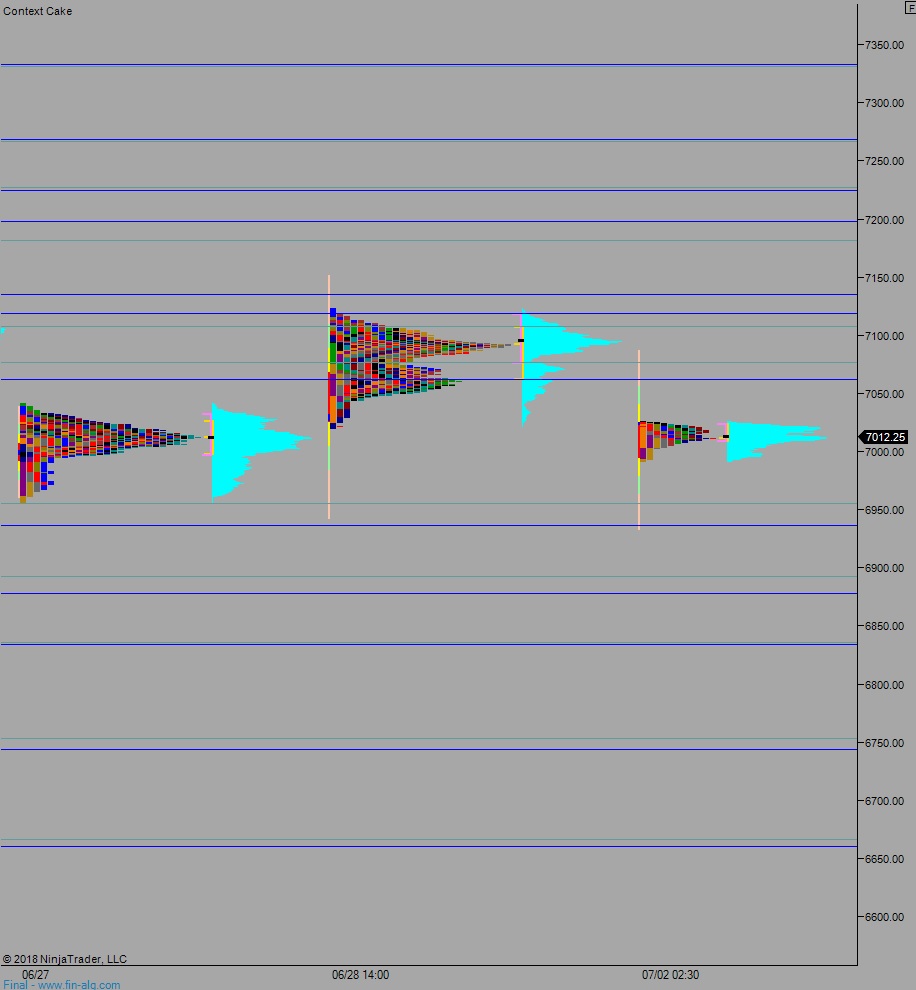

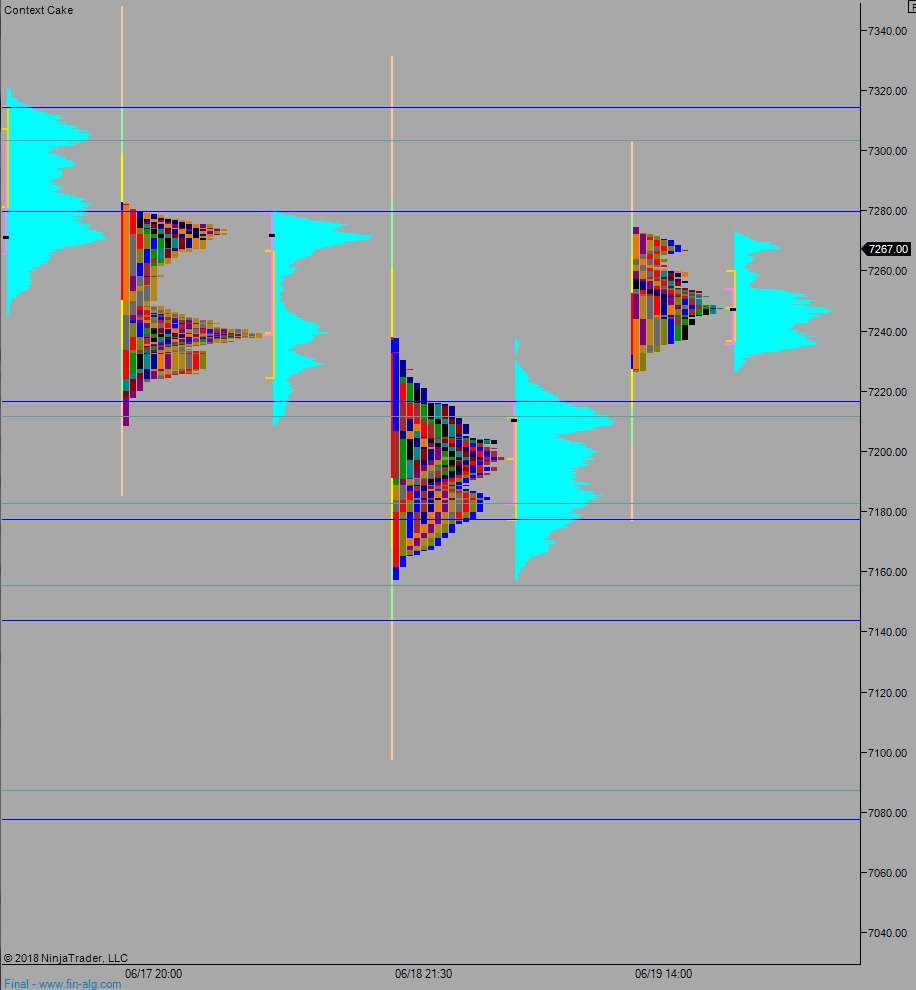

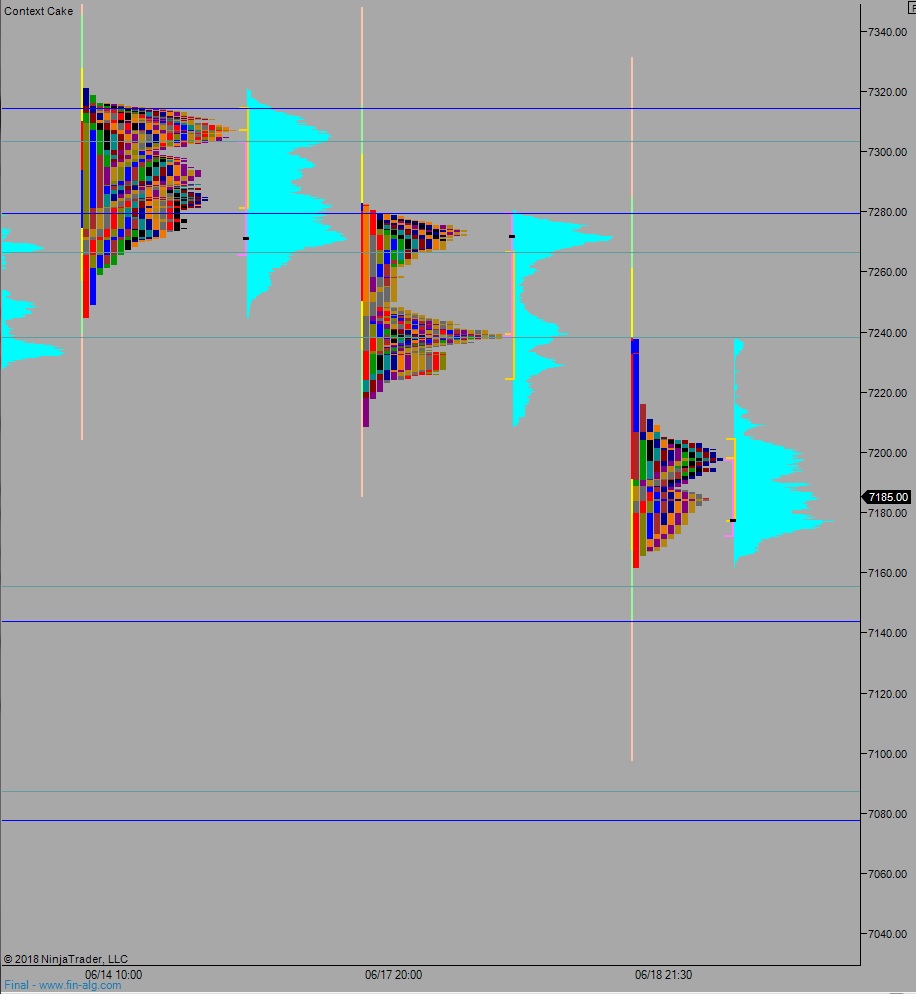

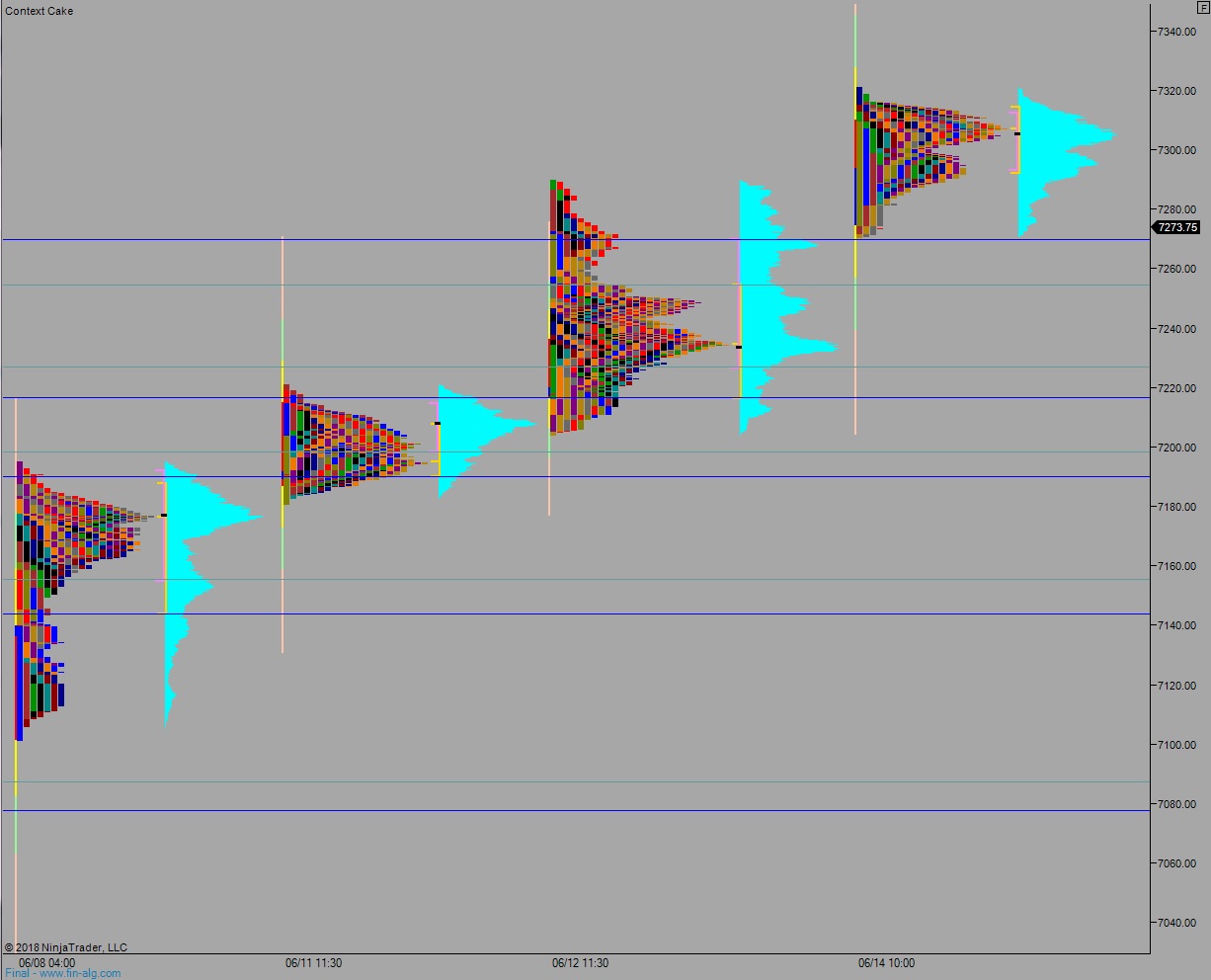

Volume profiles, gaps, and measured moves: