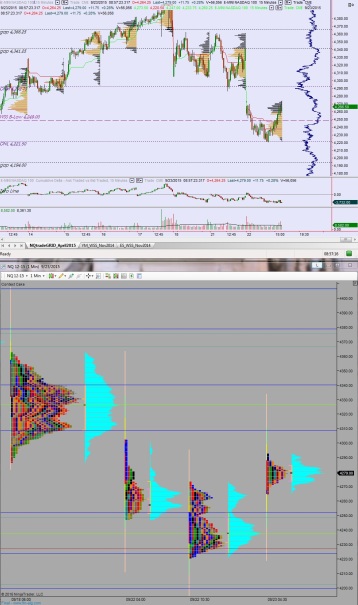

We are coming into the midweek trade gap up after NASDAQ futures had a busy globex session. Trade began yesterday afternoon lurching lower and taking back most of the late-day rally. Price pushed down near Tuesday’s low, but was unable to push through it (ledge). As the clock turned to Wednesday buyers came in and we spent the rest of the session working higher and managed to push into Monday’s range before balancing out. The volume print overnight is elevated-but-not-quite extreme on the 23rd sigma range. At 7am MBA Mortgage Applications came in much stronger than expected. Third reaction to the numbers is a buy.

At 9:45 am we will hear Markit Manufacturing PMI. This early data may lead to choppy opening trade.

Yesterday price opened pro gap down and after a two-way, open action sellers worked the index lower. We managed to push down and close the open gap from 09/03 which aligned with a contextual ledge. We then spent the afternoon rallying higher and by the close we formed a weak, double top at 4273.50. The session also had the highest NAS TRIN readings I have ever seen–peaking out near 135. This typically occurs at-or-near inflection points from my observation.

Heading into today, my primary expectation is for seller to work into the overnight inventory and close the gap down to 4266.50. Look for sellers to continue pushing to target 4250 where buyers step in. Then look for buyers to target overnight high 4292.75 with a stretch target of Monday gap fill up at 4341.25.

Hypo 2 buyers gap-and-go up, take out overnight high 4292.75 early, and set their sights on Monday gap fill up to 4341.25 with a stretch target of Fed Rate gap up at 4366.25.

Hypo 3 sellers work us down to close the gap to 4266.50, down through 4250, and continue pushing to target 4237.25. Some churn but now put the overnight low 4221.50 at risk, which is the ledge, which, if breaks look for a liquidation down to 4200.

Risk is high, if you cannot tell from these hypos. Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

Great call on the primary hypo! market seems slower today, though….like everyone waiting for the next tweet to drop

::drops tweet::