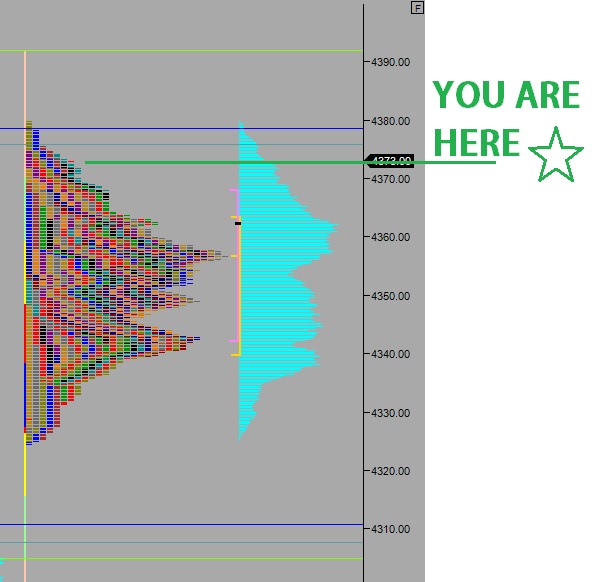

The NASDAQ printed a normal and balanced globex session, where price managed to hold the upper half of yesterday’s range on normal volume. Price also exceeded yesterday’s high, albeit briefly, and as we approach cash open buyers are working back toward this high mark. At 8:30am Housing Starts data came out way above expectations while Building Permits were well below expectations.

There are no other economic events on the calendar today.

Yesterday we started the week with a gap down which buyers quickly ate up. They continued their buying through much of the morning and lunch before responsive sellers stepped in, about 6 handles above overnight high. Sellers made a push just beyond the mid but could not push the profile neutral. Instead they found responsive buyers (responsive relative to the mid, initiative relative to the open) who then worked price back up to the high by closing bell.

Heading into today, my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4454.50. From there look for a run at overnight high 4456. Look for buyers to stall out at 4467.75 and price to traverse the whole range and take out overnight low 4438.25 before two-way trade ensues.

Hypo 2 sellers push down off the open and take out overnight low 4438.25. Some time is spent at 4433 before another leg of selling washes in and pushers us down to 4408. Look for responsive buyers here and two way trade.

Hypo 3 ferocious buying. Take out overnight high 4456 early and overtake and sustain trade above 4470. Look for a leg up to target 4488.50.

Levels:

Comments »