“No man is wiser than Socrates. But if no man is wiser than the man who knows he is without wisdom, it seems to follow that “learned ignorance” is the only wisdom that man can have.” -Socratic Ignorance

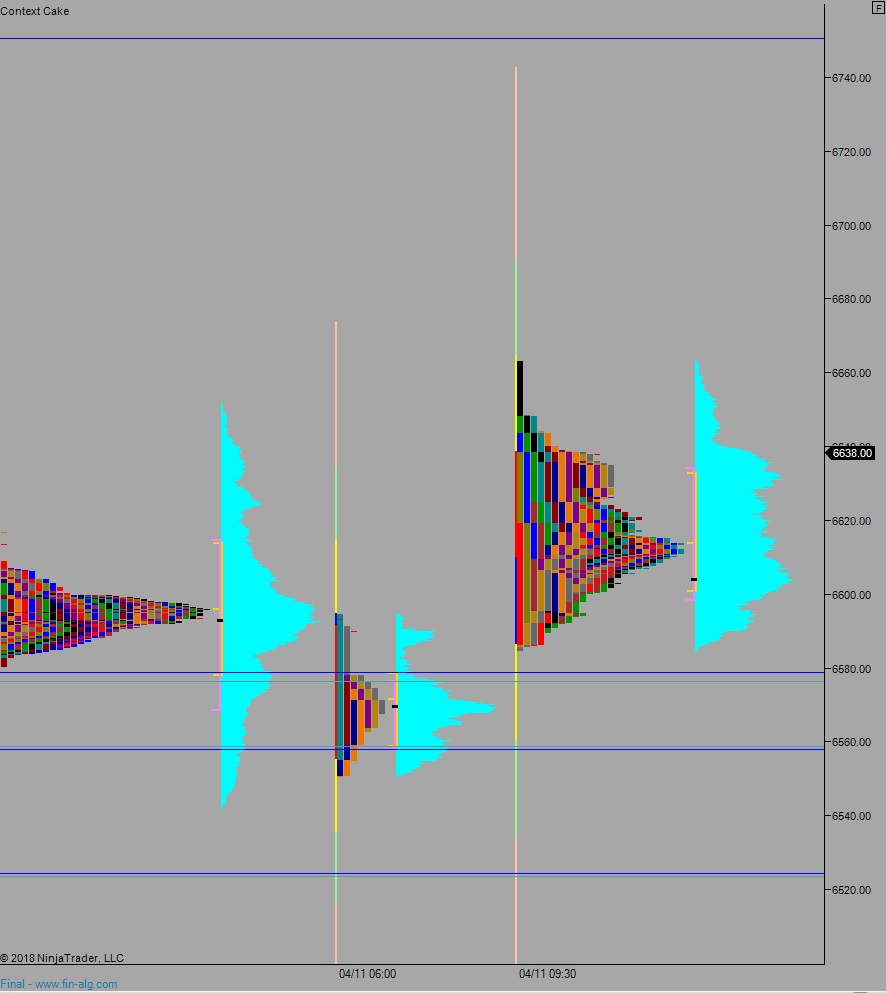

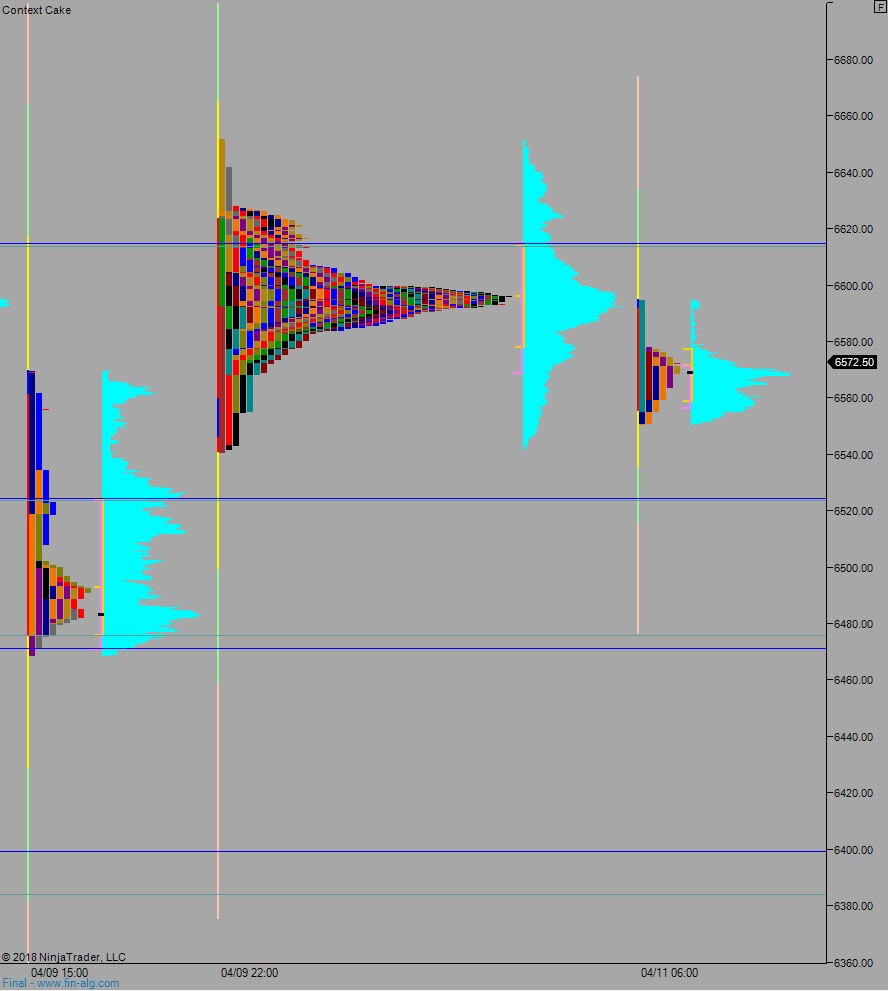

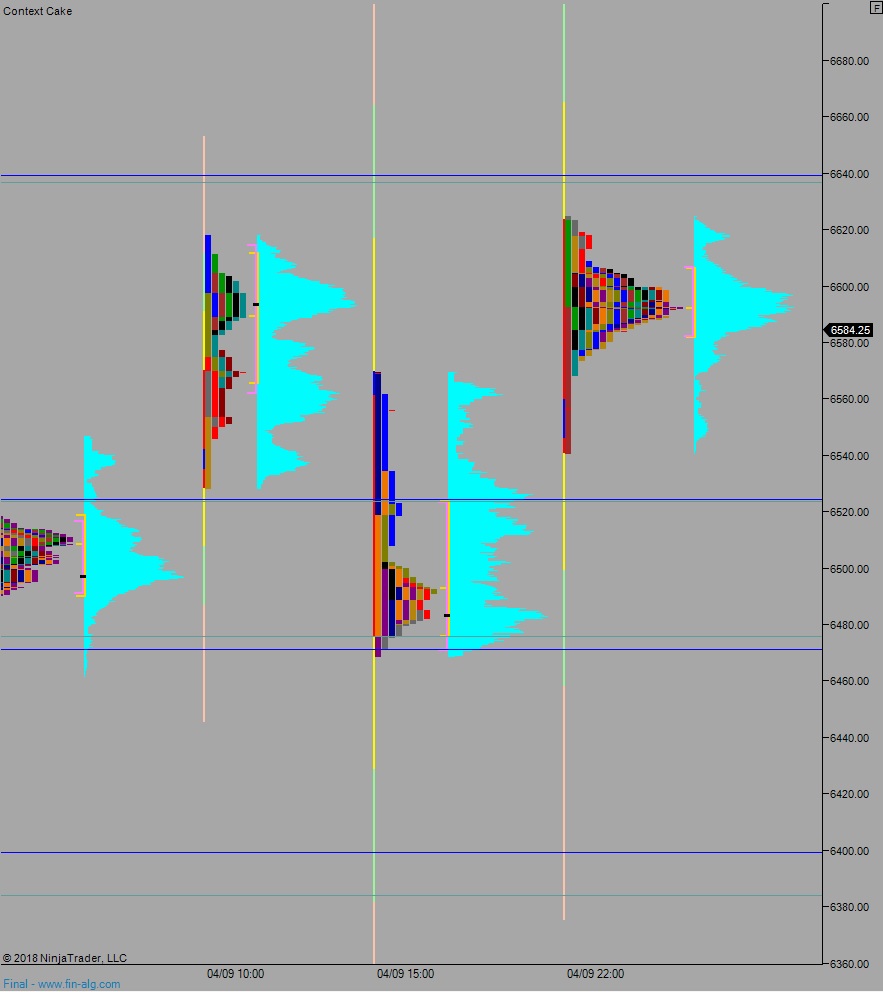

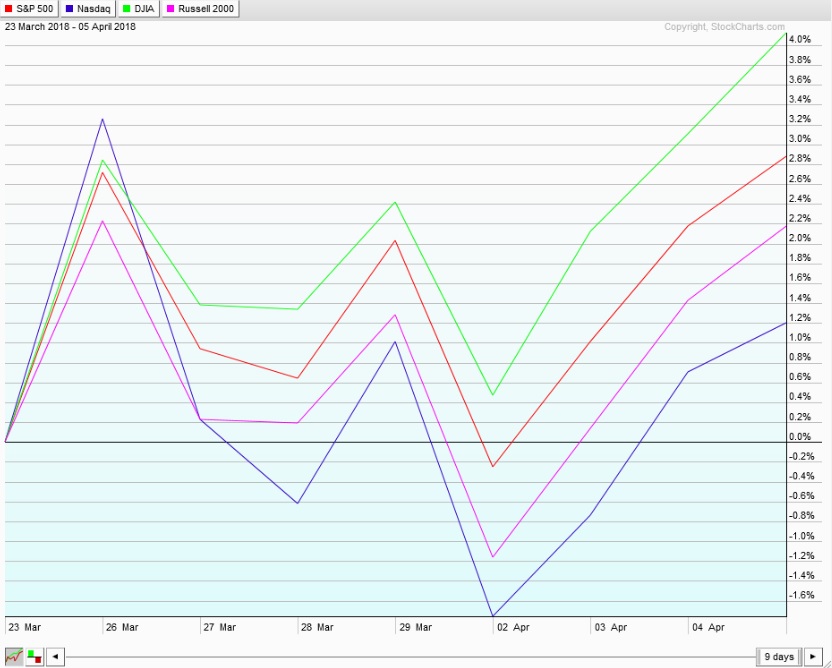

Models are neutral for a second week. That means there is no solid way of me forecasting which direction the stock market will trade over the next five days. If I did have a solid way of making a forecast, I would present a confident forecast then spend the next days working that side of the market. This is how I have become a consistently profitable trader.

That and closing overnight gaps. The overnight gap, in-range has been so good to me. I always think of overnight gaps, in-range like the teach a man to fish saying. The trade keeps a roof over my head and wholesome food on my plate.

But beyond a solid five-day bias, and outside of trading overnight gaps, I really have no idea what the market intends to do. Anyone claiming otherwise should be questioned and their reasoning put to the stoic test to see if it holds water. If they are relying on their political wit, and they are not privy to secret (illegal) information, cast their opinion aside. If they are relying on hearsay from someone else, thank them for their thoughts then kindly rinse their nonsense from your mental RAM.

There are few things I hold firm and using data to form a prediction is one. I am a speculator by trade. This is my vocation. It is something I love, and also something I take seriously. It is a business like any other. It has overhead and cost-of-goods sold. It has revenues and working capital. It needs to be audited regularly and there needs to be a plan in place. A plan extending beyond three years starts to enter fantasy land, but you can plan out your next three years.

In three years you can change, and improve, and achieve while still maintaining focus.

That is all I can offer you this icy Sunday morning—the option to ignorant.

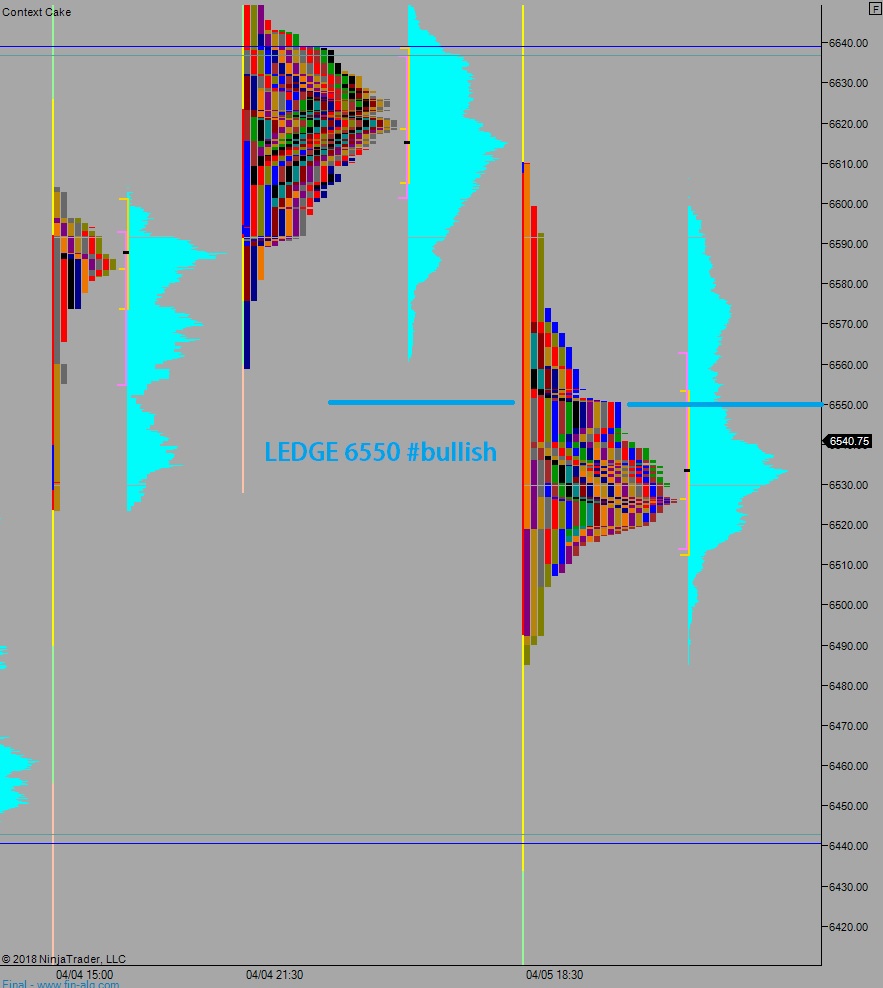

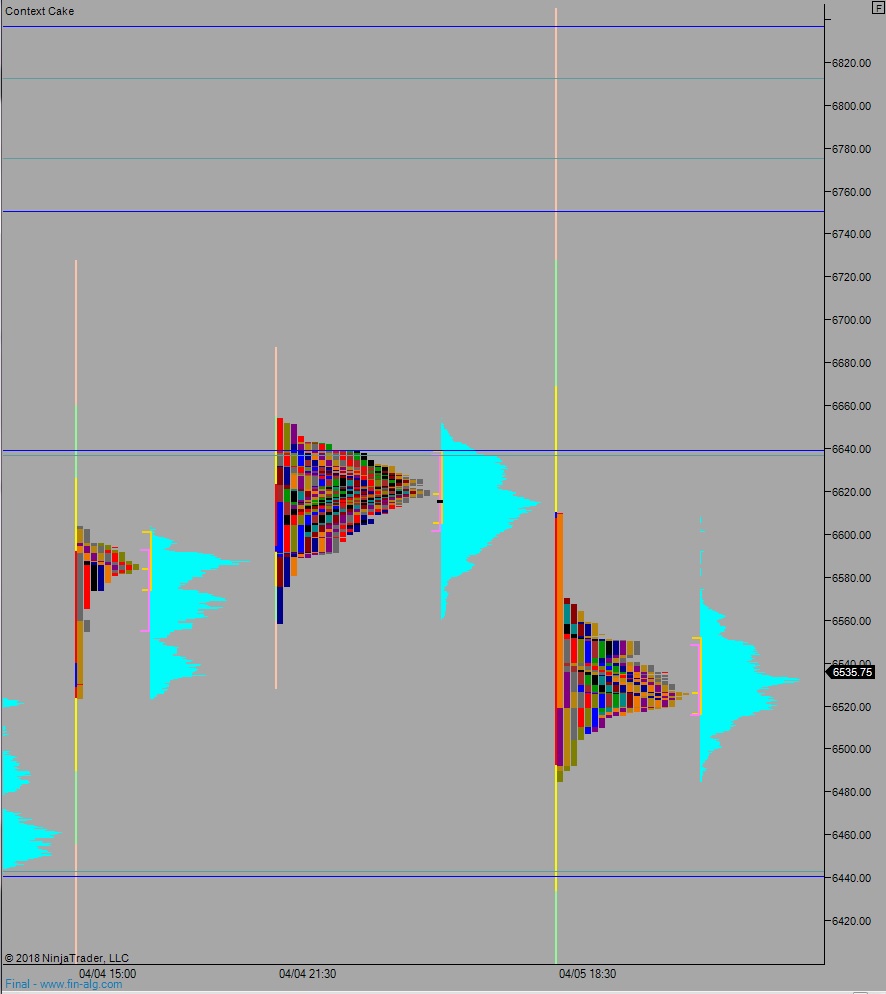

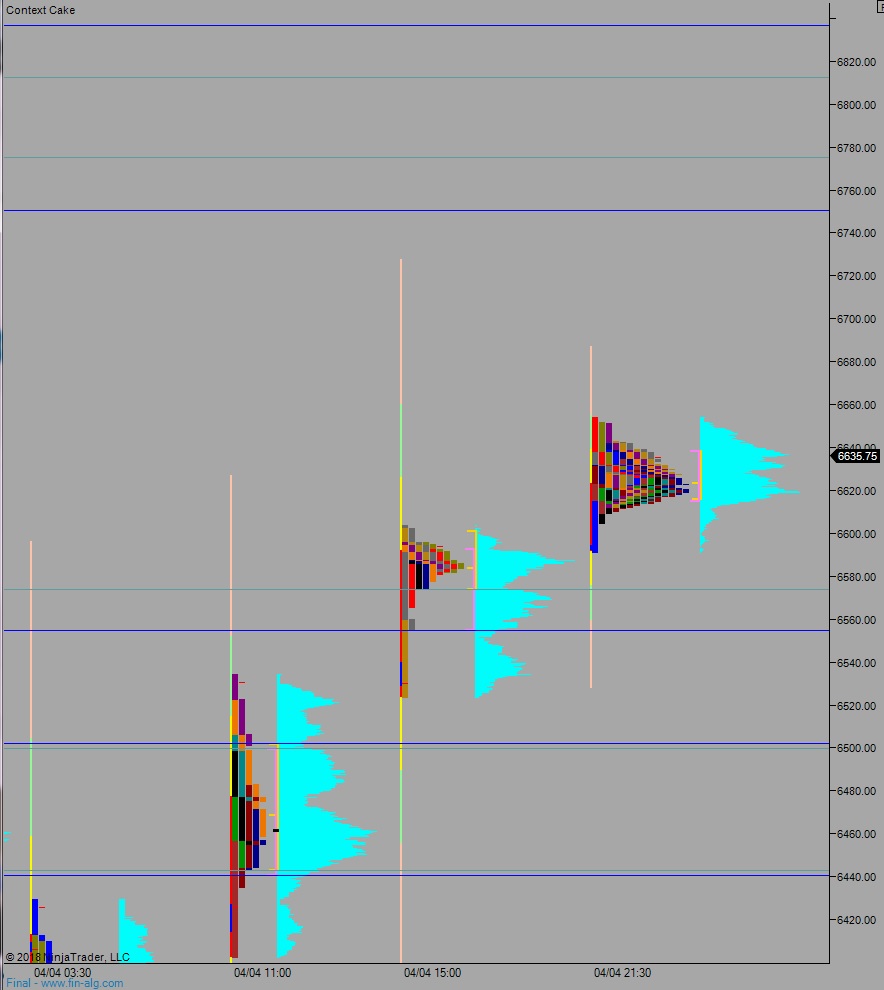

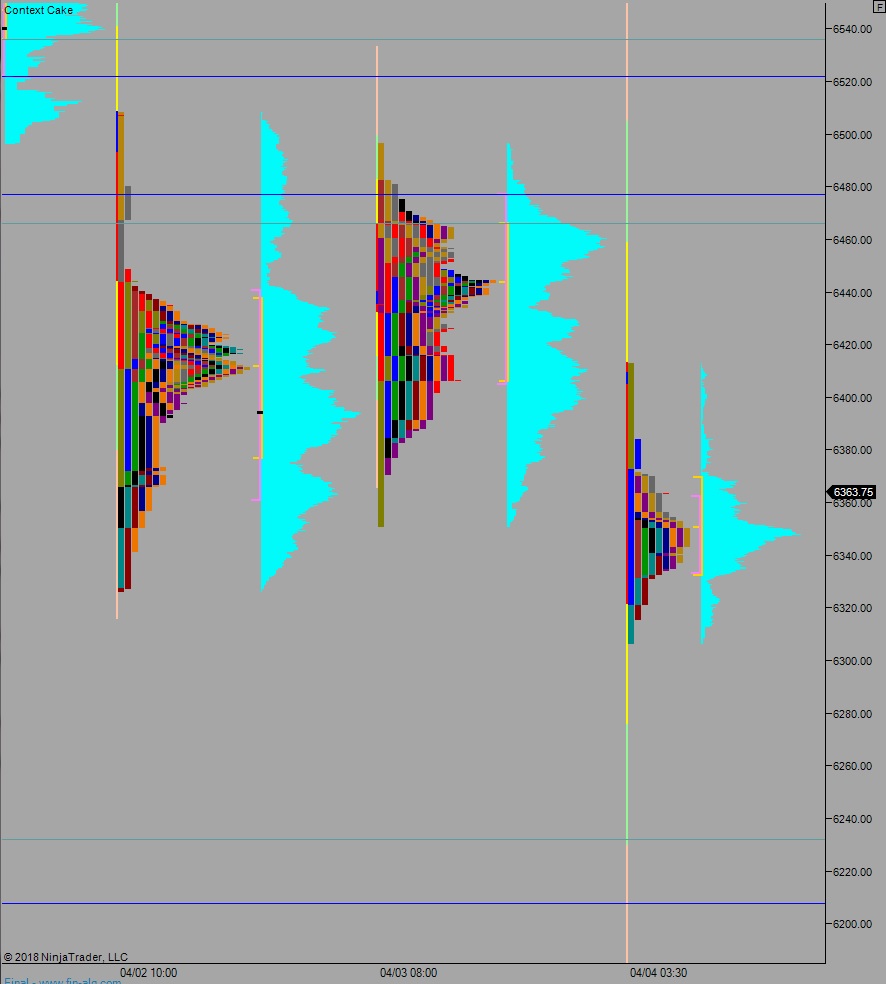

Exodus members, the 178th edition of Strategy Session is live. Go check out the one contextual piece we will be watching (for a second week) to provide simple, objective, directional bias.

Comments »