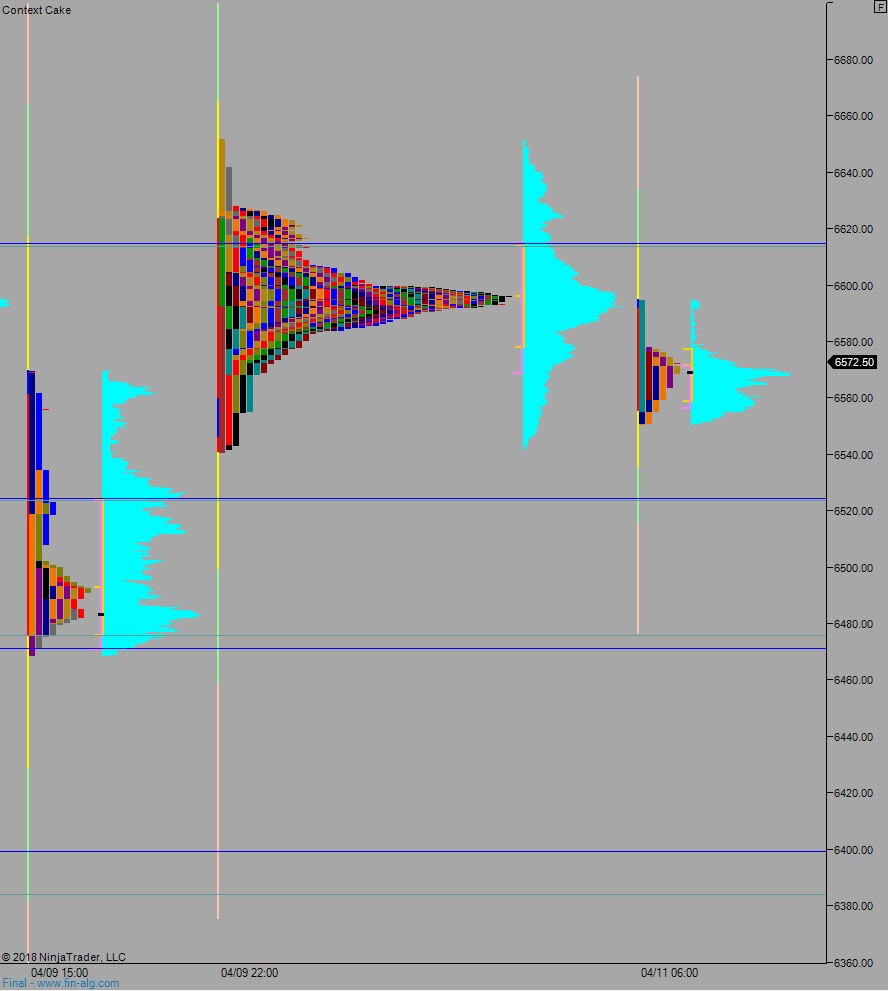

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price gradually slipped lower overnight, offering little retrace, putting nearly all the overnight inventory short. At 8:30am consumer price index data was in-line with expectations.

Also on the economic agenda today we have crude oil inventories at 10:30am and FOMC minutes at 2pm.

Keep an eye on Capitol Hill for information pertaining to Facebook and how testimony from the company’s 33 year-old CEO Mark Zuckerberg is received.

Yesterday we printed a neutral extreme up. The day began gap up, inside Monday’s big range. An attempt lower was made early on but responsive buyers stepped in ahead of the full gap fill. Buyers became initiative ahead of New York lunch, working us range extension up but stalling ahead of Monday’s high. We then went range extension down, but not by much, putting us neutral. THEN we traversed the entire range and went range extension up AGAIN, eventually closing near session high, earning the neutral extreme designation.

There was a mini-failed auction. The Tuesday high-of-day poked just beyond last Thursday’s high, last Thursday, April 5th.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up at 6623.75 setting up a move to take out overnight high 6627.75 before two-way trade ensues ahead of the 2pm FOMC minutes. Use third reaction after FOMC minutes to dictate direction into end-of-day.

Hypo 2 sellers gap-and-go lower, take out overnight low 6550.25 then continue lower, down to 6524 before two-way trade ensues ahead of the 2pm FOMC minutes. Use third reaction after FOMC minutes to dictate direction into end-of-day.

Hypo 3 stronger sellers press a gap fill down to 6495.75, look for buyers ahead of 6475.75 before two-way trade ensues ahead of the 2pm FOMC minutes. Use third reaction after FOMC minutes to dictate direction into end-of-day.

Levels:

Volume profiles, gaps, and measured moves: