NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight after sellers broke down through a tight mini-balance that formed Tuesday afternoon. As we approach cash open price is hovering near Sunday’s globex lows. At 8:30am Advance Retail sales data came out better-than-expected.

However, investors are more likely waiting to hear from Walmart (Aug 16th, before-market-open) for a sense of the retail landscape heading into the holiday season.

Also on the economic agenda today we have industrial/manufacturing production at 9:15ma, business inventories at 10am, NAHB housing market index at 10am, crude oil inventories at 10:30am, and net long-term TIC flows at 4pm.

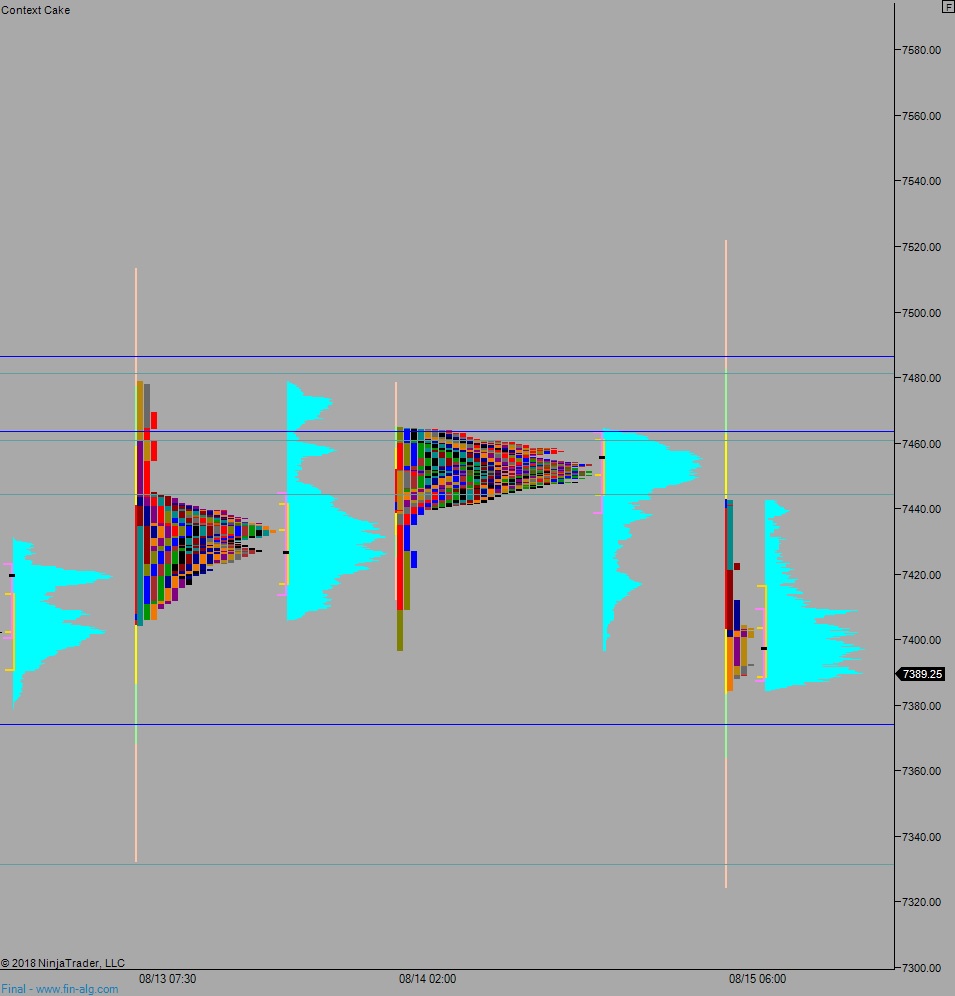

Yesterday we printed a normal variation up. The day began gap up and sellers quickly worked the 40 point gap shut. Just a touch below the gap fill a responsive bid stepped up and jerked the market back higher, back up 40 points. But buyers never became initiative. Instead we formed a tight mini-balance into the close.

Heading into today my primary expectation is for sellers to reject a move back into Tuesday’s low 7397 setting up a move to target 7374.50 before two way trade ensues.

Hypo 2 stronger sellers sustain trade below 7374.50 setting up a move to target 7334.25 before two way trade ensues.

Hypo 3 buyers work into overnight inventory, reclaim Tuesday low 7397 and sustain trade above it setting up a move to target 7444.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: