NASDAQ futures are coming into Friday gap up after an overnight session featuring extreme volume on elevated range. Price worked higher overnight, slowly auctioning its way back up to the Thursday cash high. As we approach cash open, price is hovering just below Thursday’s high.

On the economic calendar today we have Industrial/Manufacturing production at 9:15am followed of U. of Michigan’s primary reading of January sentiment at 10am.

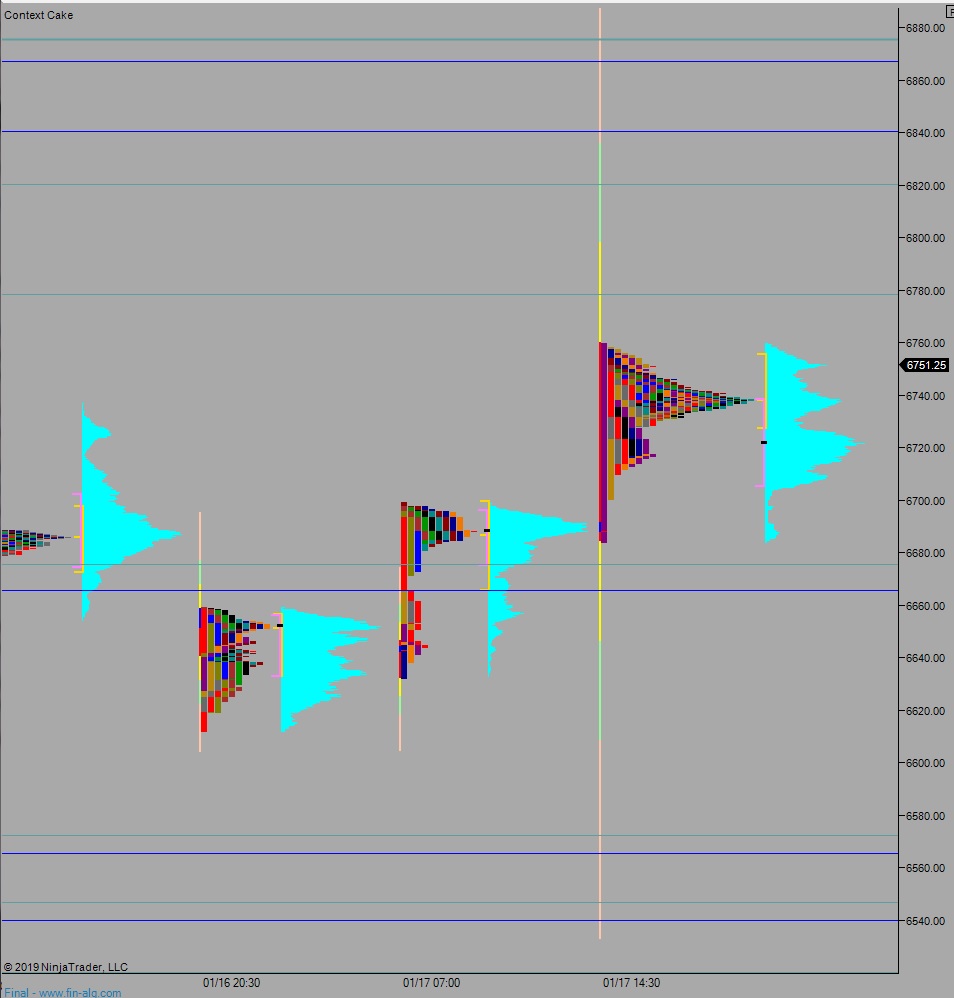

Yesterday we printed a double distribution trend up. The day began with a gap down and push lower. Sellers discovered a responsive bid right at Tuesday’s naked VPOC 6646 and the auction began working higher. The overnight gap filled, then we went range bound along Wedneday’s VPOC. Later in the day price jolted to a new weekly high and despite finding responsiev sellers just up above the 12/14 high, we ended the day in the upper quadrant—in a newly formed distribution.

Double distribution trend up.

Heading into today my primary expectation is for buyers to gap-and-go higher, closing the 12/13 gap up at 6772.50. Look for sellers up at 6803.25 and two way trade to ensue.

Hypo 2 sellers press into the overnight inventory and close the gap down to 6720 before continuing down through overnight low 6710. Look for buyers down at 6700 and two way trade to ensue.

Hypo 3 stronger buyers sustain trade above 6800 setting up a move to target 6820 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: