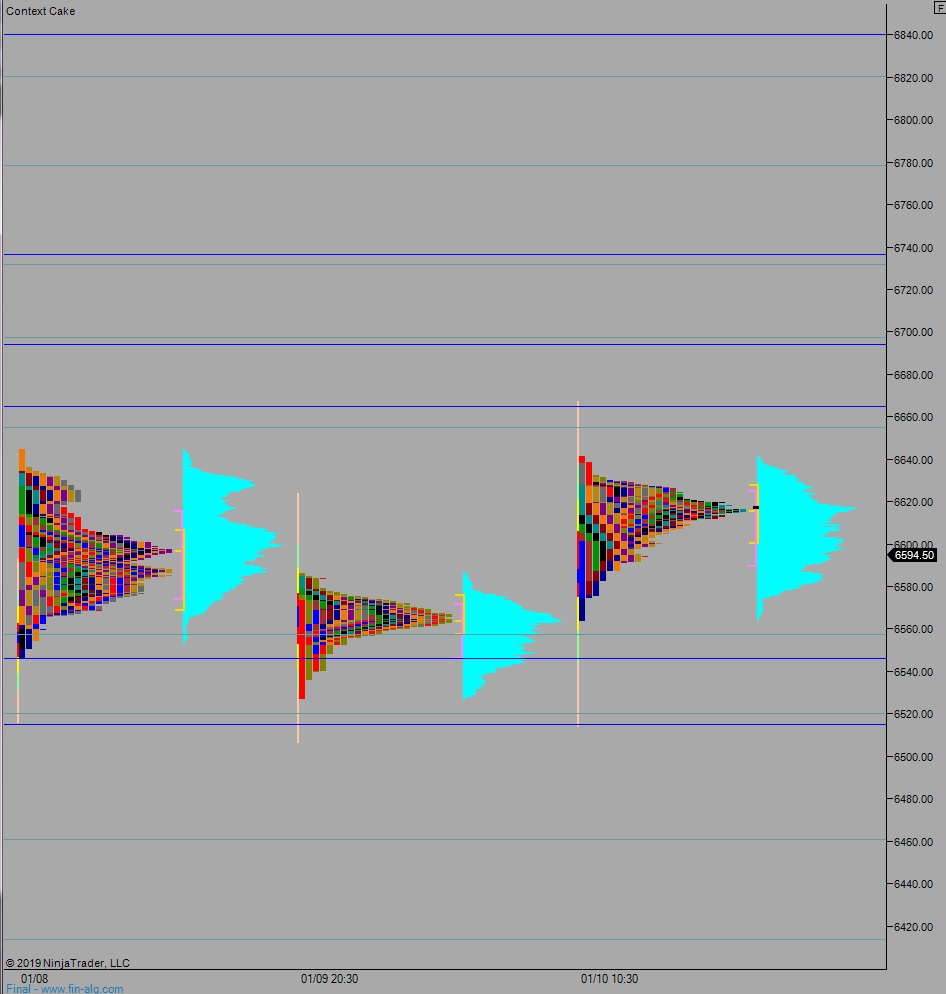

NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme volume on elevated range. Price poked beyond the Thursday high briefly before settling into balance inside Thursday’s cash range. Some AM selling came through, and as we approach cash open price is hovering above Thursday’s daily midpoint. At 8:30am CPI data came out in-line with expectations.

Also on the economic calendar today we have a monthly budget statement at 2pm.

Yesterday we printed a normal variation up. The day began with a gap down near the Wednesday low. Sellers attempted to press us away from the Wednesday range early on but were met with responsive buying. Said buyers turned initiative (initiative relative to Thursday open, responsive relative to Wednesday close) and worked the overnight gap closed. Sellers returned price to the midpoint around lunch time, using Powell’s talk as grounds for action, but buyers became initiative during the afternoon session and we ended the day near session high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6624.25. From here we continue higher, up through overnight high 6641.75. Look for sellers up at 6666 and two way trade to ensue.

Hypo 2 stronger buyers sustain trade above 6666 setting up a move to target 6695 before two way trade ensues.

Hypo 3 sellers press down through overnight low 6588.50 setting up a move to target 6557 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: