NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, trading down into the Tuesday morning conviction buying zone before discovering a bid. At 8:30am Philly Fed data came out much better than expected and intial/continuing jobless claims data came out mixed. Advance good trades balance and retail sales data have been delayed due to the government shutdown, but upcoming earnings from Walmart [Feb 14th, BMO] will provide better insight into trade and retail data anyhow. As we approach cash open, price is hovering below Wednesday’s low.

On the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 10-year TIPS auction at 1pm.

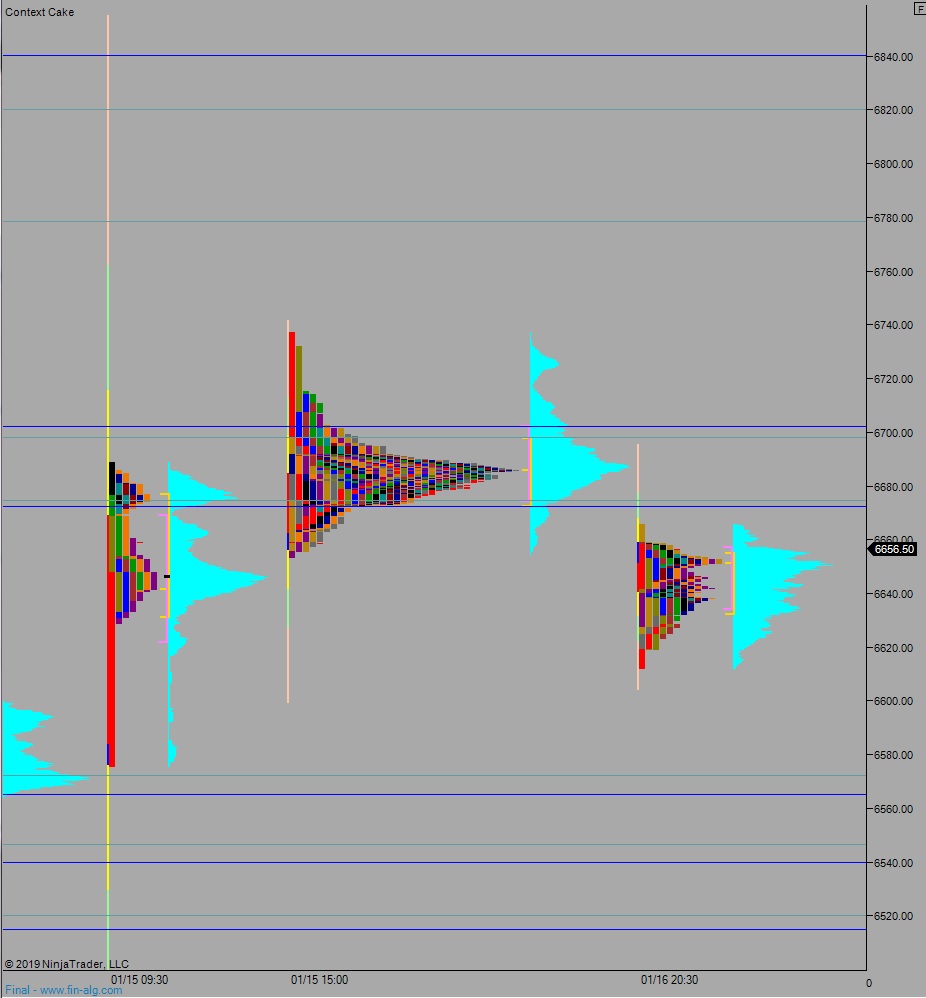

Yesterday we printed a normal variation down. The day began with a gap up, and after a brief two-way auction price drove higher. Sellers stepped in late morning and rejected price away from the value area high of a volume profile distribution that formed back on December 13th. The result was an excess high. After bouncing around on the daily low for much of the session, price eventually closed near low-of-day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6666.25. From here we continue higher, up through overnight high 6675.50. Look for sellers up at 6672.75 and two way trade to ensues.

Hypo 2 stronger buyers trade us up to 6700 before two way trade ensues.

Hypo 3 sellers reject an attempt up through overnight high 6675.50 setting up a move down through overnight low 6612.25 to target 6600. Look for buyers down at 6572.50 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: