NASDAQ futures are coming into Tuesday with a slight gap up after an overnight session featuring extreme range and volume. Price worked higher overnight after an attempt early in the globex session to go lower. Buyers rejected a move down through the Monday midpoint, setting up a steady campaign higher. Sellers were discovered near the top of last Friday’s range and price slumped back into Monday’s range. As we approach cash open price is hovering inside the Monday high.

There are no economic events today. Earnings from JP Morgan came out weaker than expected pre-market. The stock is indicating it will open down half a percent.

Yesterday the NASDAQ printed a normal variation up. The day began with a gap down and out of Friday’s range but inside the 3 and a 1/2 day micro-balance that began forming late last Tuesday afternoon. Buyers engaged after a long two-way open auction. Said buyers pressed up to last Friday’s high before their attempt to reclaim last Friday’s range was rejected. We ended the day just below session midpoint.

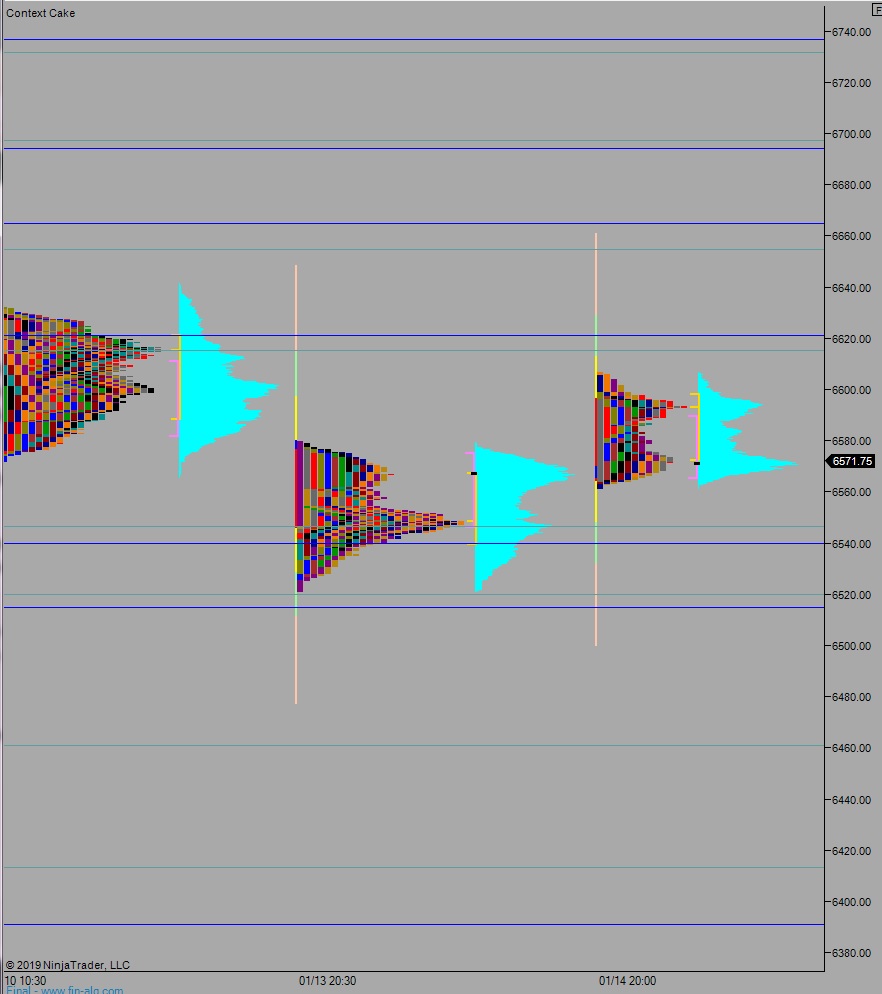

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6546. From here we continue lower, down through overnight low 6540. Look for buyers just below overnight low and two way trade to ensue.

Hypo 2 stronger sellers trade us down to 6520 before two way trade ensues.

Hypo 3 buyers work up through overnight high 6606.75 setting up a move to target the open gap at 6612.50 then the open gap at 6624.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: