Comments »Congratulations to the entire Ford team! The strong quarterly financial results we are announcing today – with improved results in every region – are more evidence that our One Ford plan continues to deliver and build momentum.

Thanks to our efforts to serve our customers around the world and deliver profitable growth, we are announcing solid volume, revenue and market share increases in all regions. Importantly, we also are improving our expectations and guidance for full year profit, Automotive operating margin and operating cash flow.

Our second quarter earnings are driven by our highest second quarter and first half North American profits since at least 2000, our best-ever quarterly profits in Asia Pacific Africa, continued solid performance from Ford Credit and a return to profitability in South America.

Our results also reflect more proof that our transformation plan in Europe is on track to return to profitability by mid-decade, as Europe improved its losses compared with a year ago and the first quarter.

We will continue our laser focus on serving customers with vehicles delivering the best quality, fuel efficiency, safety, smart design and value through our One Ford plan, which remains unchanged:

- Aggressively restructure to operate profitably at the current demand and changing model mix

- Accelerate the development of new products that customers want and value

- Finance the plan and improve the balance sheet

- Work together effectively as one team, leveraging Ford’s global assets

It is important for all of us to read the attached news releaseand understand the progress we are making against our plan and our outlook for the future.

We will meet with financial analysts and representatives of the news media throughout the day to discuss this information and answer questions.

We also will discuss our results, accomplishments, challenges and opportunities during today’s Global Town Hall at 11 a.m. EDT U.S. (12 p.m. São Paulo, 5 p.m. Cologne, 11 p.m. Shanghai).

One Team. One Plan. One Goal. One Ford.

Congratulations and thank you!

Alan

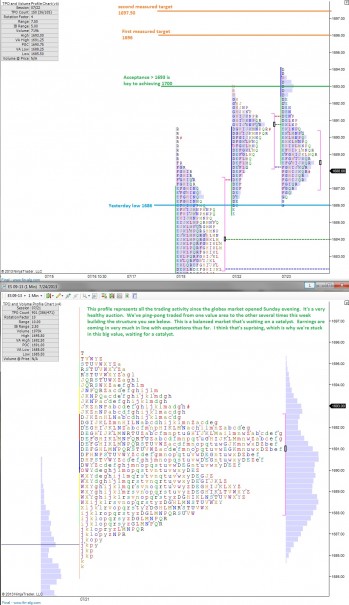

Early Strength in the Futures – Will It Fade Like Yesterday?

We’re experiencing a big of strength again in the overnight market, pressing us up against the all-time highs we experienced during yesterday’s globex session. The important matter becomes how we handle these high water marks early on in the session. Yesterday they were aggressively faded and we spent the remaining session stuck on support until an early afternoon rally which was faded.

If we can see price holding above 1693 during the first hour of trade, that alone would be an impressive achievement and could suggest the pain trade is on, pressing price higher when everyone is becoming more conservative.

I’ve highlighted some measured targets to monitor in the event we trade higher, and also a key support level and some notes about the large auction occurring this week in the following profile charts:

Comments »Simply Put – We’re Not Making Enough Money

As the rally pushes on, showing small signs of exhaustion but by no means cueing the fat lady, stocks…well most of them…are simply not providing the returns necessary to support the superfluous lifestyle we desire.

How is one to afford three-tiered infinity pools when their variable income is only a few hundos?

And I get it, it’s a tough tape, a stock picker’s market if you will, but none of this matters. I want my cake.

Let it be known that I crushed the EXK trade so far and the BPZ awesomeness. And I needed to because my two jumbos ENPH and TPX and a pair of smitten homos at a pride festival: useless to society. On the day, I was up just a tad below 1%.

Futures are considered a different beast by some, but I think you just have to sharpen your lens and get a good timeframe that works for you. For some it’s the 2500 contract volume bar, for others it’s renko bars or minute bars. I use a range bar, currently the 6-tic. But if you find a chart and like the way it trades over a few 100 days of data, go for it. It’s no different than trading a stock.

My futures game is getting tight as in I know it’s getting close to reaching the next level of profitability. I need to make sure the next time we see a real intraday opportunity in the market I can stick to my plan and not go cowboy on the tape.

Anytime the tape is levitating and I’m not making money, I start jamming into lots of names. Instead, I’m doing the opposite, trimming some long exposure where I have wins and cutting out a few names. I sold GRPN for example…at break even.

I’m sick of talking about myself, what’s working for you? Are you playing the biotech lotto? Are you utilizing an option strategy during earnings?

Are you crushing some earning’s action?

I know someone is coming all over this tape, I’d love to hear about it. (no homo)

I’m off to peddle graveyard roses for grocery money…

Comments »Stop Thinking So Much

After spending the morning getting myself well positioned in the futures, talking a bit of smack on the twitter network, and other general business tasks I grew hungry.

The pickle of it all was my damn minions aren’t here today, bastards.

So I had to go get some grub myself, oh the humanity.

And while I did, I was sequestered from my kickass electronics and forced to view the market through the lens of an iPhone. Stupid-archaic-fossil phone!

As luck would have it, I was well positioned in the futures, buying 1687.25 in the ES_F. I took a scale at a point and a quarter because the sellers appeared as if they would not relent. Then as I cursed society’s insistence on dawdling through life, a small burst of selling caught me off guard and I covered my long for +0.75.

At that very moment, the move I planned on riding occurred, back the VPOC, without Raul. All because I had to fetch my own food.

So far I missed my first scale in EXK too, because I held out for a few more pennies. I’m sure it still gets it, but I wanted to get my first scale quick to fulfill the old instant gratification desire.

ENPH is plagued by a seller in and around $7.50, a jackass really. TPX, my only position larger than ENPH, has been a cold fish for weeks, freezing my assets in place. Do you see how much time I’m wasting?

Instead of getting frustrated, I went and talked to strangers about anything and everything besides the markets: the rampant bug infestations occurring, the blood red moon, the biblical rain storms…you know, stuff the common folk discuss.

All this, while I wait for my next setup…

Comments »

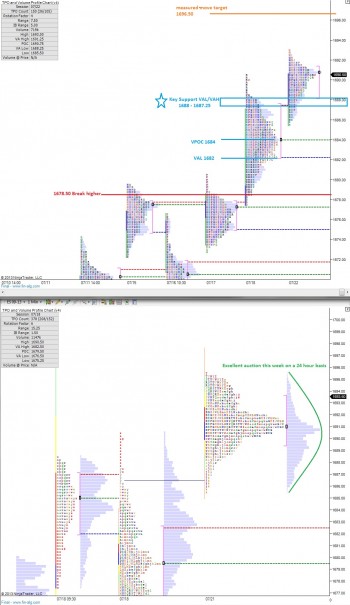

Let The Market Do The Talking

I don’t have much by the way of commentary this morning. The market proved strong overnight mostly during the European session and since printing new all-time highs at 1695.50 we’ve seen a bit of digestion.

Continuation seems the most likely scenario, first to the measured target of 1696.50 and perhaps the 1700 century mark.

In case the market begins to break down and trade lower, we have several key reference points, including a bias zone from 1688 – 1687.25 meaning, you want to stalk long entries above, and shorts below when day trading.

I’ve noted the aforementioned levels and made note of the healthy auction taking place this week on the following market profile charts:

Comments »Club Sandwiched

Today’s session had a smack of indecision which led to me selling First Solar into the closing bell. It goes like this: you’re sitting in a well-sized, well entered position in an industry—in this case solar. You’re also sitting in an oversized, well entered position in the same industry. The oversized position, in my case ENPH, gets beaten over the head for the third straight session and now you face a decision. Do you cut the loser, even though it’s technically still on track with your plan? Or do you cut the small winner, thus reducing your overall exposure to a bipolar industry?

I chose the latter, and I’d do it again if I had the chance.

It does take a certain bit of blissful ignorance to let your balls swing low in this market. We printed another doji candle in the $SPX, and I plum don’t like where this one is placed. So I cut FSLR.

FSLR in all honestly, because I’m an honest mother lover, presents a better chart setup than ENPH. But I see less downside risk in ENPH, as we near my max pain level. About $6.50, on a closing basis, is max pain. I won’t become an investor in ENPH, if you know what I mean, but certain setups take time to reward you, and the reward is sweet money.

That and I bought EXK and played grab ass in the futures. That’s my day. Good night.

Comments »The Precious Metal Trade is Back ON!

The popularity pendulum has swung again, and the bunker lifestyle is back en vogue. This trend, like parachute pants, may not last long, but goodness it is fun while it lasts.

Home gamers and pros alike will spend today clamoring over a small basket of stocks.

For the patient types, RGLD

For the-runner-the-gunner, EXK

For the degenerate gamblers, any-and-all-miners

I was quick to engage,”gangnam style” this morning via EXK as it sports my marque setup which caught my eye over the weekend. It should have caught my eye Friday when I was in my summertime coma. I’m not caring so much.

Here’s my plan, as you can see I’ve jumped the gun a bit:

The plan is a trigger above $3.75, target 1 is $4 (6.7% gain), target 2 is ~$4.50 (20% gain), then you just let the final piece ride and see if the big bankers want to turn this thing around. Risk is below $3.40.

Comments »Changing Character of the Market

There was a notable shift in the character of the S&P last week as we reached new heights. There was a compression to the daily ranges, a drop off in the volume, a decrease in broad equity participation, and well structured auctions.

Starting yesterday evening with a small burst of strength, the globex session managed to print a six handle range which balanced out and shows a slight edge going to the sellers.

Longs want to see 1686.50 holding as support. Otherwise we may begin retesting the pockets of low volume below in the composite profile built late last week.

Above, we have the current globex high at 1694.25 then the measured move target of 1696. The close proximity of the measured target to the 1700 century mark means we should all have the level on our radar if the market sees early strength.

I’ve highlighted the levels I’ll be watching using the 24 hour profile today, to give visualization to the balanced overnight session.

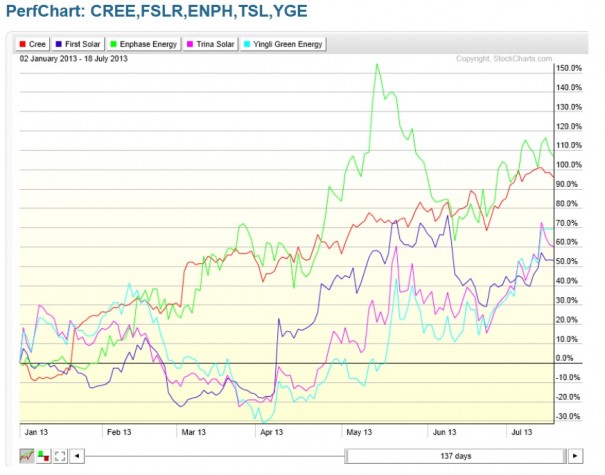

Comments »SOLARS ARE NOT CREE

It doesn’t take a genius to realize that solar companies offer the same promise as CREE: a reduced dependency on the electrical grid. But pull out a 2013 chart of CREE and compare it to your favorite solar issuance. Actually no, I’ll do it for you.

Behold! Greatness, smooth and non-porous…vs…bleep,blop,bloop:

Better yet, let’s get visualized via a performance chart, shall we?

NOTICE ANYTHING? I do, CREE besting the competition and doing so in a smooth, methodical manner. But wait, who is that little shining star, outperforming on the year ever so boldly?

Indeed it is ENPH. And I’m fully over sized into ENPH, sitting though a melt down of sorts. If I had it my way, I’d be buying more I bought more here because ENPH is a winner this year, don’t let anyone tell you otherwise. I implore PPT subscribers to dial this ticker into your machines and observe the statistics.

It’s hot. All other solar exposure is a crappy crap shoot, trust. Look at March and April weakness across the board on the performance chart, who didn’t care? CREE and ENPH.

Think

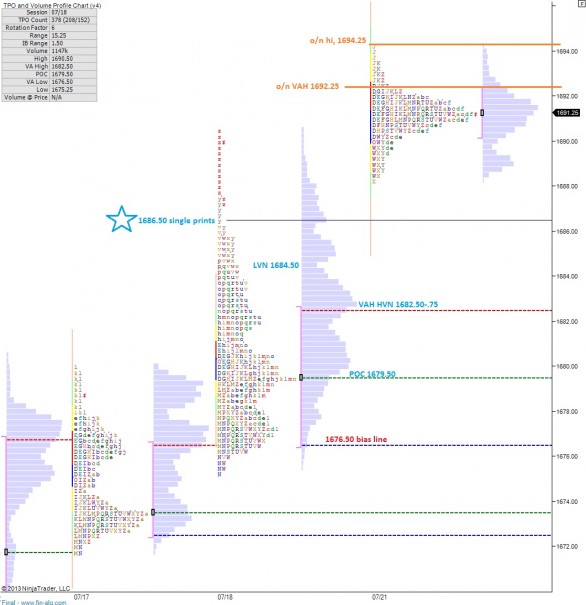

Comments »Stay Focused on The Big Board

The market balanced out overnight after an early evening of weakness perhaps spurred on by the weak numbers out of tech giants Google and Microsoft. Therefore, we should be cognizant of the market’s reaction to these afterhours moves early on today.

We have giants GE, SLB, and HON set to report any minute which could get things moving.

All this is important but shouldn’t take our attention too far from the broad S&P and how it behaves today.

Many of the Chicago traders are pleased with the recent market activity as it’s auctioning very neatly within the confines of the market profiles. It’s also doing so in a very slow manner. Therefore, it’s more important than ever to know their relevant levels as their confidence in the tape increases.

I’ve highlighted this week’s levels of key market activity in the following profile charts. The ‘Launch Pad’ was discussed yesterday morning, and essentially represents the key accomplishment of the bulls this week. We want to see them defending 1678.25 early on.

Comments »