I’m chopping away at the market this morning, zipping through the internet like an invisible ghost. I’ll tell you something, I prefer it this way. Fuck attention I only want to trade well and bank coin. This site, this site right here, that you’re on, iBankCoin, this site, it was the beacon of truth. In my eyes, there wasn’t a more pure place for people of the internet to gather and discuss the important matter of accumulating wealth and comporting yourself as a gentleman.

Now, I don’t even know.

Sure, rules were set at the beginning of my interim position. And no, I did not meet the 3% goal for earning a tabbed home on the site. Nobody did. What did I do?

Propel my portfolio to all-time highs

Tell jokes

Spoon-feed winners

Get to the point

And now let me get to the point once again: I’m not going to change my style for internet attention. I’ll keep writing here or elsewhere, and I couldn’t care less about who reads it. It makes me sharper, talking to you cretins.

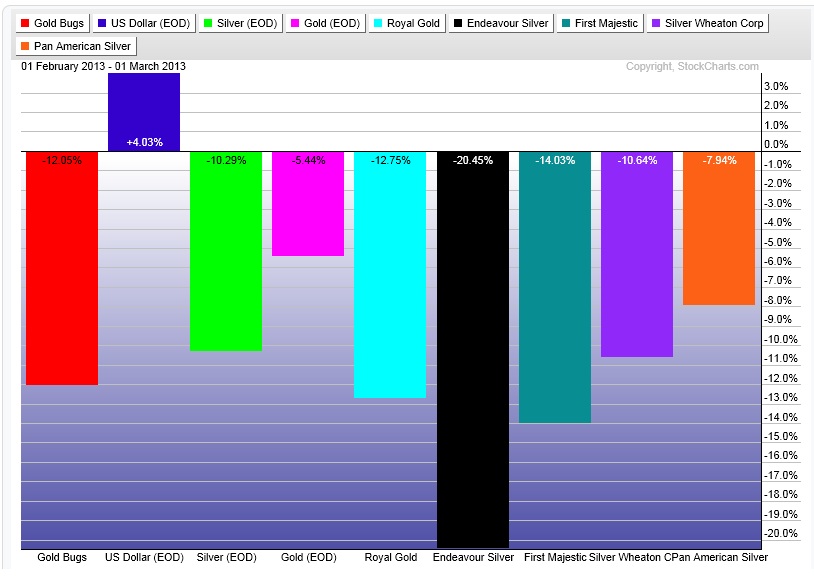

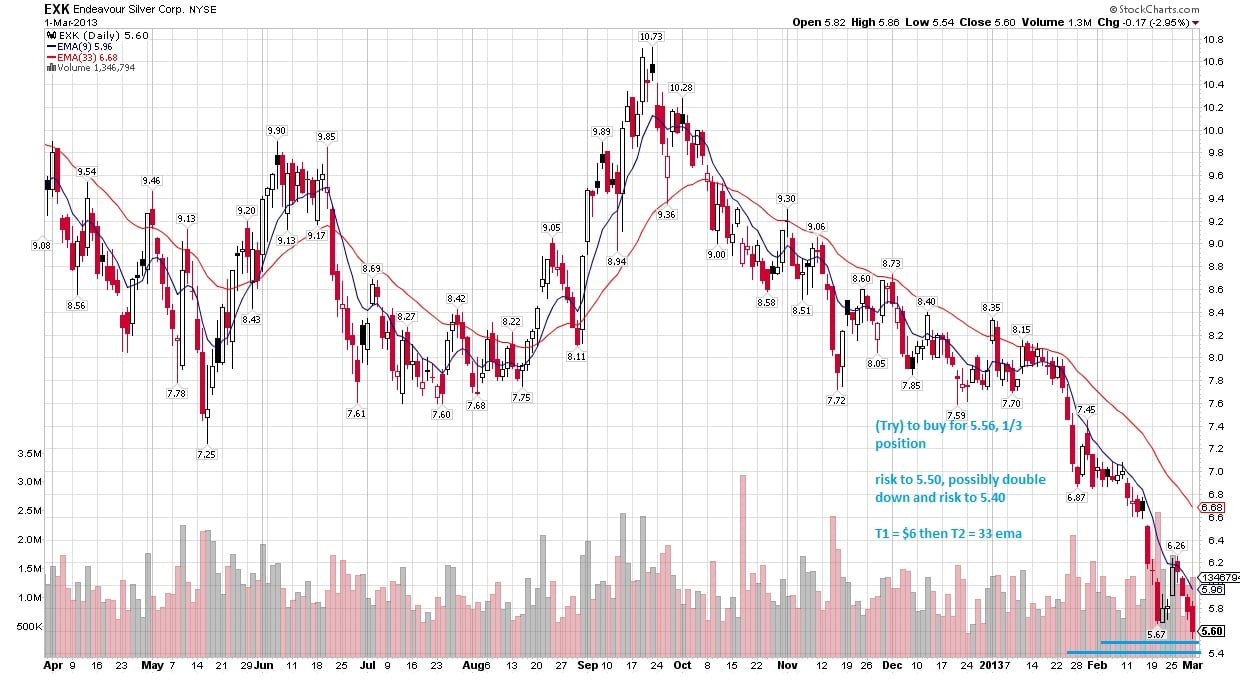

This morning I bought some TRLA and RGLD. RGLD is already a loser and I’ll be selling it soon. I told you I don’t like knife catching. I had a plan based on the most recent swing, it didn’t work out, and I’m looking for a graceful exit. Note that I used a tiny 1/3 position because I accepted the low probability of success.

I took a loss, BOOM! It happens. The key is limiting the downside.

What else? I took a scale on ANGI during that REDICULIOUS spike up to $18.34, and reported it real time. Get it while it’s here boy.

Now it’s all eyes on ZNGA. Adios homos

Comments »