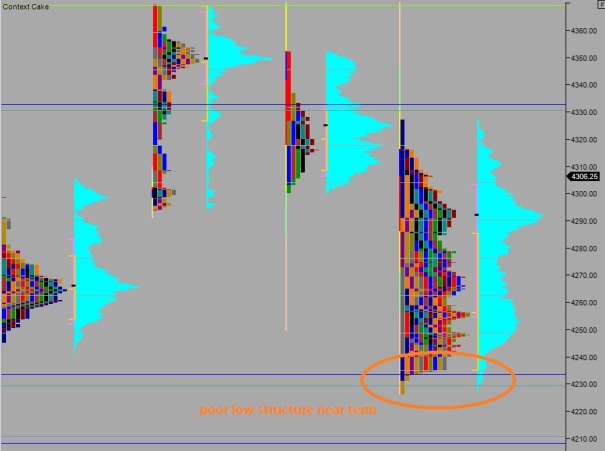

Nasdaq futures traded an elevated range overnight but price managed to stick inside Thursday’s high and low throughout the session. Volume metrics will be screwy for the next 5 trading sessions because some volume stays behind and trades the September contract while the majority rolls on to trading the December contract. The overall structure of the globex session is balanced with a slight downward skew.

We have a few medium impact economic events today. At 10am we shall hear the primary September Confidence read from University of Michigan. At 1pm the Baker Hughes rig count is out. At 2pm the Monthly Budget Statement will be released.

Yesterday we printed a normal variation up. Price opened just below Wednesday’s low and buyers quickly stepped in to fill the overnight gap. Hypo 3 yesterday called for strong buyers to push well up into Wednesday’s range and that was what transpired. Sellers responded to the higher prices and knocked us back down to the session mid before we ended the day.

Heading into today, my primary expectation is for price to try and work lower. Look for sellers to struggle taking out overnight low 4249 setting up 2-way trade that works closed the overnight gap up to 4284.25.

Hypo 2 look for sellers to target the overnight low 4249 setting up a move for the ledge at 4226. This is a key test zone and if we go below it look for price to spill over and trade down to 4208.

Hypo 3 buyers firm up and work higher to target overnight high 4305.75 and test up above yesterday’s high 4318.50.

Levels:

Comments »