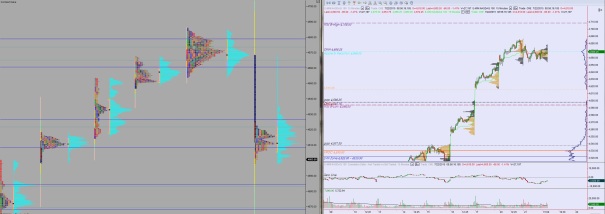

Nice drive off the open up into the single prints. Already nearly printed a first sigma range so it is going to take some OTF participation to push the pole climb. Otherwise this wide initial balance might be setting up the dreaded normal day.

Comments »POLE CLIMB INITIATED

It might take some love from Apple, but we have all the makings of a pole climb today. Delta just turned positive. Let’s see if our bloated markets have what it takes…4640 will be a tricky point to navigate.

Comments »Air Is Thin Down Here

Nasdaq futures are pro gap down as we head into cash open. The move began shortly after Apple earnings were released and is continuing lower as the morning kicks in. Range is abnormal but volume metrics are in line. We are trading right around the gap left open back on 7/16.

At 10am we have Existing Home Sales and at 10:30am crude/gas/distillate inventories. Texas Instruments reports earnings after the bell and will be a key driver behind a the PHLX Semiconductor Index which is threatening a rollover at a major support level.

Yesterday the Nasdaq opened flat and proceeded to range extend down before quickly finding a big and two-way balanced trade ensued. The market appeared to be waiting for Apple earnings before deciding its next move.

Intermediate term, we are trading down into a confluence of prices around 4600 but the market profile is quite thin until down around 4580 range.

Heading into today, my primary expectation is for buyers to push into the overnight inventory and work the gap fill. If buyers can trade north of 4622 then look for a pole climb to ensue all the way back up to close the overnight gap up to 4668.25.

Hypo 2 is a gap-and-go down type open. Look for sellers to press into the cash market early on and trade down to 4584. Look for responsive buying here and two way trade to ensue south of 4607.

Hypo 3 half gap fill up to 4634 then roll back over to take out overnight low 4597.75.

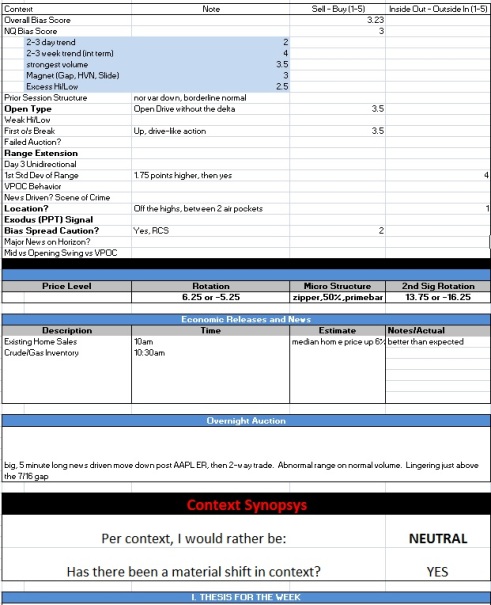

Levels:

Comments »This Downward Spiral Pleases Me

Did you have a pleasant afternoon? That was some legit liquidation after the Apple numbers, but as a trader you should fight the urge to jump to conclusions. The close proximity of two events does not imply causation. Let that one sink in a bit.

Does lightning cause thunder? Of course not–both are the result of an electrical discharge. A more primitive man may cite mystic causes like Thor or Zeus or Raul3 and his gun show.

In my role as a low/medium frequency futures trader, I go out of my way to design systematic methods of establishing contextual ‘grounds’ for causation. My tools are statistics, market profile anomalies, simple mathematical models, and the Exodus market hybrid score.

Does it matter if a move was news driven? Absolutely, but by no means does its proximity imply cause.

A touch lower and the RCS has struck again, for glory.

Meanwhile the GARP index was up nearly a percent on the session. Carry on, nothing to see here. Leave these works to me and my team of assassin cats.

Switchboard 07/21/2015

Keying off opening swing low 4660.25 to see if locals are in control, wait-and-see mode. Or if instead we go test the ledge lower.

Comments »WATCH THE LEDGE

Nasdaq futures are up a touch overnight as overnight volatility continues to abate. Volume and range are low-end normal on a balanced session of 2-way trade. The action was contained within yesterday’s range.

The economic calendar is empty again this morning. The market will be tasked with digesting weak trade in IBM after their earnings fell short of investor expectations. More importantly we have Apple reporting earnings after the bell.

Yesterday sellers managed to close the overnight gap early on before initiative buyers stepped back in and continued pushing higher. The action was unidirectional for long stretches of time, but still manages to resemble a normal variation on the market profile. Selling was seen late in the session but was contained above the sessions IB.

Looking out a bit further, we can clearly see a ledge of volume formed at 4650. Keep this level in mind going forward. It can tell us two things—if sellers are unable to push us over the abnormal outcropping then bulls are incredibly strong. Otherwise, and more likely, we tip over the ledge which is likely to trigger some liquidation due to the air pocket structure below it.

Heading into today, my primary expectation is for the market to enter ‘wait-and-see’ mode. Look for two way trade with some profit taking. Look for the overnight low to be taken out 4667.50 setting up a test of 4660. Responsive buyers in this area but they’re contained south of swing high 4686.

Hypo 2 sellers push down through 4660 setting up a move toward the ledge at 4650. If they can push over it, then look for liquidation down to the LVN at 4640.

Hypo 3 buyers push up through overnight high 4683 to continue higher. Look for a move to the ATR target high 4708.50.

Levels:

Comments »Back in The Saddle Again

Despite my bitter appetite for trading stocks and hardened disposition toward diversification, I have some baggage to manage. SUNE caused a feeding frenzy in solars, for instance, an industry I ambitiously piled into PEAK EURO CRISIS.

Basic materials are literally dead, we don’t need them any longer. Transportation & semiconductors, things that are built using these worthless materials, have opted out of the party over at the Nasdaq.

This is a tech rally lads. I love tech rallies. It makes my mind leap 30-40 years into the future where all the trimmings of The Jetsons lifestyle are commonplace and the world is powered by small blocks of cheese.

The barbarians are killing each other for gold and oil while we tirelessly wean the world off of it.

Rose colored sunglasses, bright star-shaped ones. All the while listening to this bubblegum jive:

Comments »Swtichboard 7/20/15

Navigating The Highlands

Nasdaq futures continue to drift higher as we head into a fresh week. Volume was light but normal overnight on a session that featured little rotation on its continued ascent to new highs.

This week the economic calendar is somewhat quiet, and today we have no economic releases. Morgan Stanley is up pre-market after reporting earnings.

Last week was spent pushing higher, aggressively at times, and looking for sellers. They were nowhere to be found. As a result the pushed through the upper bound of our recent range to break out. The other majors (S&P, DOW, Russell) lagged behind a bit and are still inside their respective ranges.

Whenever we take out a major level, I like to pull up a long term chart of the Nasdaq composite to see where we are trading. This is the equivalent of pulling out the national interstate map when you cross a state line. As you can see, we are up in blue skies where theoretically anyone who ever invested in the Nasdaq is profitable. Also notice, last week was the first time we closed above the all-time high set back in 2000:

Heading into today, my primary expectation is for price to continue drift higher. I don’t do much up at these prices. We’ve exceeded my measured move targets.

Hypo 2 is seller push into the overnight inventory and close the weekly gap down to 4651.25. Look for sellers to target the overnight low 4646.50. From here look for buyers to defend 4639, otherwise a test down to the LVN at 4627.75.

Comments »No Sir, I Don’t Like It

What if I told you I’ve spent the entire weekend devising a new scheme for investing my hard earned pesos? If every hot summer minute was spend brooding in a cold office behind computer screens and reams of paper?

There were 57 biotech stocks up over 10 percent last week. Fifty seven. The Nasdaq is literally at all-time highs—not bearish. Last week’s rally was propelled by tech and finance, two pillars of modern society.

I am committed to the stocked market. There are fortunes to be made in these waters. But at the same time I know there are powerful ways to be milked.

There are intelligent ways to generate alpha, and I don’t think it wise to completely abscond from that hard-earned wisdom. So I’m retooling my process of exposing myself to individual stocks. This is all still developing, very much developing. Like always, I’m hoping for the best and planning for the bitter worst.

As for these markets, heading into potentially the hottest week of the year, I don’t like the look. Everyone’s coming into the week with rose colored sunglasses on certain the fix is in.

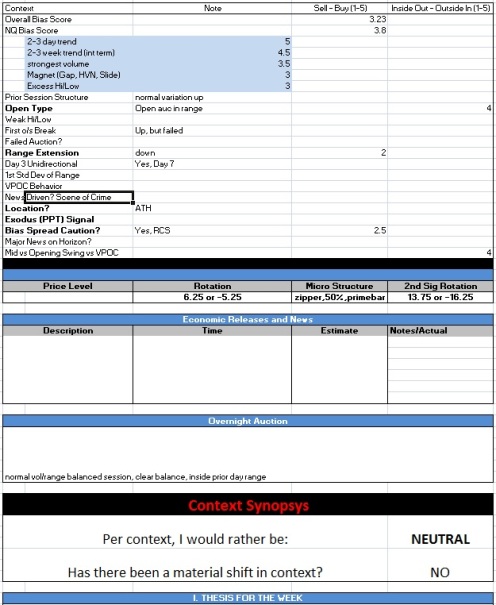

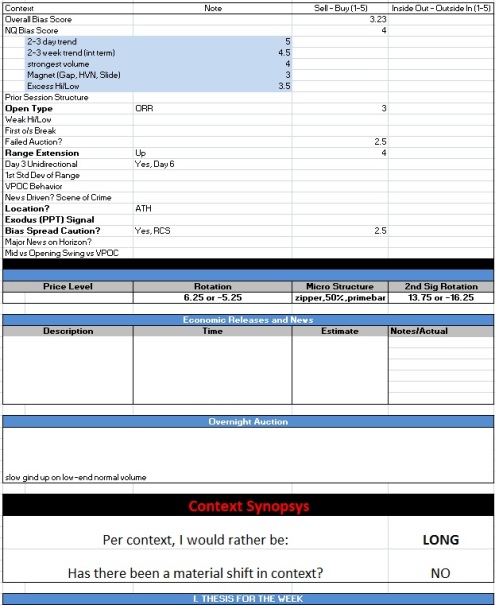

We shall see. In the meantime, this week’s Exodus Strategy Session is published. Inside it we recap last week’s action and build out the context for the week to come.

Comments »