One of the core reasons to build a market model is having objective data to analyze when it generates similar readings.

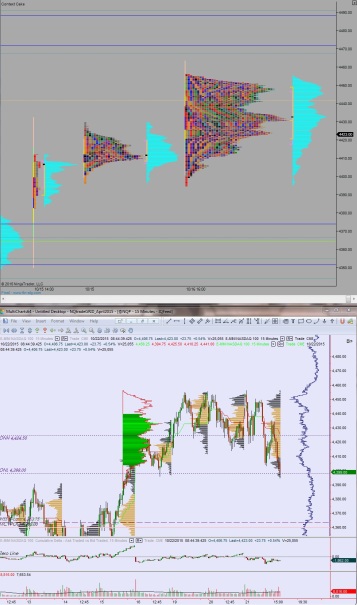

Coming into this week the score was extremely high into the territory where I call for the short bias. Until a few hours ago that bias treated me well. But there was another hint in the data—at extreme readings the market tends to drift sideways.

Therefore I came into the week expecting very little price discovery. Think about how useful that is. It tells me the good trades are on the outside of the market, to fade extremes back to the mean. That is valuable information for a NASDAQ trader lads.

The conclusion I drew from the objective evidence was as follows:

Market model has short bias, but an extremely high reading. The prior two instances of extreme numbers lead to range compression and upward drift.

My model is not the best, but it is the best for me and my trading style. I encourage you to build one that suits your approach. The reward is well worth the effort. A word of caution—garbage in, garbage out is true. That’s why I only feed my model a lean diet of Exodus Market Intelligence and raw (organic) IQ Feed.

I look forward to watching my model grow and mature. Next Sunday will be its 49th sample. My baby was born just after last year’s iBC Investor Conference, remember?

Join us Saturday. It’s not too late. #iBCNYC will put you in a position to win. This is not a silly festival. It is a rare gathering of incredible minds. Don’t be shy. Behind closed doors more Wall Street elites are quietly joining our ranks. You should too.

Comments »