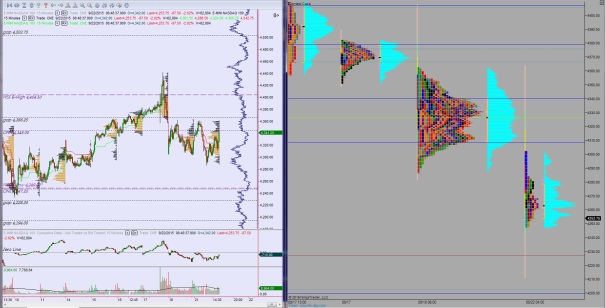

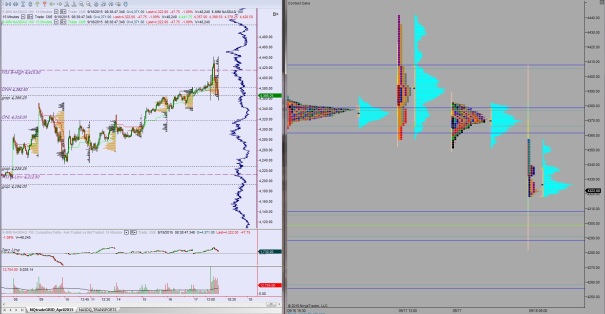

NASDAQ futures are coming into Tuesday with a big pro gap down. The session spent a few hours balanced before 3am when the selling came in and price began trending lower. Sellers managed to push us well below Monday’s close and all of last week’s range. As we head into cash open price is bouncing along the lower ATR band. Both range and volume are extreme 3rd sigma.

The economic calendar is still light. At 9am we have House Price Index following yesterday’s miss in Existing Home Sales.

Yesterday we printed a neutral day. The market opened gap up, sellers worked the weekend gap closed to the tick (4326.75) before sellers stepped up. Price was unable to take out last Friday’s high before we faded lower and traversed the entire range. Then we faded back up to the mean by end of day. Monday was the 3rd consecutive neutral day as higher time frame participants continue to push the NASDAQ around.

Heading into today, my primary expectation is for sellers to work a gap-and-go lower. There are some open gaps—one at 4228.25 and another at 4194 that are likely to behave as magnets. There is a ledge/weak low around 4227 which price may spill over causing an acceleration down to the 4200 zone.

Hypo 2 buyers work into the overnight inventory. Work up to 4280 but struggle to recapture Monday’s range low 4286.50 before sellers step back in and take out overnight low 4247.25. Look for a move to target the open gap at 4228.25 and a test, but failure to spill over the 4227 ledge before 2-way trade ensues.

Hypo 3 vigorous buying early on, take back Monday’s range low 4286.50 early setting up a full gap fill up to target 4310 before 2 way trade ensues.

Levels:

Comments »