The statistician in me died a little today when we pushed neutral for the fifth consecutive day. There are no other streaks like this in four years of data. This is the ubiquitous long-tail risk that lingers in the universe, waiting to show up and destroy civilization. Chalk it up as another 2015 anomaly sent to destroy us. This market is like the 90’s in Detroit where most streets were the ‘wrong street’ and going down them assured your life would be threatened.

While the market devises new ways to hoodwink investors, I am sitting calmly and biding my time with low cash reserves. My book was flat despite the afternoon selling. I should have sashayed back into a short biotech position. It seems so clear now that these so called ‘scientists’ are destined to slowly combust back to their basic molecular state of carbon ash.

Speaking of our good friend carbon, dinosaur bones aka oil is on an insane run. Equally insane is the friend of mine who for the last 2 months has steadily bought about $10k worth of UCO every week. He calls it a long term investment, lol. After weeks of my lambasting him about the bastard nature of leveraged ETFs, he is having a rather deep bellied chortle today. What can I say? Averaging into a spelunking asset isn’t my game.

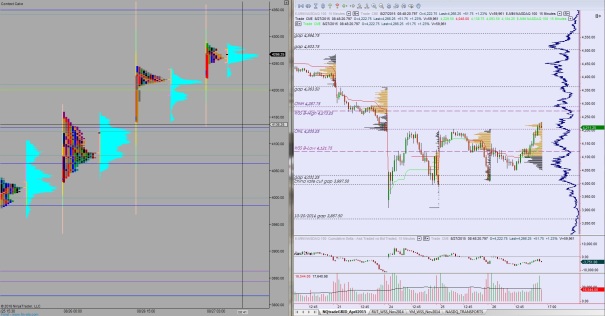

Option Addict is right. In these conditions you don’t use charts, statistics, or roads (extra Doc Brown). You trade using the prevailing sentiment. Or, like me, you realize how abnormal the situation is and just go into wealth preservation mode aka don’t trade.

I HAVE MADE NO CHANGES TO MY BOOK. Good day good sir.

Comments »