I am all for keeping the streak alive but this death march into the weekend will not stand. I demand a voracious, broad based rally into the Labor Day weekend.

For those of you just tuning in, the Nasdaq futures are on an epic streak of neutral prints. Today is the ninth consecutive neutral day. You may be asking yourself, “What is a neutral print, and why does this ‘Raul’ fella care?” I shall lay forth both answers, and more, for you, the investor class to sop up like a crumbled farm biscuit.

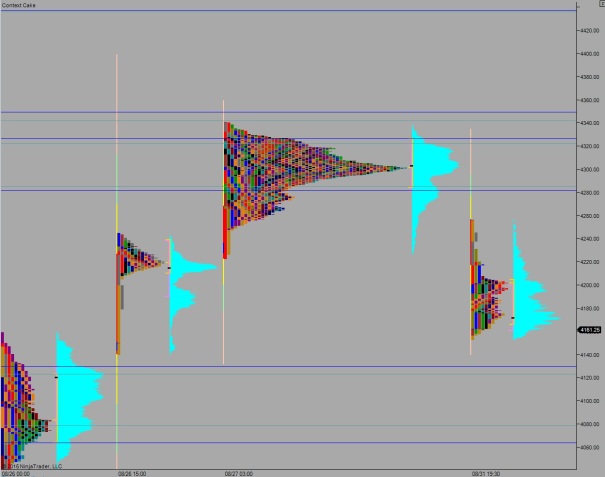

Neutral prints refer to the way a day session pans out. The range of the first hour of trade is considered the initial balance. We spend the first hour of trade digesting the overnight session and working through any MOO [market on open] orders. After that, a way of gauging directional conviction of the higher time frame [i.e. anyone whose positions last longer than a local scalper/daytrader] is to mark which side of the initial balance range breaks. If we break both initial balance high and low, the day is considered a neutral day. The only variation we can see once we have gone neutral is a neutral extreme where price closes near either session high or low.

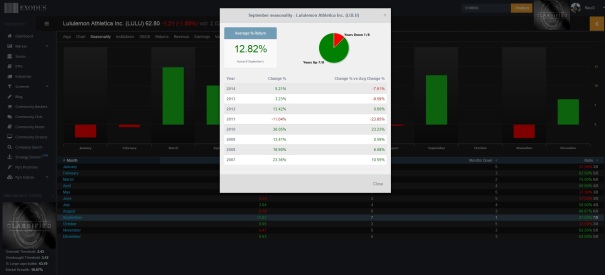

Neutral days are a low probability occurrence. My [somewhat] dated study shows them occurring about 23% of the time. The odds of printing a second consecutive neutral session are low as well, about 21%. When neutral days also tend to occur also interests me. They often happen at or near inflection points. Therefore, they are the type of event that makes my trader senses tingle.

If you think about what happens on a neutral day, you begin to appreciate them even more. The market is enticing both higher time frame buyers and sellers to interact with the market. They are both being aggressive, and neither is making any headway. All the posturing and shoving isn’t yielding any results. But lots of compression is built into the market–fuel for the next move.

Now take that combustible fuel and multiply it 9x, and you have our current situation heading into the holiday weekend. What a jungle.

So bull or bear, you gotta be asking yourself, “Do I feel lucky?” Well, do ya, mutha fucka!? [Say the first part like Dirty Harry, the second like Sam Jackson]

Comments »