Price action has been front running the Fed all week as investors nudge back into equity positions. The upward drift suggests a delay in the widely anticipated interest rate liftoff. Data out this morning from the Philadelphia Fed supported this idea, and put an early bid in stocks. Action is slow, but under the surface some names are already showing decent gains.

Breadth has a subtle whiff of strength, starting the day around 60% according to Exodus super computers. Leading the way are small caps. A key context piece to watch today is the Nasdaq transportation index. I put a note in last Sunday’s Exodus Strategy Session regarding this index, see below:

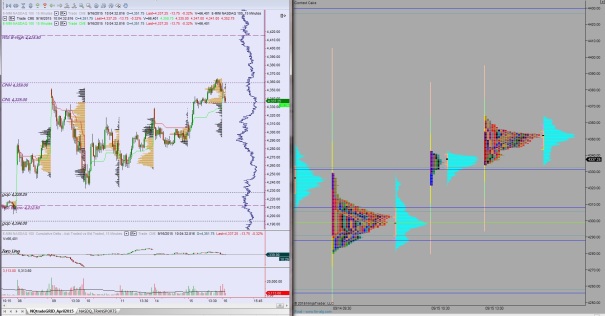

Transports have an interesting look. Price has compressed into an ascending wedge over the last 10 days and pushed back into its range. My primary expectation is for price to make a fast push up and out of the wedge pattern to test the top of range again.

We are seeing this play out and as we head into an important macro event this afternoon the index is pushing up into the well defined upper bracket. Keep an eye on transports this afternoon for an objective take on how the market is reacting to the rate decision:

Comments »