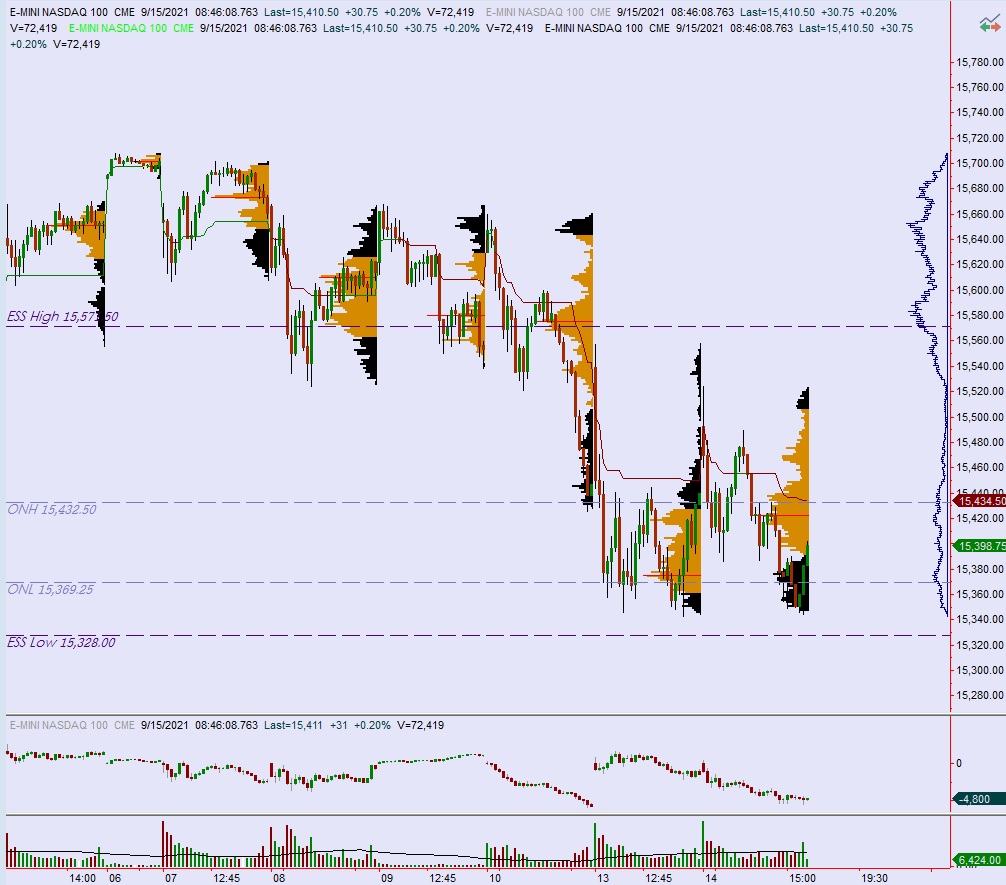

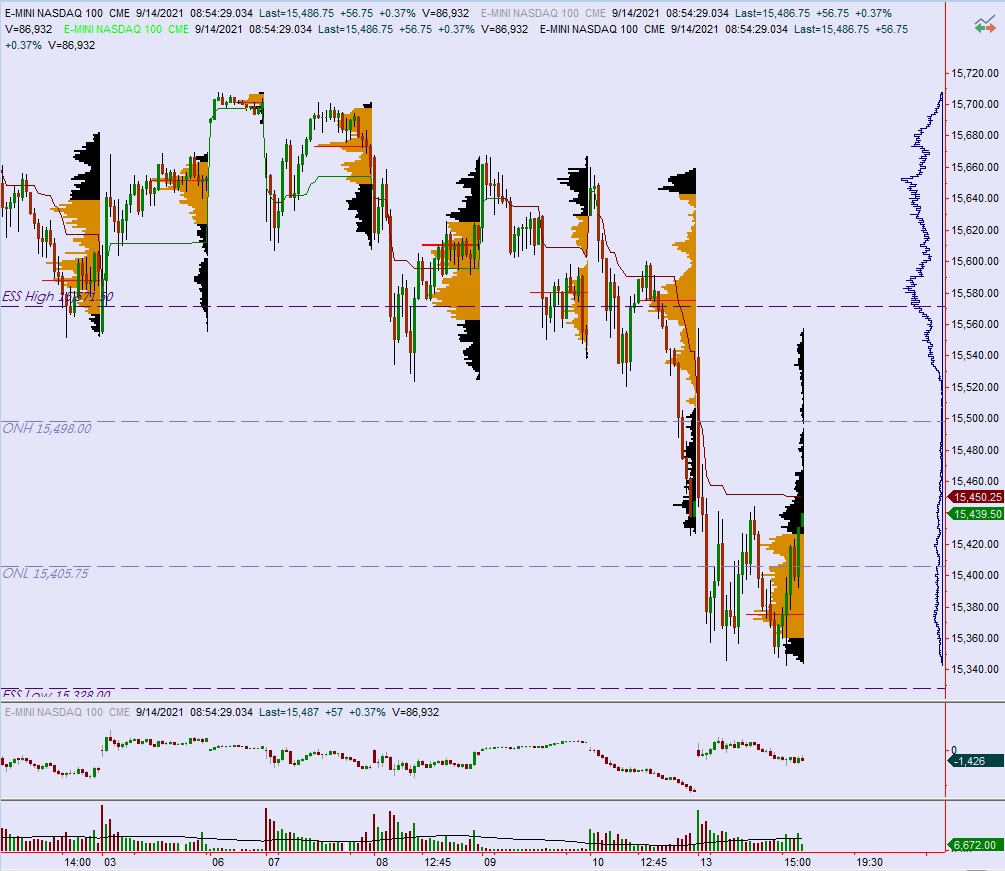

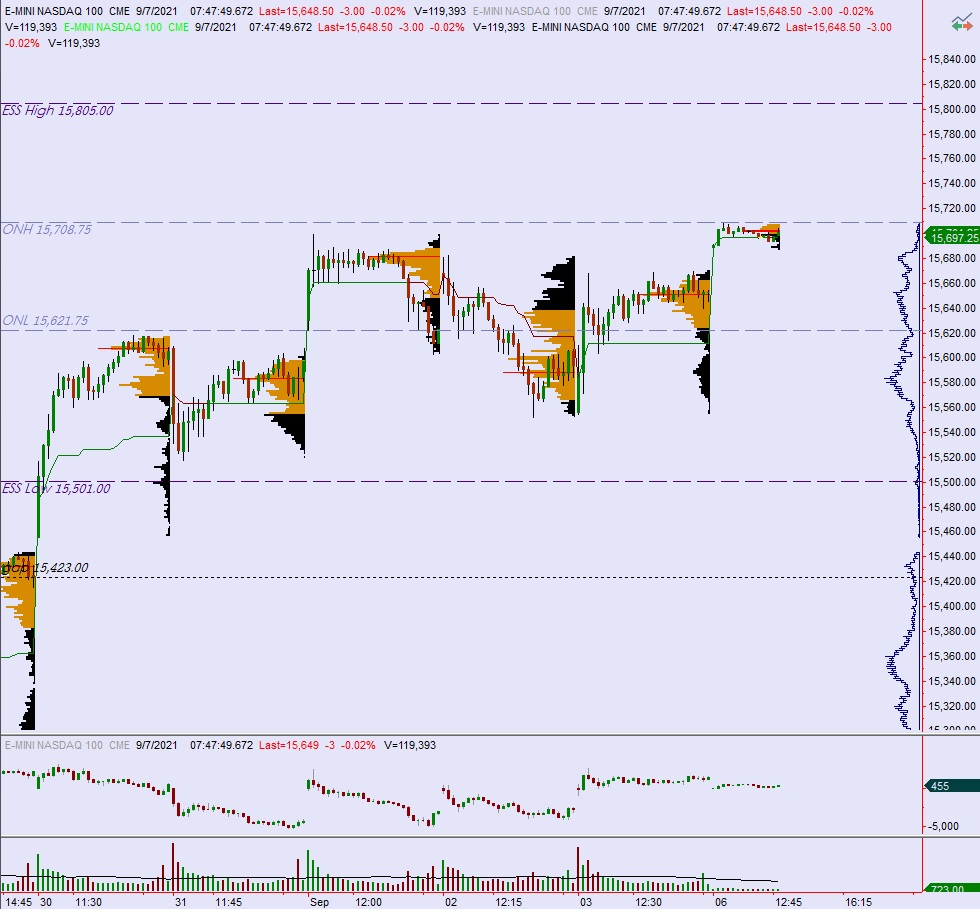

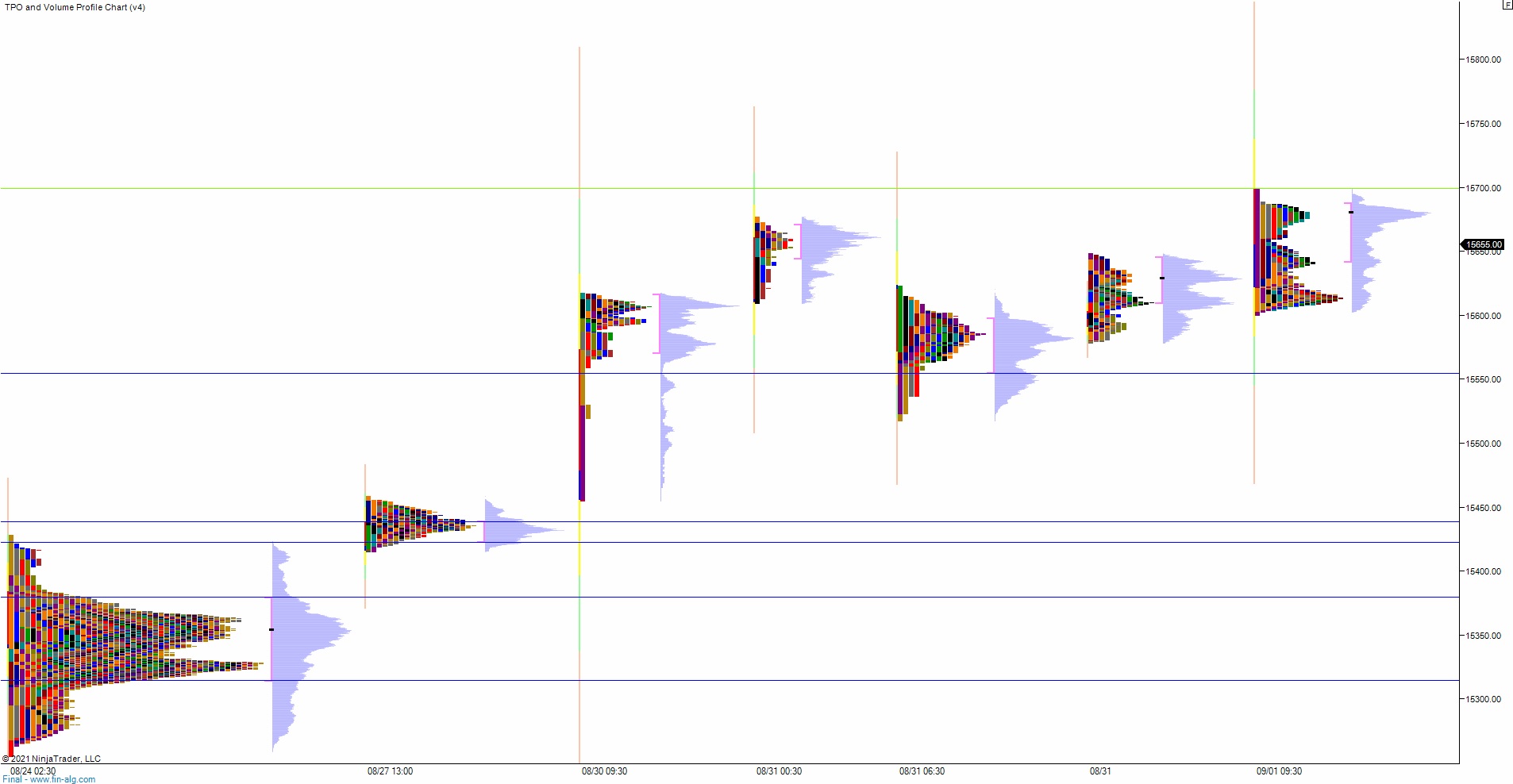

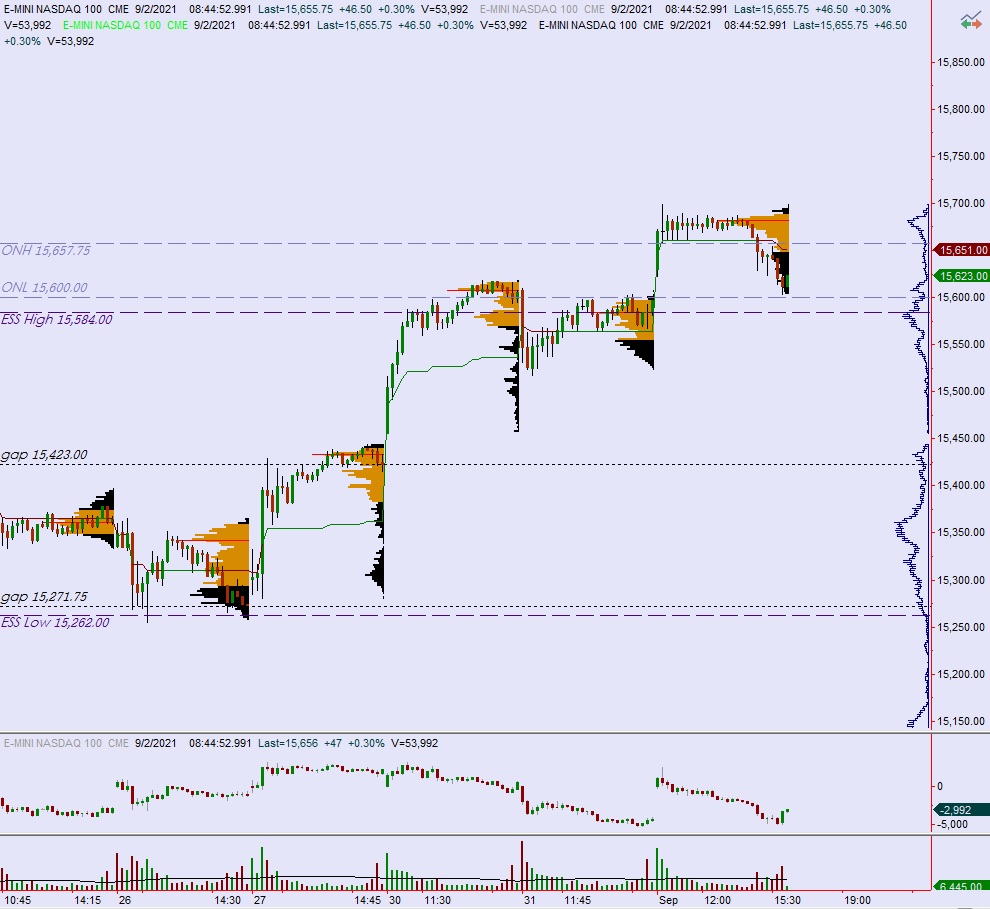

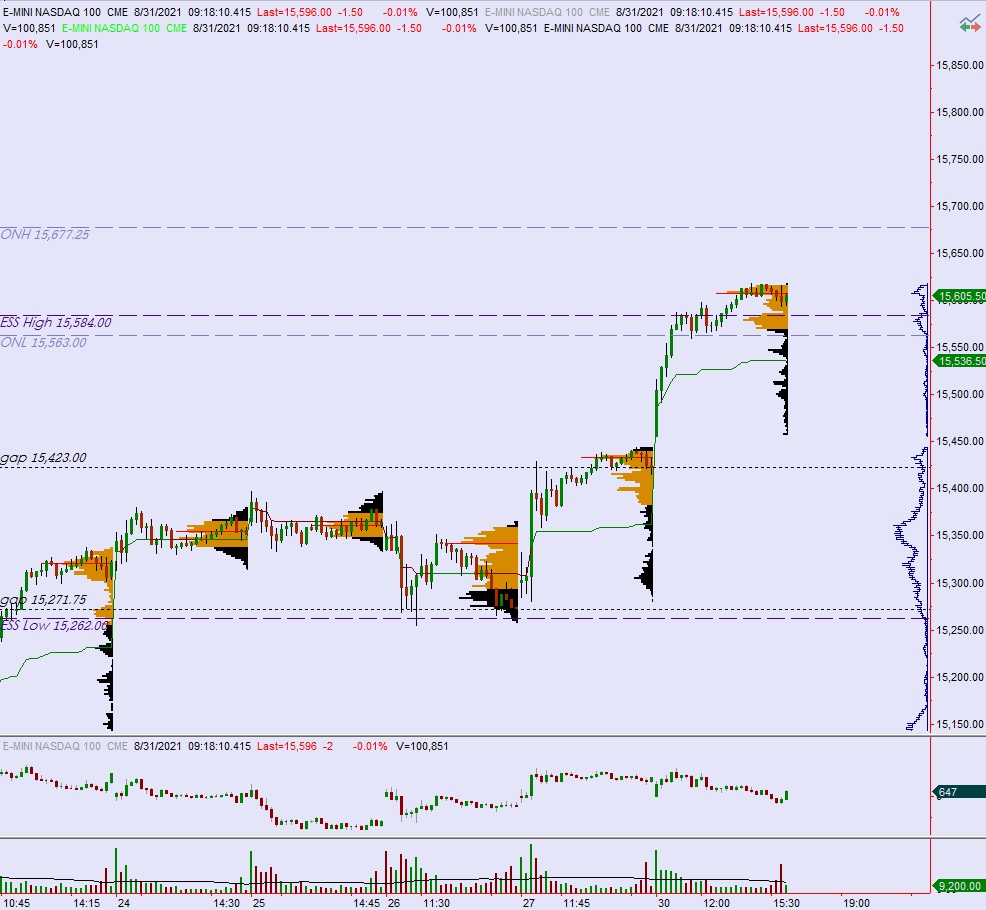

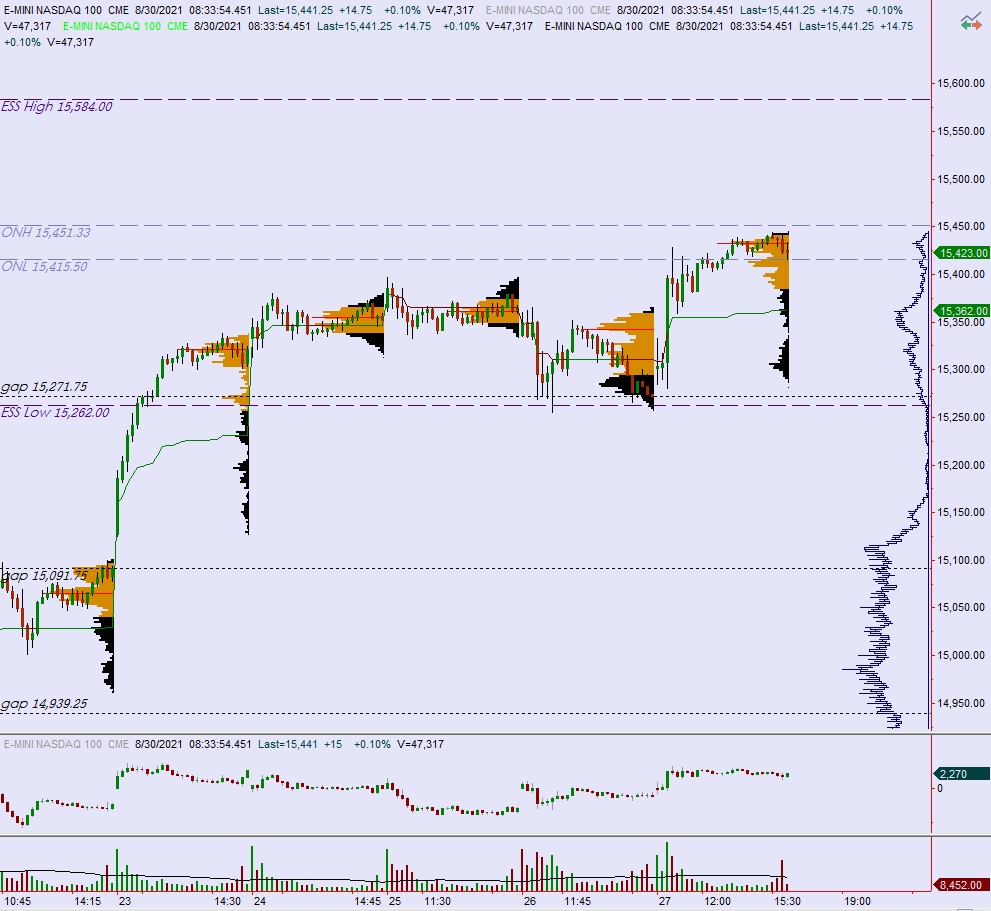

NASDAQ futures are coming into Friday with a slight gap down after an overnight session featuring elevated range on elevated volume. Price was balanced overnight, balancing along the upper half of Thursday’s range. As we approach cash open price is hovering about 50 point above the Thursday midpoint.

On the economic calendar today we have consumer sentiment at 10am.

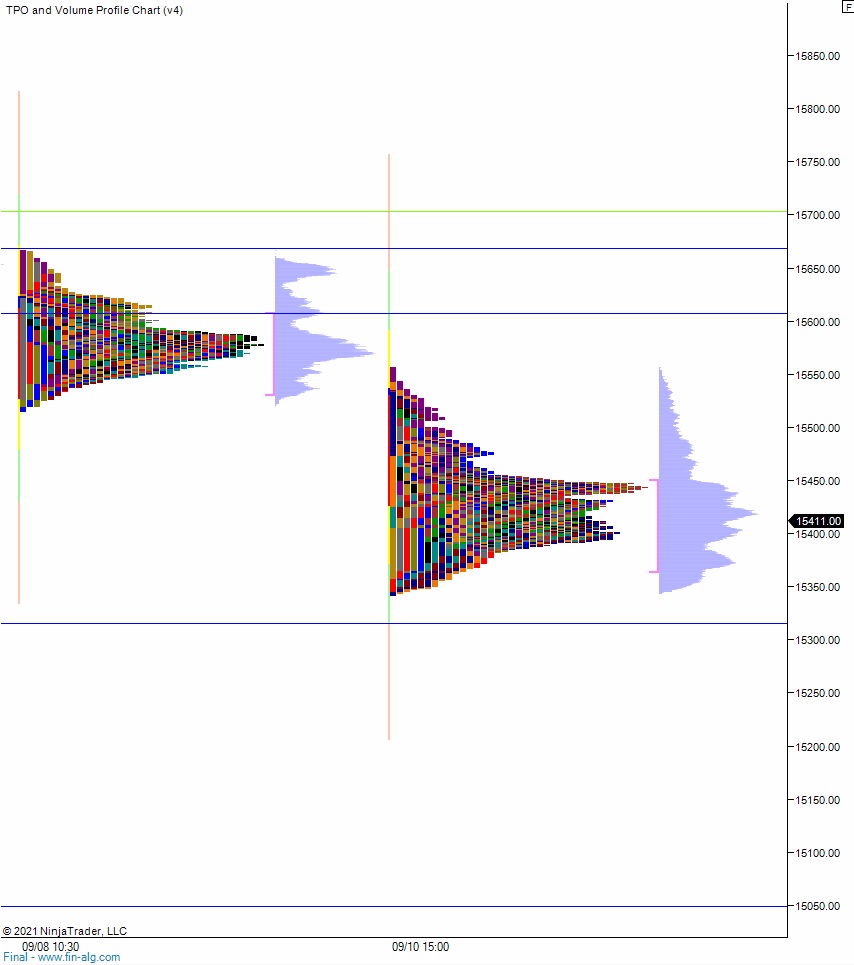

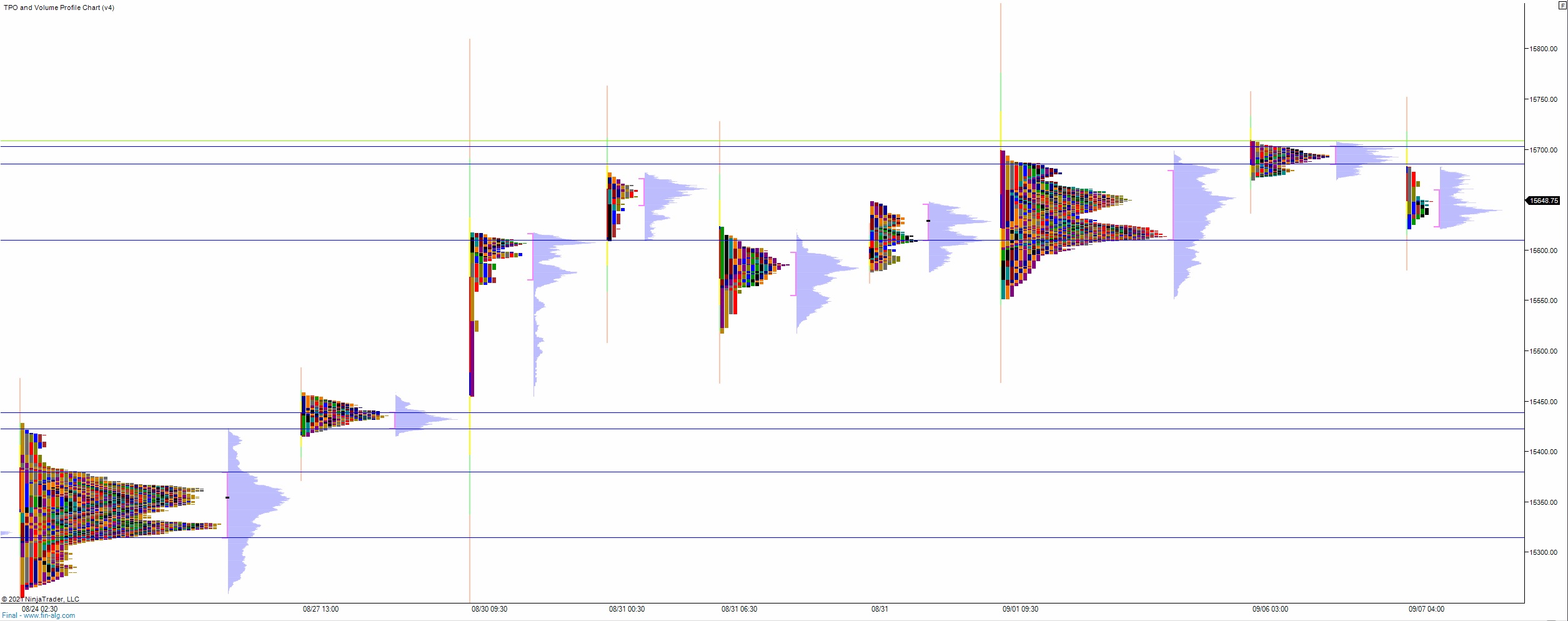

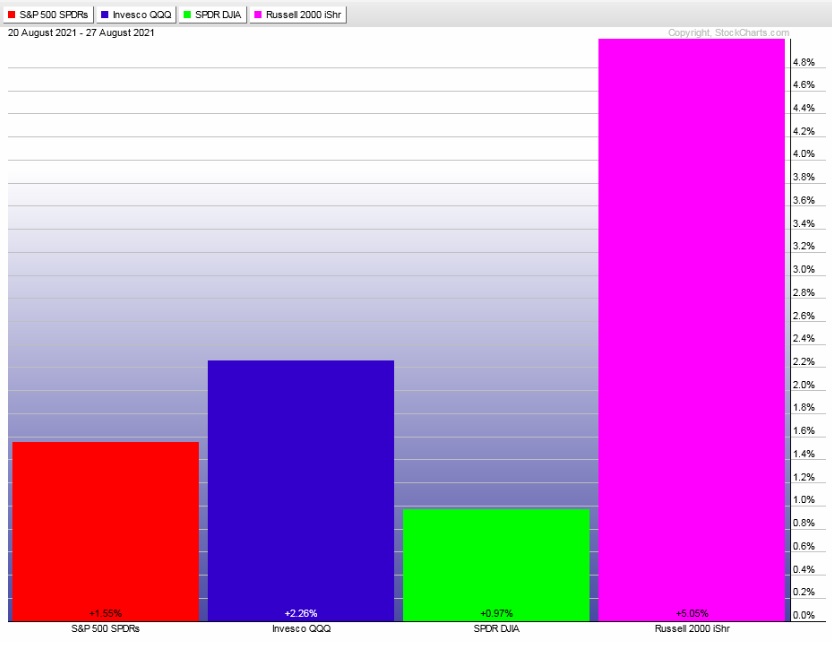

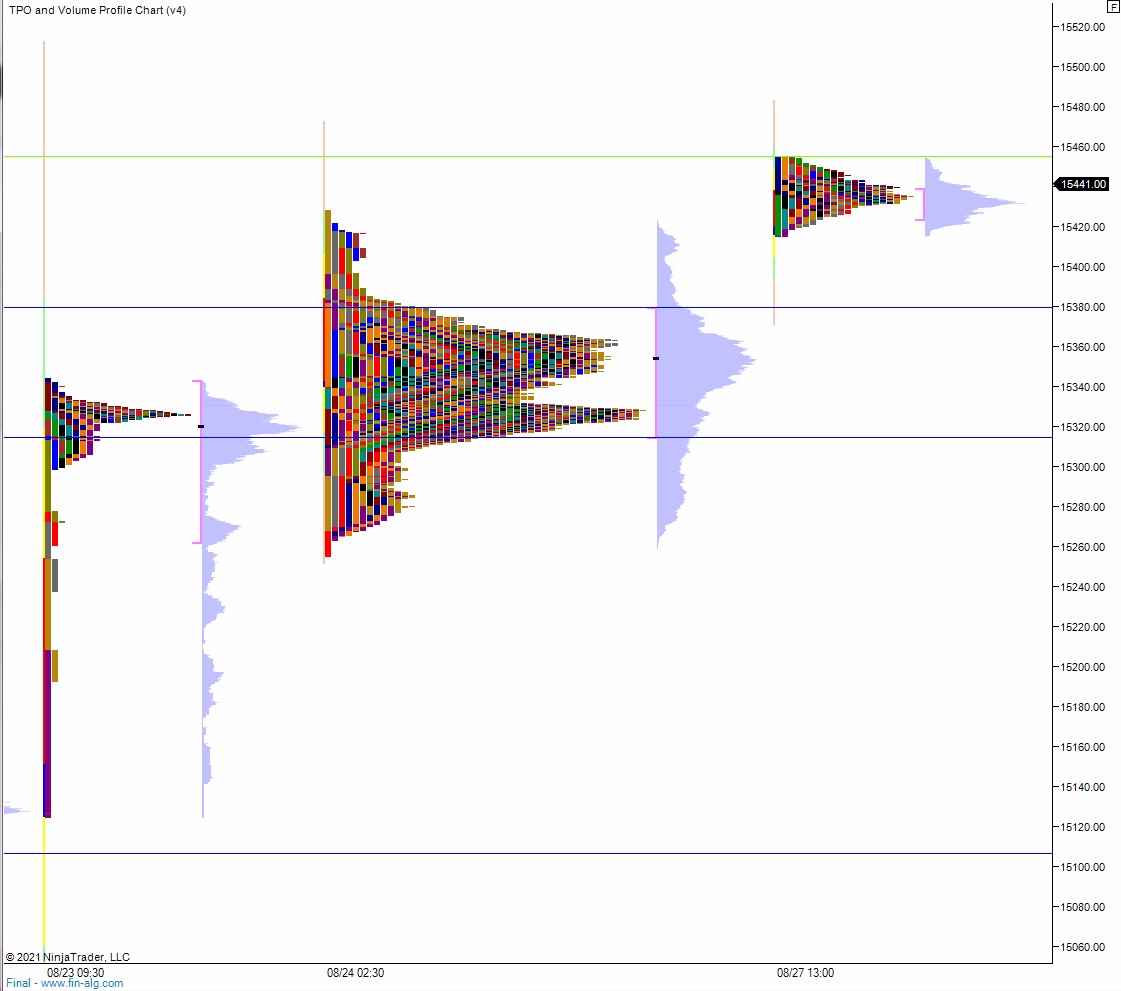

Yesterday we printed a normal variation up. There was a brief range extension down, and one could argue it was a neutral extreme, however the probe below initial balance low came in the moments after 10:30am and was a short duration. The next thing to happen was a strong rally up through the midpoint. Then after basing along the mid for a bit a ramp higher into the afternoon and another ramp higher into the bell that saw price nearly take out the weekly high.

Heading into today my primary expectation is for buyers to press up through overnight high 15,528.25 setting up a tag of 15,571.50.

Hypo 2 stronger buyers rally up to 15,600.

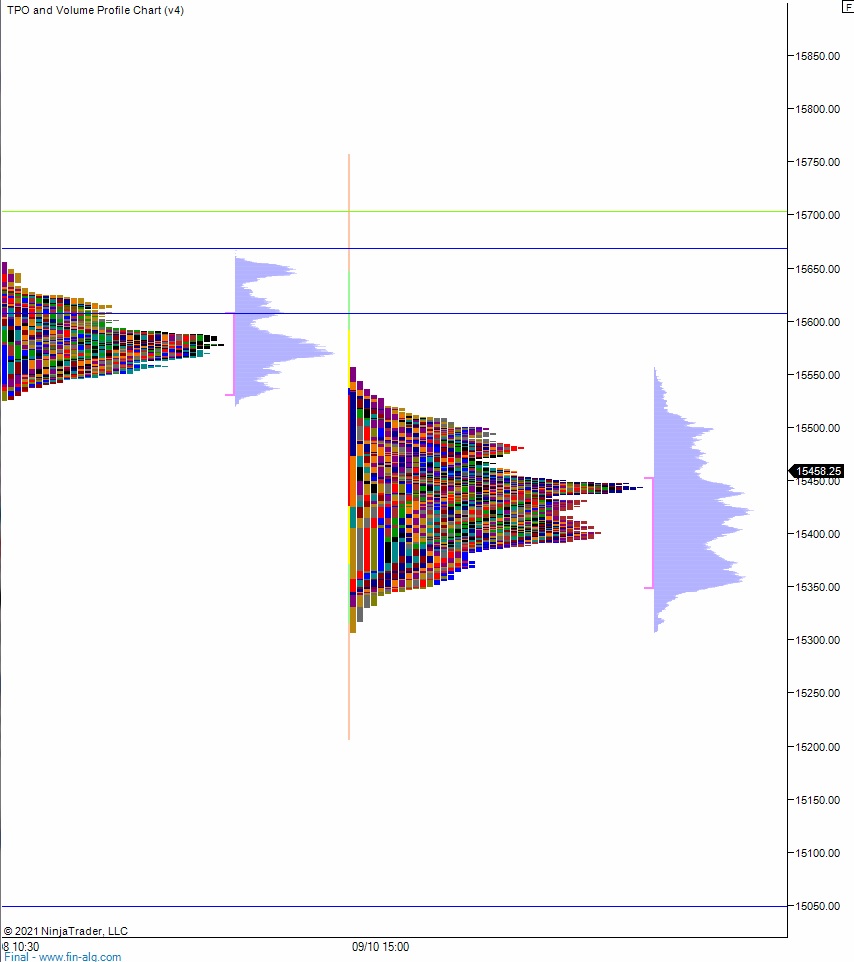

Hypo 3 sellers press down through overnight low 15,458.25 on their way to tagging 15,400.

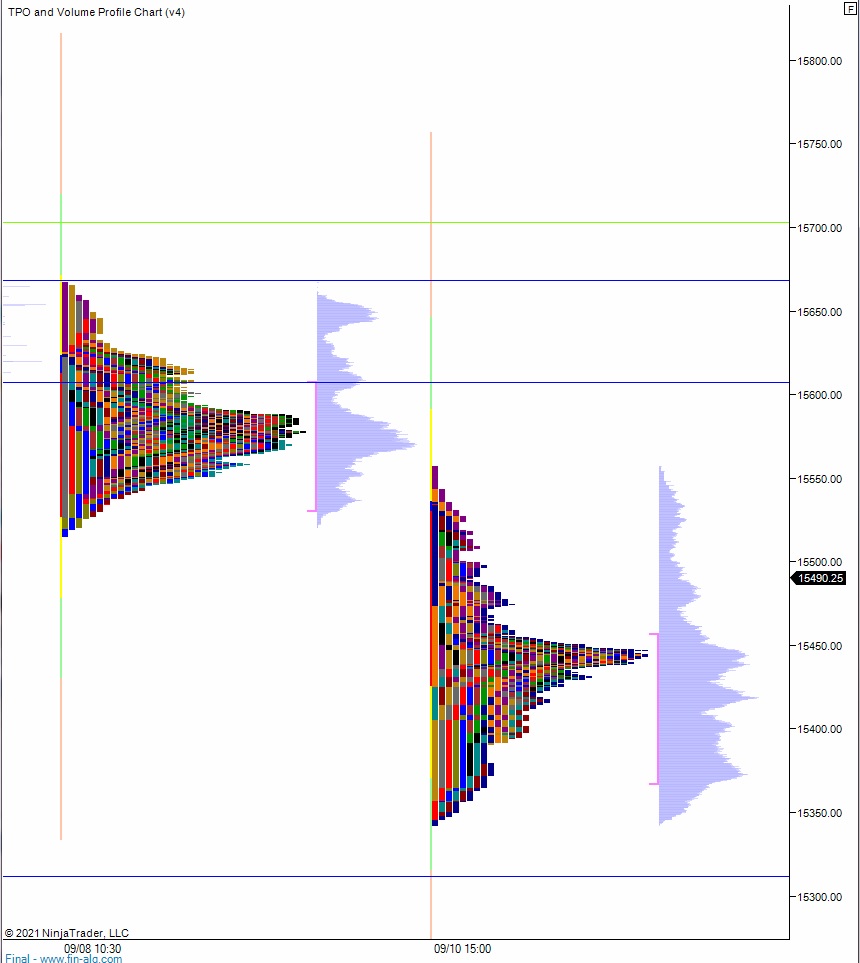

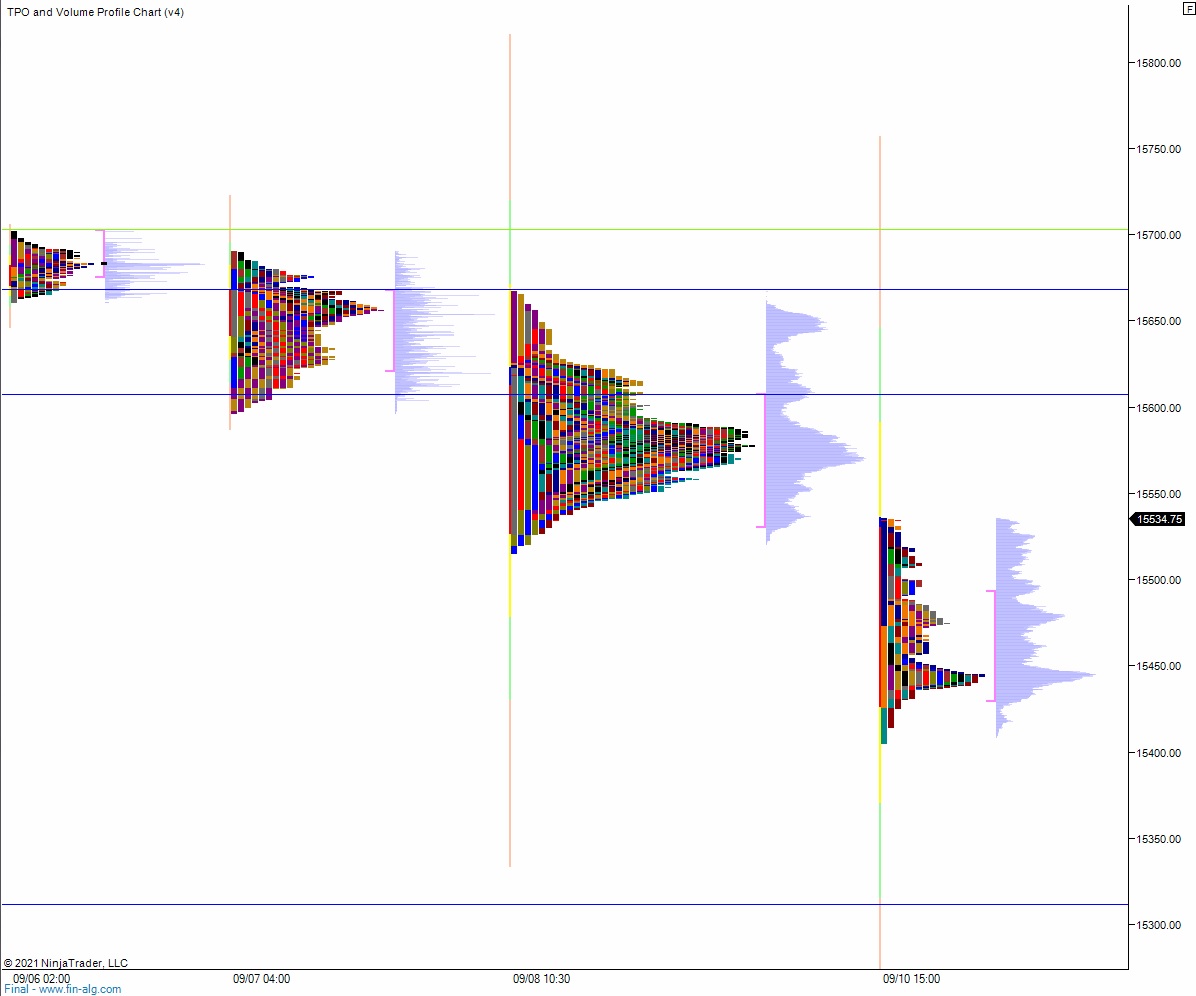

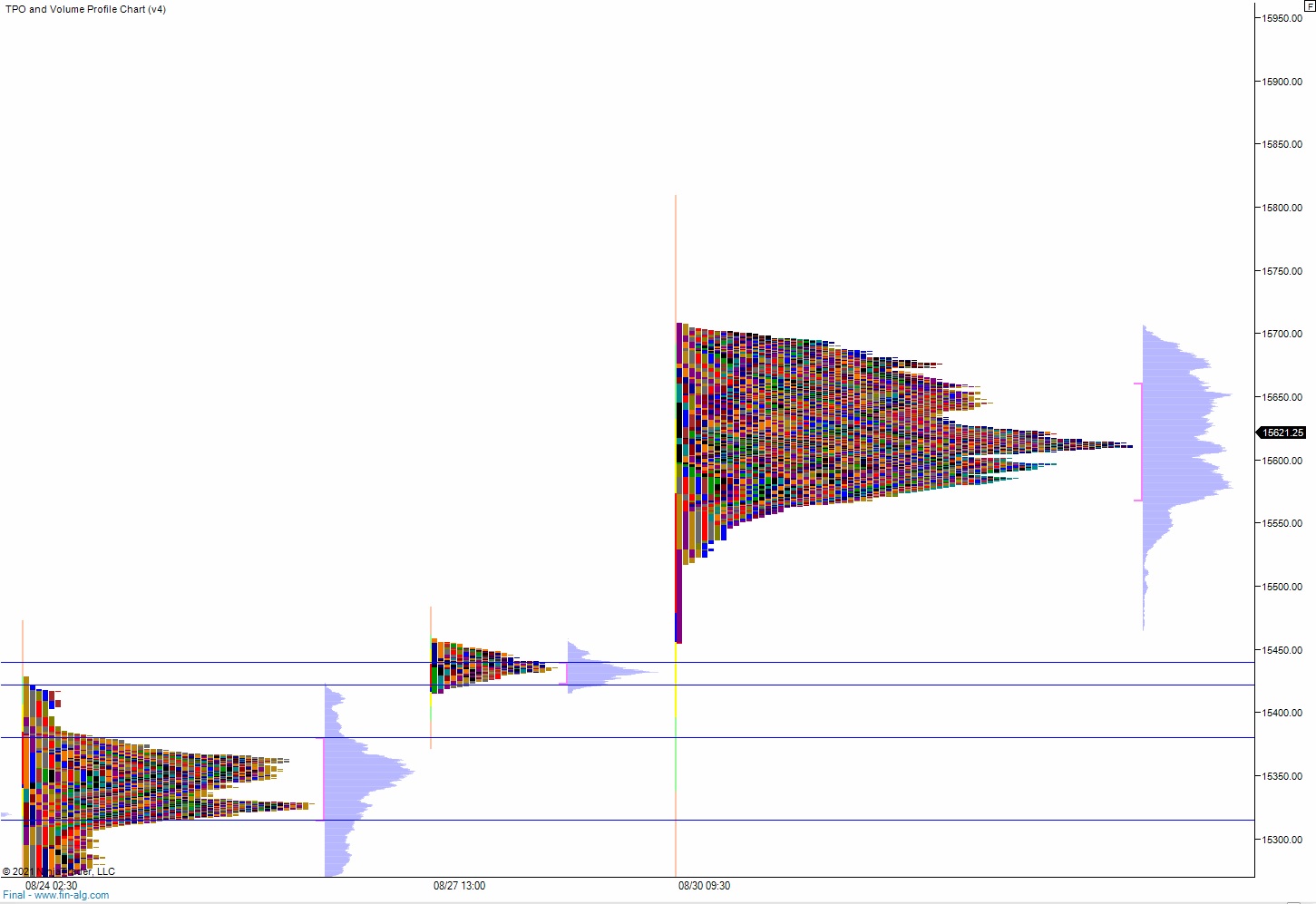

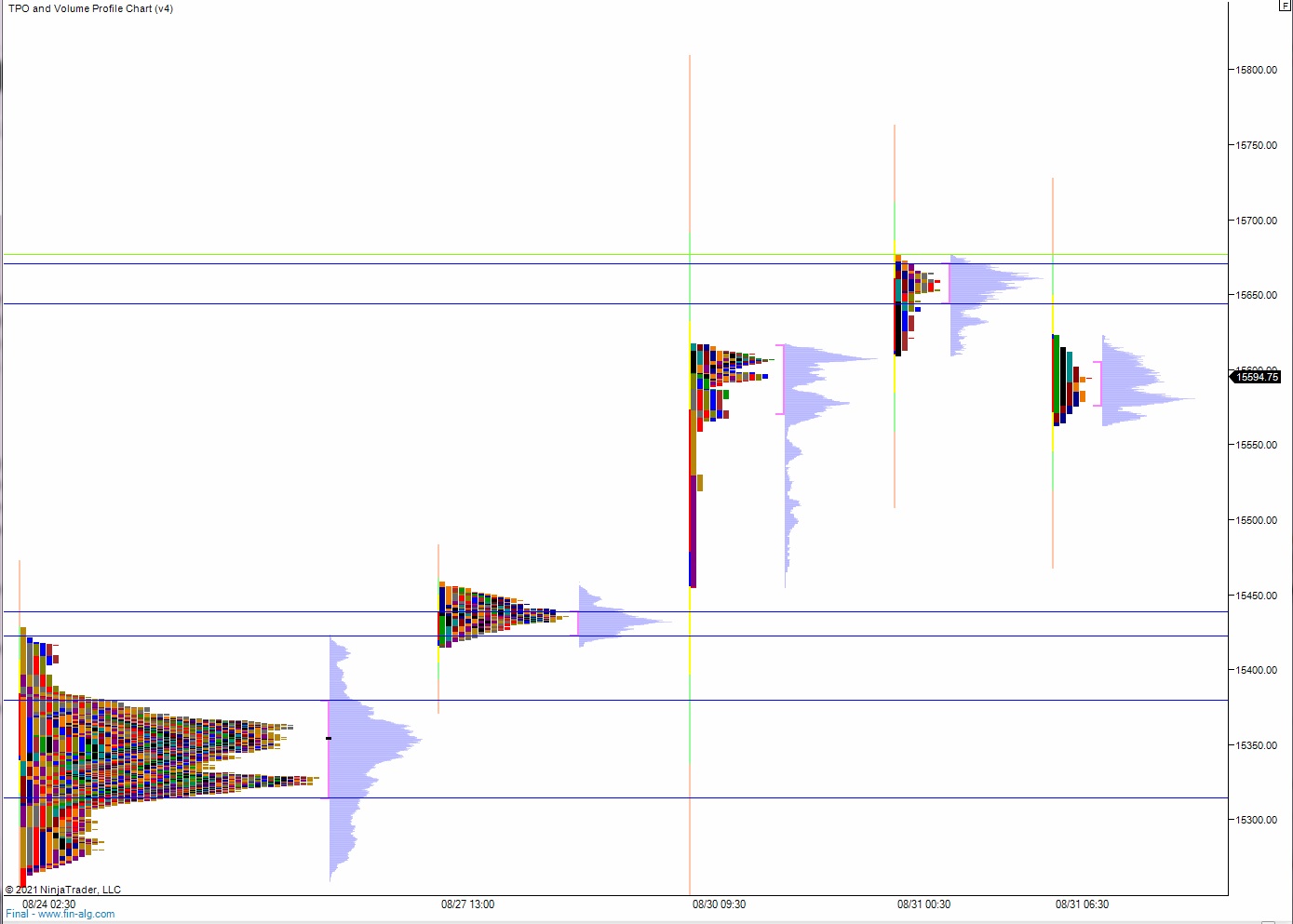

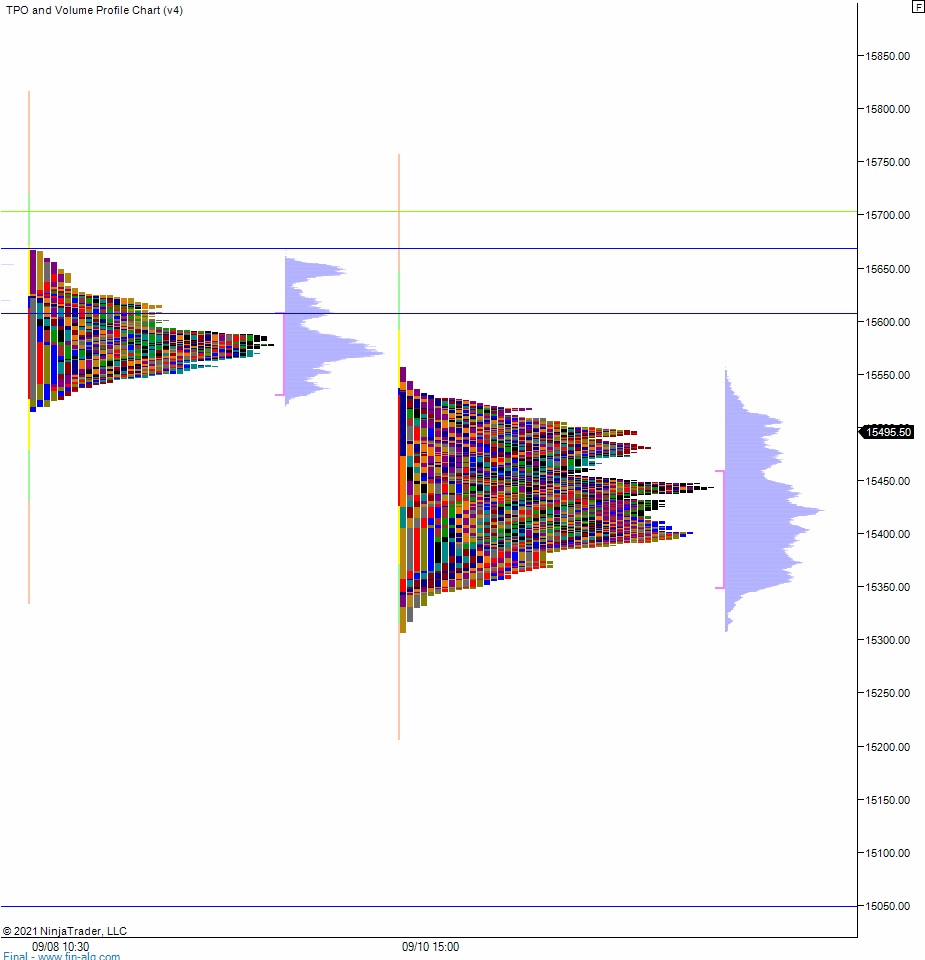

Levels:

Volume profiles, gaps and measured moves: