NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring elevated range and volume. Price drifted lower overnight, drifting down near yesterday’s open. At 8:30am the economic data came out about as ideal as bulls want to see—jobless claims worse than expected, Philadelphia Fed data much better than expected and retail sales data stronger than expected. As we approach cash open price is hovering about +50 point above the Wednesday midpoint.

Also on the economic calendar today we have business inventories at 10am followed by 4- and 8-week T-bill auctions at 11:30am.

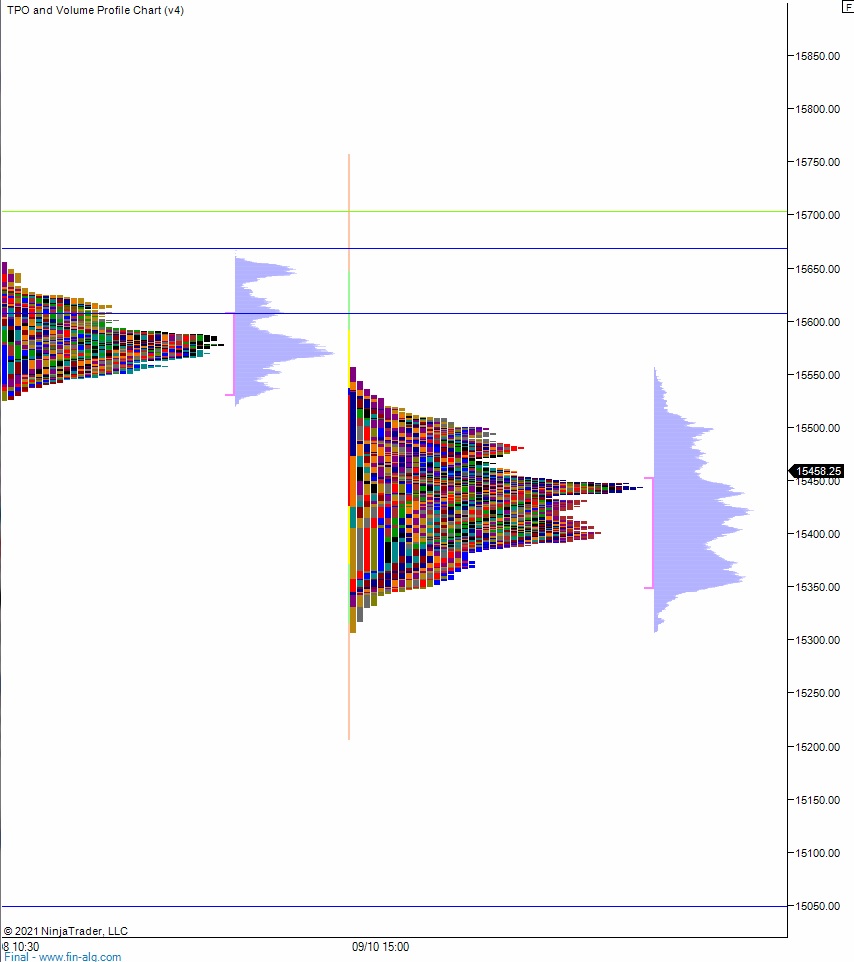

Yesterday we printed a double distribution trend up. The day began with a slight gap up. After an open test higher sellers stepped in and worked price down through the weekly low. Price bottomed out before going range extension down, just after 10:30am. Initial test back to the midpoint was defended by sellers, but midway through New York lunch a second buy pushed through the mid and triggered a rally. Price made new high-of-day before 1pm and continued to rally up into the closing bell. We did not exceed the Tuesday high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 15,499.75 before two way trade ensues.

Hypo 2 stronger buyers trade up to 15,571.50 before two way trade ensues.

Hypo 3 sellers press down through overnight low 15,433 and tag 15,400 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: