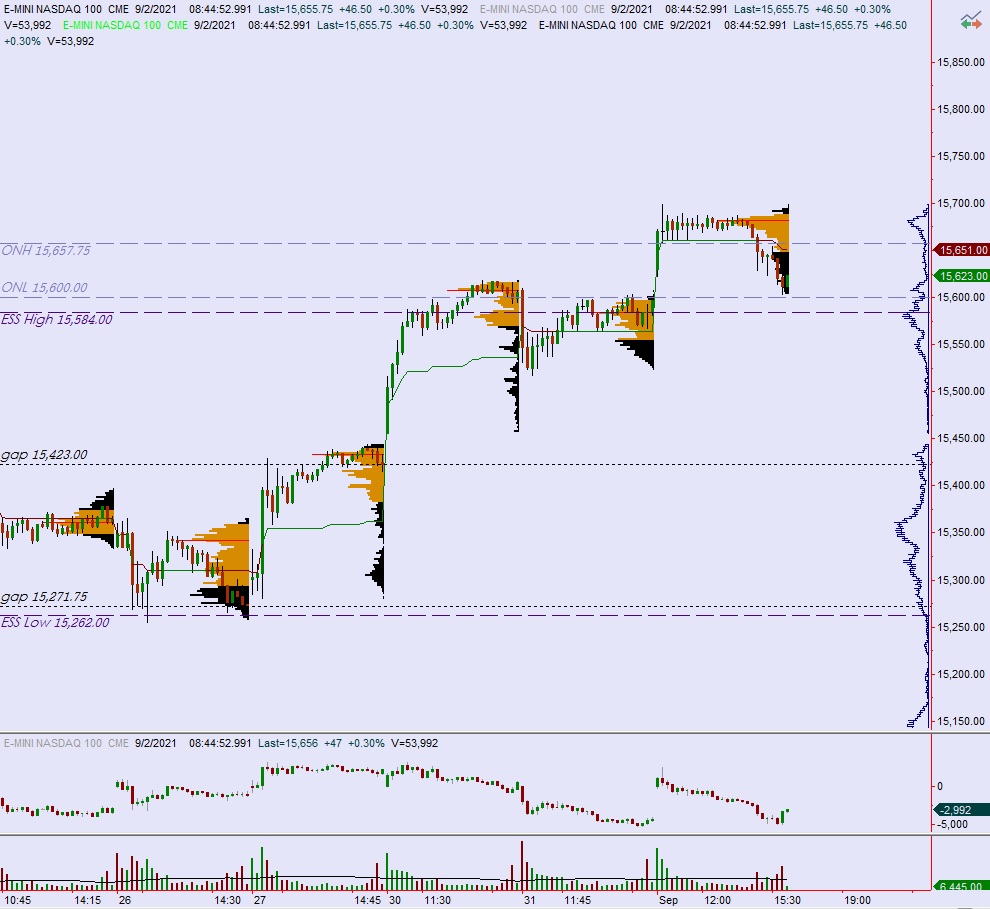

NASDAQ futures are coming into the second day of September with a slight gap up after an overnight session featuring normal range and volume. Price was balanced overnight. After briefly poking below the Monday low price stabilized. At 8:30am jobless claims data came out in-line with expectations and as we approach cash open price is hovering along the Monday midpoint.

Also on the economic calendar today we have factory orders at 10am followed by 4- and 8-week T-bill auctions at 11:30am.

Yesterday we printed a normal variation down. The day began with a gap up beyond the prior two days’ ranges and a drive higher. Said drive achieved new record highs before flagging in a tight range for many hours. Late in the day sellers reversed the morning drive making a late range extension down and closing near the lows after nearly filling the overnight gap.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 15,623. Sellers continue lower, taking out overnight low 15,600 before two way trade ensues.

Hypo 2 buyers press up through Wednesday high 15,699 before two way trade ensues.

Hypo 3 stronger sellers work down to 15,555.50 before two way trade ensues.

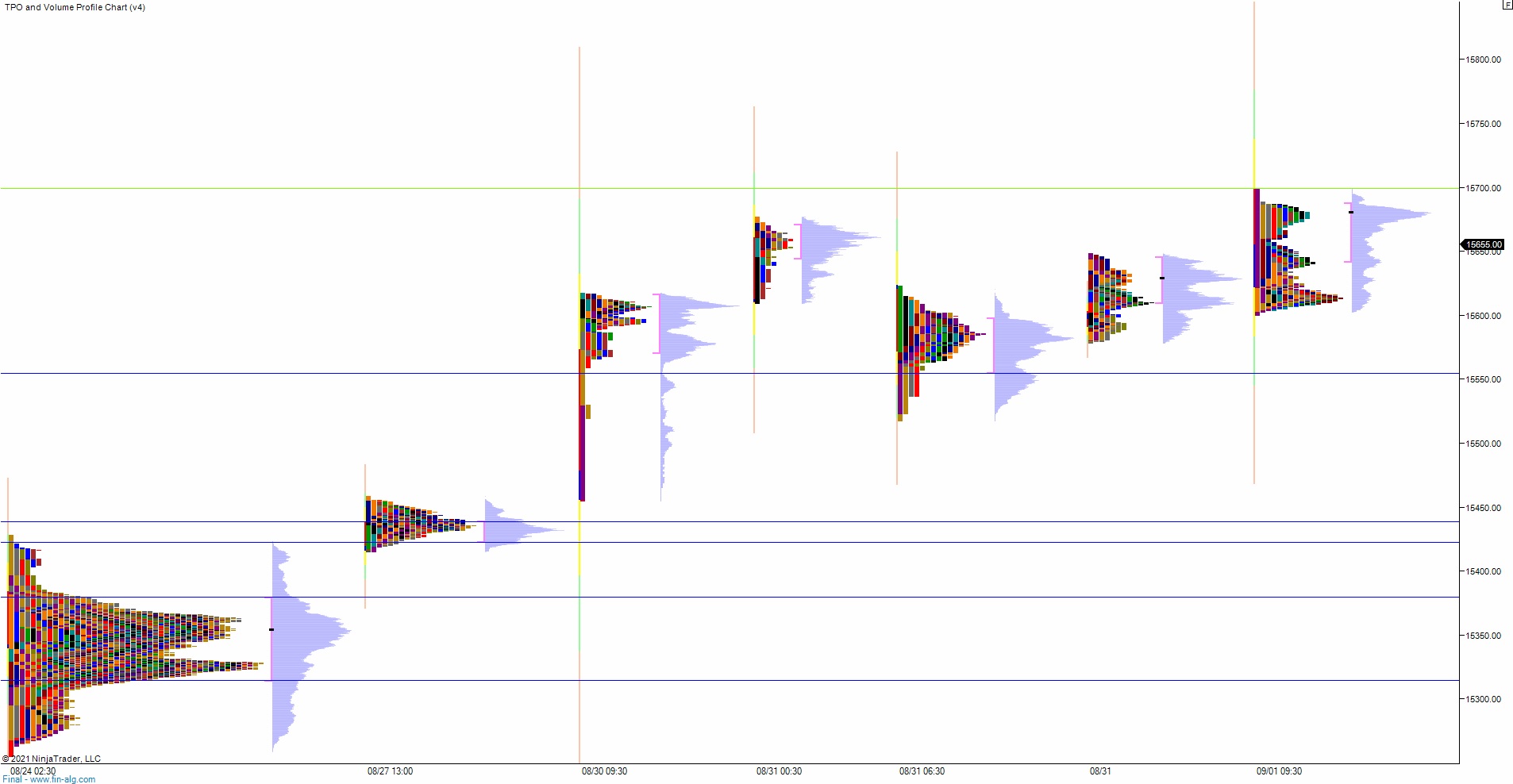

Levels:

Volume profiles, gaps and measured moves: