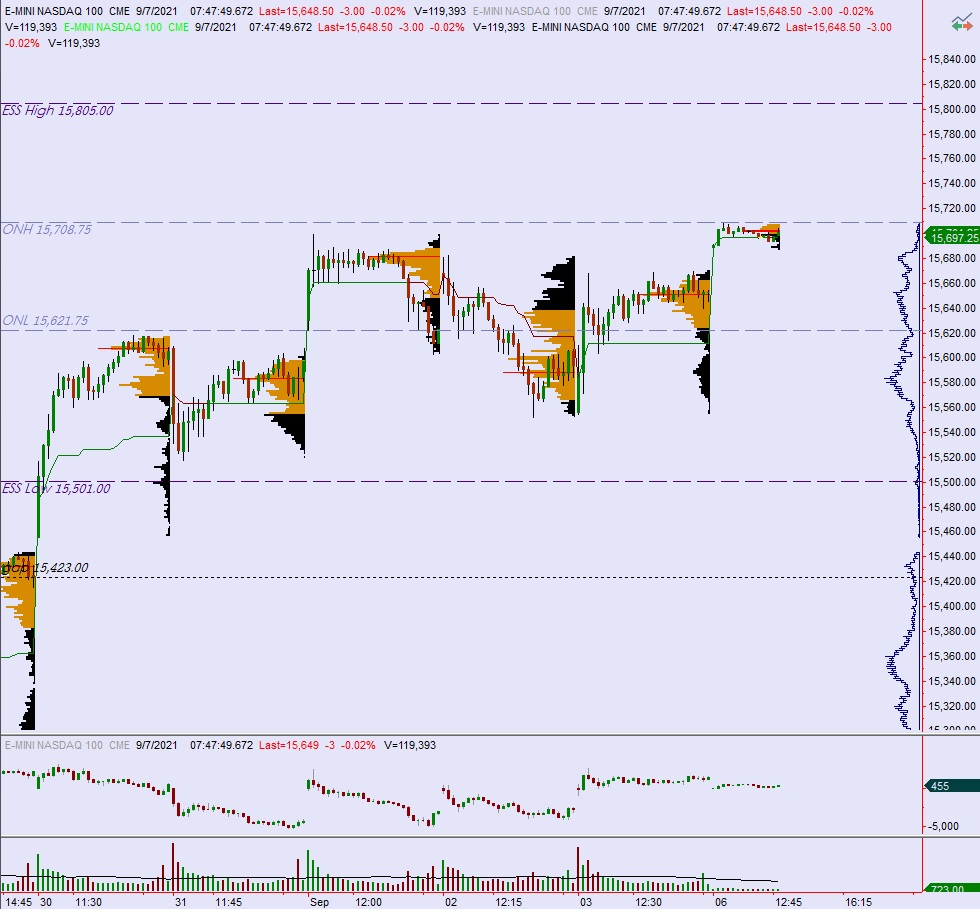

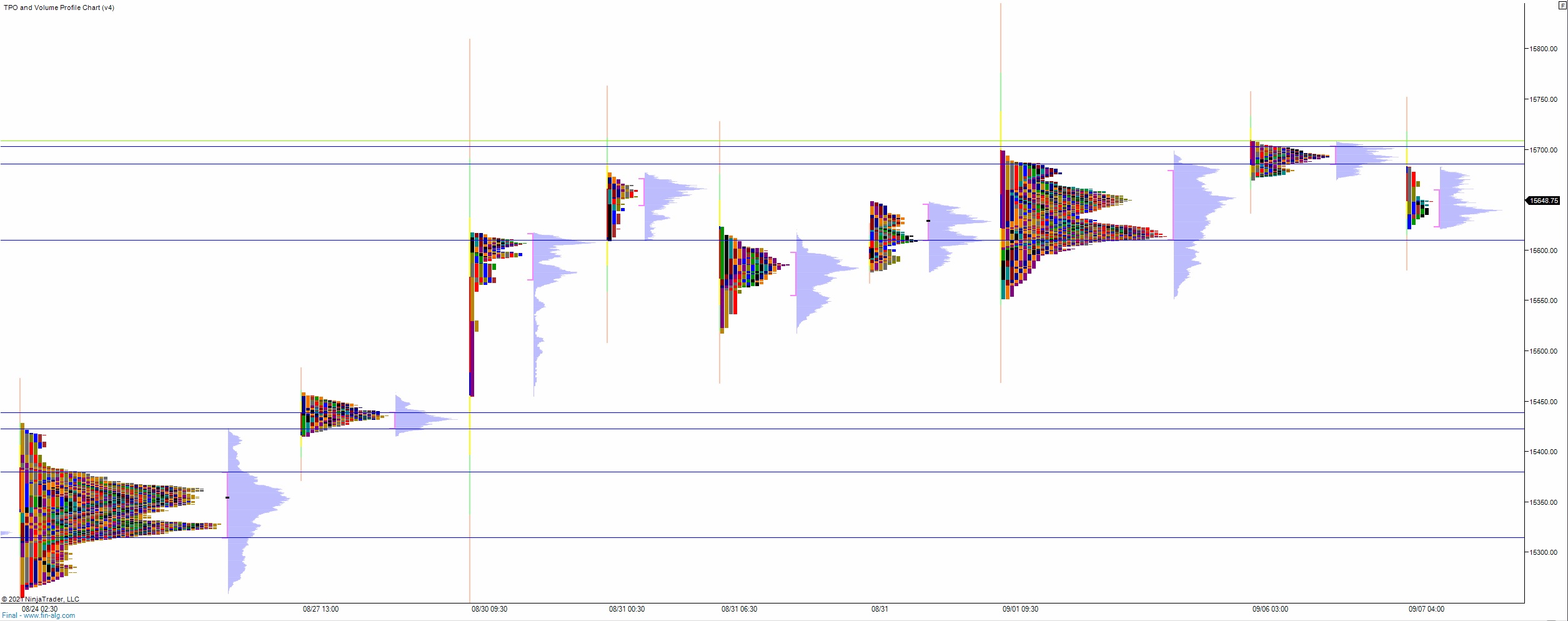

NASDAQ futures are coming into the second week of September about five points below the Friday close after an overnight session featuring extreme volume on elevated range. Price drifted slightly lower overnight after printing a new record high early in the globex session. As we approach cash open price is hovering in the upper quadrant of last Friday’s range.

On the economic calendar today we have 3- and 6-month T-bill auctions at 10am, 52-week T-bill auctions at 11:30am and a 3-year note auction at 1pm.

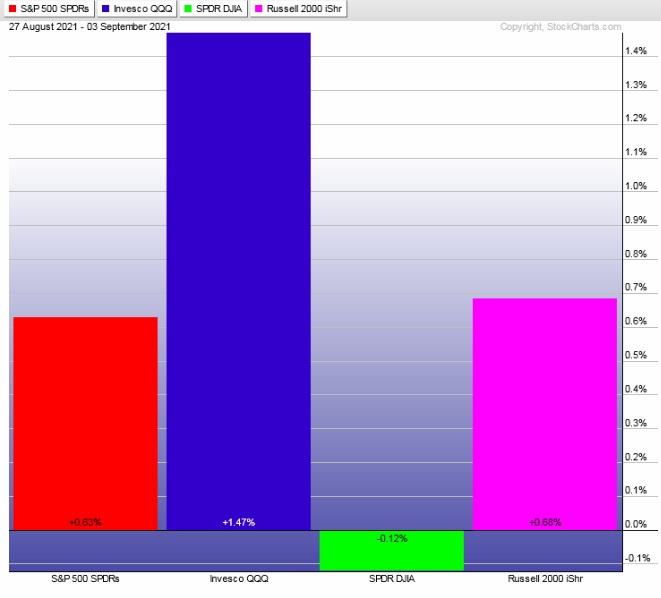

Last week the major indices had a bit of strength early in the week and then a steady drift along the highs into the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap down in range. Buyers drove into the open, quickly resolving the gap. Buyers continued the drive for the first 30 minutes of trade but a sharp excess high formed before buyers could take out the Thursday high. Instead price checked back to the daily mid. Buyers defended the mid sending price into a steady drift along the daily high, eventually making a range extension around 1:45pm New York. Price drifting along the high into the close.

Heading into today my primary expectation is for buyers to work up through overnight high 15,708 before two way trade ensues.

Hypo 2 sellers press down to 15,609.75 before two way trade ensues.

Hypo 3 stronger sellers tag 15,500 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: