NASDAQ futures are coming into the first full trading week of September up +90 after an overnight session featuring extreme range and volume. Price was balanced overnight. Just before 2am price poked below the Friday low and was met with strong responsive buying. Since then price has worked back up into Friday range and as we approach cash open price is hovering just below the Friday midpoint.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

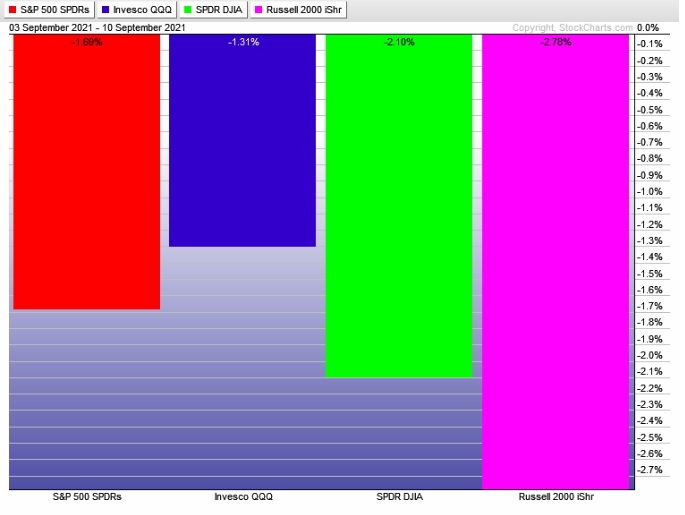

Last week featured a bit of strength Tuesday morning was faded. Then steady selling all week. Eventually closing out the week on the lows after Friday of heavy selling.

The last week performance of each major index is shown below:

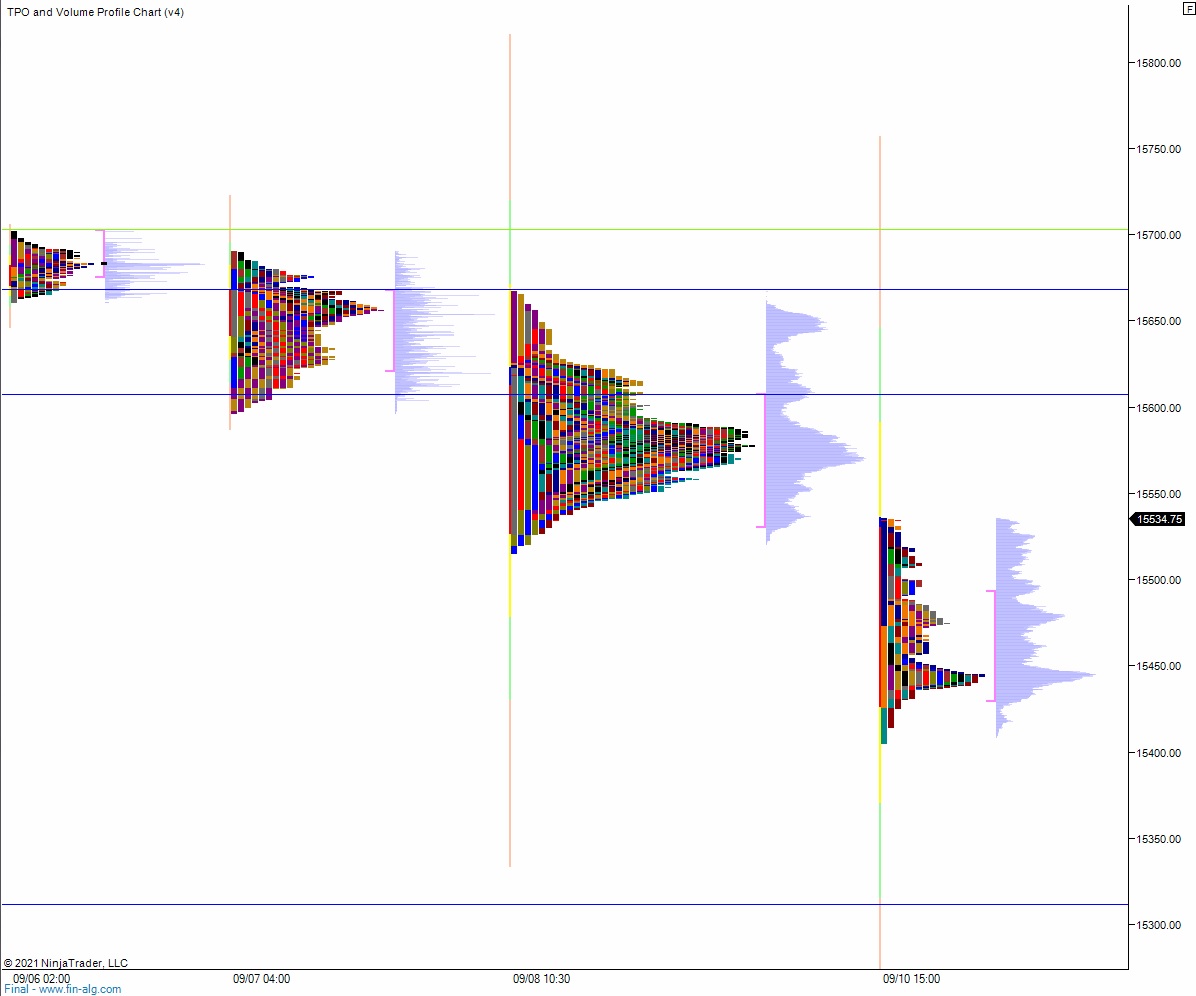

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up in range. After an open-two-way auction failed to take out the Thursday high sellers stepped in and drove down into the gap, effectively closing it before New York lunch. Around noon price probed below the Thursday low before making a sharp move back to the daily midpoint. Sellers defended the mid and we sold off into the close and closed on the lows.

Heading into today my primary expectation is fora gap-and-go higher. Buyers sustain trade above 15,500 setting up a run to 15,570.25.

Hypo 2 sellers to work into the overnight inventory and close the gap down to 15,447 before two way trade ensues.

Hypo 3 stronger sellers press down through overnight low 15,405.75. Look for buyers down at 15,400 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: