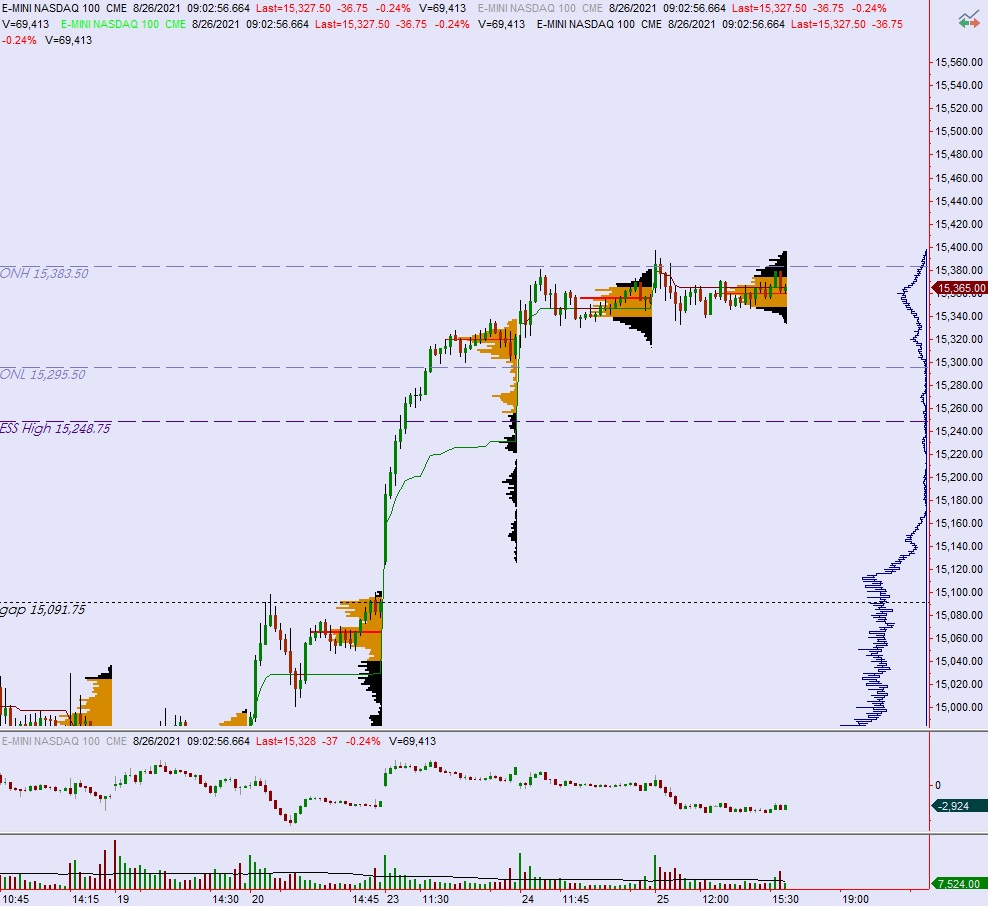

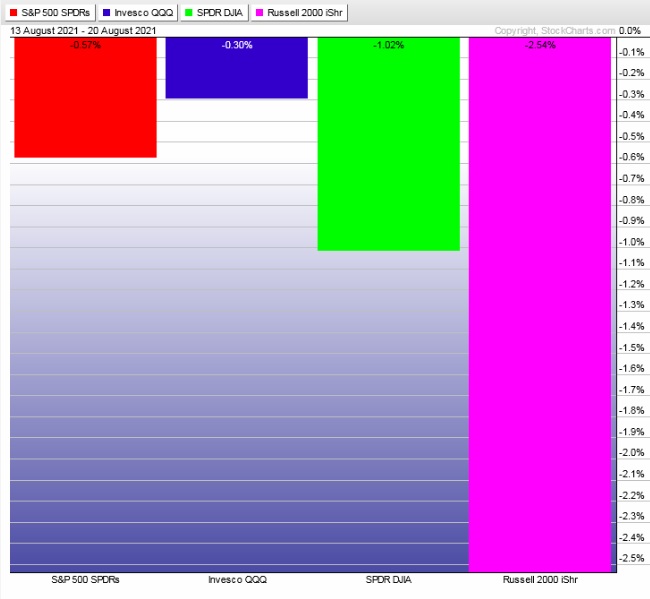

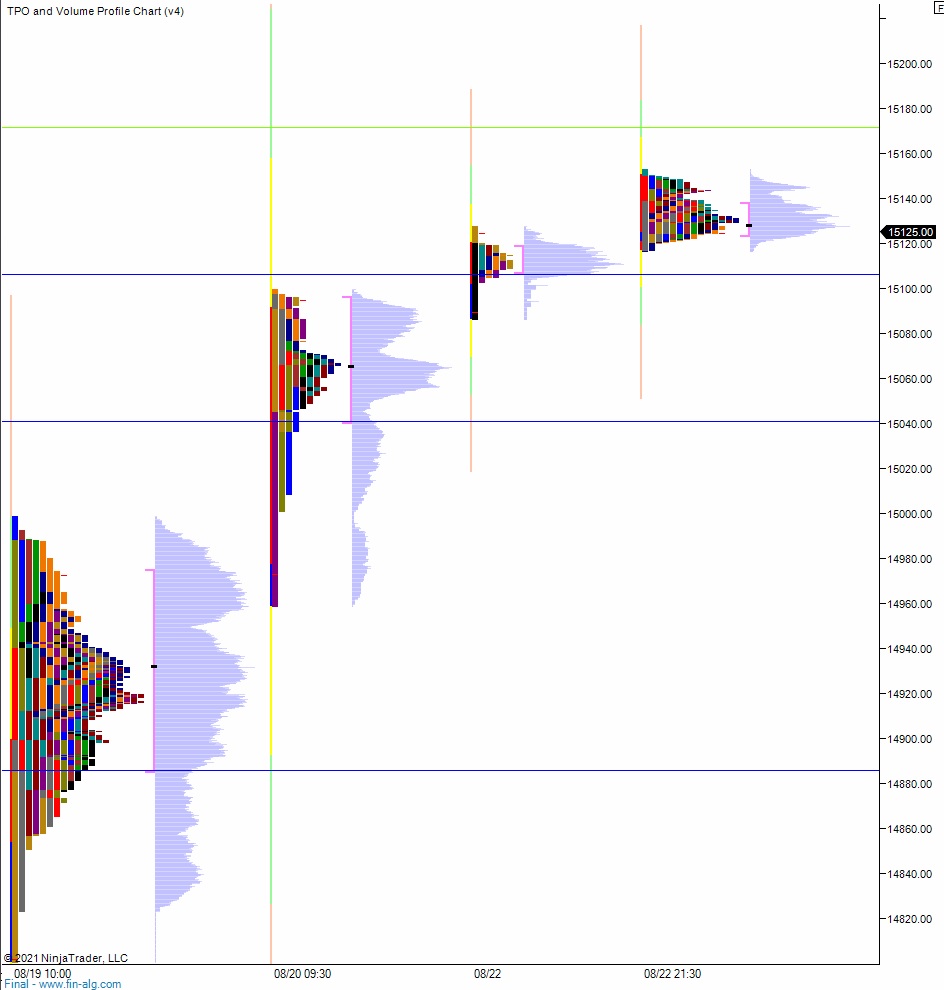

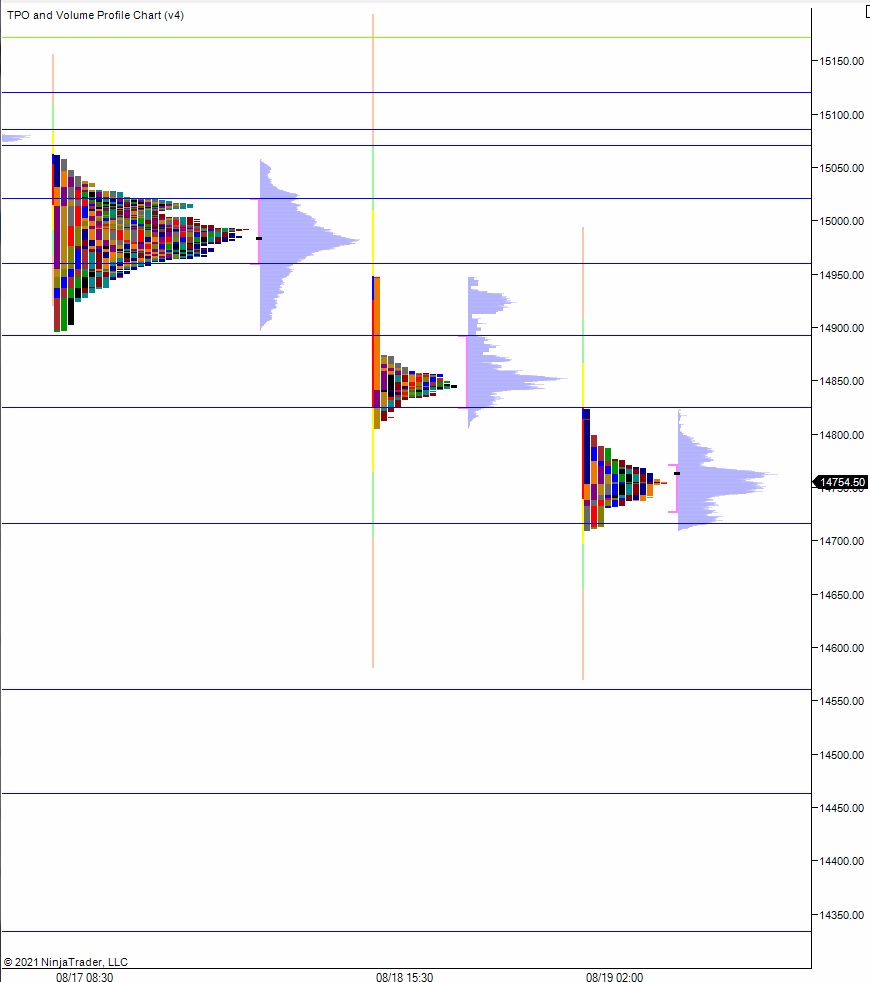

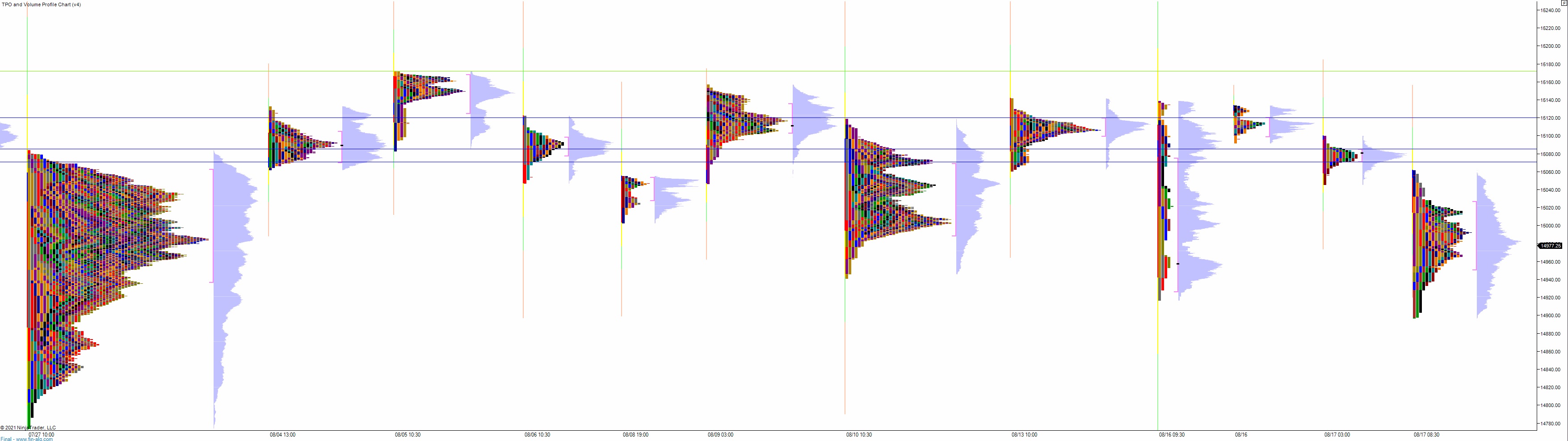

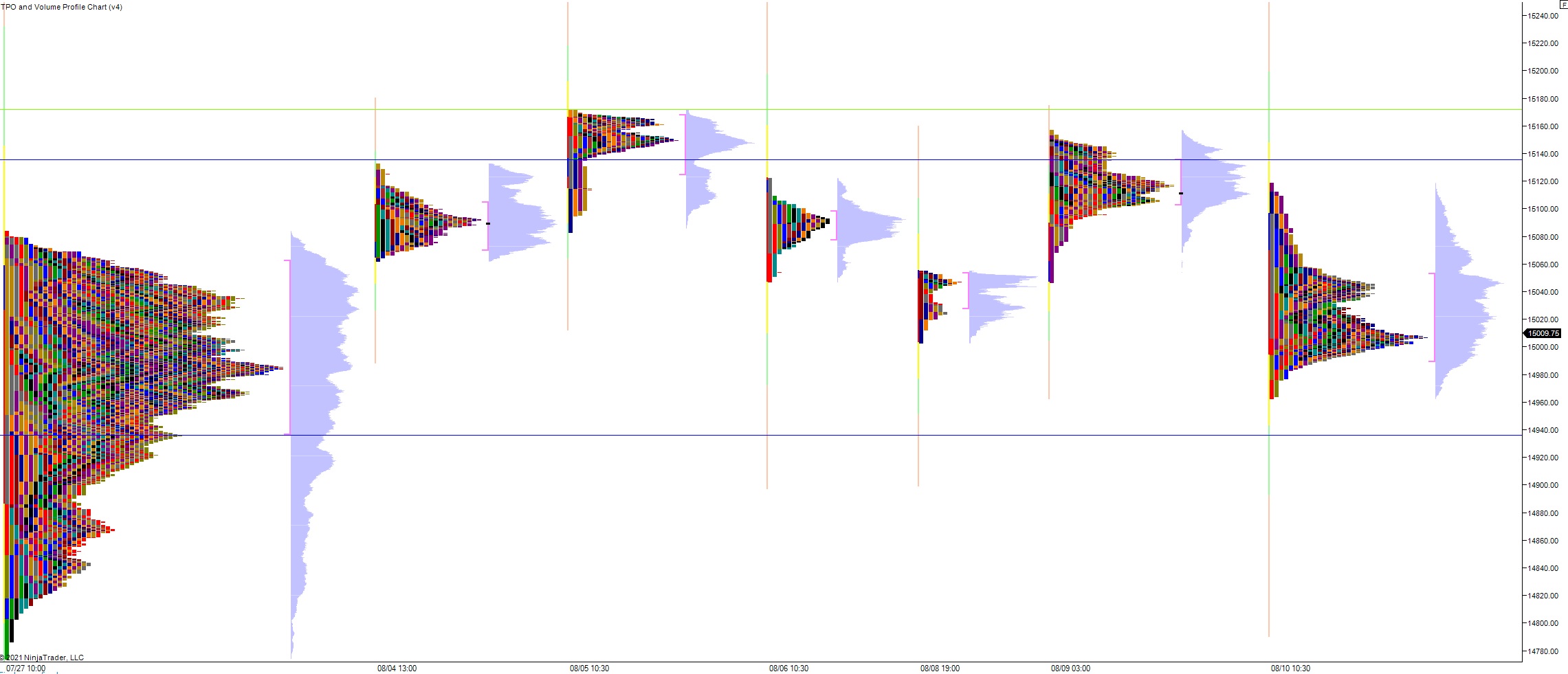

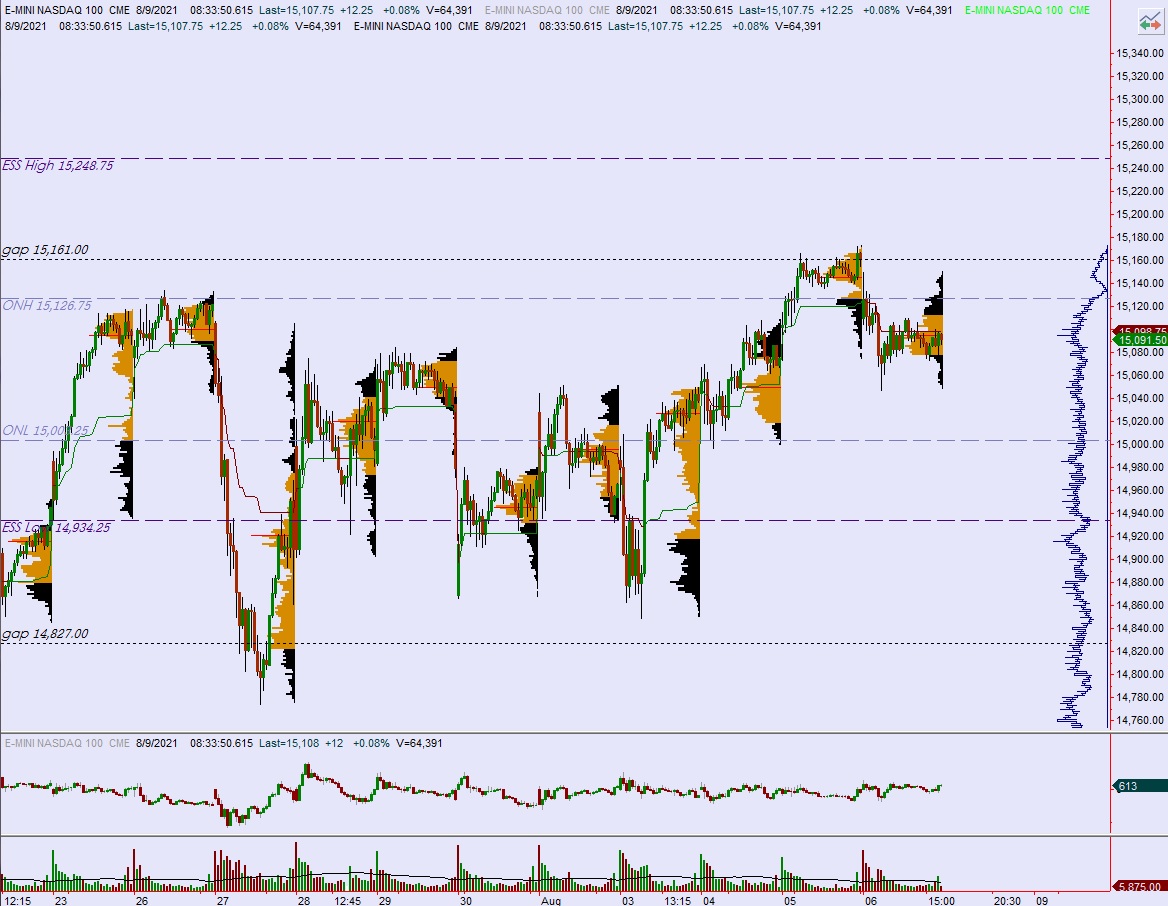

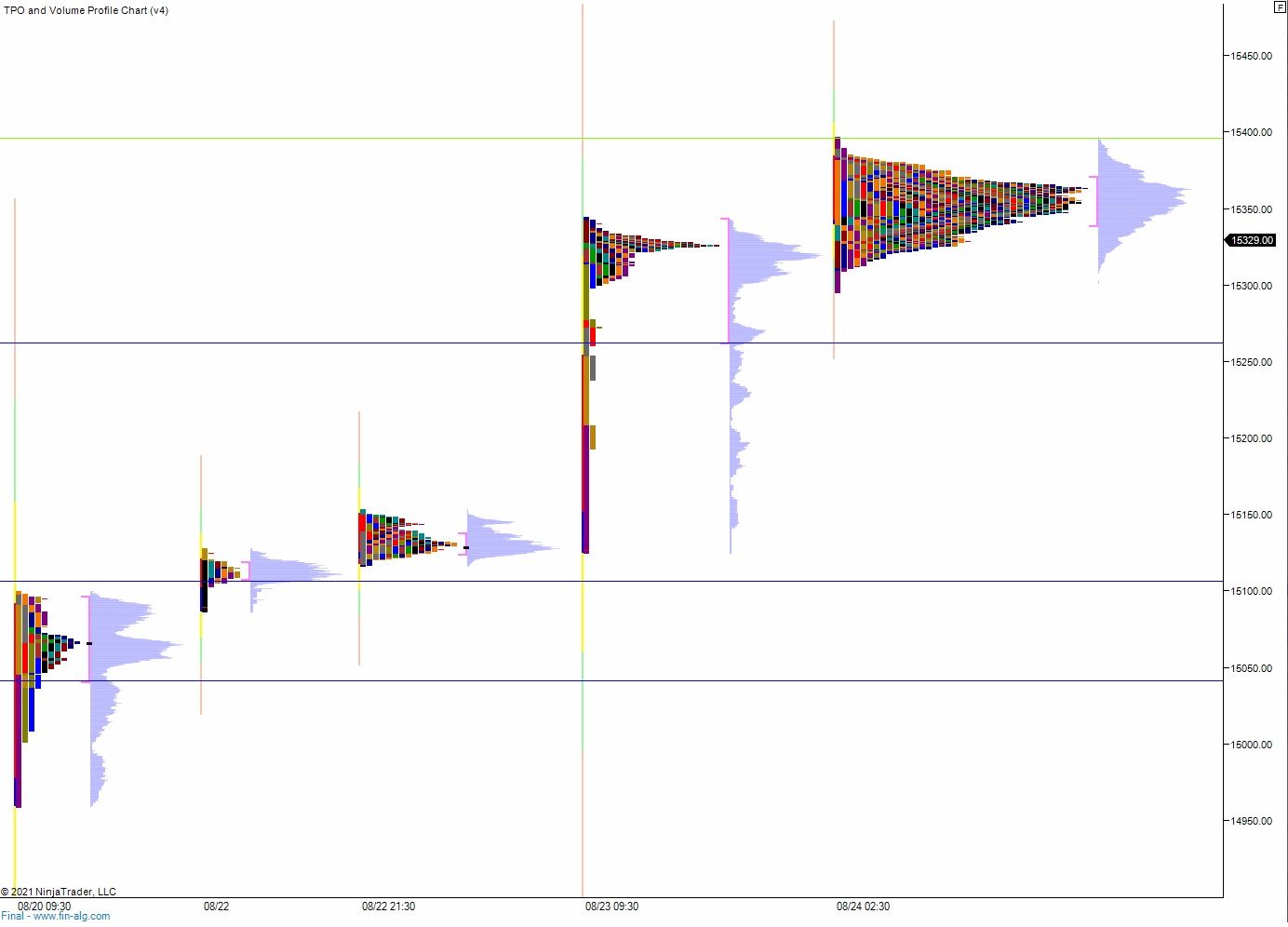

NADSDAQ futures are coming into the final Thursday in August with a slight gap down after an overnight session featuring elevated range and volume. Price sort of drifted lower overnight, working down into the Monday range for a bit. Then it rotated back up into Wednesday range. At 8:30am GDP and jobless claims data came out inline with expectations and as we approach cash open price is hovering below Wednesday’s range.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 7-year note auction at 1pm.

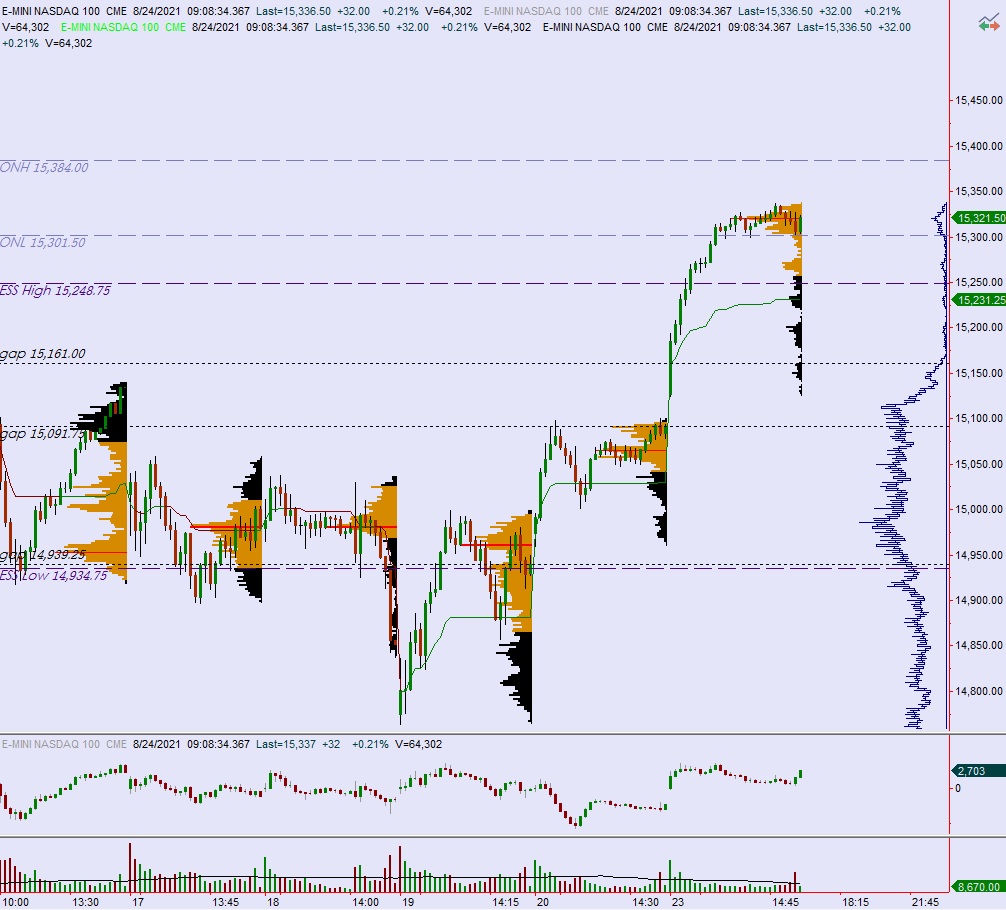

Yesterday we printed a normal variation down. The day began with a slight gap up in range. Buyers drove higher off the open, working up to a new all-time high in the first 15 minutes of trade. This would mark session high and sellers quickly resolved the overnight gap shortly thereafter. Then sellers pushed an early range extension down. Sellers could not, however, campaign price down through the Tuesday low. Instead price drifted below the daily midpoint for several hours before ramping up through it late in the session.

Heading into today my primary expectation is for sellers to reject a move back into Wednesday low 15,333 setting up a move down through overnight low 15,295.50. Look for buyers down at 15,262 and for two way trade to ensue.

Hypo 2 stronger sellers trigger a liquidation down to 15,200.

Hypo 3 buyers reclaim Wednesday low 15,333 and sustain trade above it setting up a move up through overnight high 15,383.50 and a prove beyond all-time high 15,397. Look for sellers at 15,400 and for two way trade to ensue.

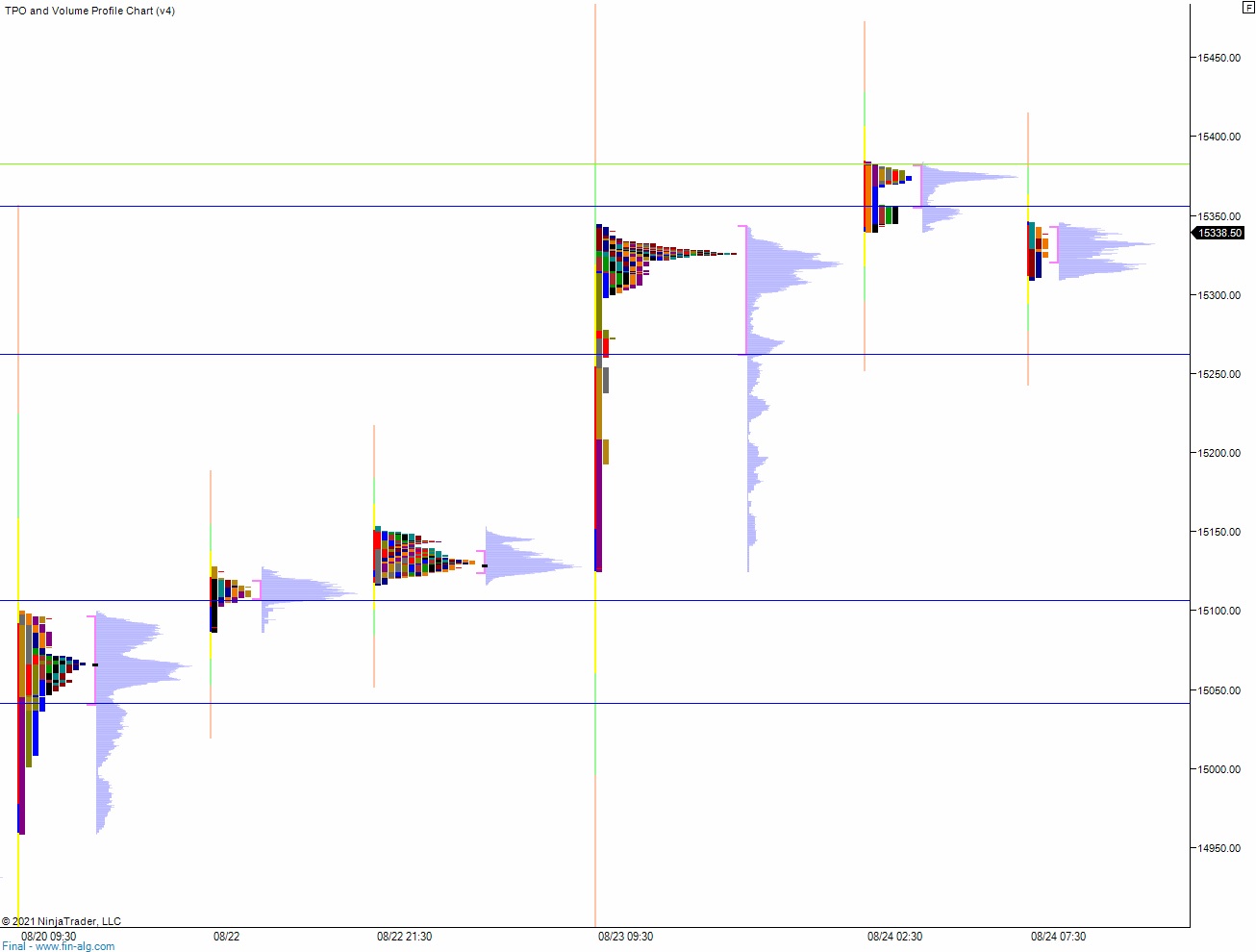

Levels:

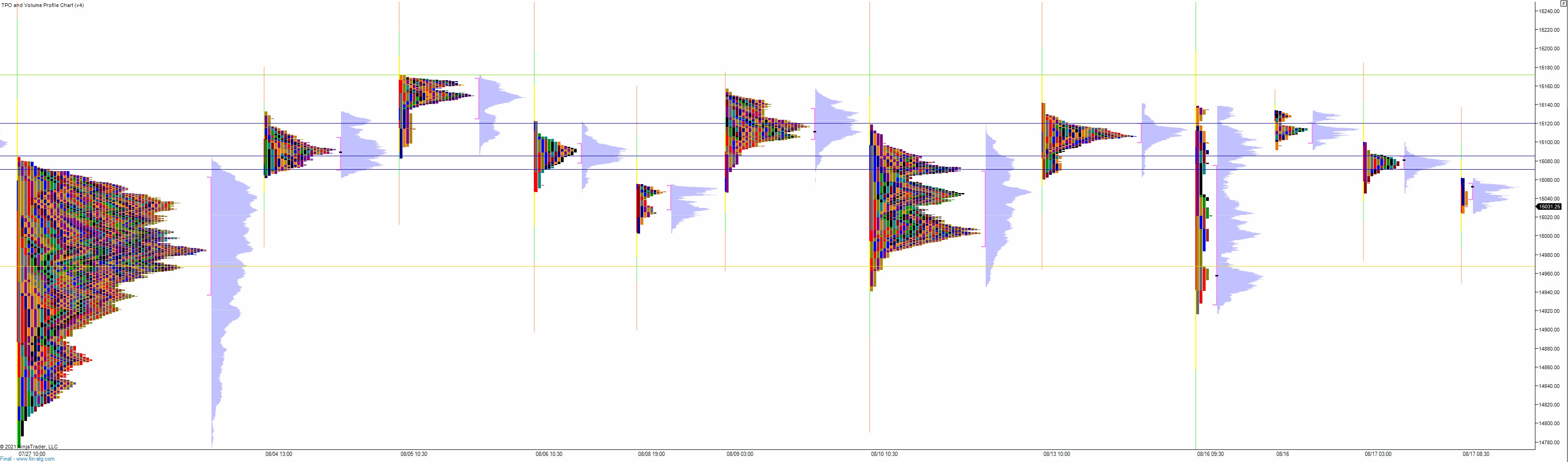

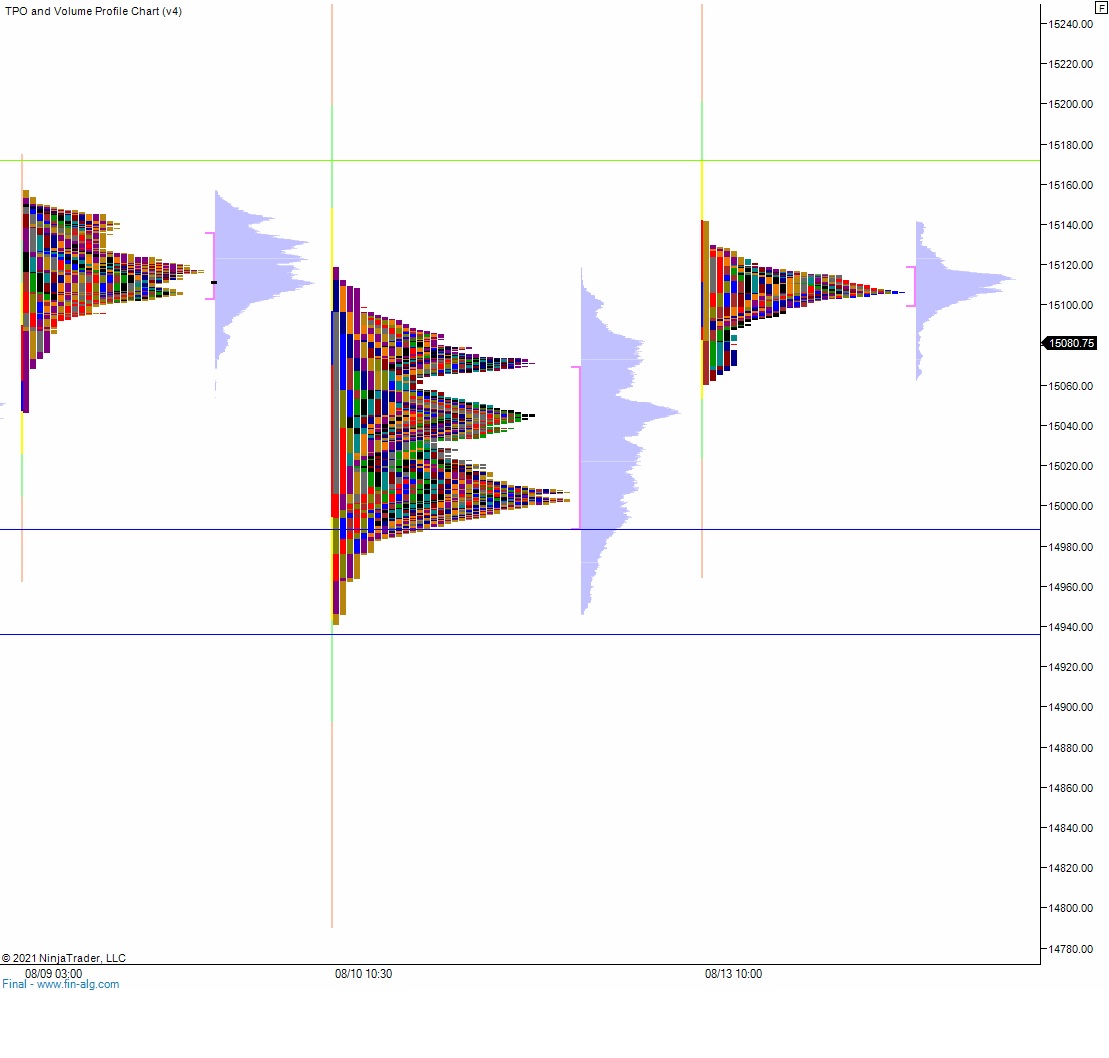

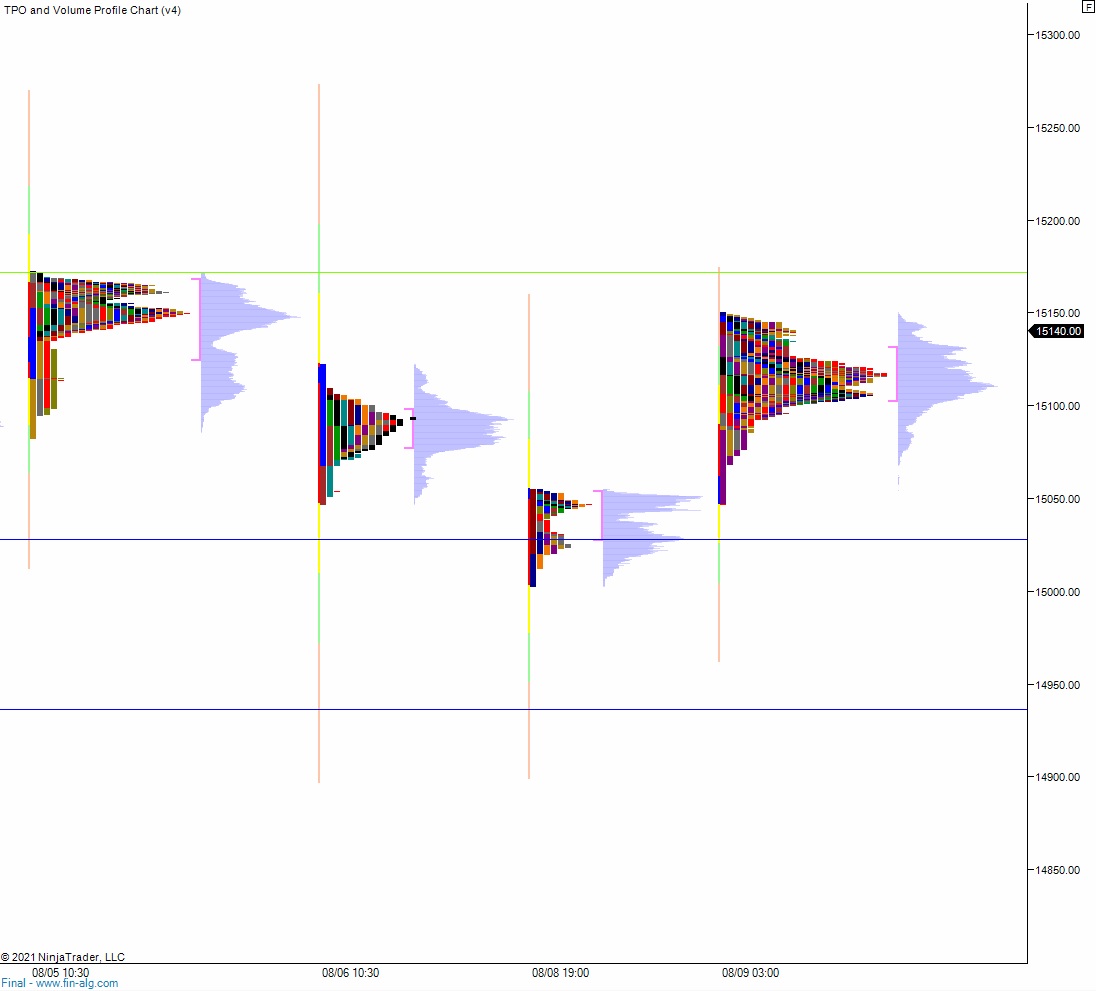

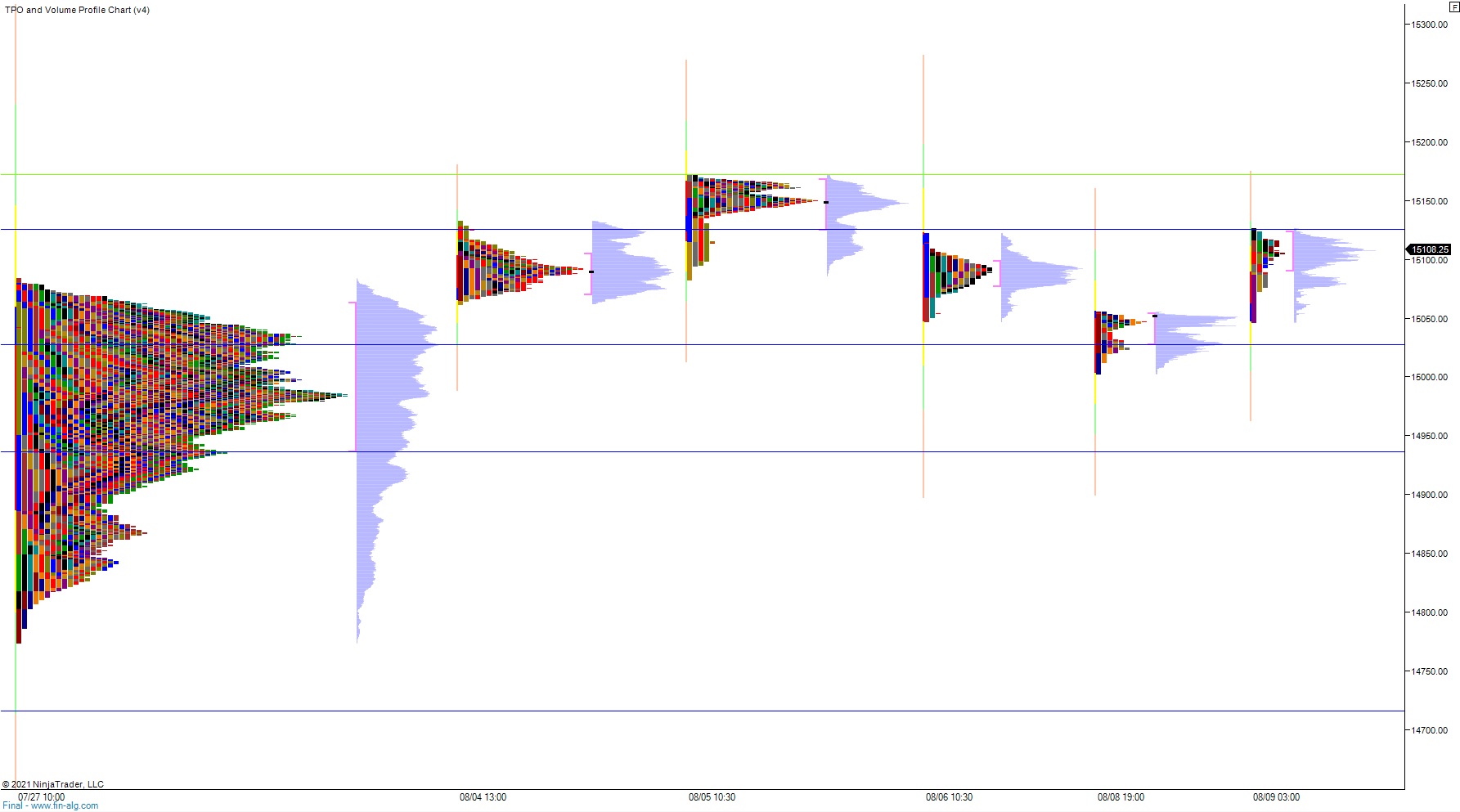

Volume profiles, gaps and measured moves: