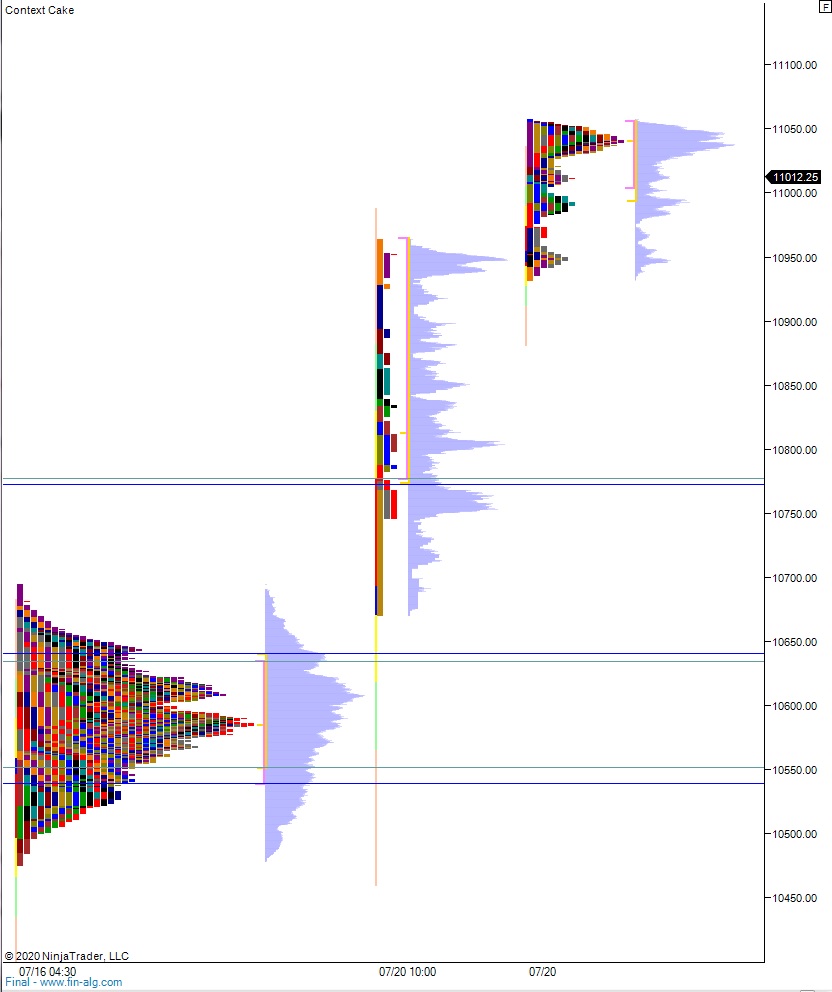

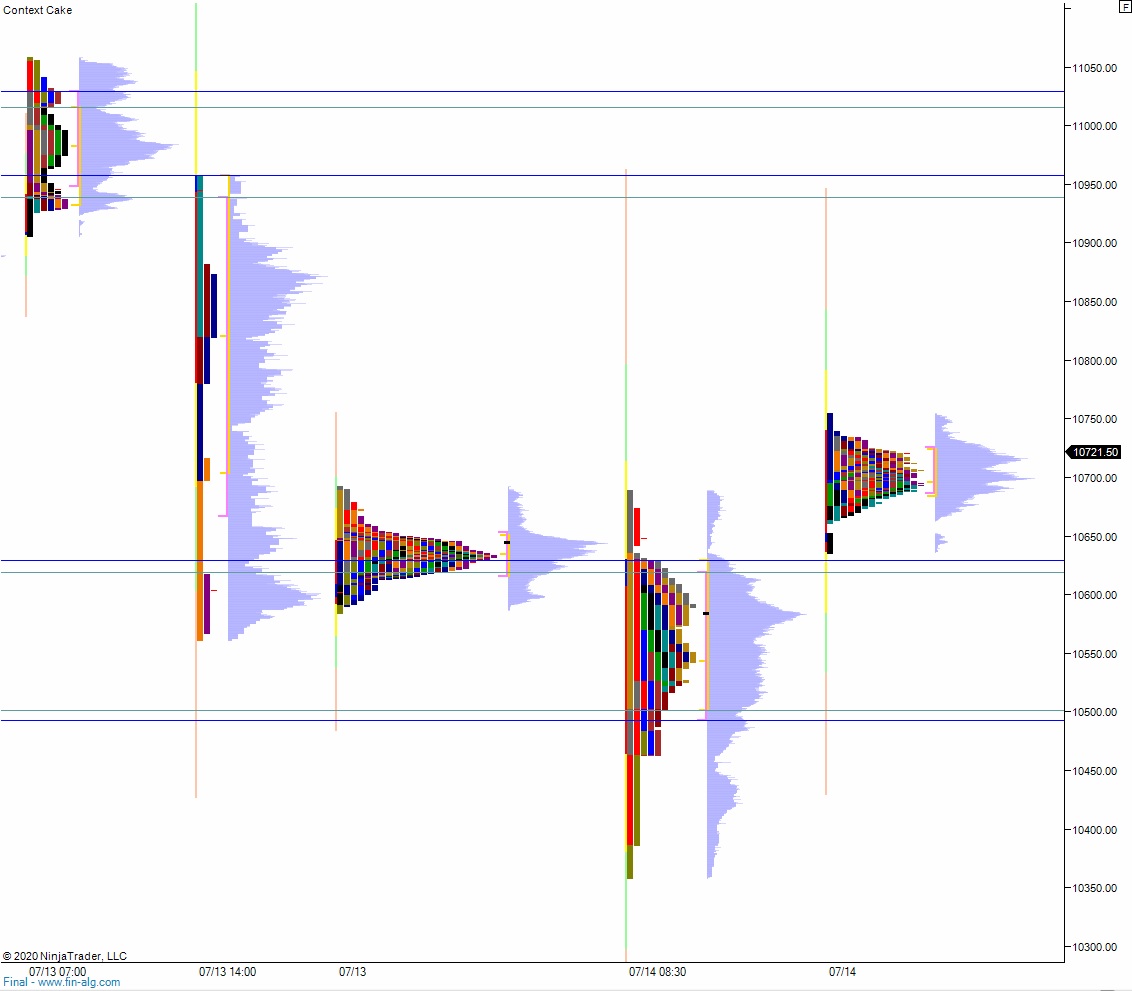

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated volume on extreme range. Price was balanced overnight. Sellers managed to work price about -1.75 points below Tuesday’s cash low before discovering buyers. Failed auction down around 2am. From there price steadily campaigned higher, and as we approach cash open price is hovering above Tuesday’s midpoint.

On the economic calendar today we have the Fed meeting announcement at 2pm. CME Fed Fund Futures are pricing a 100% probability of the central bank leaving their benchmark borrowing rate unchanged at 0%. At 2:30pm we’ll hear from Fed Chairman Jerome Powell who is scheduled to give a press conference.

Major NASDAQ component Facebook, Inc is set to report earnings after the bell. The company will also be on Capitol Hill today along with Amazon and Apple dealing with politicians who want to argue the tech companies have become too powerful.

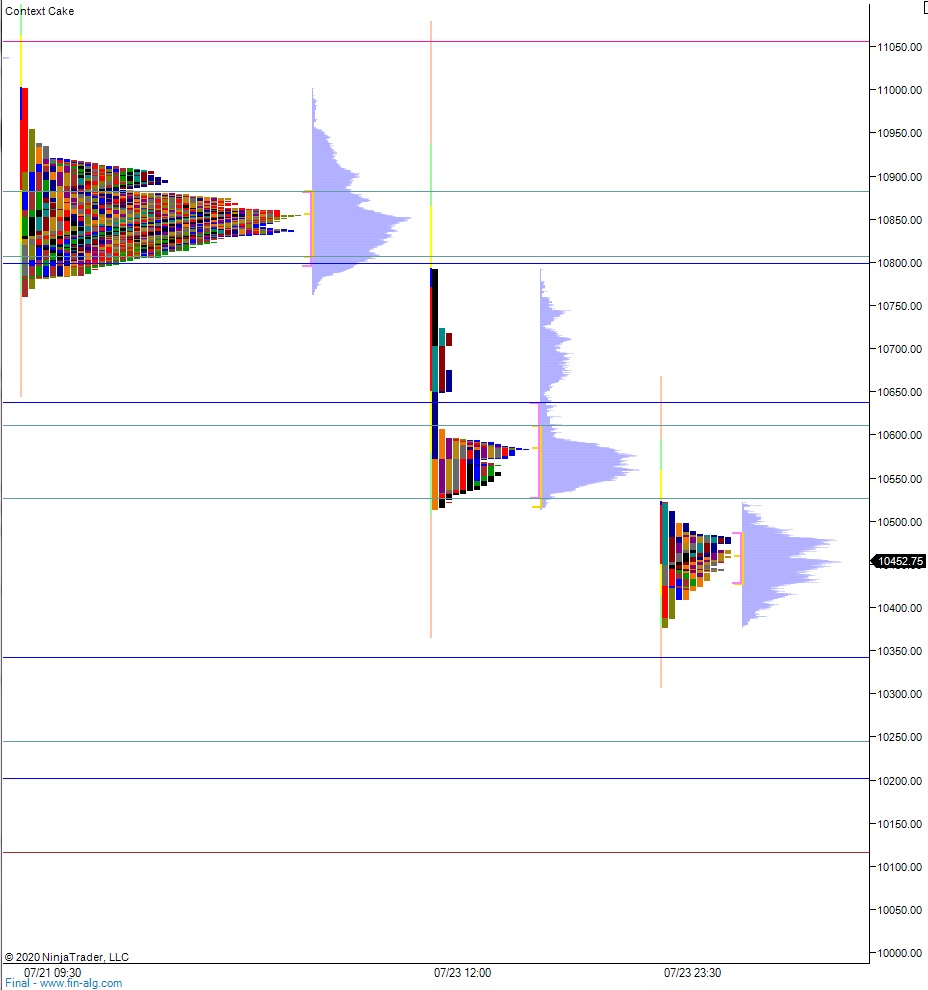

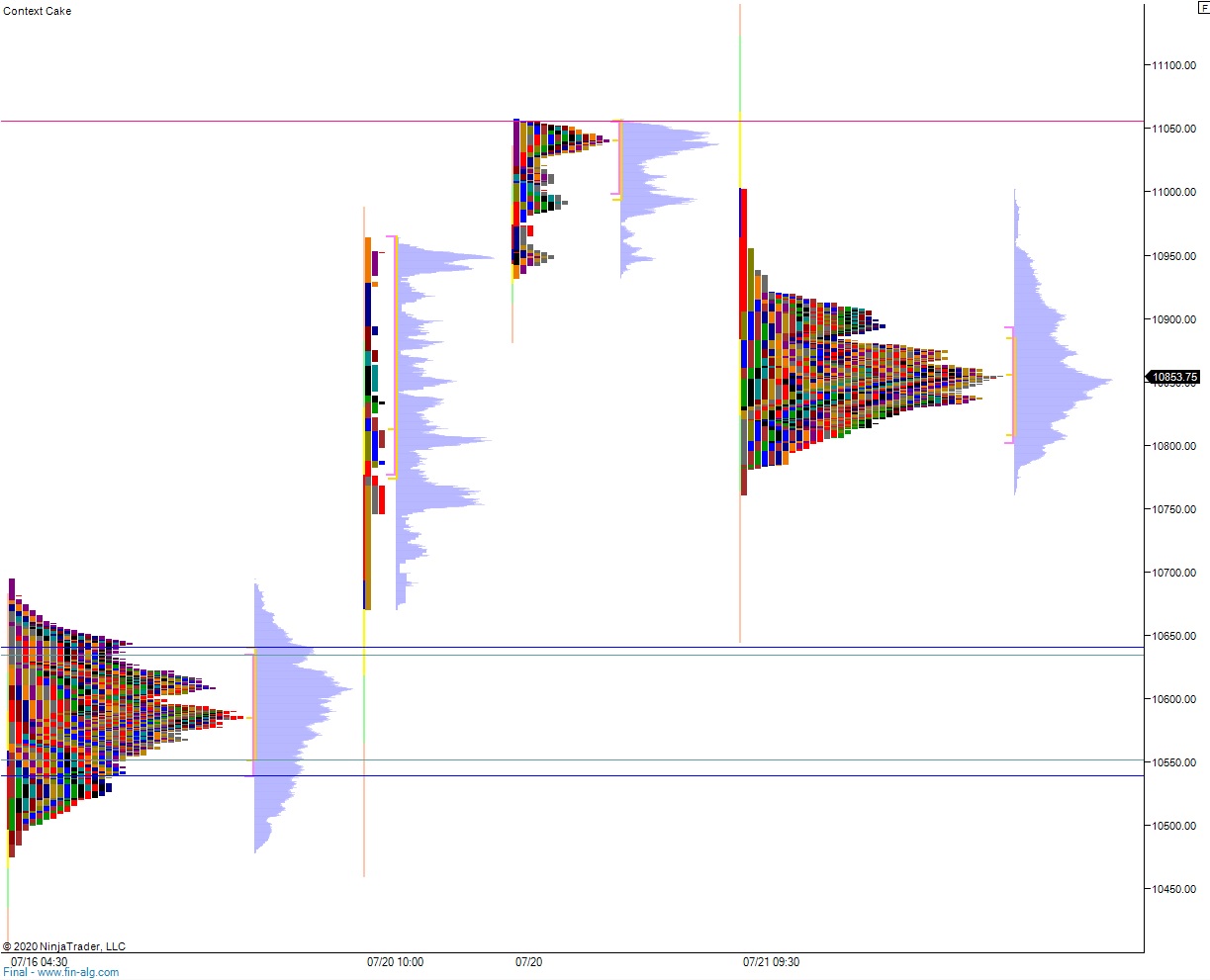

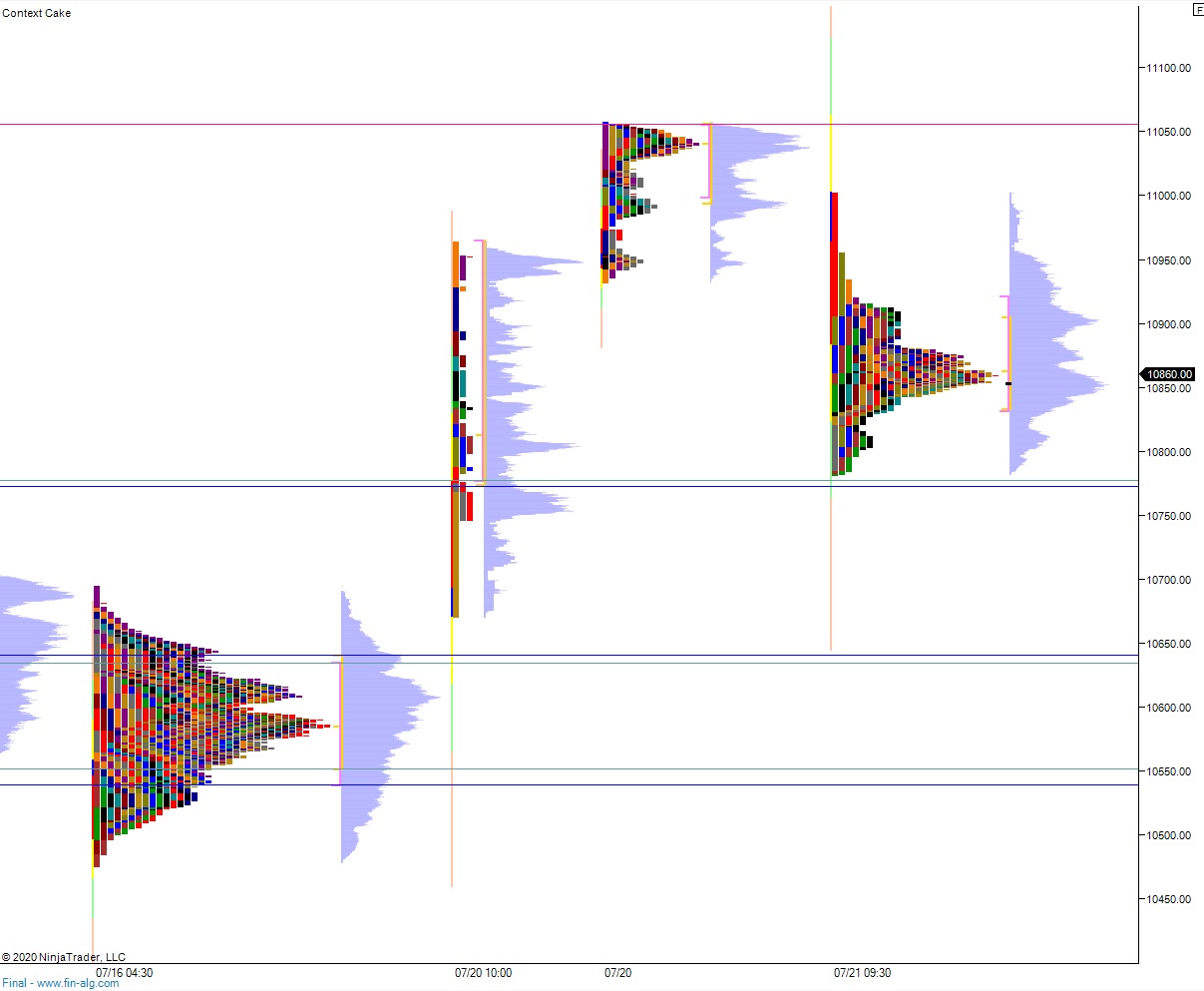

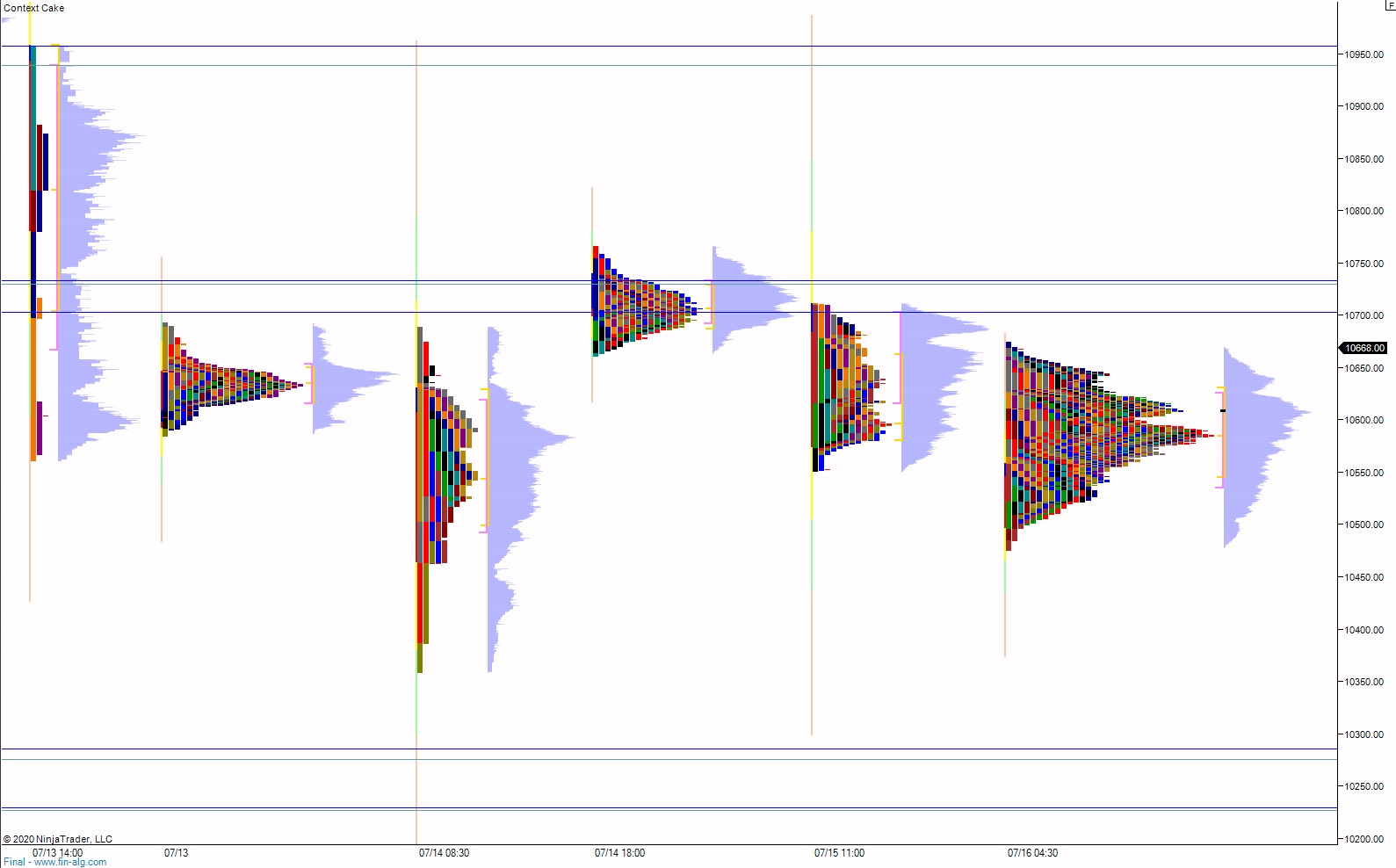

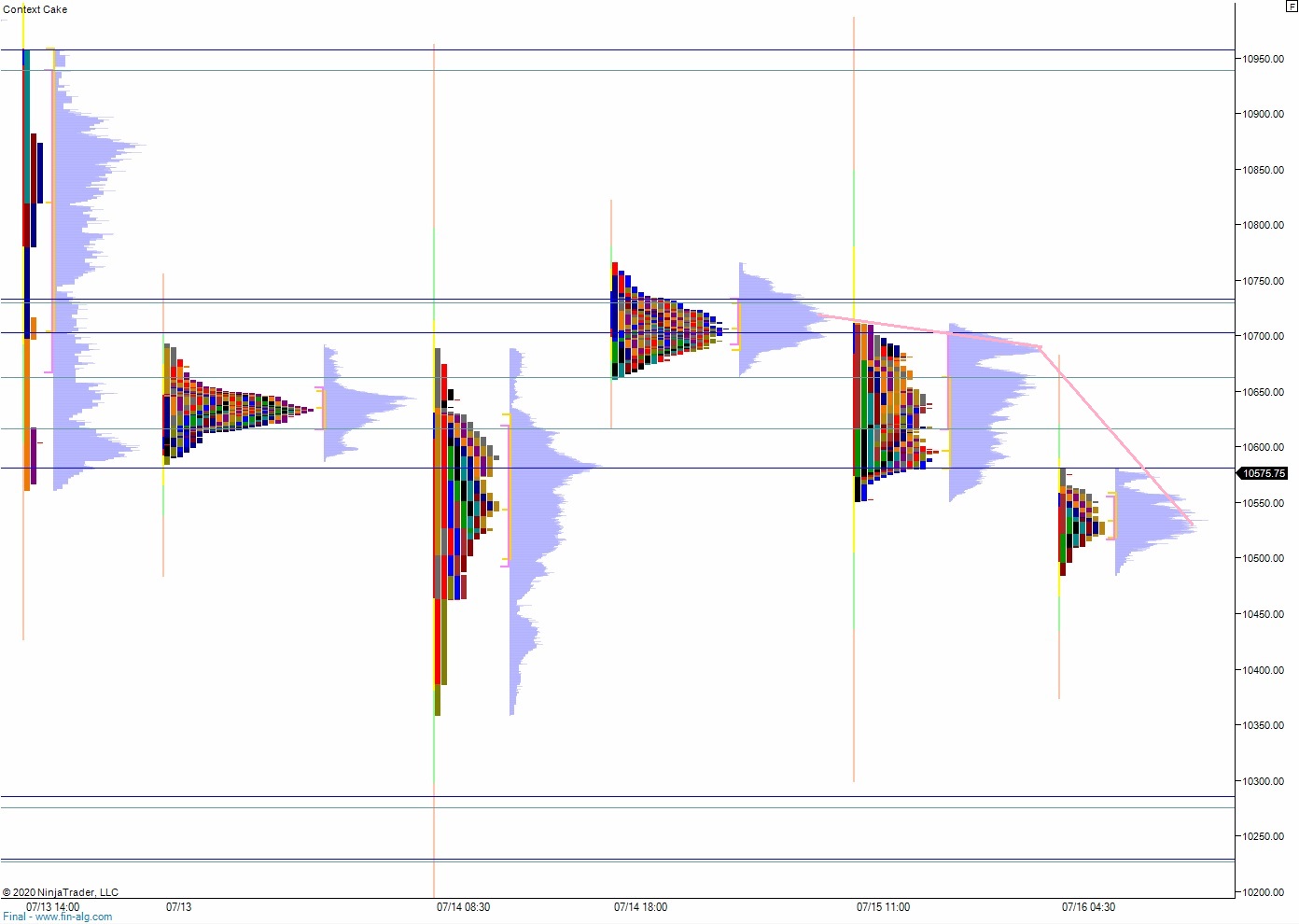

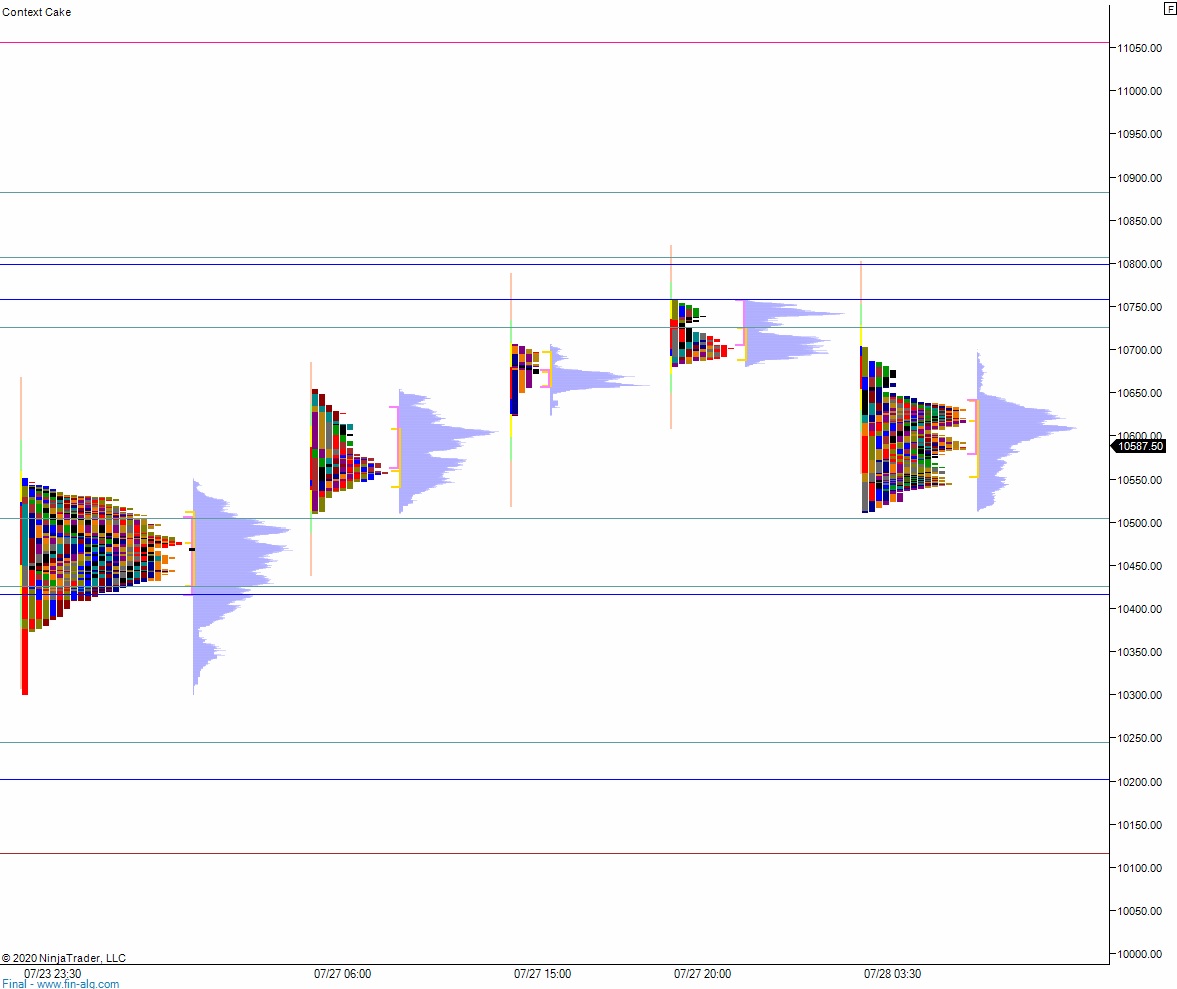

Yesterday we printed a neutral extreme down. The day began with a gap down. After an open two-way auction in range sellers probed down into the lower quadrant of Monday’s range. By 10am the auction had reversed higher and managed to go range extension up before New York lunch. Said buyers were unable however to close the overnight gap. Instead we sold off into the afternoon after failing to take out the daily high around 2pm. Sellers managed to press neutral and end the day near session low.

Neutral extreme down.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 10,539.75. From here sellers continue lower, taking out overnight low 10,512.25. Look for buyers down at 10,500 and two way trade to ensue. Then look for third reaction after the FOMC decision to dictate direction into the end of the session.

Hypo 2 stronger sellers close the gap down at 10,457.75 before two way trade ensues. Then look for third reaction after the FOMC decision to dictate direction into the end of the session.

Hypo 3 buyers press up through overnight high 10,617.50setting up a move to close the gap up at 10,675.50 before two way trade ensues.

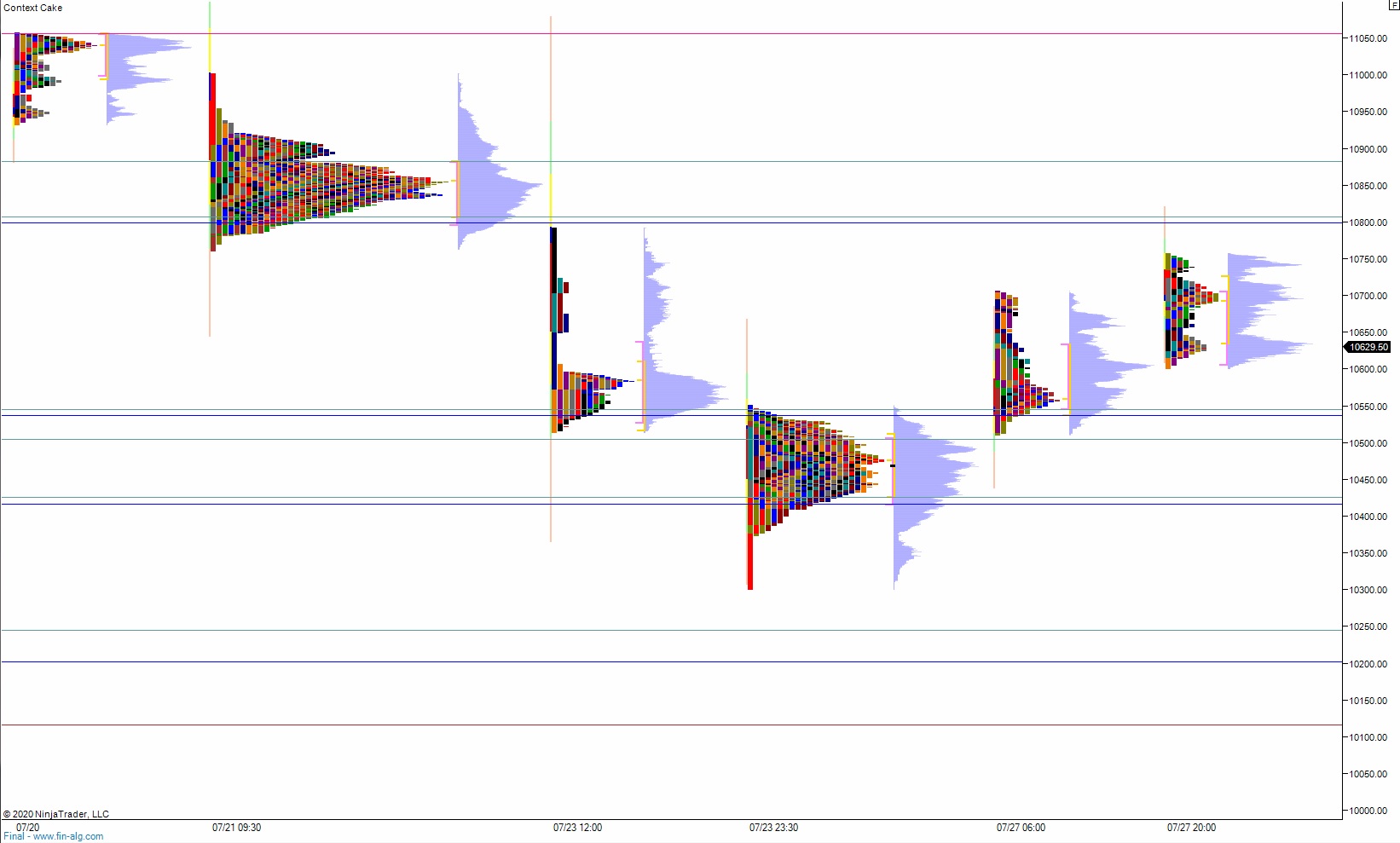

Levels:

Volume profiles, gaps and measured moves: