NASDAQ futures are coming into Wednesday with a slight gap down after an overnight session featuring normal range and volume. Price was balanced overnight, exceeding the Tuesday high for a while and making a new record high print along the way before settling back into the Tuesday range. As we approach cash open, price is hovering in the upper quadrant of Tuesday’s range.

On the economic calendar today we have crude oil inventories at 10:30am, a 20-year bond auction at 1pm and then the FOMC minutes at 2pm.

Major chip maker and NASDAQ component NVIDIA is set to report earnings after the bell.

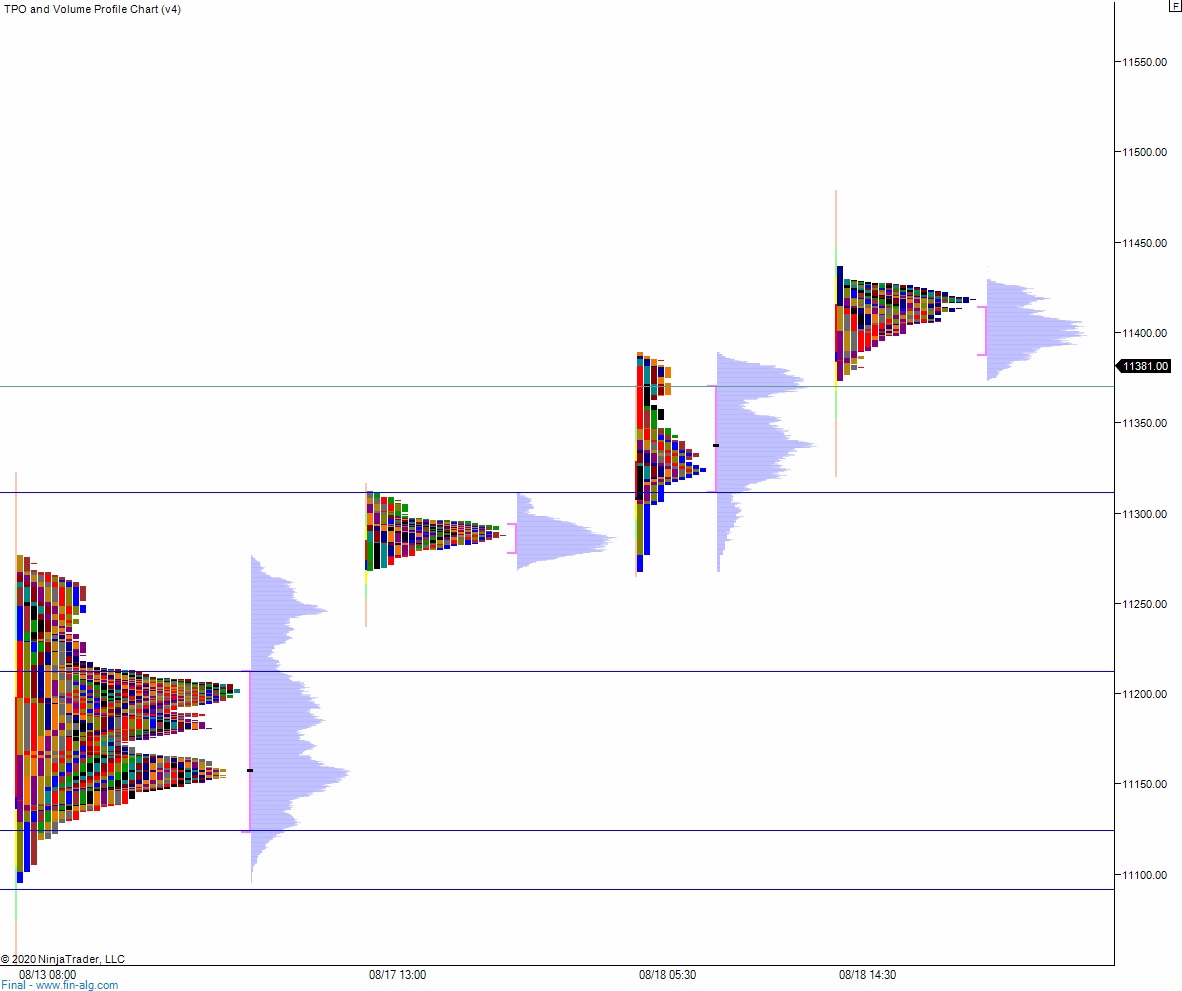

Yesterday we printed a neutral extreme up. The day began with a gap up and after a brief open drive higher responsive sellers stepped in. Said sellers closed the overnight gap and exceeded it by a few point before discovering responsive bids. Buyers were in control for the rest of the session, first by forming a sharp excess low, then by reclaiming the midpoint, then finally by slowly campaigning higher for the rest of the session and closing at the highs.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 11,409.75. From here we continue higher, up through overnight high 11,437. Look for sellers up at 11,450 then two way trade ensues.

Hypo 2 stronger buyers tag 11,500 before two way trade ensues.

Hypo 3 sellers press down through overnight low 11,374. Look for buyers down at 11,333 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: