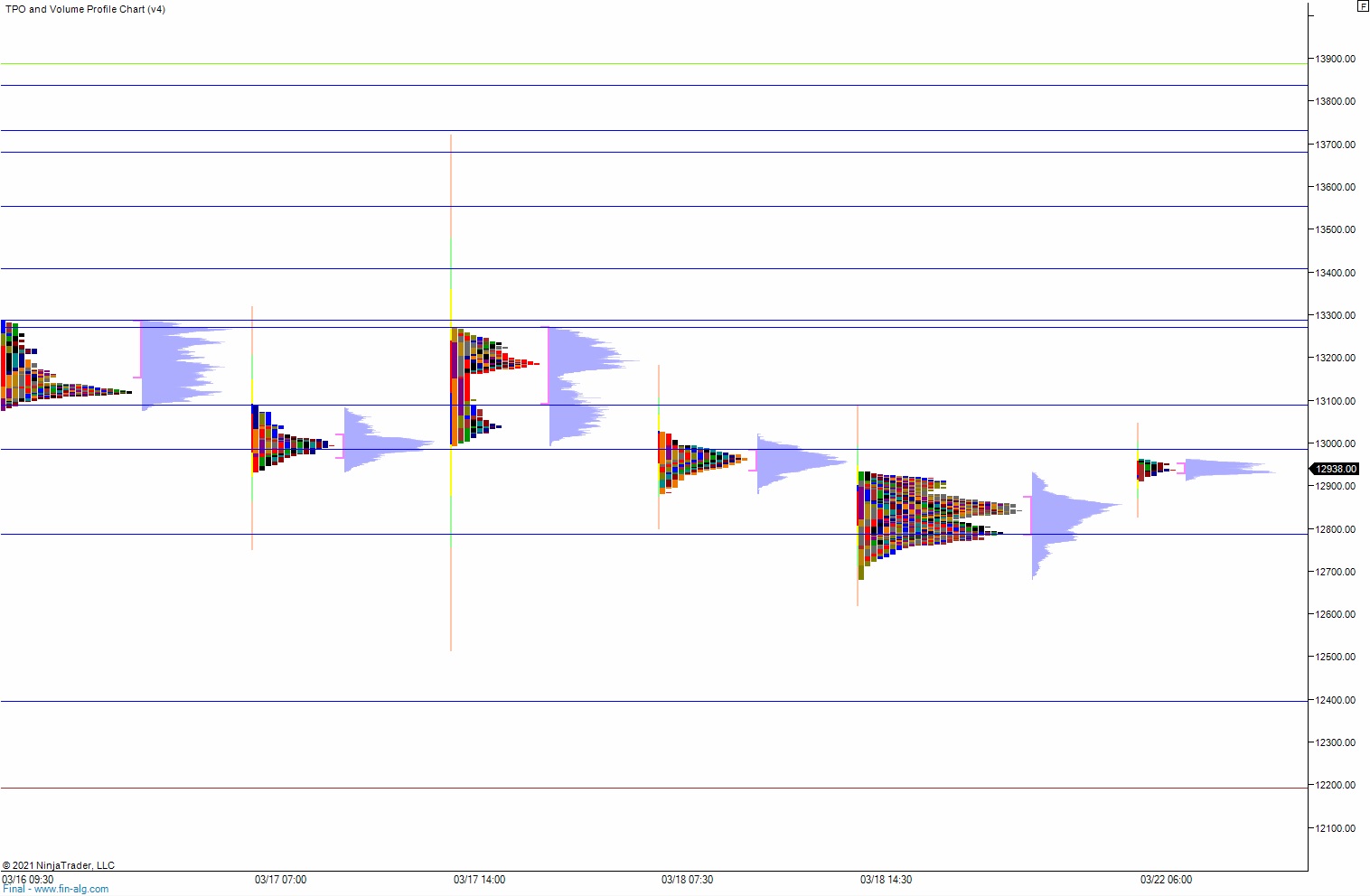

NASDAQ futures are down about -55 after an overnight session featuring extreme range and volume. Price first worked lower overnight, trading down to last Friday’s midpoint, catching a little bounce, then further down, right about exactly to the 68% retrace level of the big Friday afternoon rally. Since then price rallied about +150 then faded down about -40. As we approach cash open, price is hovering in the upper quadrant of Friday’s range.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

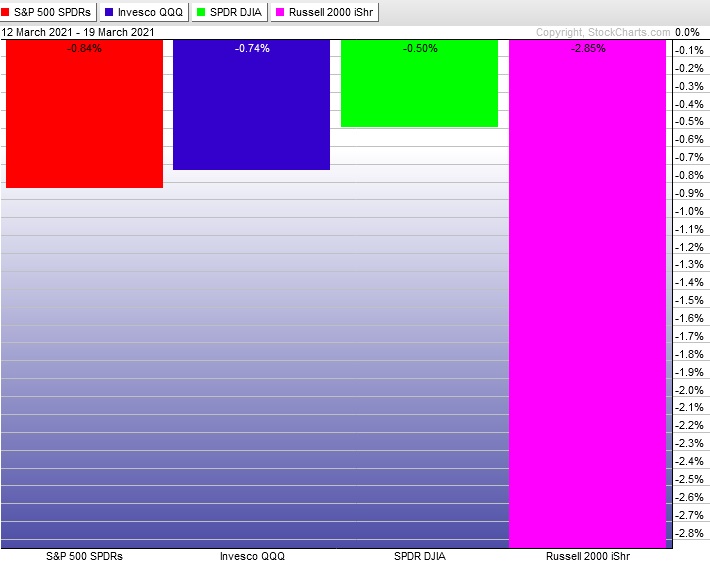

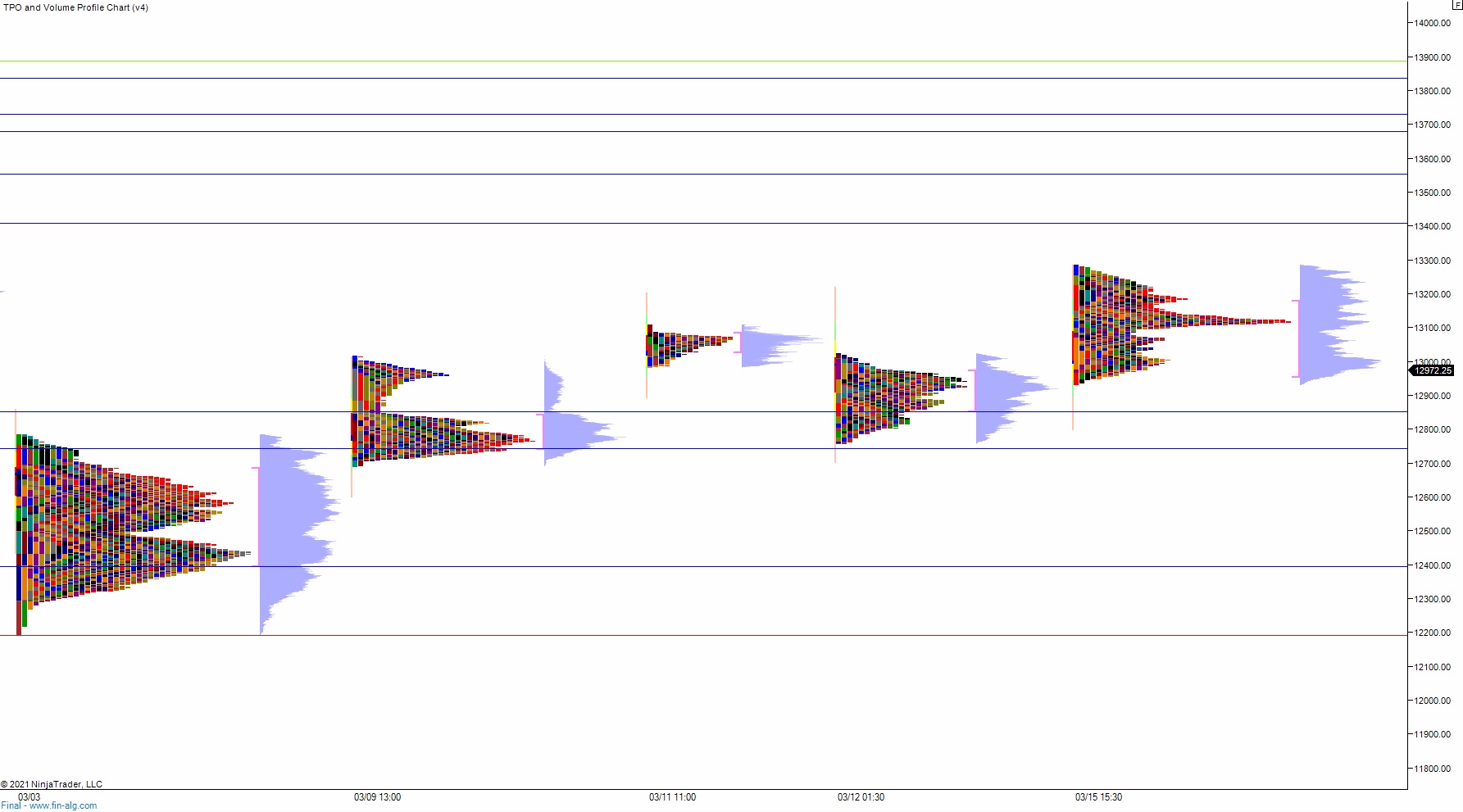

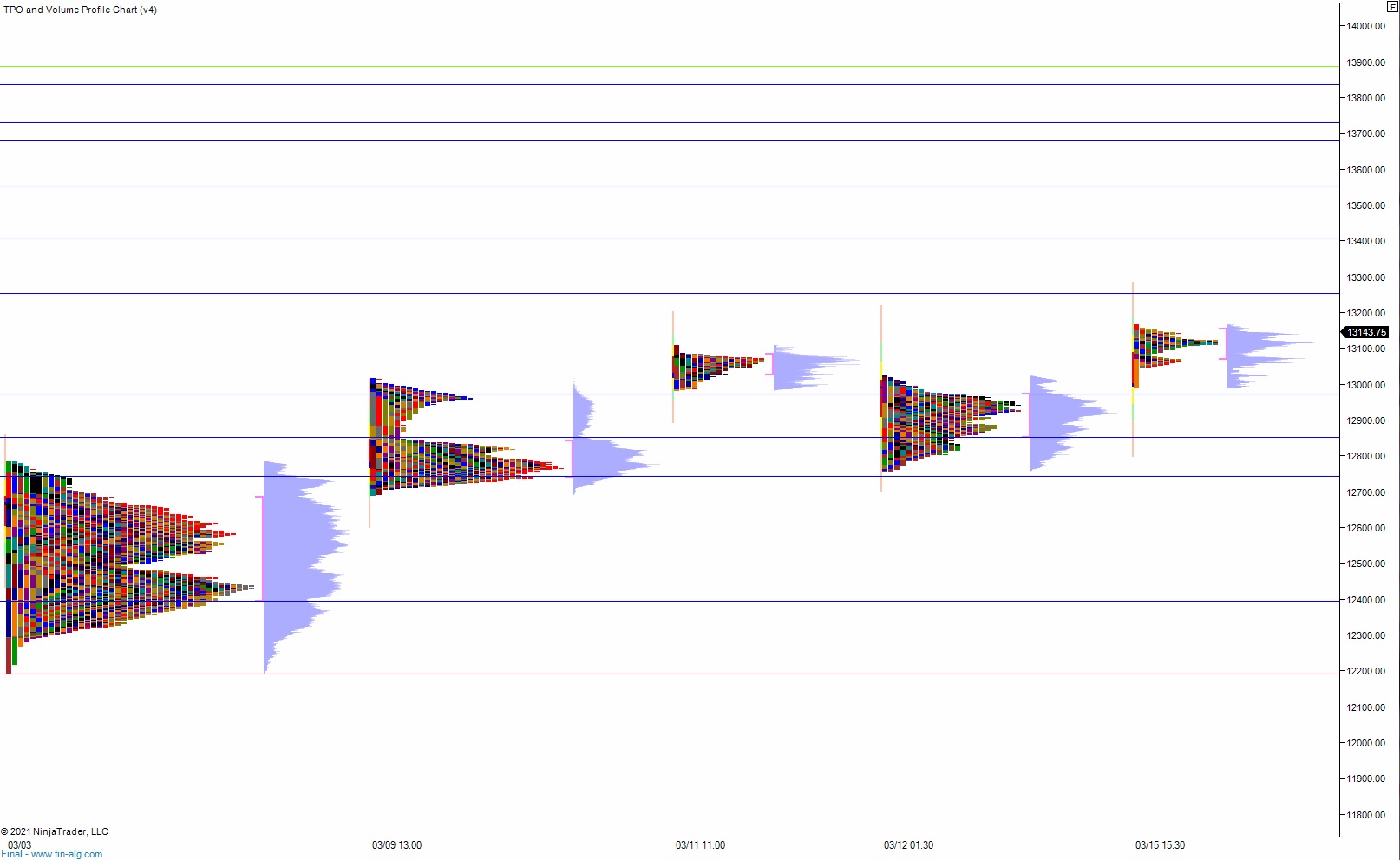

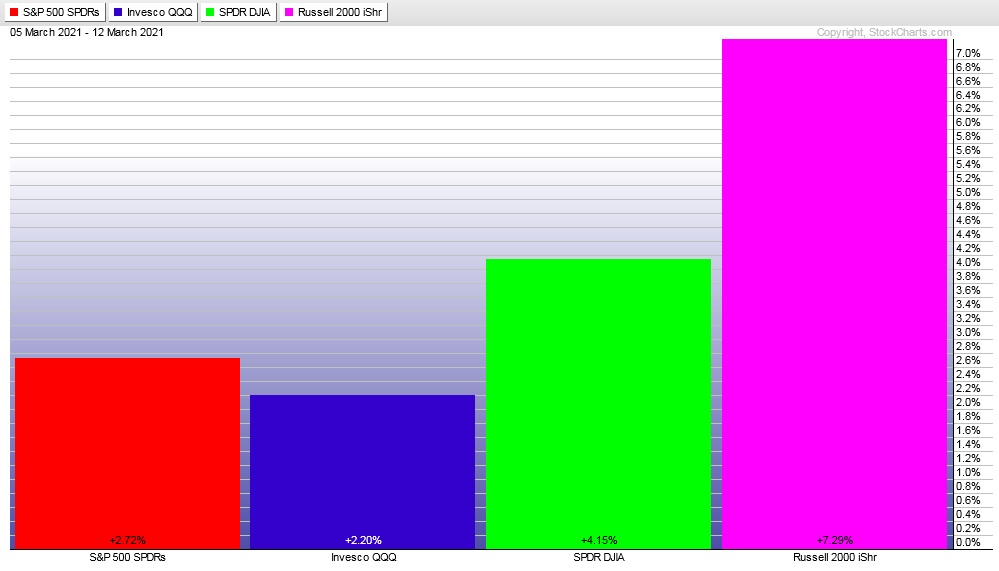

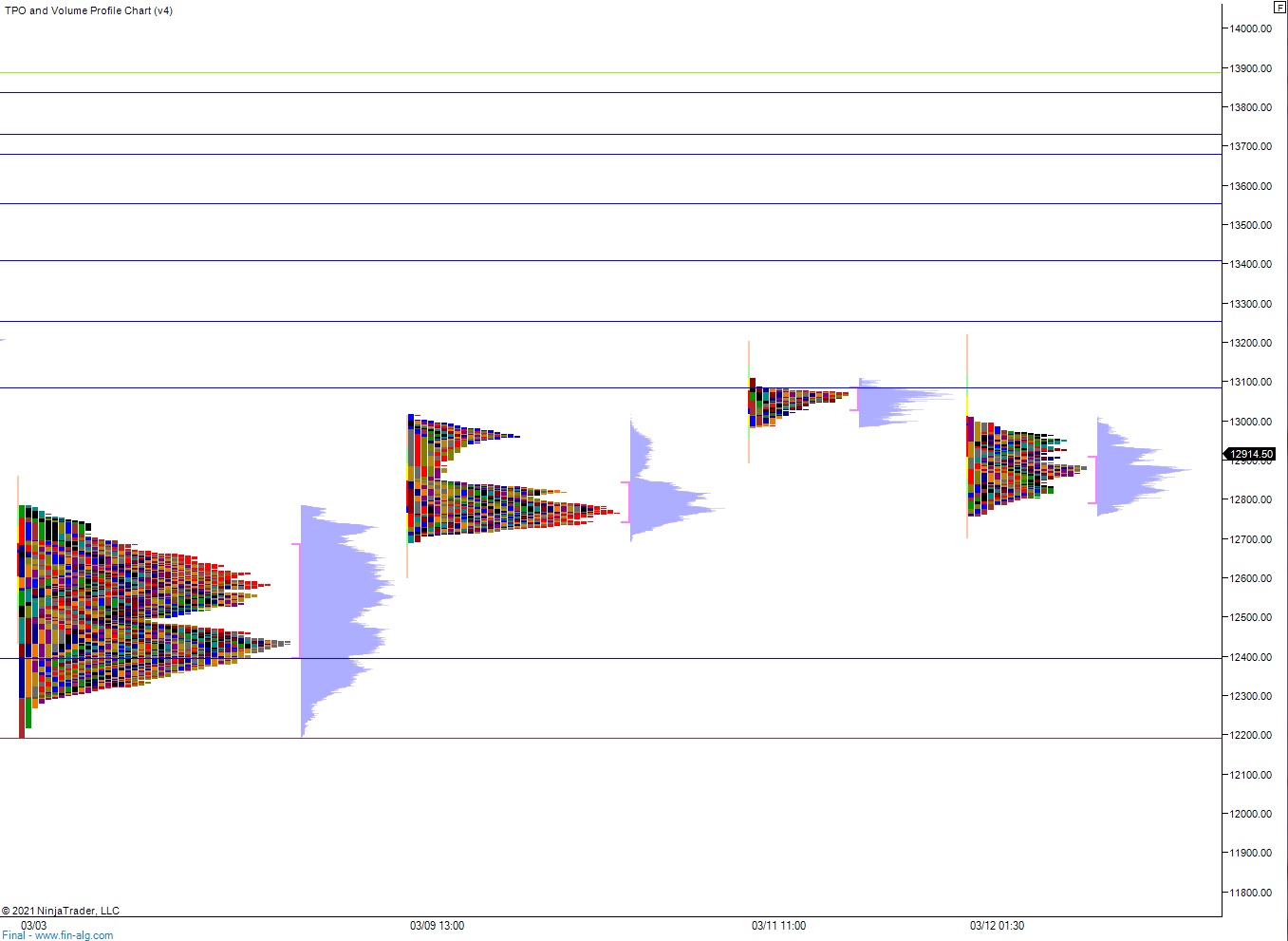

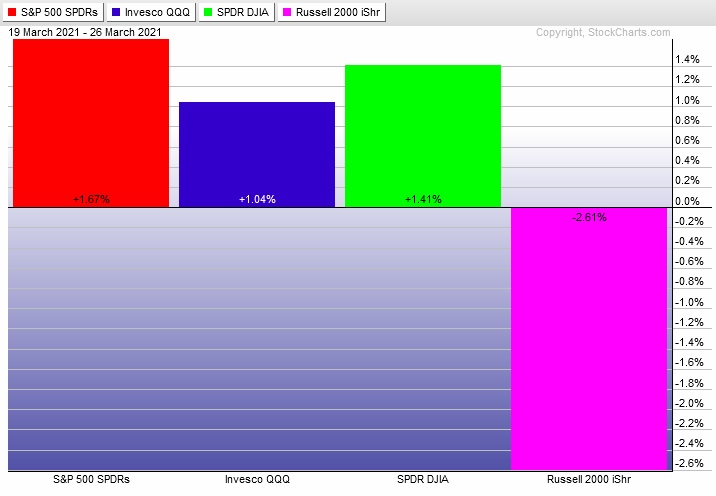

Last week we had conviction buying Monday. Seller control Tuesday through Thursday morning. Then a sharp excess low formed Thursday, ultimately leading to a rally into the weekend which was accentuated by a late Friday ramp. The last week performance of each major index is shown below:

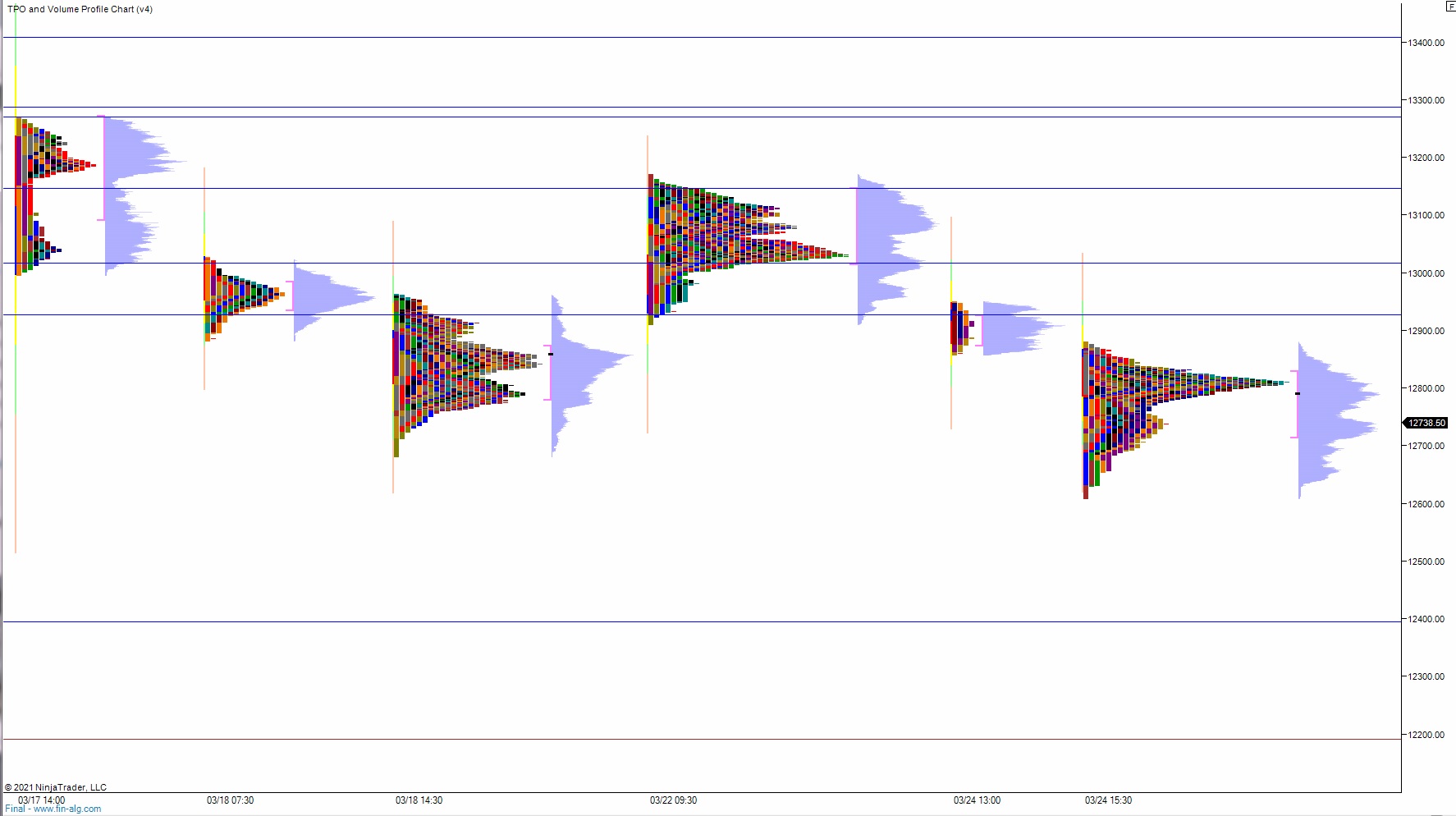

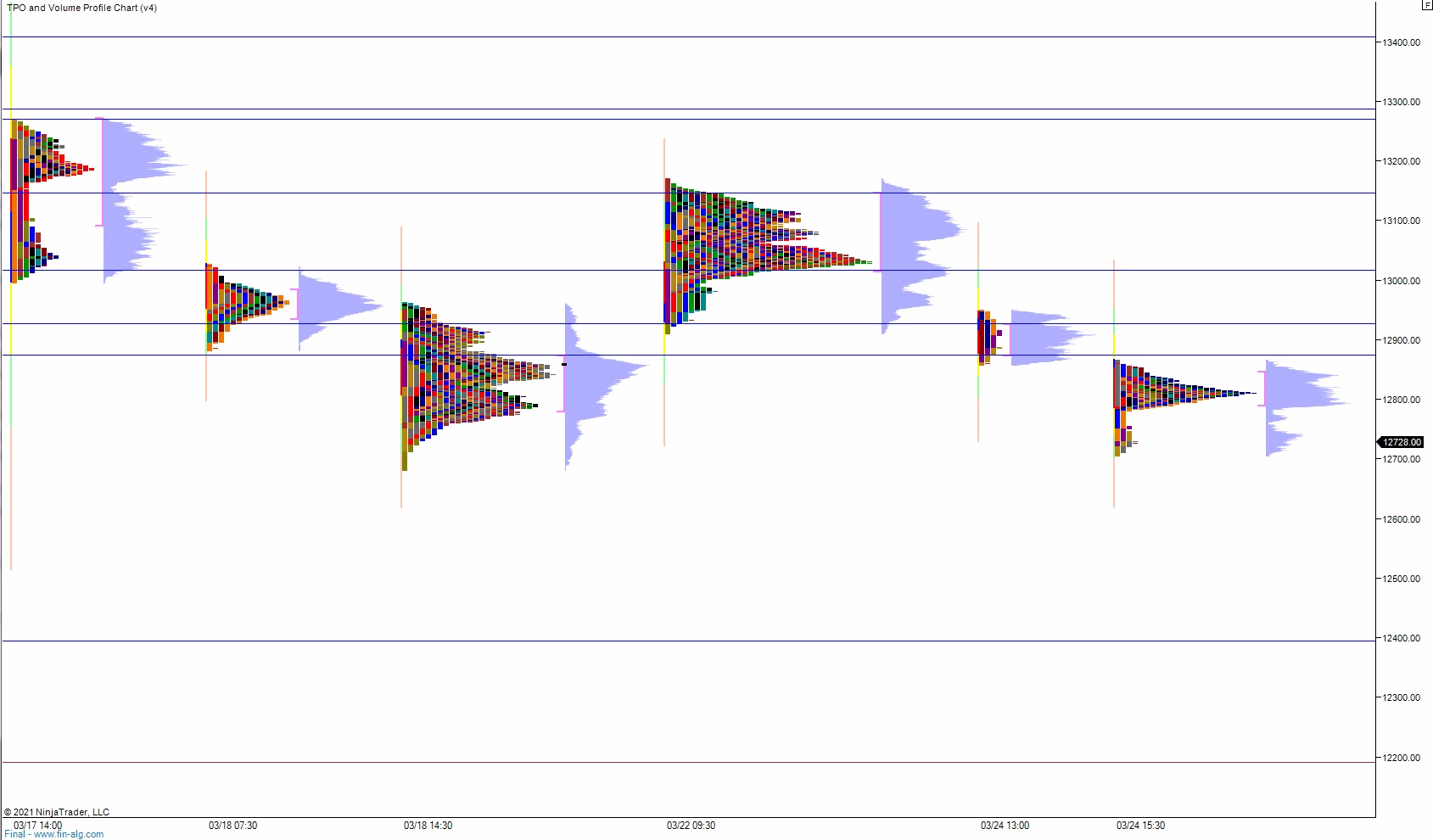

On Friday the NASDAQ printed a neutral extreme up. The day began with a slight gap down in range. Buyers quickly resolved the gap during an open drive up and price went into a range extension up before New York lunch. Then the action became choppy, chopping all over the midpoint and eventually making a new high of day before a hard sell pressed to a new low of day and into a neutral print. Those sellers never took out overnight low. Instead just before 3pm a responsive buyers stepped in and what followed was a strong ramp that eventually made a new daily high and close at it.

Heading into today my primary expectation is for buyers to work a gap fill up to 12,959 then continue higher, up through overnight high 12,978. Look for sellers up at 13,000 and for two way trade to ensue.

Hypo 2 stronger buyers trade up to tag the 03/23 naked VPOC up at 13,092 before two way trade ensues.

Hypo 3 sellers press down through overnight low 12,807.50 on their way to tagging 12,800.

Levels:

Volume profiles, gaps and measured moves: