NASDAQ futures are coming into Tuesday up a quick +60 after an overnight session featuring extreme range on elevated volume. Price initially drove higher overnight, pressing up beyond last week’s high until about 3:33am. Since then we have been in balance along last week’s high. At 8:30am retail sales data came out well below expectations. Price has not shown much reaction to the data and as we approach cash open price is hovering above last week’s high.

Also on the economic calendar today we have industrial production at 9:15am, business inventories and housing market index at 10am and a 20-year bond auction at 1pm.

Yesterday we printed a neutral extreme up. The day began with a slight gap down. Buyers resolved the down gap during an open two-way auction in range and after a small try lower buyers drove up beyond last Friday’s high. Price was choppy for the next several hours, walking all over the midpoint and eventually pressing a brief range extension down around 11:35am New York. This was met with a strong responsive buy and by a bit after 12pm buyers had reclaimed the mid and by 2:20pm we were into a new high of day and a neutral print. The rest of the day was all buying, with the steady campaign effectively closing the gap left behind last Thursday. We ended near session high.

Heading into today my primary expectation is for buyers to gap-and-go higher, tagging 12,200 before two way trade ensues.

Hypo 2 stronger buyers squeeze up to 13,253.50 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 13,073.75. Look for buyers down at 13,000 and for two way trade to ensue.

Levels:

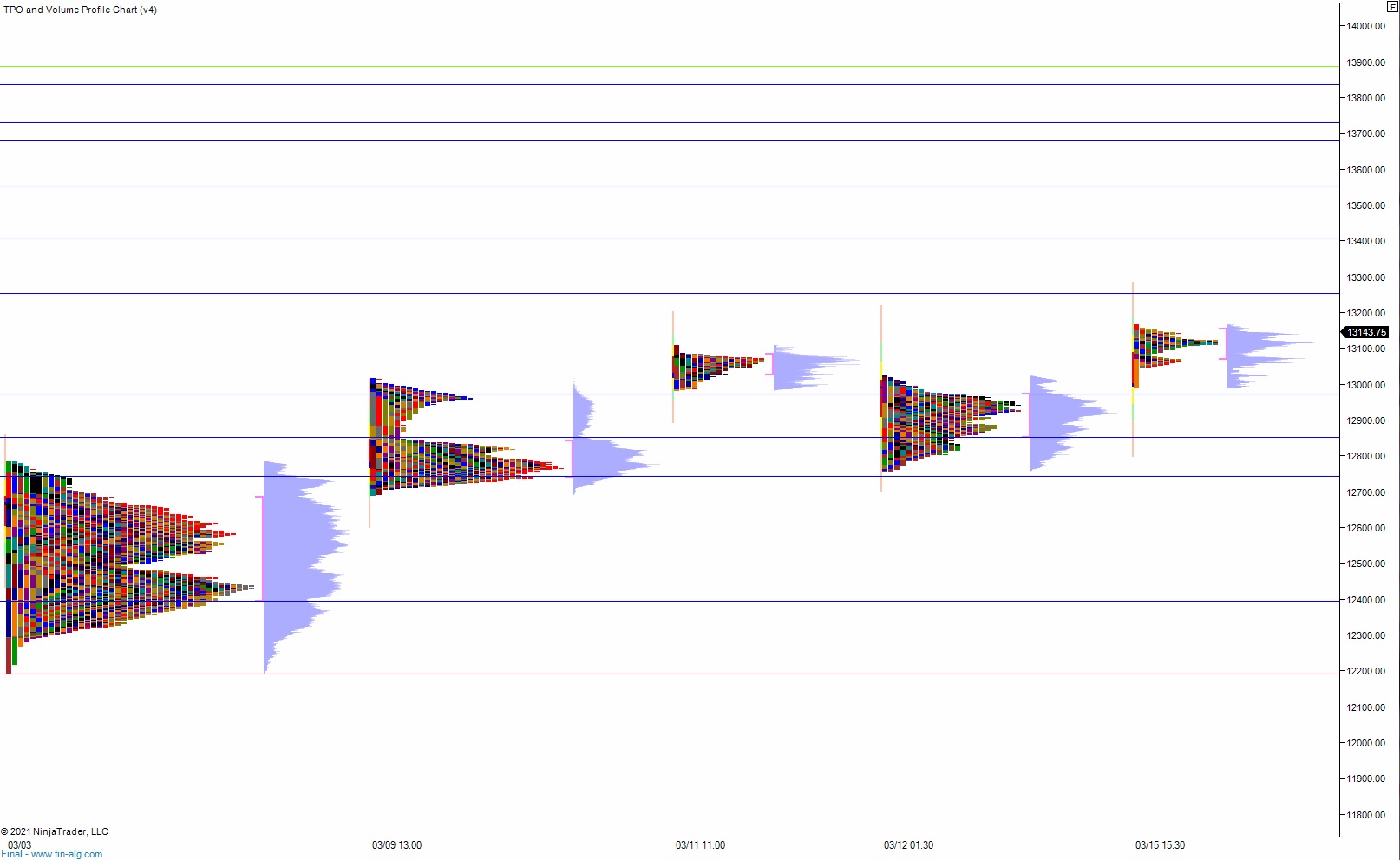

Volume profiles, gaps and measured moves: