NASDAQ futures are coming into the week with a slight gap down after an overnight session featuring extreme range and volume. Price was choppy overnight, trading up beyond the Friday high for a bit, up to about the Thursday midpoint, before chopping back down into the Friday range. As we approach cash open, price is hovering about 10 points below the Friday high.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

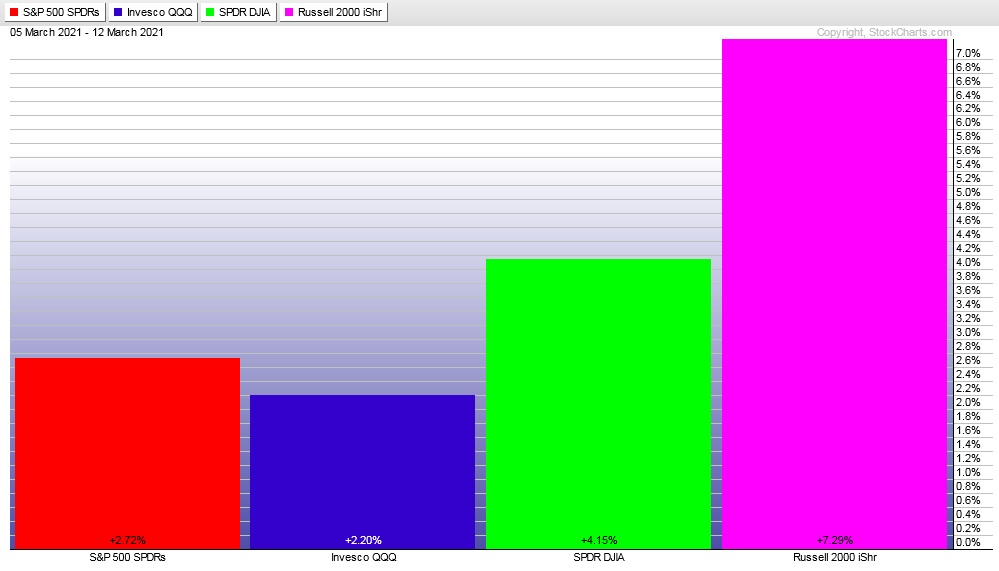

Last week we saw buyers in control all week long everywhere except the NASDAQ. The NASDAQ saw a hard sell Monday then sort of chopped higher for the rest of the week.

The last week performance of each major index is shown below:

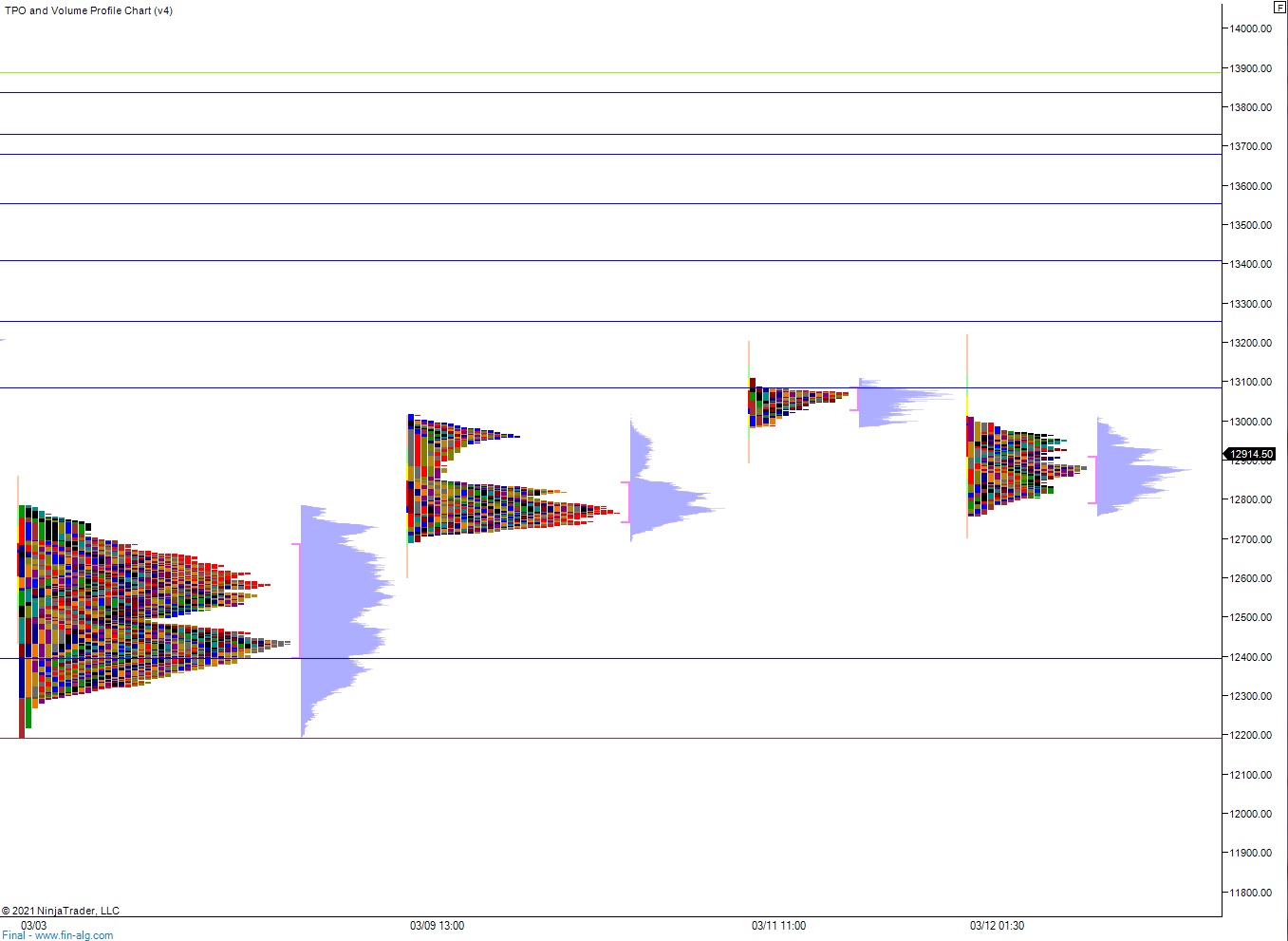

On Friday the NASDAQ printed a neutral extreme up. The day began with a gap down below the Thursday range. After an open two-way auction outside range buyers made a try back up into the Thursday range. Sellers rejected the move, sending price down through the opening swing and into an early range extension down. This move also served to close the open gap left behind Wednesday. From then on it was buyers in control. First they reclaimed the mid then the sprung up from it, pressing into a neutral print. Buyers defended a check back to the mid and eventually pressed neutral. The buying managed to reclaim the Thursday range but not really explore it much. We closed on session high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 12,925.75. From here buyers continue higher, tagging 13,000 before two way trade ensues.

Hypo 2 stronger buyers trade up to and close the Thursday gap 13,051.50 before two way trade ensues.

Hypo 3 sellers press down through overnight low 12,862.50 setting up a run down to 12,700.

Levels:

Volume profiles, gaps and measured moves: