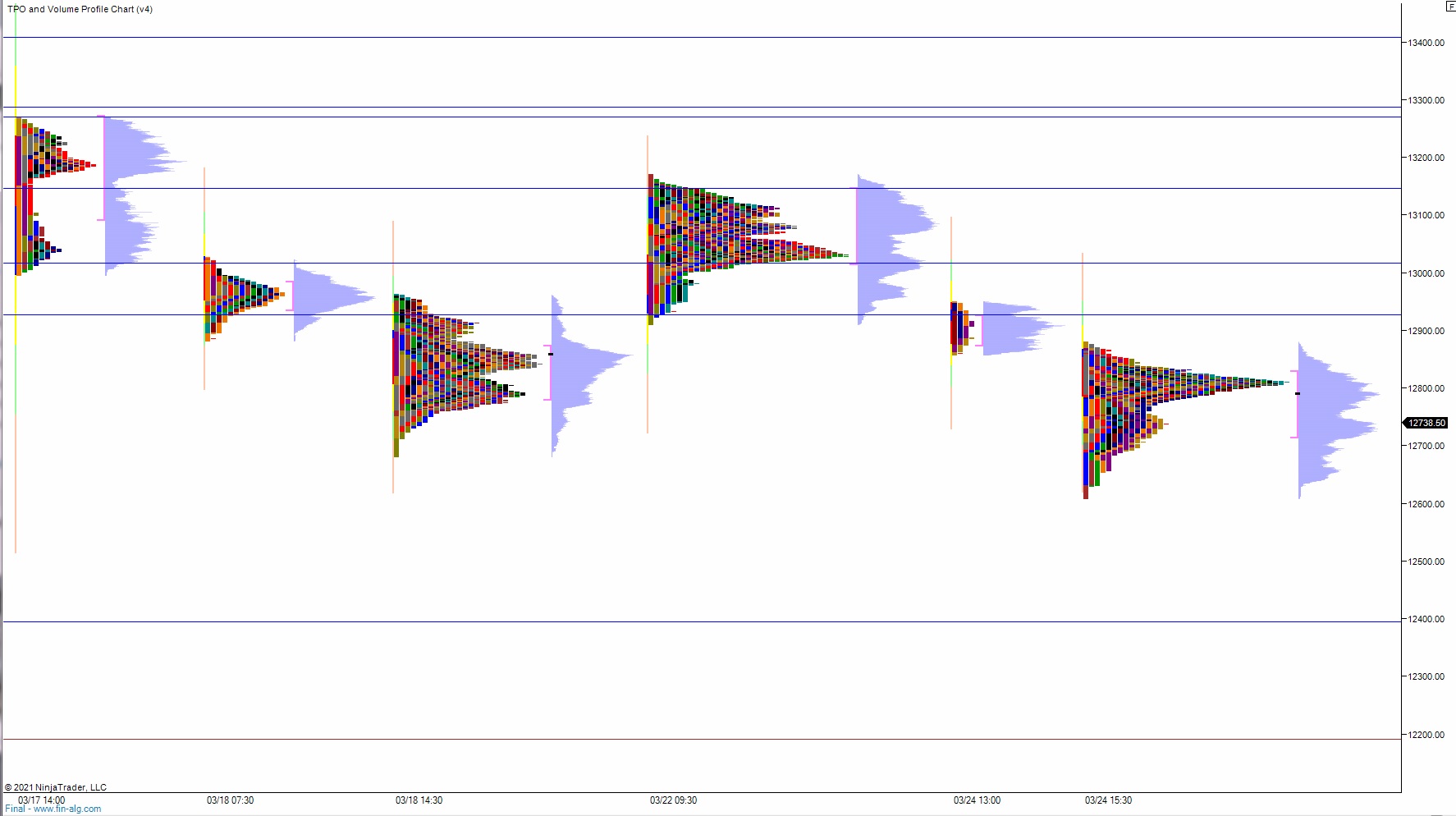

NASDAQ futures are coming into the final Friday of March (the last Friday in Q1) with a slight gap down after an overnight session featuring extreme range and volume. Price initially worked higher overnight, probing up beyond the Wednesday high around 1am New York and sustaining these prices until about 3:30am when sellers knocked price back down into the nearby balance. Then around 6:30am sellers became initiative and formed a steady down rotation that sent price below the Thursday midpoint. At 8:30am personal income and outlays all came out in-line with expectations and then international trade in goods did the same. As we approach cash open price is hovering about +20 above the Thursday mid.

Also on the economic calendar today we have consumer sentiment at 10am.

Yesterday we printed a normal variation down. The day began with a gap down below the Wednesday range. Buyers drove higher into the opening bell quickly resolving the overnight gap. Then about +30 points into Wednesday range sellers stepped in and rejected price out of the range. This all happened within the first 45 minutes of trade and soonafter we pressed range extension down. Sellers managed to trade down below last week’s low before a responsive bid was discovered near the lows of March 9th. From about 11:30am to 1:30 buyers managed to regain the daily midpoint. Sellers chopped down through it in the early afternoon before we ultimately ramped higher into the close. Closing near session high but never pushing neutral.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 12,793. From here buyers continue higher, taking out overnight high 12,881. Look for sellers up at 12,900 and for two way trade to ensue.

Hypo 2 sellers press down through overnight low 12,676 and test below Thursday low 12,609.75. Buyers are just below at 12,600 and two way trade ensues.

Hypo 3 stronger sellers blow through 12,600 on their way to tagging 12,500. Stretch target 12,479.75.

Levels:

Volume profiles, gaps and measured moves: