NASDAQ futures are coming into Monday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, first by taking out the Friday high around 10pm New York, then after several hours of balance along the Friday high by continuing higher. As we approach cash open price is hovering in the upper quadrant of Thursday’s range.

On the economic calendar today we have Fed Chairman Powell set to speak at 9am, existing home sales at 10am and then 3- and 6-month T-bill auctions at 11:30am.

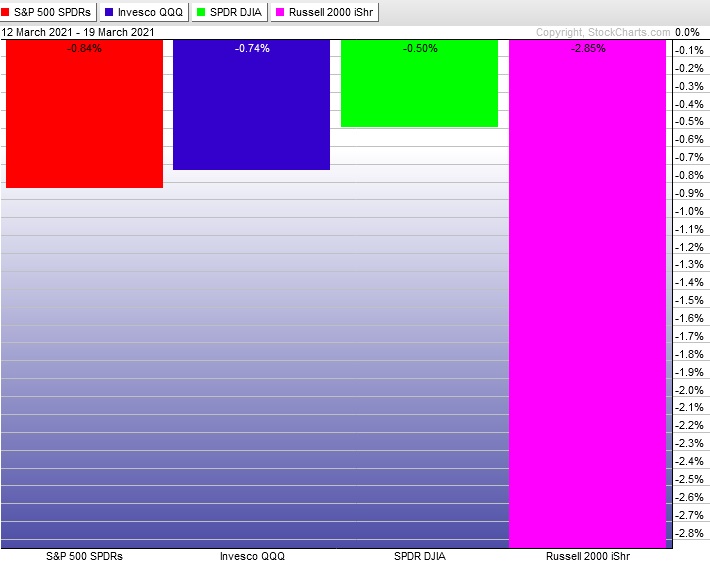

Last week was choppy. Buyers drove higher through Tuesday. Wednesday markets gapped down then marked time until The FOMC announcement then shot higher. Thursday through Friday morning saw sellers erasing the Fed move. Then buyers resumed control into the weekend with a mellow rotation higher. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with sellers making an early try down below Thursday low. This selling was reversed before the first hour was complete and a sharp excess low had formed. From then on it was buyers in control. Buyers reclaimed the mid then defended a check back to it, ultimately leading to a tight balance along the daily high and into the weekend.

Heading into today my primary expectation is for buyers to gap-and-go up to 13,000 before two way trade ensues.

Hypo 2 stronger buyers trade up to 13,093.75 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 12,829.75. Look for buyers down at 12,800 and for two way trade to ensue.

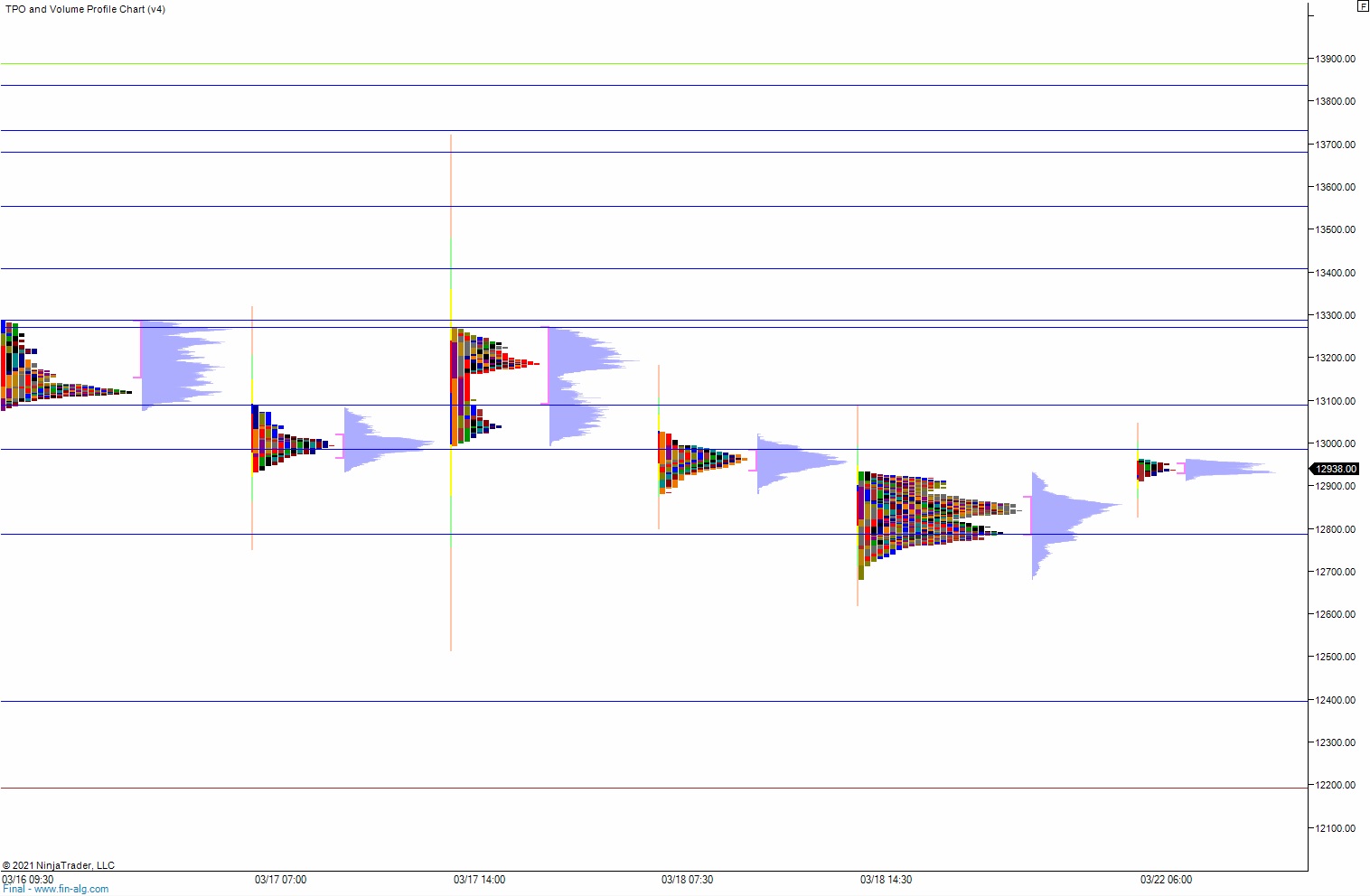

Levels:

Volume profiles, gaps and measured moves: