NASDAQ futures are coming into Thursday down a quick -60 after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing along the lows of Wednesday’s range until about 7:45am when buyers stepped in and pressured the tape lower. At 8:30am GDP data came out in-line with expectations and jobless claims data slightly better than expected. As we approach cash open price is hovering down near last week’s lows.

On the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 7-year note auction at 1pm.

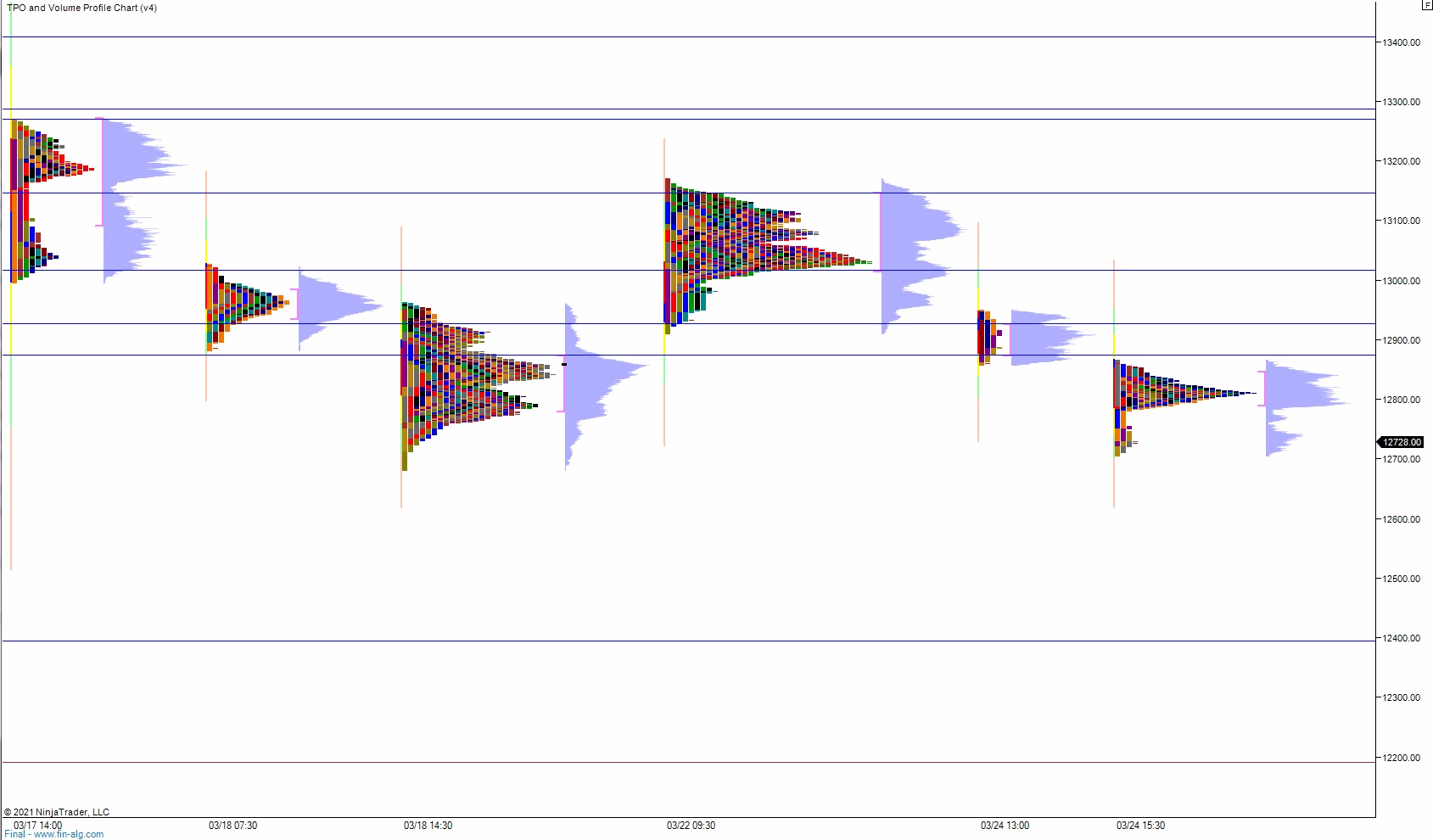

Yesterday we printed a double distribution trend down. The day began with a gap up in range that sellers drove down into at the open. Said selling erased Monday’s conviction buying and probed down into the Friday-to-Monday gap a bit before discovering a strong responsive bid. That bid sent price higher in a campaign that successfully recovered the mid and much of the territory lost during the early sale. It could not, however, make new session high. Instead sellers reclaimed the mid and after chopping along the bottom-side of mid for about an hour began a campaign to go range extension down. Range extension down happened around 1:15pm then after a pull back sellers became initiative and drove lower into the close, eventually closing on session low.

Heading into today my primary expectation is for buyers reclaim Wednesday low 12,787.25 and work a gap fill up to 12,801.25. Buyers continue higher, taking out overnight high 12,859.50. Look for sellers up at 12,875 and for two way trade to ensue.

Hypo 2 buyers to work into the overnight inventory and trade up to Wednesday low 12,787.25. Sellers reject a move back into Wednesday’s range and two way trade ensues.

Hypo 3 gap-and-go lower sets up a liquidation down to 12,600. Stretch targets are 12,500, 12,479.75 then 12,400.

Levels:

Volume profiles, gaps and measured moves (note how VPOCs are still concentrated right along the pre-FOMC levels):