On most days I want to execute the people I dislike according to the style of the music I am listening to. On some days I listen to baroque classical and on other big band jazz. According to the style of the music, I conjure up ways I’d dip my enemies into hot tar, or break their bones into dust against carriage wheels. But then I am transported back into real life and remember the wonderful meal I ate last week at one of my favorite restaurants, or the latte served at one of my favorite coffee shops, or the kindness bestowed upon me my strangers and ground myself in the resolute conviction that most people are good.

Humans create wonderful things and we make each other laugh, cry and vomit all over each other — based upon the caprices trending at the moment. I will admit to being blackpilled by the real time reactions to many people on X — but then again — I can recall many a time saying the most outlandish things only to be recanted later on.

It’s also important to remember the plebeian class holds little to zero sway over governmental edicts and the garrulous third estate likes to pretend their Tweets on X is causing some sort of revolution, when in fact they’re not. The institutions are the same and the same creatures who inhabited them before your tweet are there now collecting their wages to do dastardly things.

So what is the solution?

The answer is always happiness. One can achieve this in various ways: love, success, creativity, selflessness etc.

After these thoughts are published and sent out to the world, I will most likely immediately tweet something to gin up controversy or bring awareness to something that pisses people off. I cannot help it and it is in my nature. But it doesn’t help to hide the evils of the world and we all hope that one day is improves. We do not yearn for perfection — but order and safety and peaceful coexistence without spiteful people doing spiteful things.

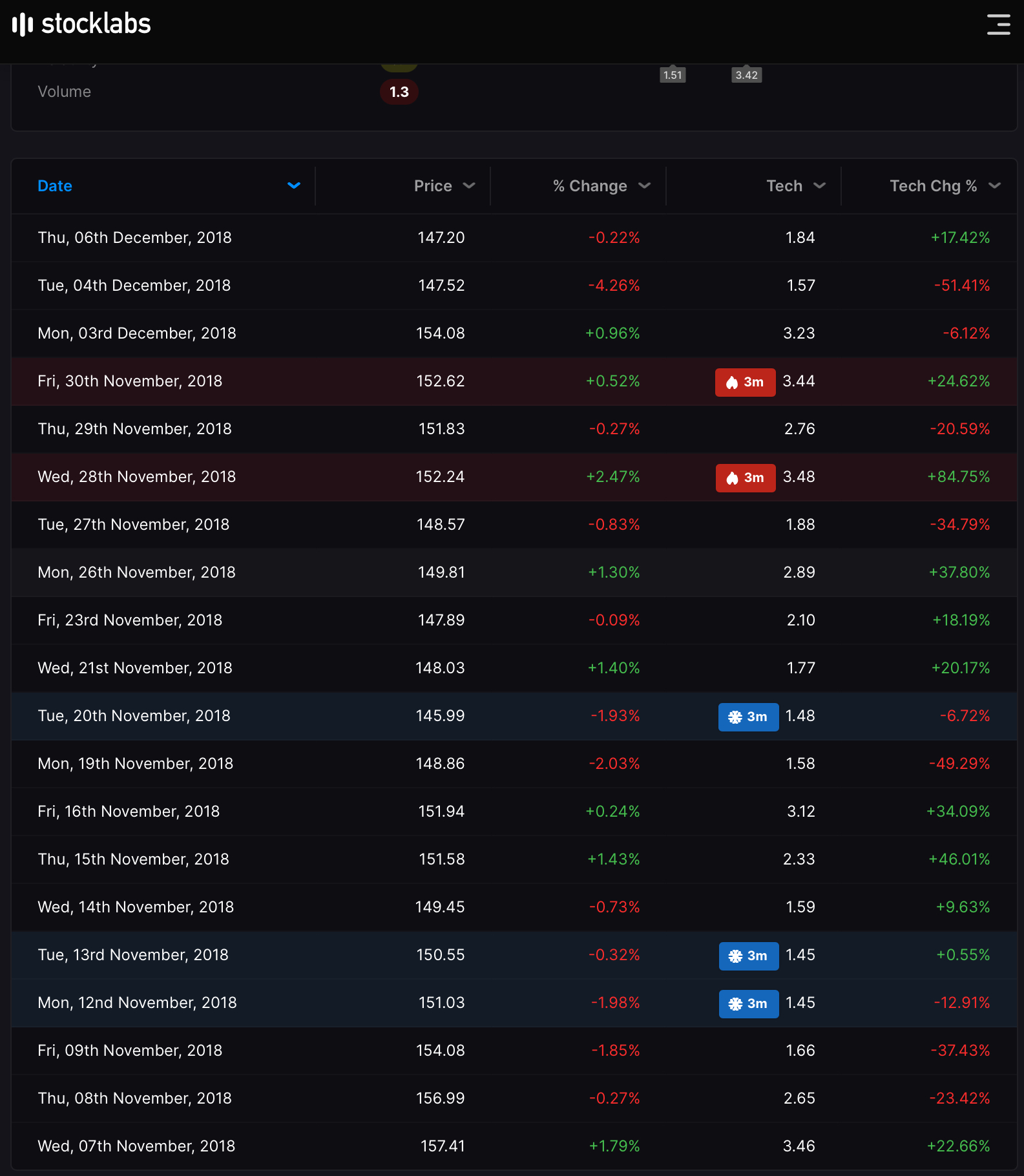

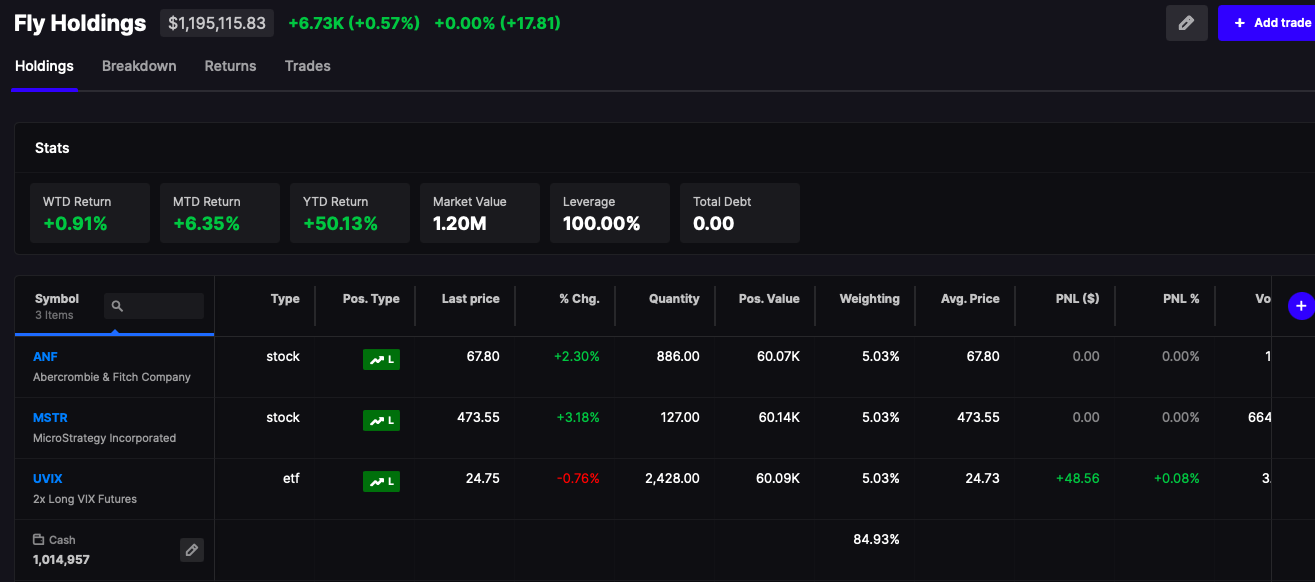

For me, I find joy in trading stocks, writing, doing videos with my writing, finding new ways to create enemies — reading, listening to music (anything but rap is acceptable), listening to Audibles when in car or shower. I used to be something of a mixologist, but now focus more on health so booze is really out. I also used to smoke an estate pipe once per week or a cigar once per month — but I’ve limited that too since I do believe to be disciplined is to be content and nothing is worse than hedonism and doing what you like all the time.

I do drink coffee about 2 to 3 times per day; but I make sure not to enjoy it too much and would never add any sugar to it and really try to limit the amount of milk as well, since coffee black is the best version of coffee and the best version of black coffee is espresso or an Americano.

I’ll get back to market commentary in my next post.

Comments »