Just quick afternoon update for you fucks who are permanently long.

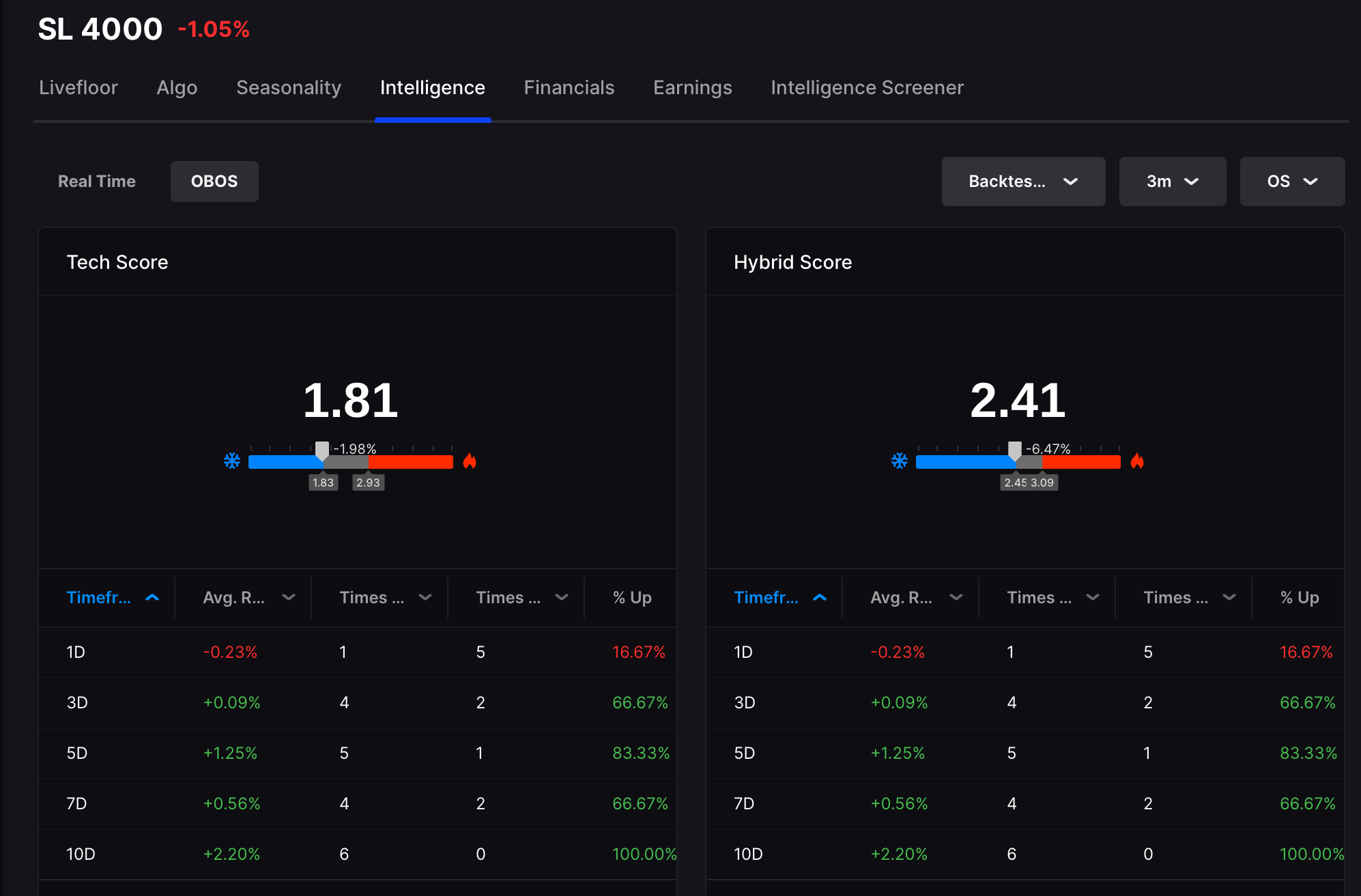

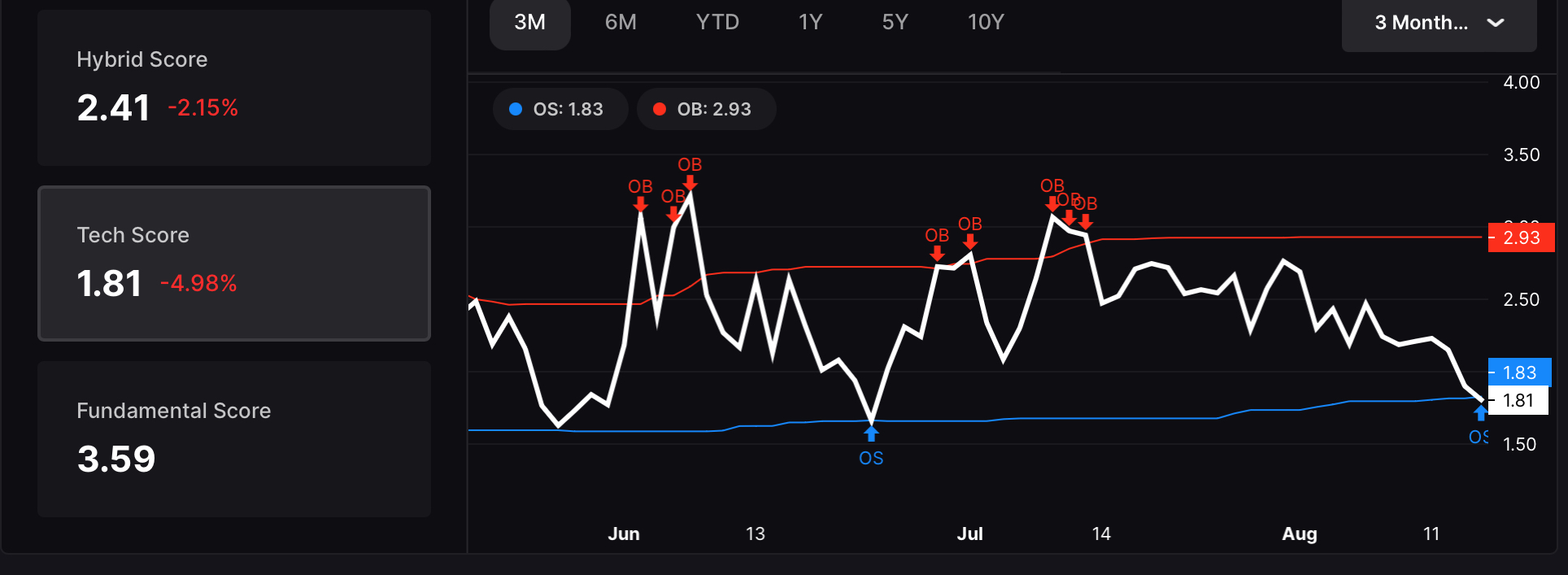

I’ve been doing this a very long time and I even built mean reversion algorithms to time markets. I remind you of this to separate the chaff from the wheat. We are not the same. Having said that, I mentioned a week ago that Stocklabs had flagged oversold — but if we started to “cluster signals” it could be the preceding elements of the apocalypse.

The character of this market has been to sell down all rallies and this doesn’t conform with a bullish tone or tenor. I will tell you this now — if markets do not bounce after today — it’s 100% over. I am hoping we do bounce a little, in order to assuage longs back into the building so we can burn it down later. But if we collapsed now — I would not offer protest.

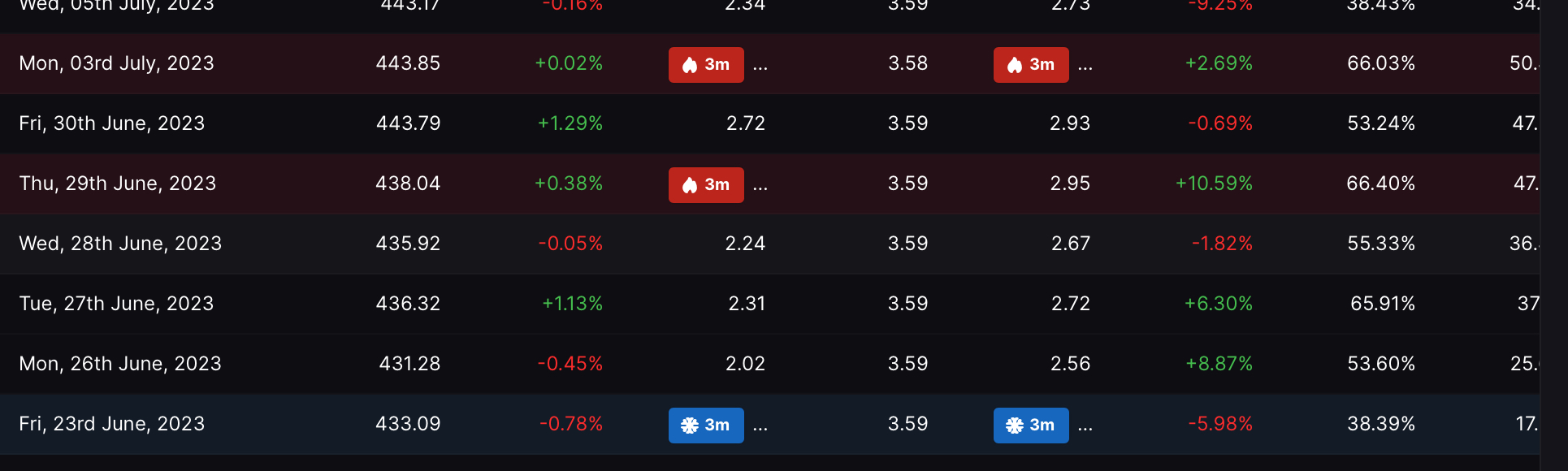

At the heart of this tumult are treasury yields. We are +9bps to 4.33% and markets are screaming HELP to an obstinate Fed. We have not gone down yet. The fact that stocks have held it together up until now is admirable and shorting a market that defies logic is usually a reason to be long.

The divergence between small and large cap is a wide chasm today, +0.6% v DOWN 0.7%. My best guess is for stabilization and an attempted rally in the late afternoon or tomorrow. HOWEVER, I am open to suggestions and should we flop and flail and flounder, you will rue the day you chanced upon this eloquent prose and decided to ignore my most dire warnings.

You have been warned.

Comments »