I often think about the topic of the stock market versus the very obvious decay in the west, specifically America. The macro analysis would suggest degradation amidst the populous, lawlessness, Neo-liberal ideologies run amok, oppression, and a want regard for the value of life both here and abroad.

For anyone “normal” or conservative, the cultural landscape of present day Americana is shockingly depraved, steeped heavily in degeneracy — celebrated and controlled by mentally ill people.

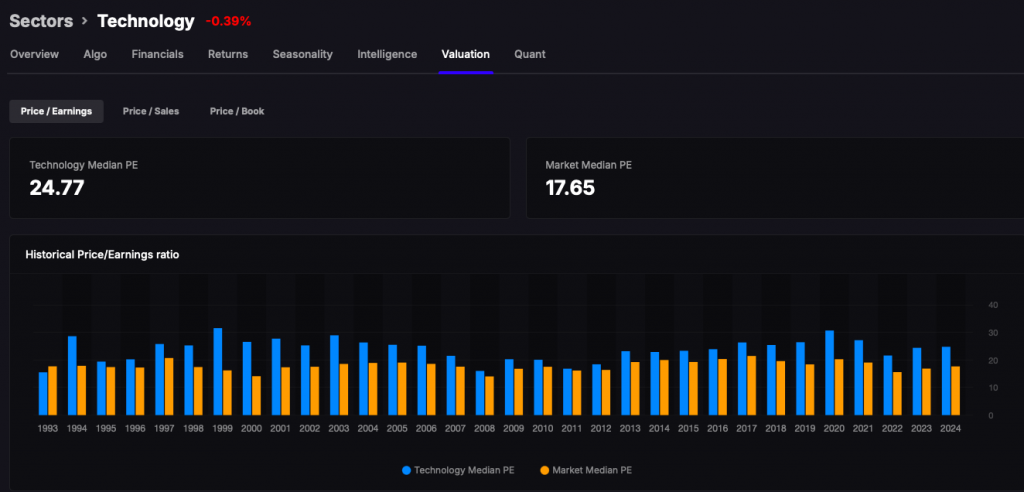

But taking a step back from that, and perhaps this is me trying to cope with RECORD HIGHS in the stock market — do these conditions warrant immediate decay in GDP and stock valuations?

After all, the merchant selling widgets prospers when more customers enter his store. Ergo, the greater the populace, at least for a time, the greater the profit. Eventually it will end with social discord being so untenable it will fracture and collapse — resolved only by violence and conquer.

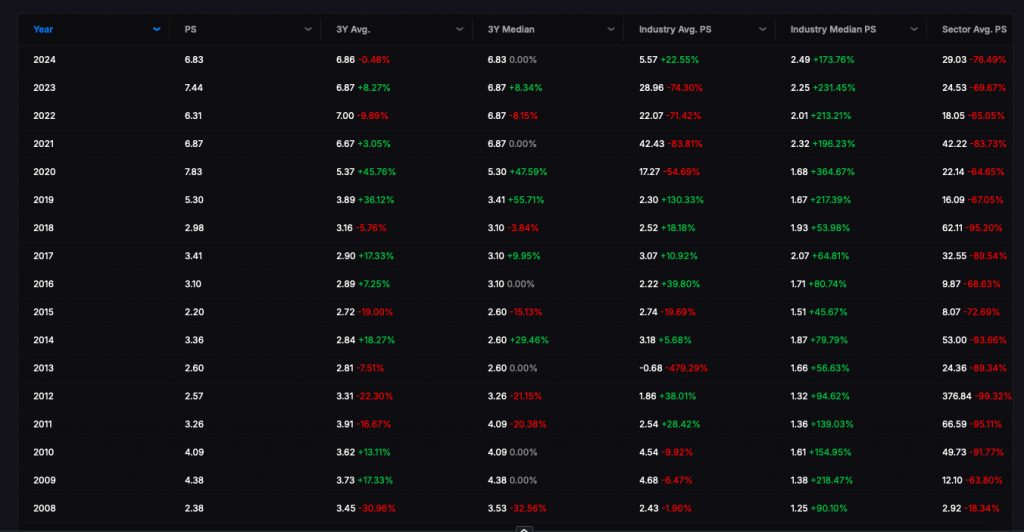

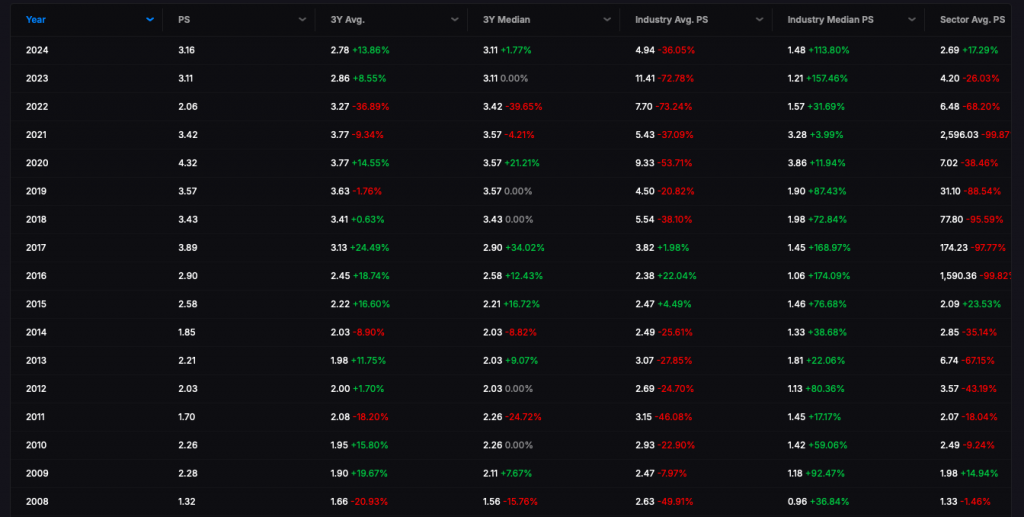

What our esteemed leaders have figured out after 2008 is that they can print as much money as they wanted because the demand for Euros and Dollars was infinite, since 3rd world populations were steaming higher and all of their currencies were shit. In other words, the infinite money hack deployed by Central Banksters is without consequence — up until the point when confidence is shattered and/or an alternative takes root.

The more people entering the west, the more customers and that’s all they really care about, with the added bonus of replacing and diluting the revolutionary spirit of those native to those lands. This is a cursory and over simplistic view of the present landscape to explain stock prices — but on a geopolitical plane it doesn’t hold up and the rationale isn’t motivated by money — but power and spite.

Comments »