I went in light for the session, after achieving robust gains on Thursday and didn’t begin my trading until after 1pm, at which point markets traded lower. You might’ve been in a position like this before, whereby the session looks great but you got in late and at the onset of any material intraday pullback, you yourself feel retarded for entering trades.

Truth is, there is nothing we can do about these things. It happens. There isn’t a need to panic, unless of course you feel something has changed. In my case, I ended the session at my lows down 54bps. My Quant was +104bps and my strategic +65bps. For the week, I had limited gains in trading, but up 2 to 4% in Quant and Strategic. My trading performance is usually less than those static accounts during gigantic bounces, because I am usually not partaking in wanton losses when markets trade down. On the whole, I do better than the static accounts, as indicated by my +13% gain vs the 4 to 6% YTD returns in the other accounts.

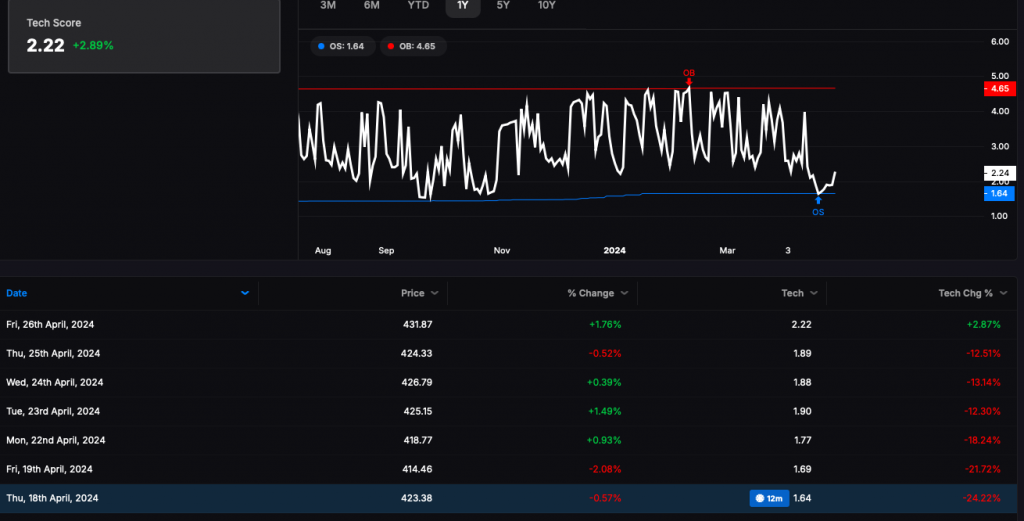

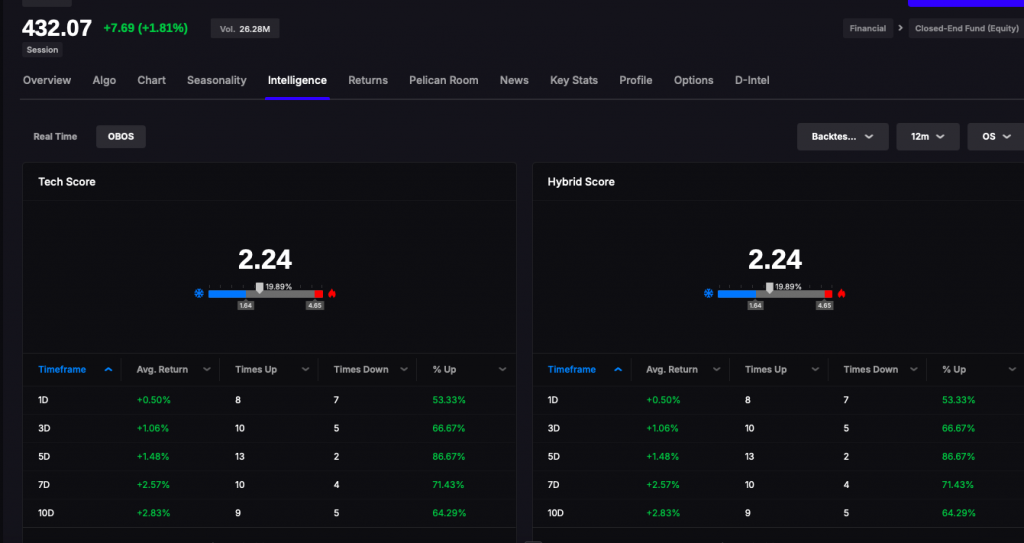

I’d like to become better, braver, at delving into oversold tapes and the irony of me having an oversold algorithm at my disposal is not lost on me. I’ve gotten so accustomed to my trading method that I am sometimes stubborn and do not like to deviate. But if I could time this mean reversions better I could likely double my annual gains, which is something for me to think about.

I haven’t lost confidence in spite of underperforming this week. I know my methods work and it’s only a matter of time before I bust loose again.

I ended the week 109% leveraged long. Before you ponder about how I could be so grim one second and the next fantasyland ecstatic about stocks, you should know that I express myself in a hyperbolic way and often do not actually mean what I say in the literal sense. Those who are in Stocklabs understand that COLLAPSE is always occurring, often at the same time I am 100% long. There is a difference between how my soul feels and what my mind makes my body do, if you can grasp that, which I doubt since most of you are 95 IQ NPCs who get angry when woken up.

At any rate, for the time being, I am bullish. But, if you must know, I can change my mind quite literally in minutes, as I am entitled to do so since I am master of my domain and you’re just a peasant reader.

Have a pleasant weekend.

Comments »