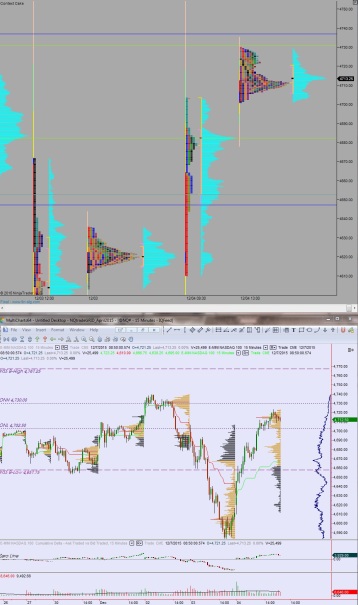

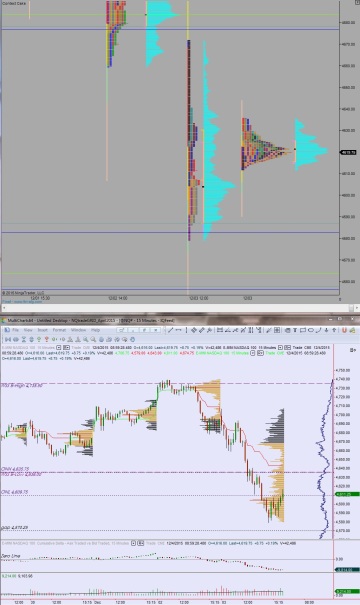

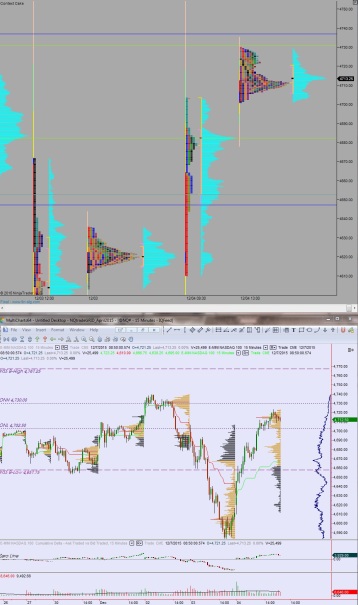

NASDADQ futures are coming into the week flat after a Globex session featuring normal range and volume. Price managed to hold the upper quadrant from Friday before briefly exceeding its high print of 4723.25. The session was balanced overall.

The economic calendar is quiet this week, with Advance Retail Sales and U. of Michigan Confidence reads being the highest impact events. Both are featured later this week. Today we only have Labor Market Conditions at 10am.

Last week started out with a Monday drift lower. Tuesday-Wednesday lunch price drifted higher, took out contract high, stalled, then Wednesday afternoon we sold hard. That carried through to a trend day down Thursday which saw a late-day bounce. Friday managed to completely reverse the trend day by pushing up for the entire session.

Heading into today my primary expectation is for buyers to work a move to take out overnight high 4730. From there look for some churn at the 4737 level before we proceed up through contract high 4739.50. Sellers no show and we continue exploring higher prices but ultimately stall out below 4767.25 and two way trade ensues.

Hypo 2 sellers push down through overnight low 4702.50 and discover responsive buyers around the 4700 century mark. Two way trade ensues with buyers targeting 4731.

Hypo 3 sellers accelerate down though 4700 setting up a move to target 4682.25.

Hypo 4 liquidation takes hold, after some churn near 4682.25 sellers push an initiative leg down to 4652.75.

Levels:

Comments »