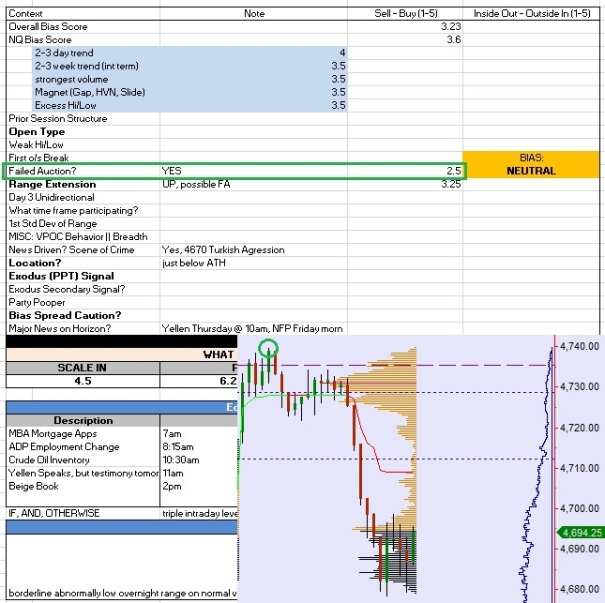

NASDAQ futures are flat up 14 now up 8 points after an extreme session. Both range and volume are beyond second sigma as traders digested a myriad of news items including a 7:38am headline snafu at the Financial Times regarding the ECB rate decision at 7:45am. At 8:30am Initial/Continue jobless claims data was in-line with expectations.

Also on the economic docket today we have a huge 10am log including Factory Orders, ISM Non-manufacturing Composite, and the start of Yellen appearing before the Congressional Joint Economics Committee.

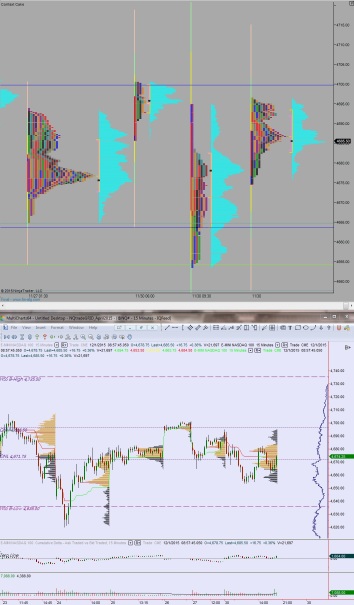

Yesterday we printed a neutral extreme down day. Price briefly went range extension up, by one point, before falling back through the entire range and closing in the lower quadrant. The action managed to make new contract high before rolling over. It also exceeded The low from Tuesday, briefly, before responsive buyers defended. We are seeing another strong defense of these prices again right now as we head into cash open.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4694.25. Look for buyers to show up here and work up to 4720.

Hypo 2 buyers push up through 4720 to target overnight high 4730.25. Look for responsive sellers at 4736.75 and two way trade to ensue.

Hypo 3 sellers close the gap down to 4694.25 and take out overnight low 4675.25 to close the Monday gap down at 4674.25 before responsive buying and two way trade.

Hypo 4 liquidation takes hold. Take out the Monday gap 4674.25 and target a move down to 4664.50.

Levels:

Comments »