NADAQ futures are priced to gap up heading into Friday. The overnight session featured a normal range on slightly elevated volume. Price pushed up into the Thursday liquidation but stalled below the midpoint of yesterday’s big range. At 8:30am Non-farm payroll data came out stronger than expected while the unemployment rate remained unchanged at 5%.

The only other economic event scheduled today is the Baker Hughes rig count at 1pm.

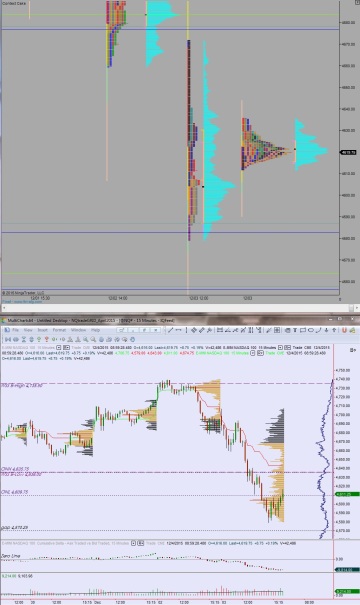

Yesterday we printed a double distribution trend day down. This day type has the second highest amount of directional conviction. The selling accelerated heading into the lunch hour and pressed deep into the 11/18 range before buyers stepped in. The day ended on a bounce.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4611.25. Sellers continue to take out overnight low 4609.75. Look for responsive buyers at the 4600 century mark and two way trade to ensue below 4625.

Hypo 2 sellers push hard, down throgh 4600 and target 4586.75. Look for buyers here who are overrun as sellers target the open gap down at 4570.25.

Hypo 3 buyers sustain trade above 4615 setting up a move to take out overnight high 4635.75. Look for responsive sellers to defend their liquidation at 4643.

Hypo 4 a pole climb. Buyers push up through 4643, sustain trade above it, and set up a pole climb up to 4676.75.

If you enjoy the content at iBankCoin, please follow us on Twitter

The pole will be climbed today my good sir.

Ha ha! +1

full on climb, caught a nice piece of it

Fed are buying stocks directly in the market.