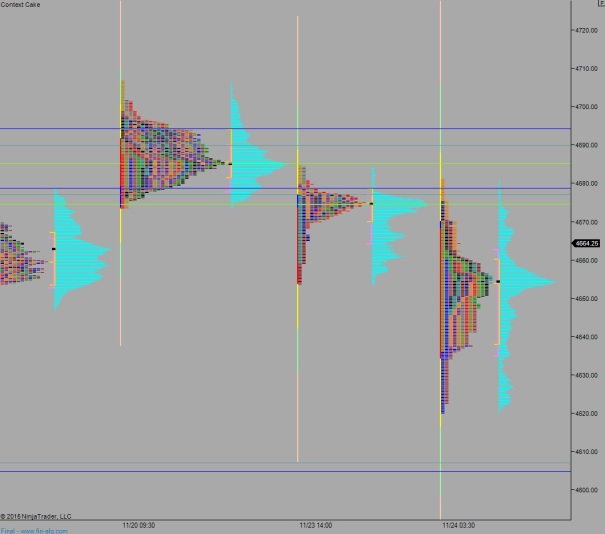

NASDAQ futures are priced to gap up after a Globex session featuring normal range and volume. Price held the upper quadrant of yesterday’s range before pressing up above the Tuesday high. We managed to print a weak/double high at 4684.50, which was the overnight high yesterday morning also. There are a ton of economic events scheduled today. We already heard MBA Mortgage Applications at 7am. We also had a data dump at 8:30am which included Personal Consumption Expenditure, Durable Goods, and Initial/Continuing Claims. The initial reaction is slight selling.

We also have House Price Index at 9am, Markit Composite PMI at 9:45am, both New Homes Sales and the final U of M Confidence read for November at 10am. Energy traders will also be watching the Baker Hughes Rig Count at 1pm.

Yesterday we printed a neutral extreme up. Price opened gap down on news a Russian jet was downed by Turkish forces. After some early buying, a strong wave of liquidation pushed in. Buyers defended the conviction/trend day printed last Wednesday and the strong buying wave carried price up to close the overnight gap.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4665.50. Just below at 4664.75 look for responsive buyers who work to take out the weak overnight high at 4684.50. Look for responsive selling at 4689.75 and two way trade to ensue.

Hypo 2 buyers gap and go, take out overnight high 4684.50 early. Look for responsive sellers up at 4694.50 then two way trade ensues, with sellers slowly working the gap fill down to 4665.50.

Hypo 3 sellers accelerate down through the open gap 4665.50 and set their sights on overnight low 4659.50. Look for a responsive buyer down near 4648 and two way trade ensues.

Levels:

Comments »