NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight during a balanced session, pushing back up near weekly highs, a place we have gone gap down-and-away from twice this week. As we approach cash open price is hovering near Monday’s closing price.

On the economic calendar today we have existing home sales at 10am and crude oil inventories at 10:30am.

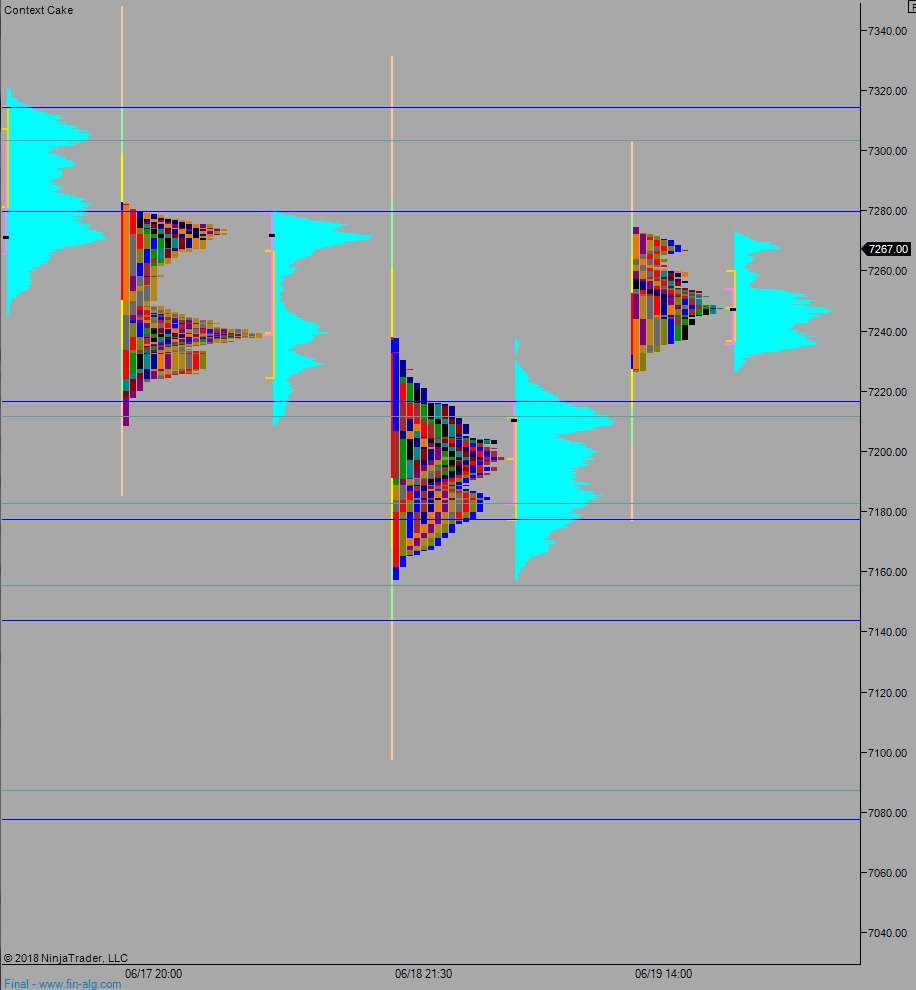

Yesterday we printed a neutral extreme up. The day began gap down and with a choppy open. By mid-morning sellers stepped in and pushed lower, into the 06/08 range from two Friday’s back. The market briefly went range extension down before a strong bid stepped in and effectively reversed the selling with one hard rotation up.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7252.50. Buyers step in here and work higher, up through overnight high 7274.75 to close the open gap at 7275.50. Look for sellers up at 7279.75 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, trade up through 7279.75 and sustain trade above it setting up a move to target 7300. Extended target is the open gap at 7312 then open air above 7321.

Hypo 3 stronger sellers close overnight gap 7252.50, trade us down through overnight low 7226.75. Look for buyers down at 7216 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: