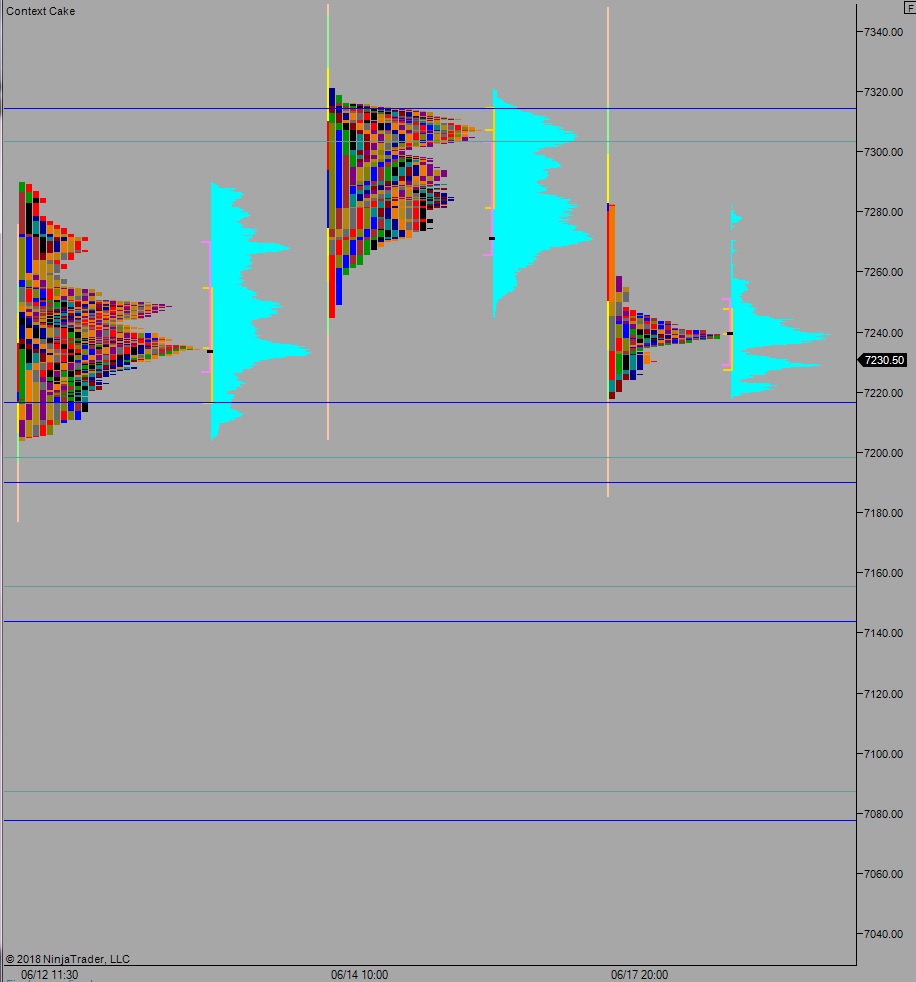

NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range on elevated volume. Price worked lower overnight, trading down into last Tuesday’s range before settling into a mini balance.

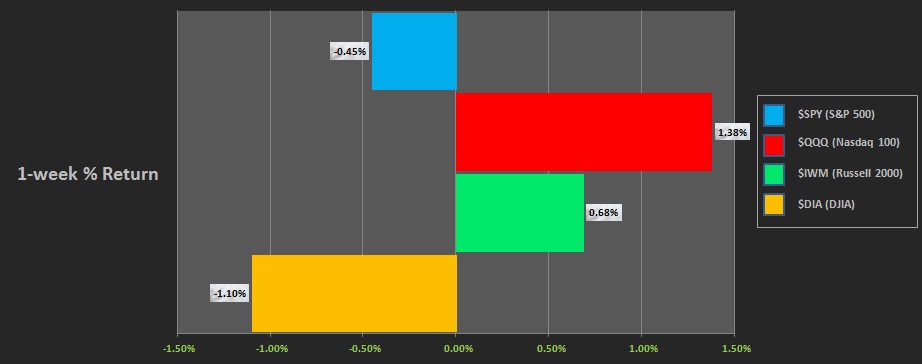

Last week the NASDAQ worked higher, making a new record high by Wednesday and sustaining the gains into the weekend. Meanwhile the other indices marked time and the Dow drifted lower. The last week performance of each major index is shown below:

On the economic agenda today we have the NAHB housing market index at 10am and both a 3- and 6-month t-bill auction at 11:30am.

On Friday the NASDAQ printed a normal variation up. The day began gap down and with a selling drive lower, down below the Thursday low. However responsive buyers stepped in ahead of the open gap from Wednesday and two way trade ensued, eventually giving way to a range extension up during the drift.

Normal variation up.

Heading into today my primary expectation is for a choppy open. Markets are out of balance from last week and we may some some institutional behavior sloshing through early on. Eventually look for buyers to step in and work into the overnight inventory, closing the gap up to 7280.75 then continuing higher, up through overnight high 7289.25. Look for sellers up at 7300 and two way trade to ensue.

Hypo 2 sellers reject a move back into the Friday low 7245 setting up a move down through overnight low 7218.25. Look for buyers down at 7209 and two way trade to ensue.

Hypo 3 strong sellers gap-and-go lower, sustaining trade below 7195 and setting up a move to target 7155.75.

Levels:

Volume profiles, gaps, and measured moves: