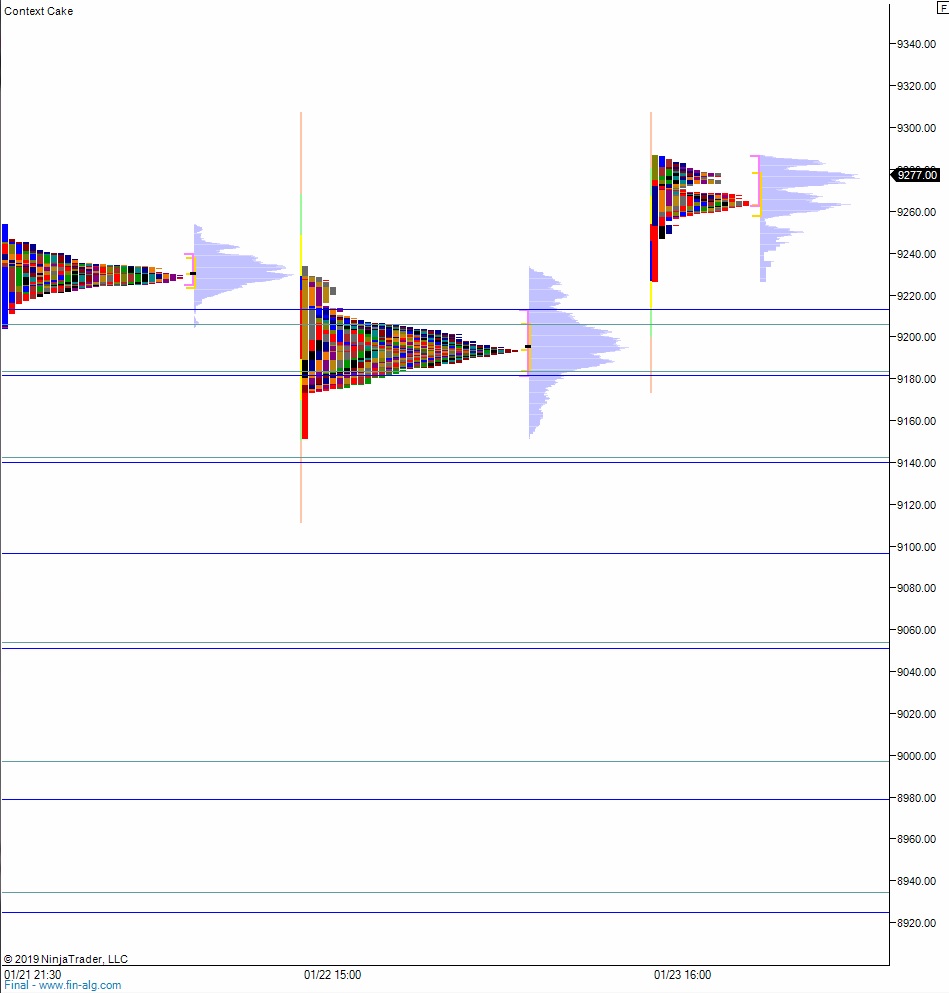

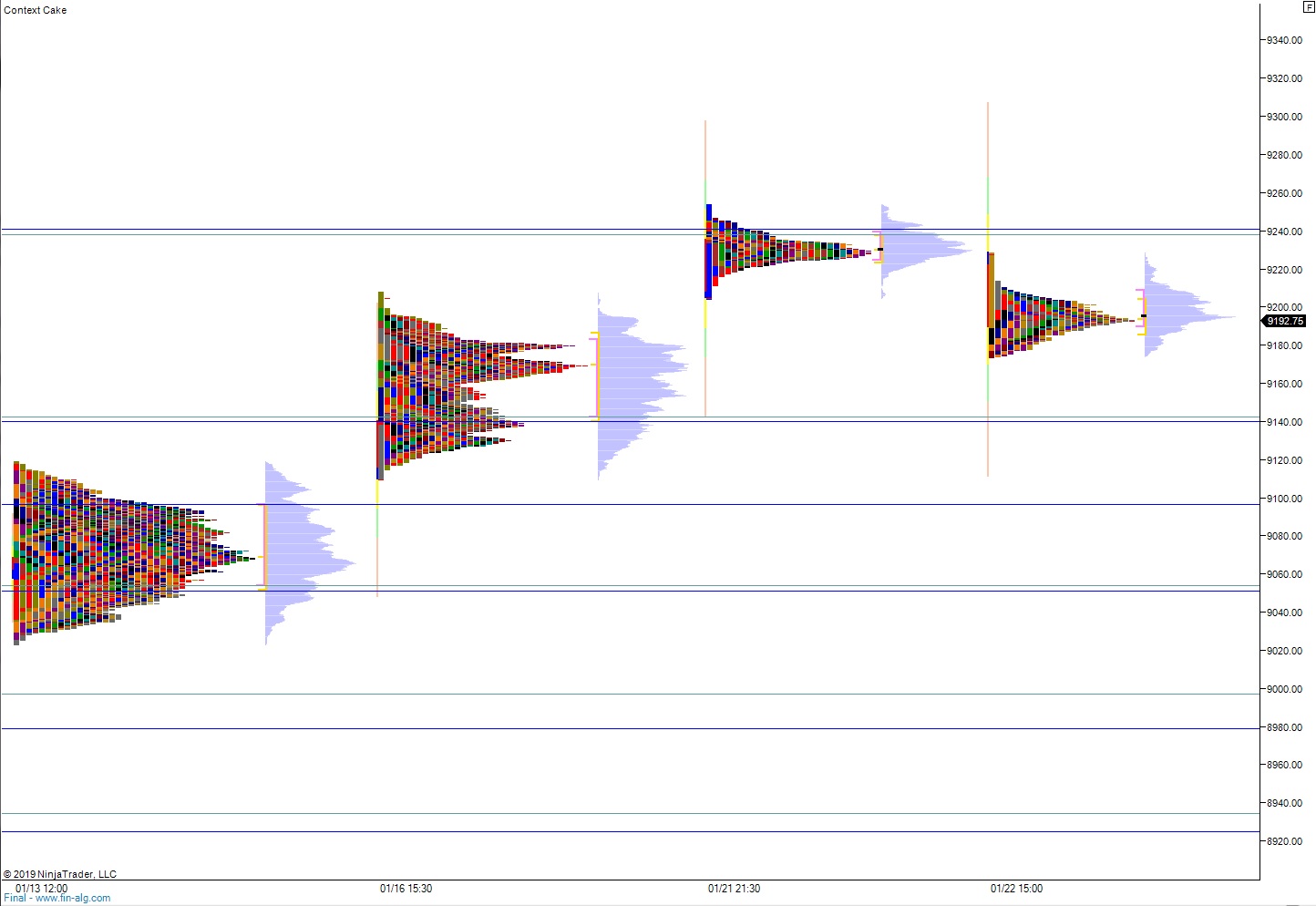

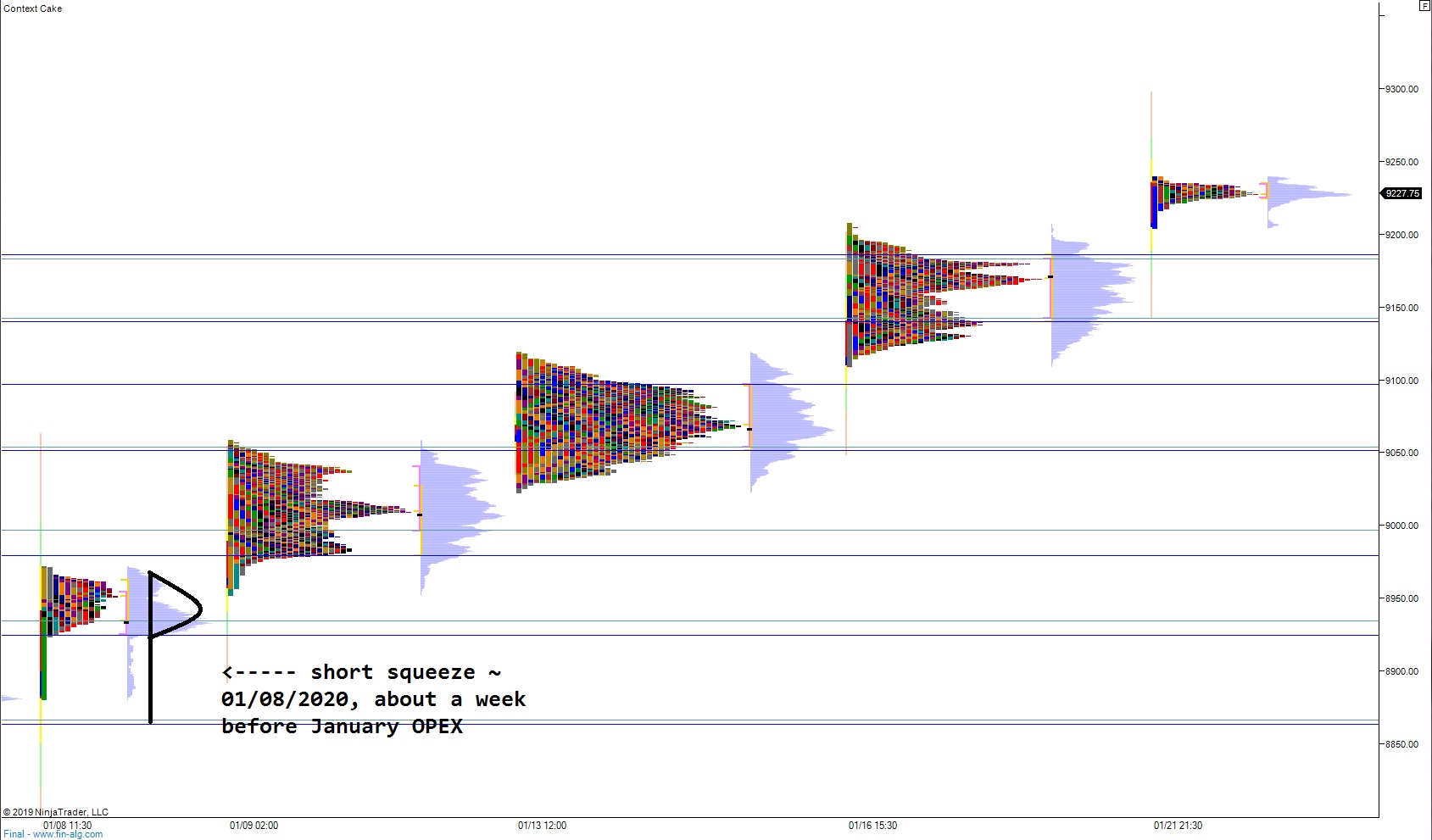

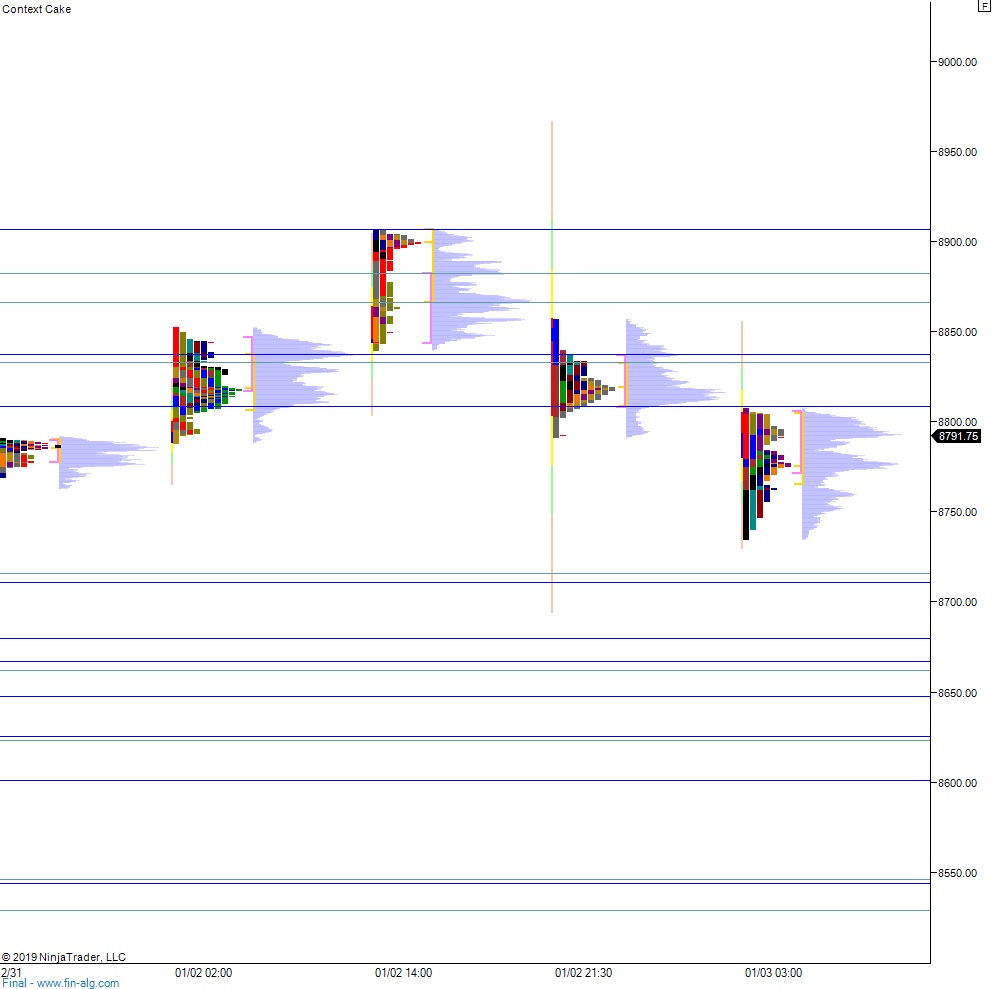

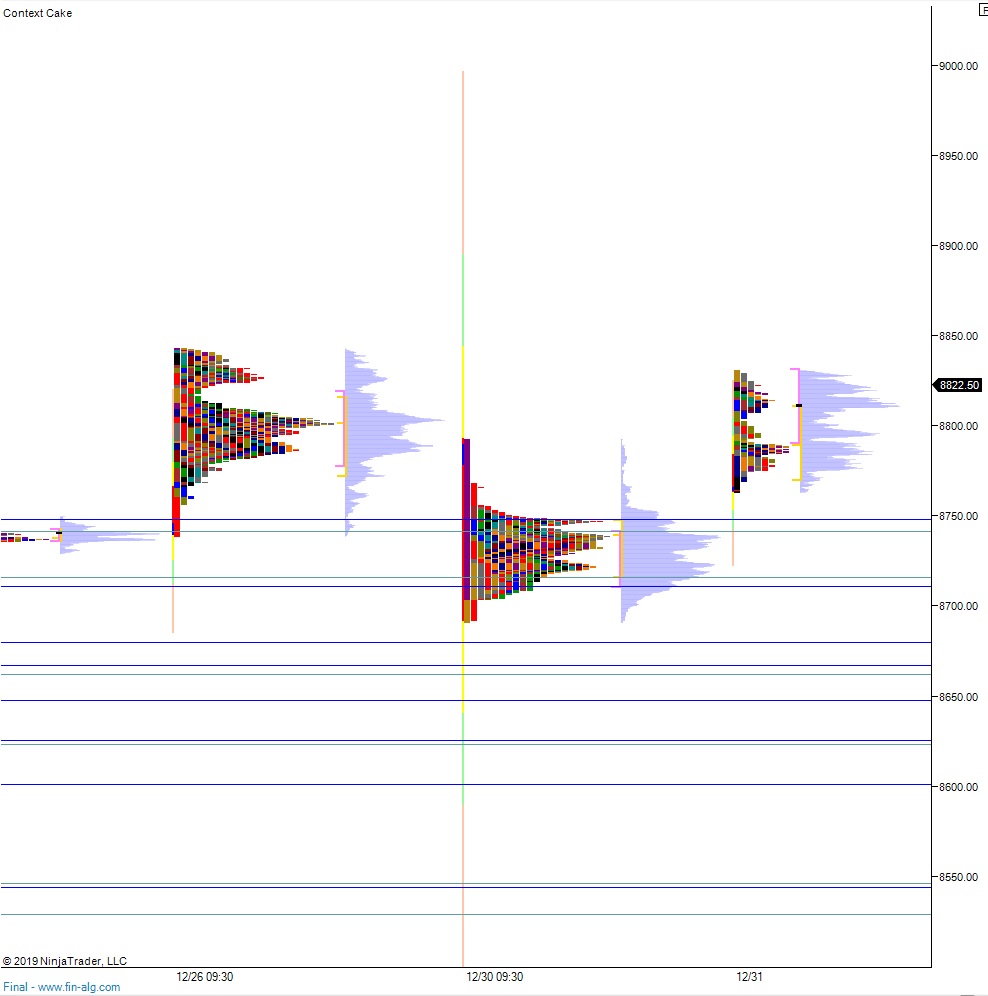

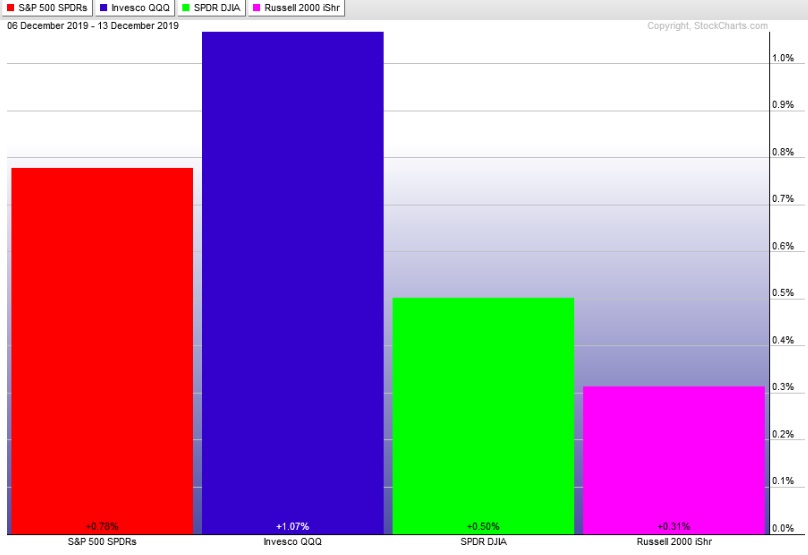

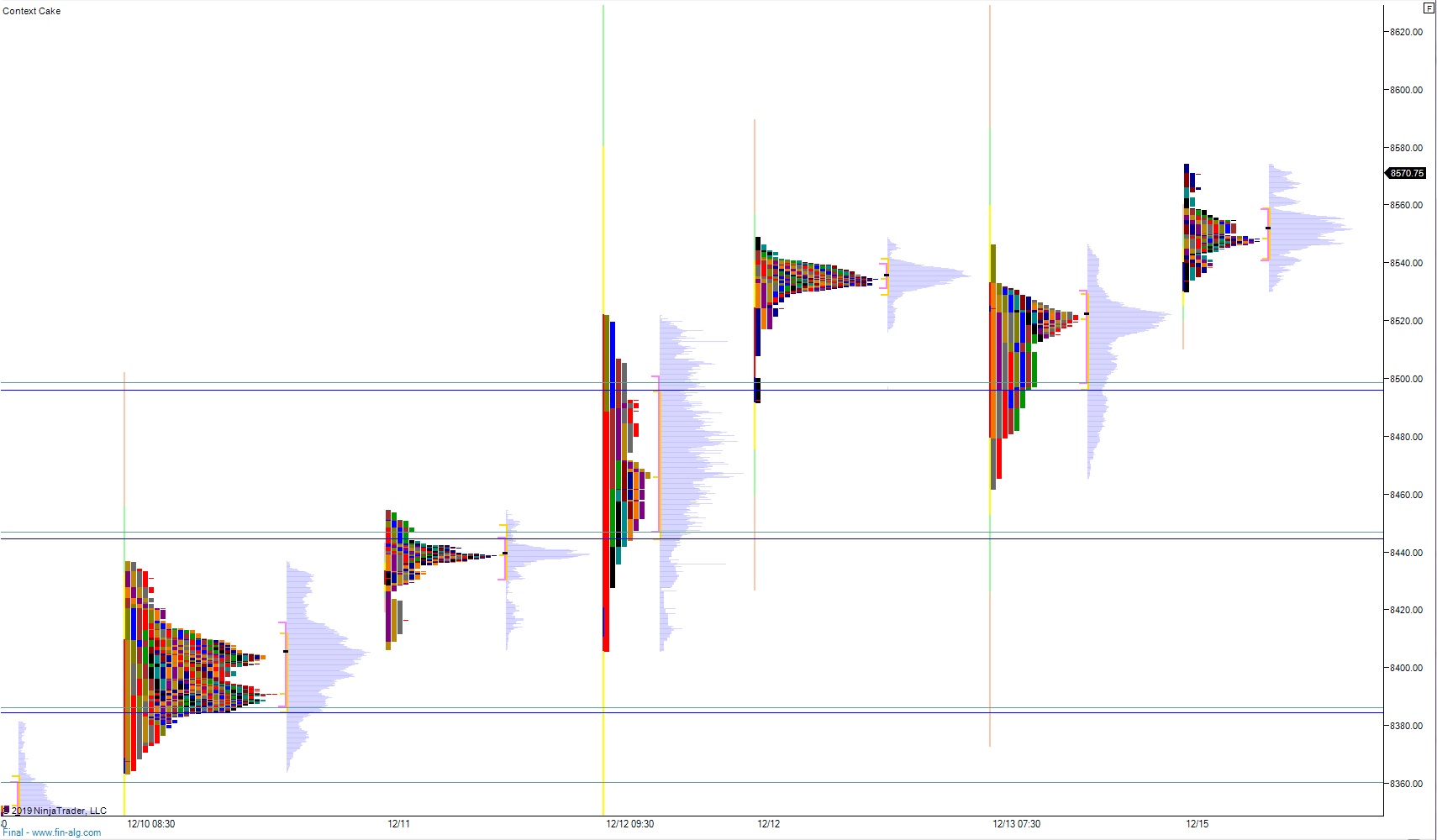

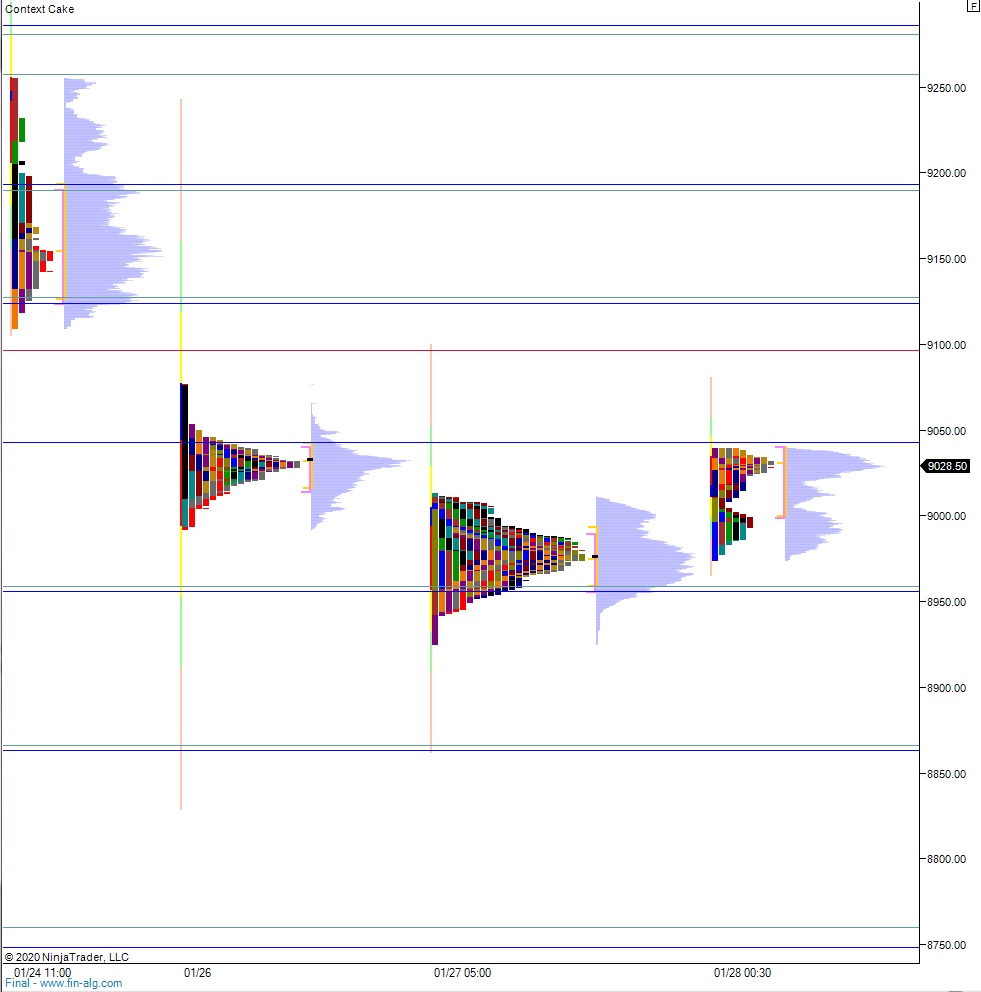

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme volume and range. Price worked higher overnight, trading up into a three-day micro balance spanning from 01/13 – 01/15. Sellers rejected a move up into this area around 3:30am New York, but buyers reemerged and probed the area again. At 8:30am durable goods orders came in stronger than expected. As we approach cash open, price is hovering in the low-value area of the 01/13-01/15 micro-composite balance.

Also on the economic calendar today we have consumer confidence at 10am, 2-year Notes and 52-week T-bills auctioning at 11:30am, a 7-year Note auction at 1pm.

Then major NASDAQ component Apple reports earnings after the bell.

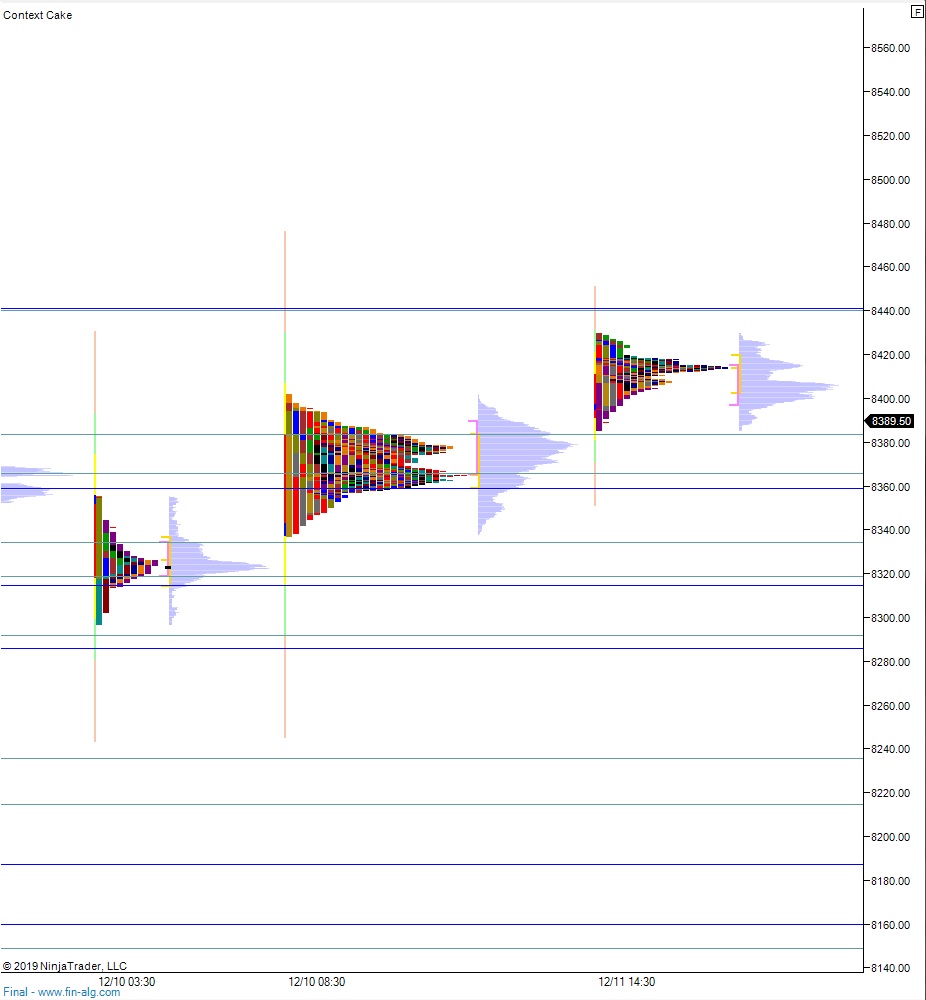

Yesterday we printed a normal variation up.; The day began with a pro gap down to a new 11-day low. Buyers were on the scene after a sharp move lower on the open. They defended their conviction buy range from 01/08. WE spent the rest of the session working higher, eventually forming a weak high just above 9000. Selelrs drove price back down below the midpoint late in the day and we ended the session below the mid.

Heading into today my primary expectation is for sellers to work into the overnight inventory and tag the 9000 level before responsive buyers (responsive relative to the open, initiative relative to Monday’s close) step in and work up through overnight high 9040, working higher to close the open gap at 9059.50 before two way trade ensues.

Hypo 2 sellers work a full gap fill down to 8954 then continue lower, down through overnight low 8949.75 before two way trade ensues.

Hypo 3 stronger sellers flush down to 8900, setting up a move to check back to the Iran conflict level 886 before two way trade ensues.

Levels:

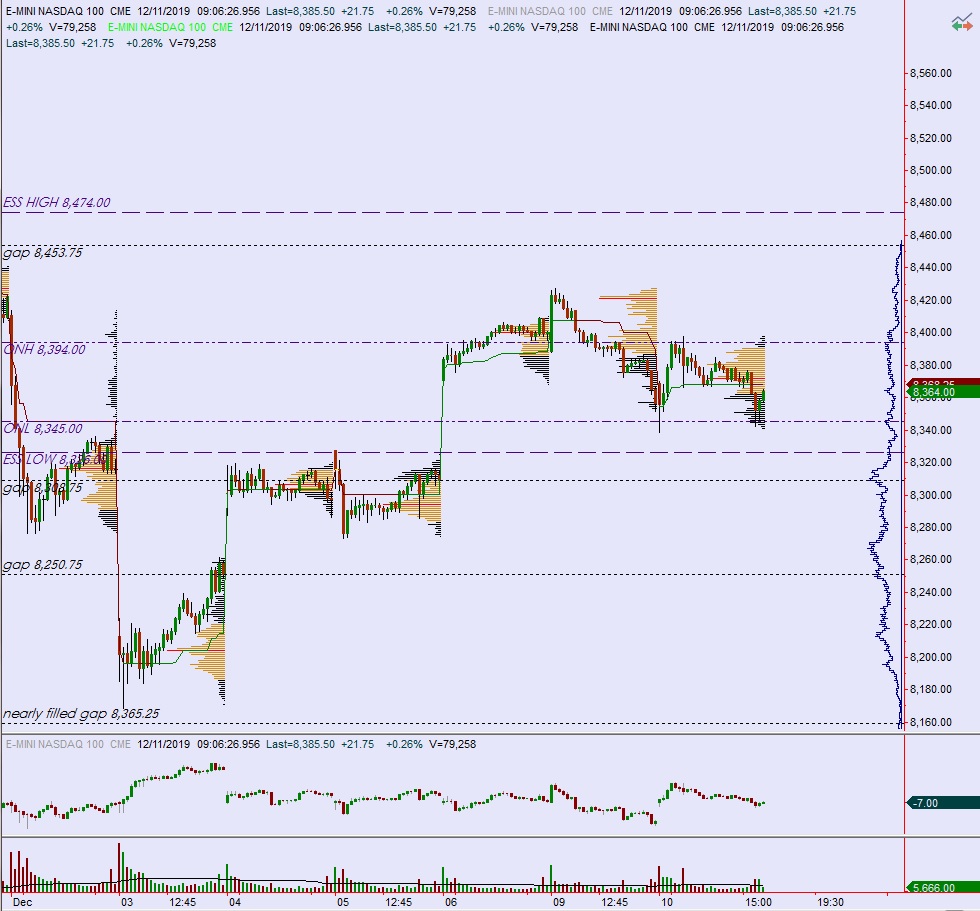

Volume profiles, gaps, and measured moves: