NASDAQ futures are coming into Monday pro gap down after an overnight session featuring extreme range and volume. The globex session kicked off Sunday night with about a -70 point gap down and then drove lower before coming into balance above 9000, levels unseen since January 10th. Then another leg lower took shape, trading down into the 01/08 conviction buying range, which was a pivot up-and-away from the initial reaction to U.S. air strike in Iran. As we approach cash open, price is hovering in the upper quadrant of this conviction buying range set back on 01/08.

On the economic calendar today we have new home sales at 10am followed by 13- and 26-week T-bill auctions at 11:30am. Then 2- and 5-year Note auctions at 1pm.

Last week was holiday shortened, with markets closed Monday in observation of Dr. Martin Luther King, Jr. day. On Tuesday we opened gap down and had a choppy Tuesday with buyers resolving the down gap before giving up much of their gains and eventually returning to the daily midpoint by close. Wednesday was gap up to record highs before some afternoon selling erased the day’s upward progress. Thursday served to work price back up to record highs before a gap up to new record highs Friday set up a trend down Friday.

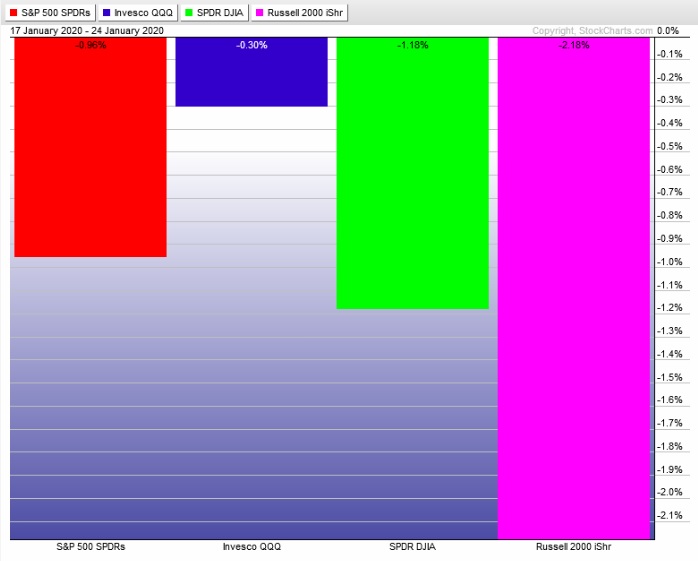

We ended the week lower. The Russell was divergent weak the whole time. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a trend down. The day began with a gap up to new record highs. After a two-way auction sellers stepped in and began driving lower, resolving the overnight gap before driving down through the entire Thursday range. Price sort of came into balance near the end of the session but sellers could still be seen exerting control.

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down through overnight low 8942.50. Look for buyers down at 8925.50 and two way trade to ensue.

Hypo 2 stronger sellers trade down to the 8900 century mark then continue lower, down to 8865 (Iran air strike level) before two way trade ensues.

Hypo 3 buyers work into the overnight inventory, reclaiming 9000 and sustaining trade above it, setting up a move to 9040 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: