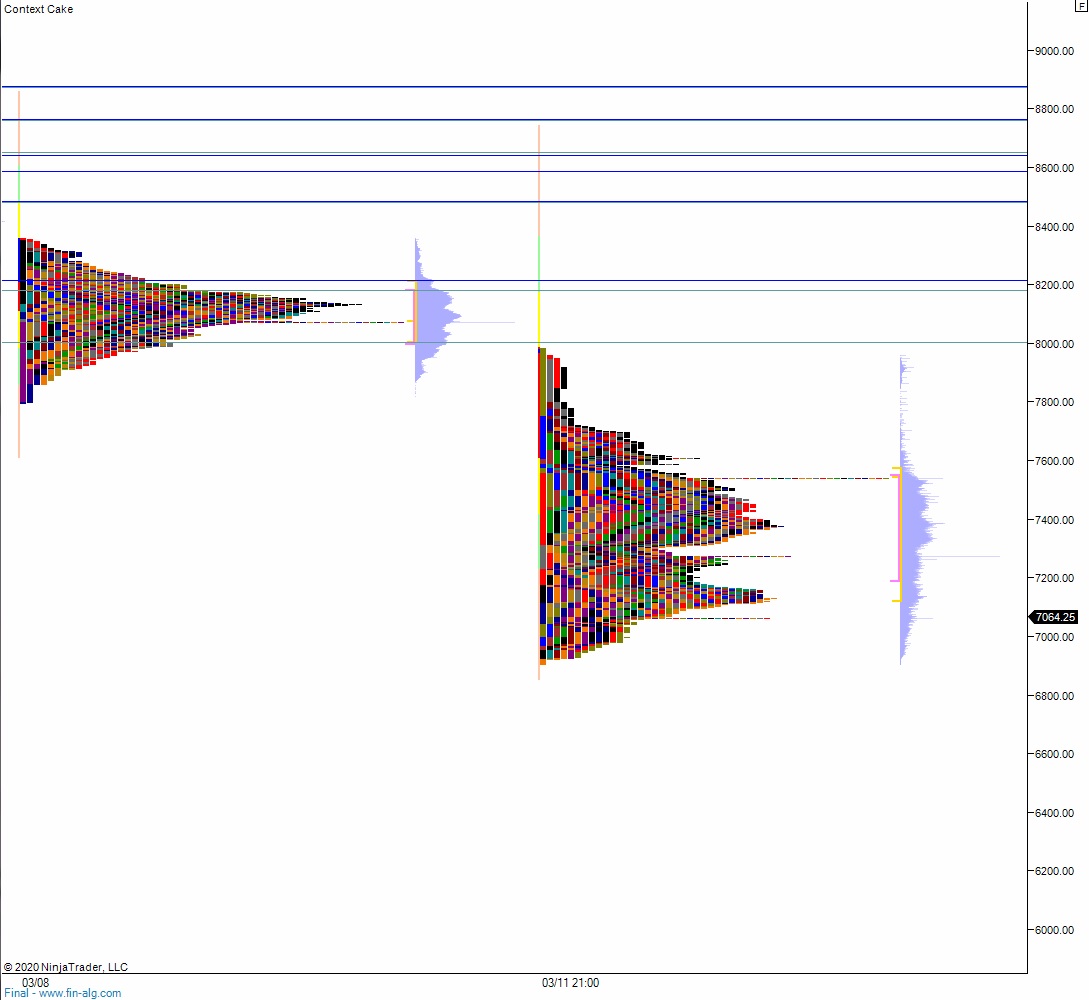

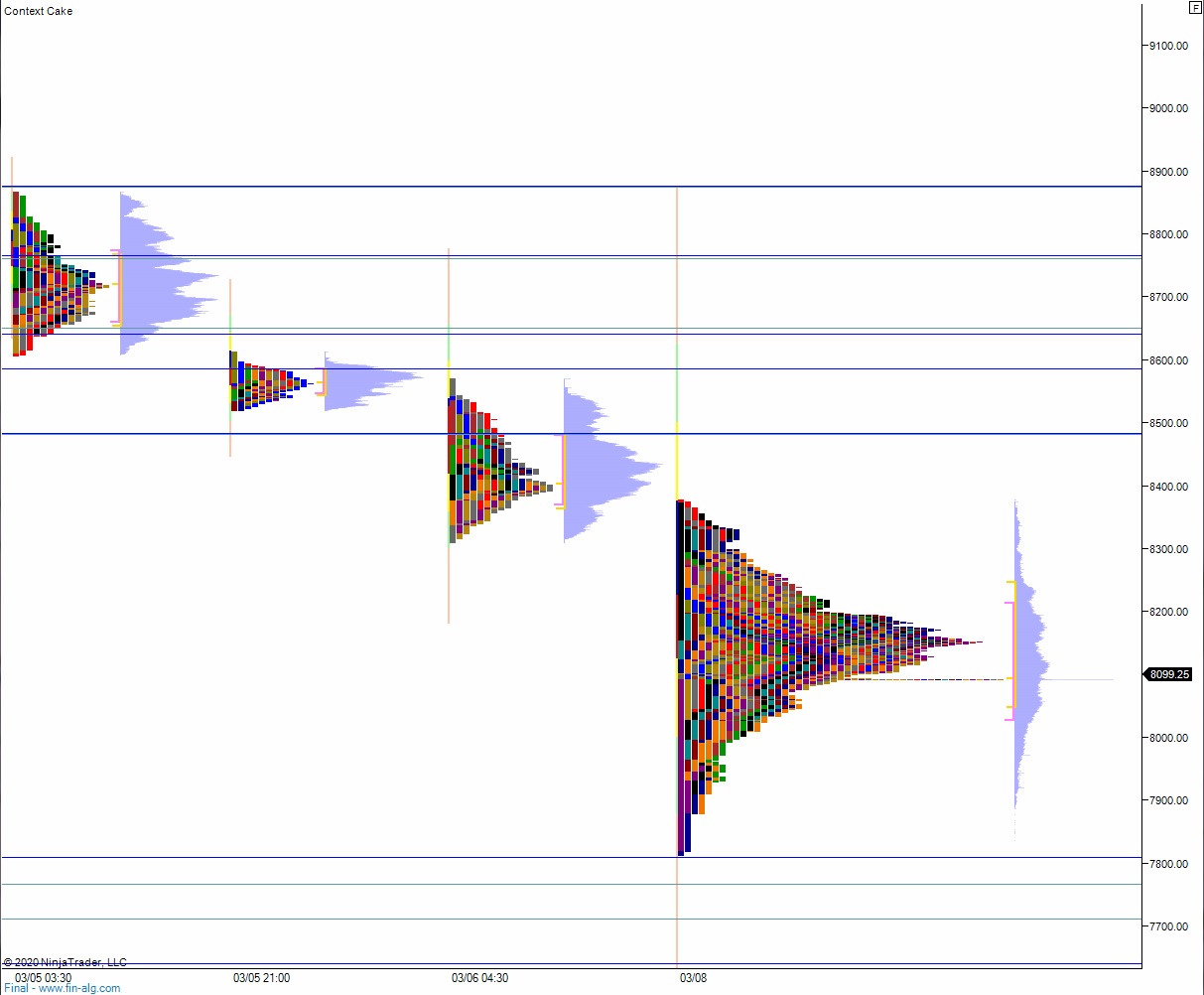

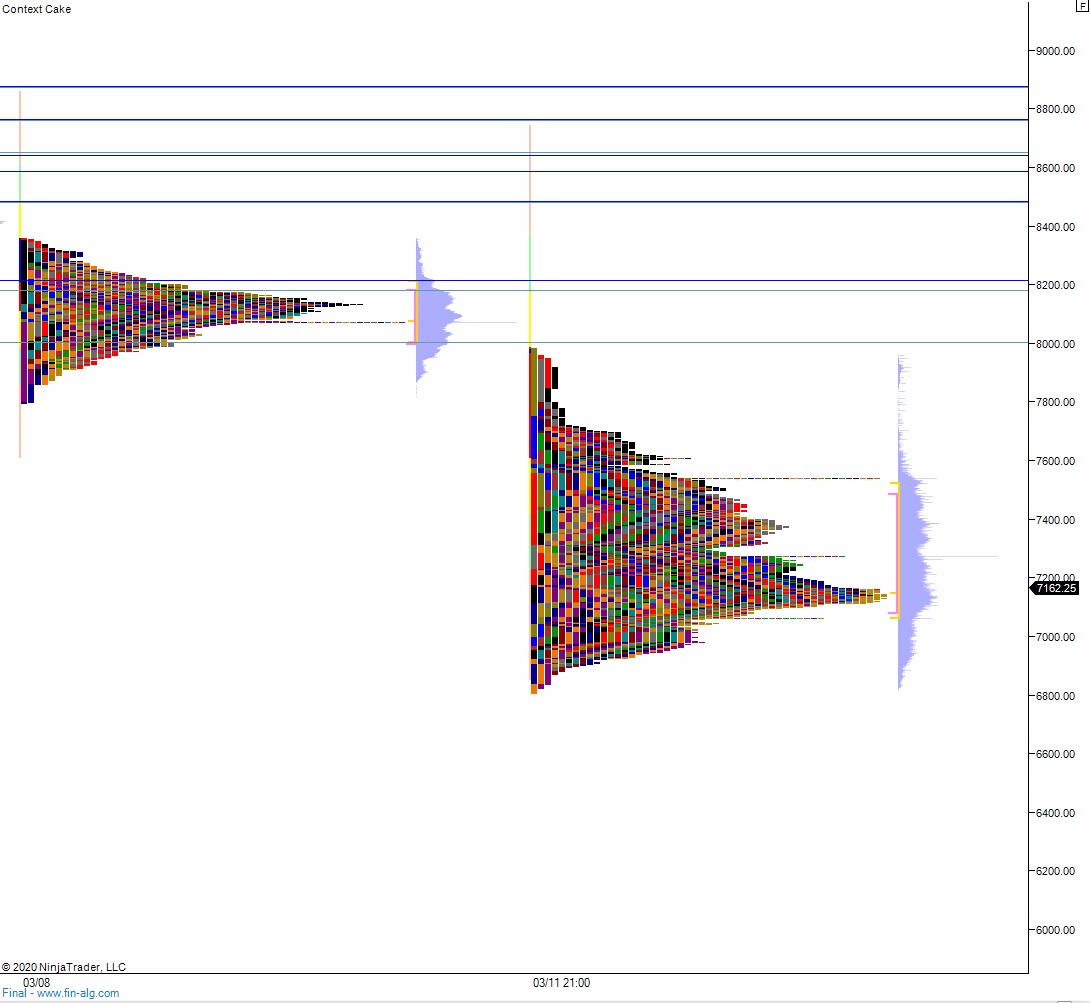

NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price took out Wednesday’s high and held above it until about 9pm New York when price reversed lower. Sellers worked price back down through the Wednesday midpoint and further, down near the lower quad of Wednesday’s range. Sellers were unable to take out Wednesday low before we began rotating higher. This up rotation stalled out near Wednesday high before we fell back to the Wednesday midpoint.

In short, balance.

As we approach cash open, buyers are rallying price up off the Wednesday midpoint and we are down about -60.

On the economic calendar today we have leading index at 10am, 4- and 8-week T-bill auctions at 11:30am and a 10-year TIPS auction at 1pm.

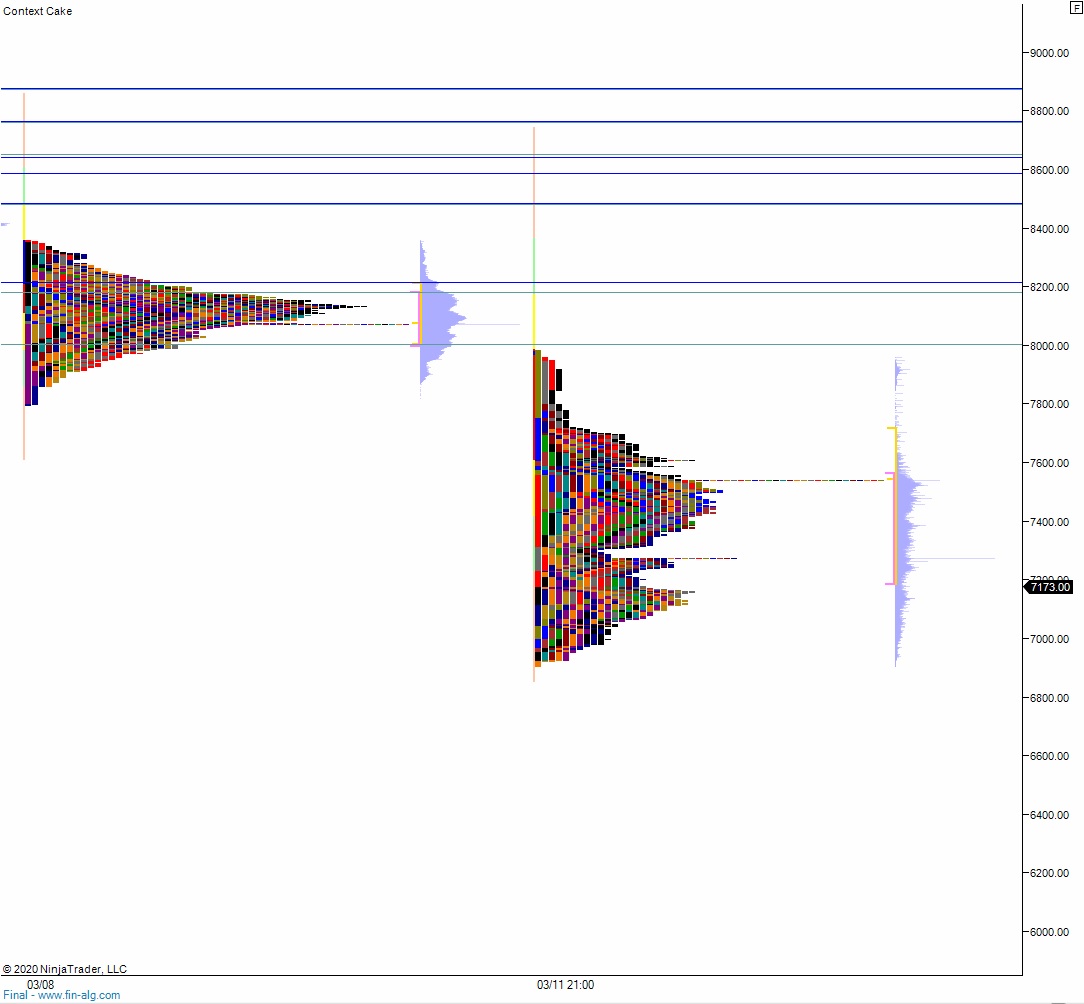

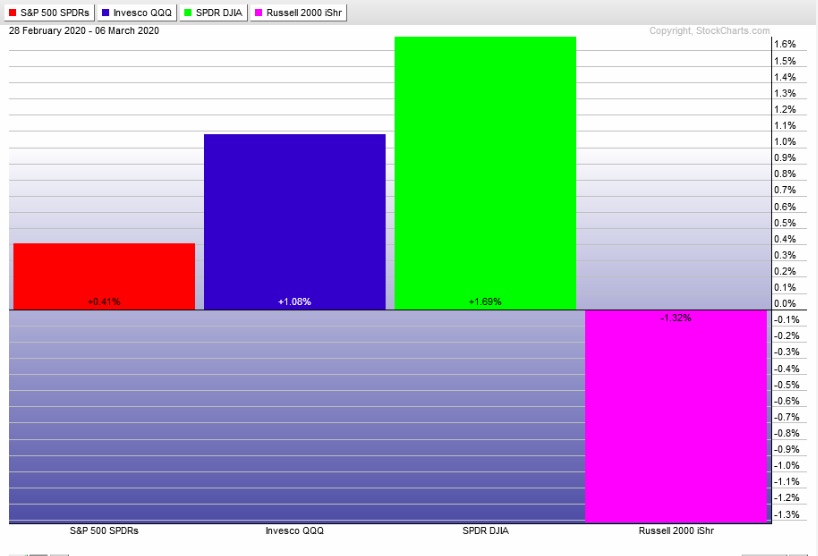

Yesterday we printed a normal variation down. The day began with a gap down near Tuesday low. Buyers drove higher off the open, working up through the Tuesday midpoint but unable to close the overnight gap before sellers stepped in. Said sellers reclaimed the midpoint and pivoted from it, making new low of day to press range extension down. Sellers continued lower, marking a new swing low. Late in the session we ramped back up through the midpoint and closed in the upper quadrant.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7205.50. From here we continue higher, up through overnight high 7424. Look for sellers up at 7432.50 and two way trade to ensue.

Hypo 2 stronger buyers sustain trade above 7432.50 setting up a move to tag 7500. From here we probe above the Tuesday high 7537, setting up a move to tag the composite VPOC at 7700.

Hypo 3 sellers press down through overnight low 6874.25 on their way down to 6800 before two way trade ensues.

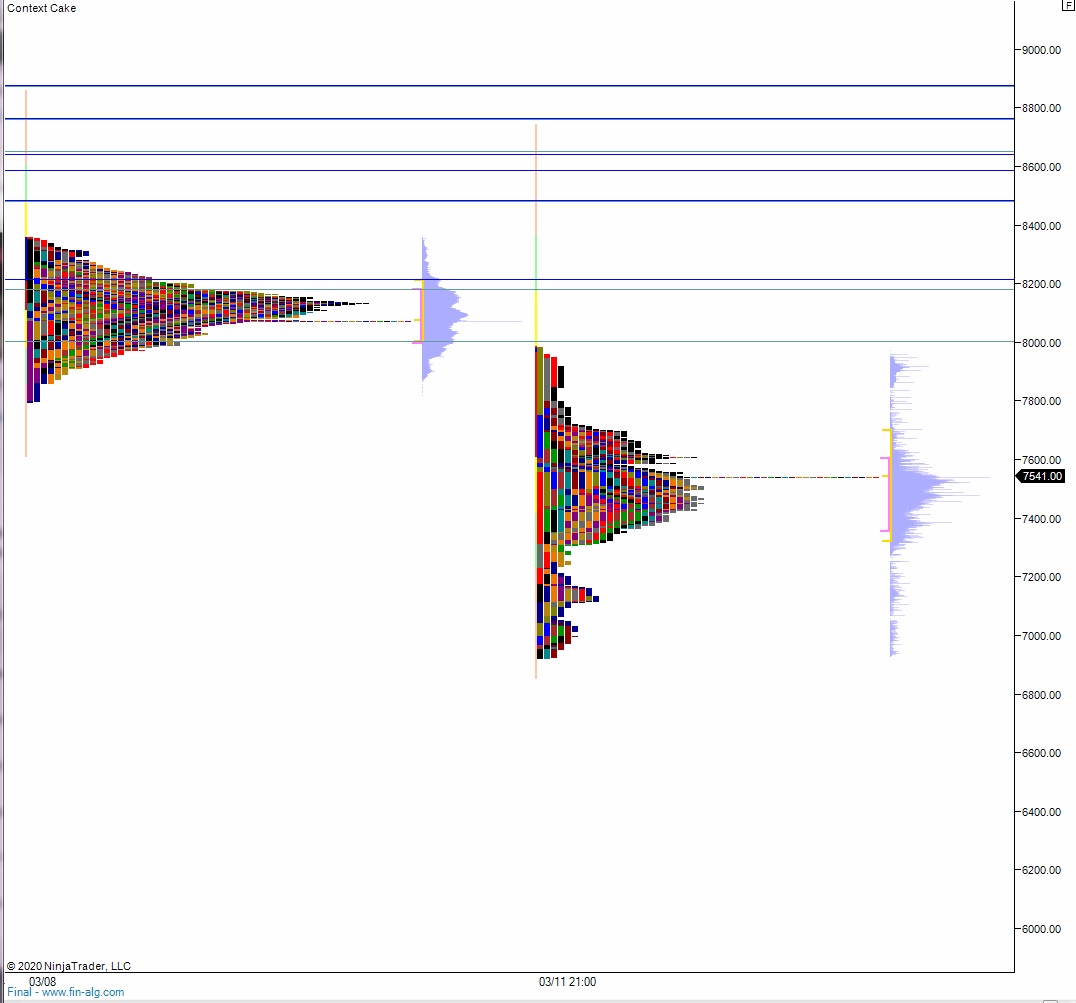

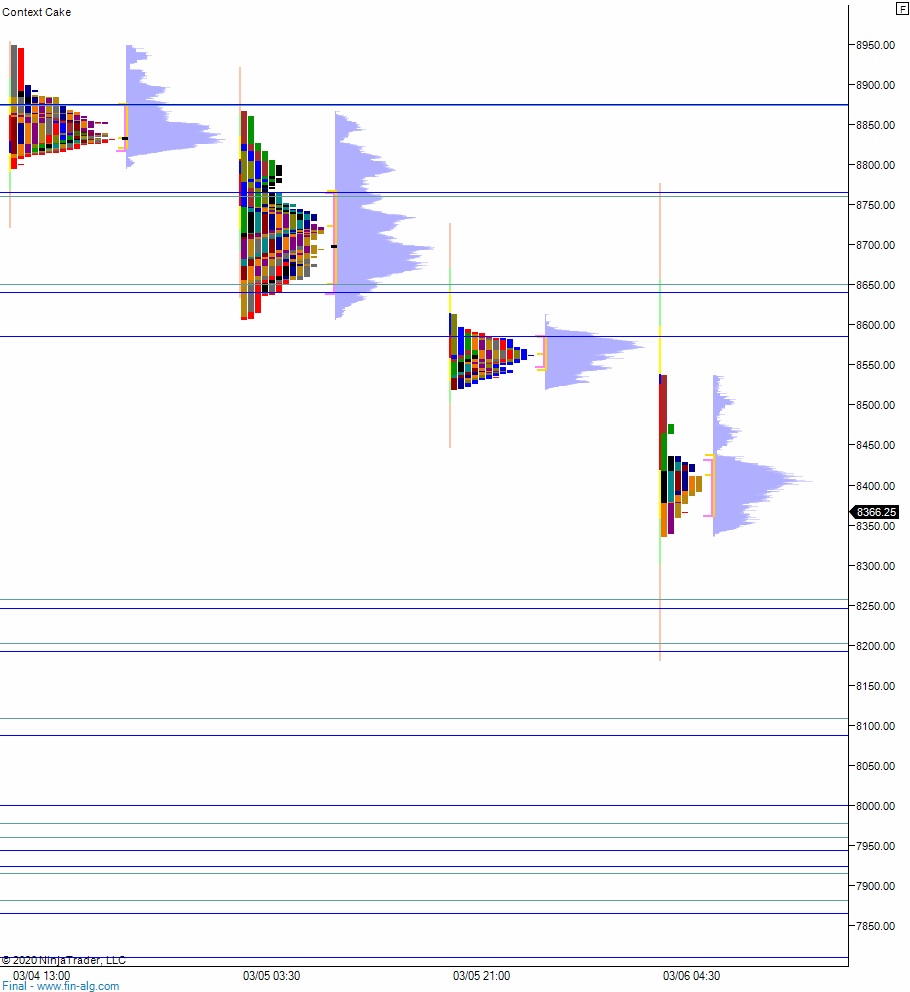

Levels:

Volume profiles, gaps and measured moves: