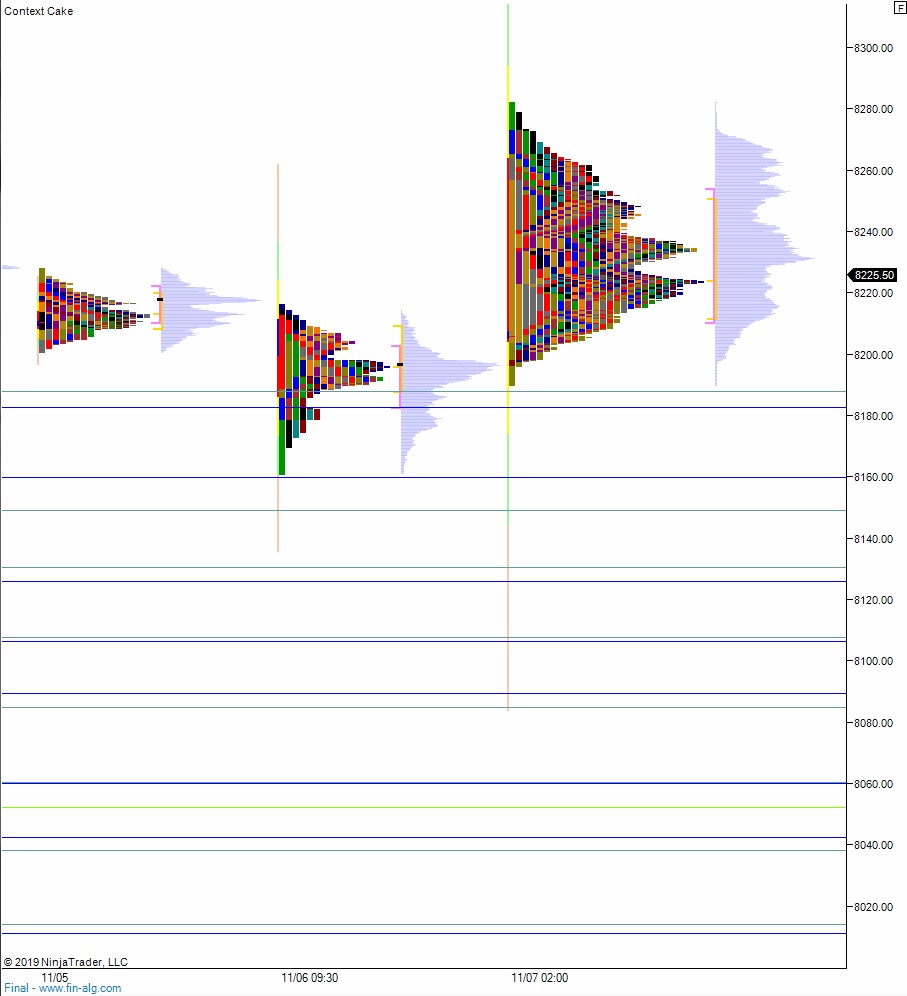

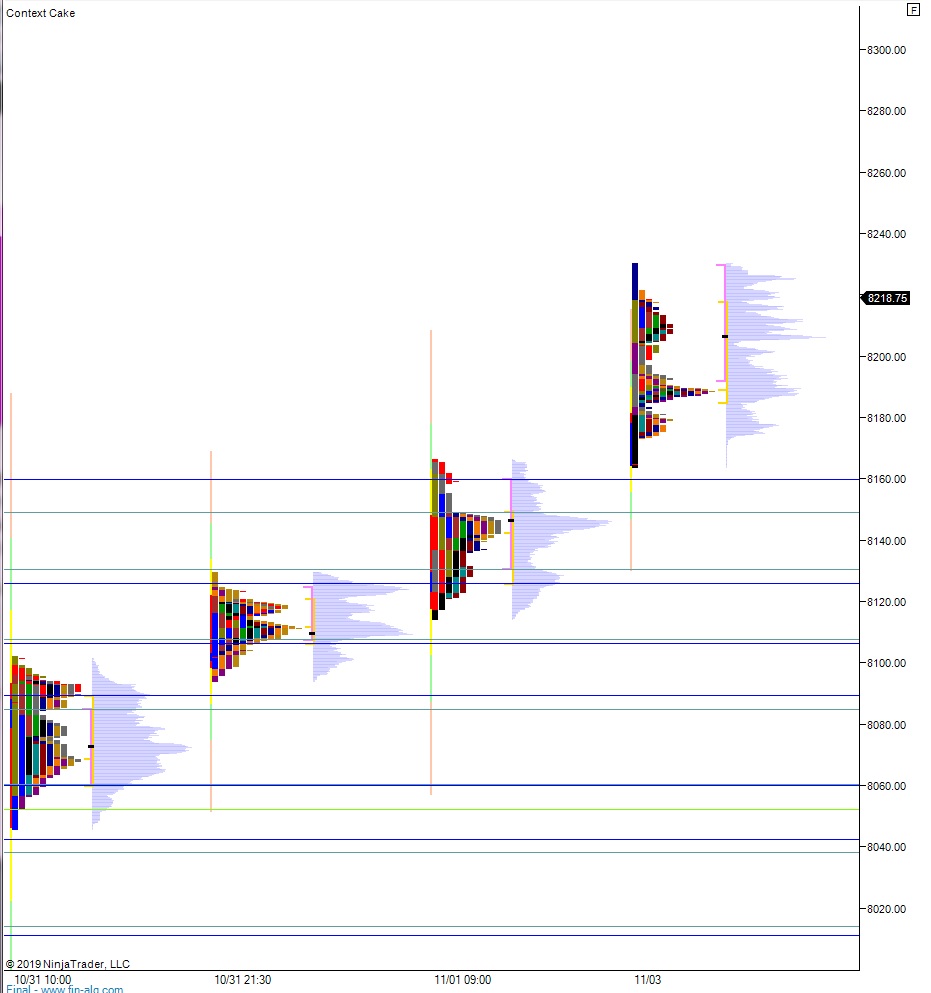

NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme volume on elevated range. Price was balanced overnight, holding Wednesday range after briefly poking above it around 10pm New York. At 7am Walmart reported stronger than expected earnings but missed on quarterly sales. They raised their fiscal year 2020 guidance:

Walmart (NYSE:WMT) reported quarterly earnings of $1.16 per share which beat

the analyst consensus estimate of $1.09 by 6.42 percent. This is a 7.41 percent

increase over earnings of $1.08 per share from the same period last year. The

company reported quarterly sales of $128 billion which missed the analyst

consensus estimate of $128.63 billion by 0.49 percent. This is a 2.49 percent

increase over sales of $124.894 billion the same period last year.Walmart Raises FY20 Adj. EPS Guidance, Says Now Expected To Be Slight Increase

Over FY19 Adj. EPS Level

So far NASDAQ futures are not reacting to the announcement, WMT shares are about +2.8% higher in pre-market trade. Reminder: major semiconductor manufacturer Nvidia is set to report earnings after the bell.

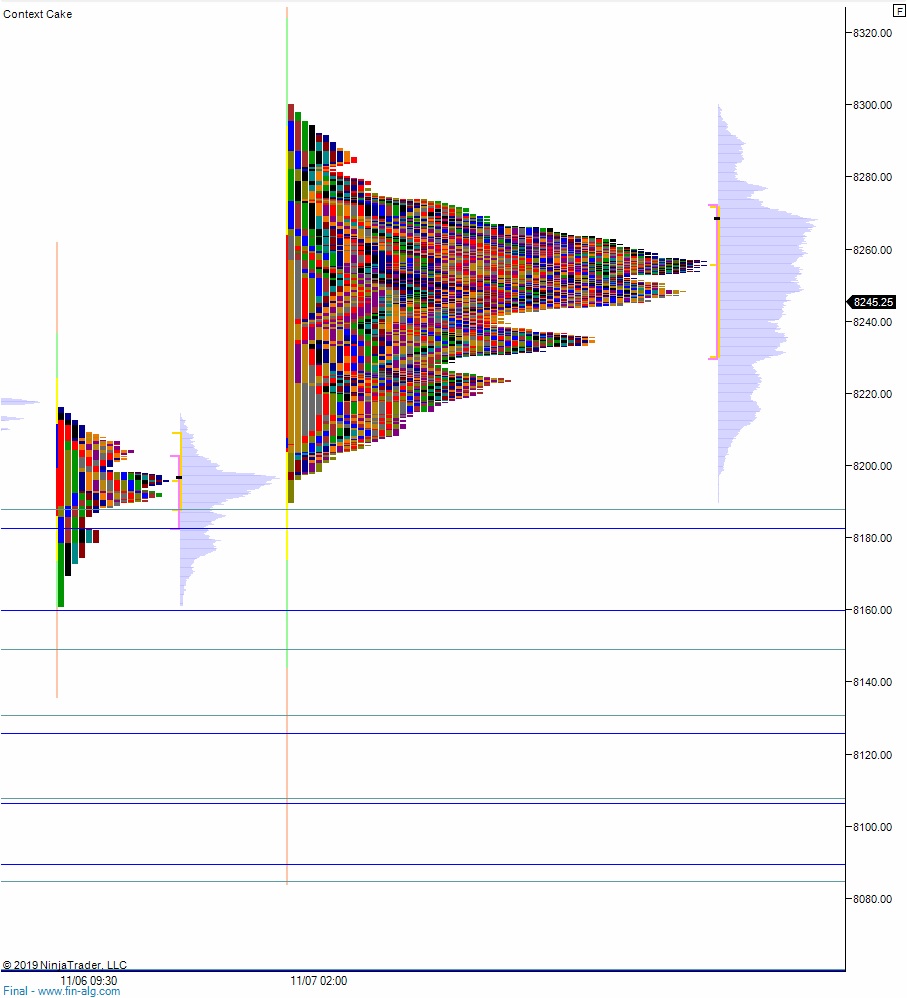

As we approach cash open, price is hovering along the Wednesday lows.

Also on the economic calendar today we have Federal Reserve chairman Jay Powell going before the House Budget committee at 10am, crude oil inventories at 11am and 4- and 8-wek T-bill auctions at 11:30am.

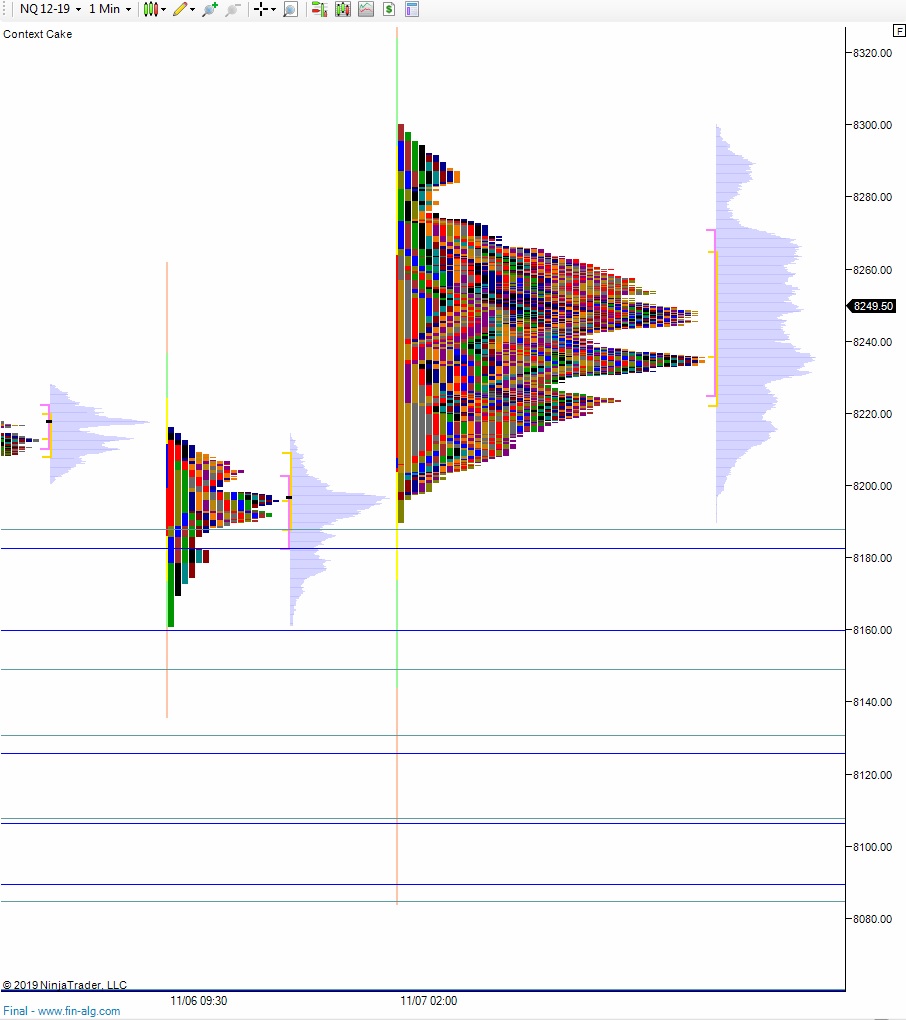

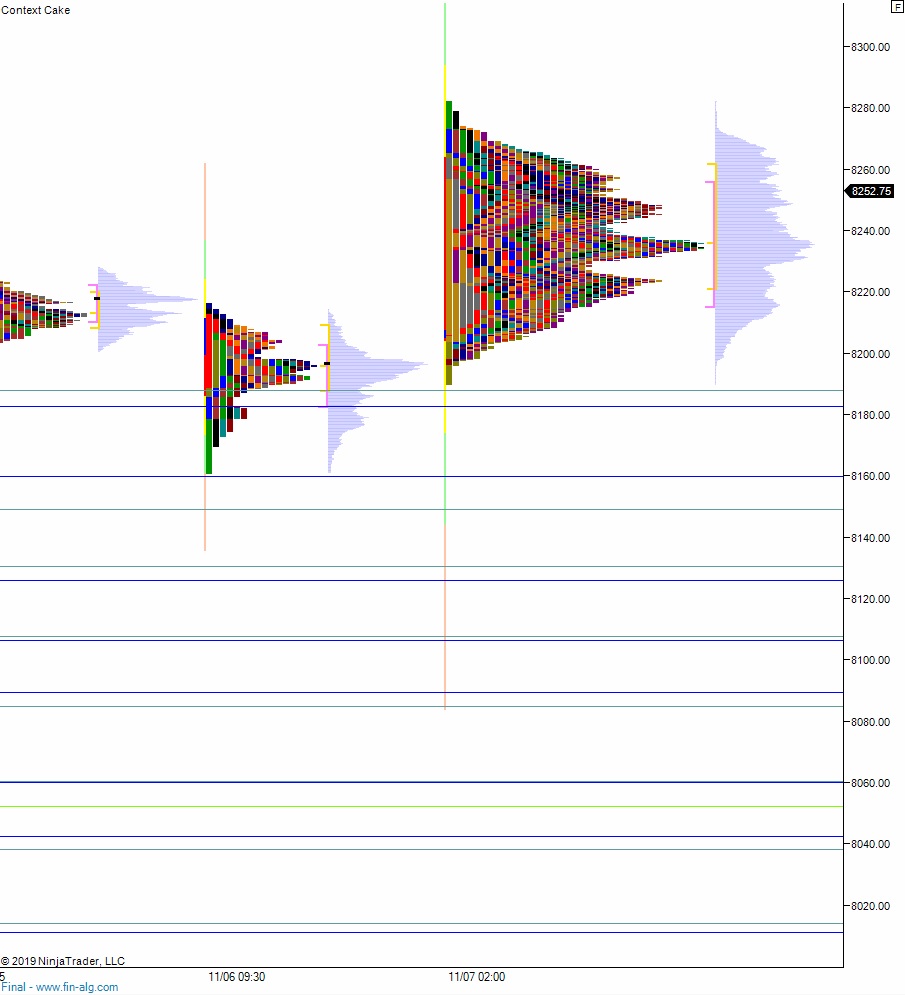

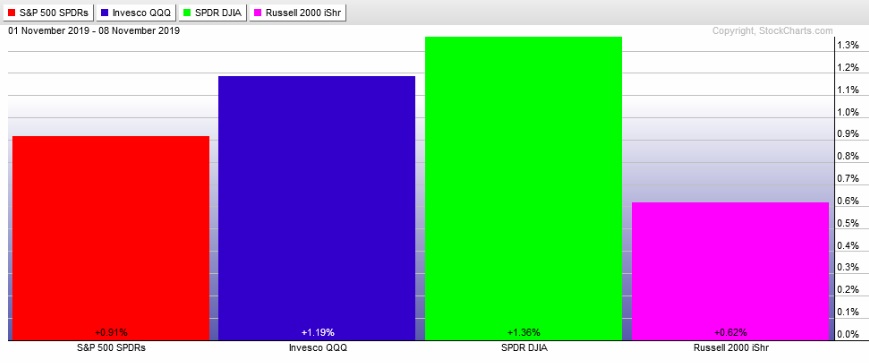

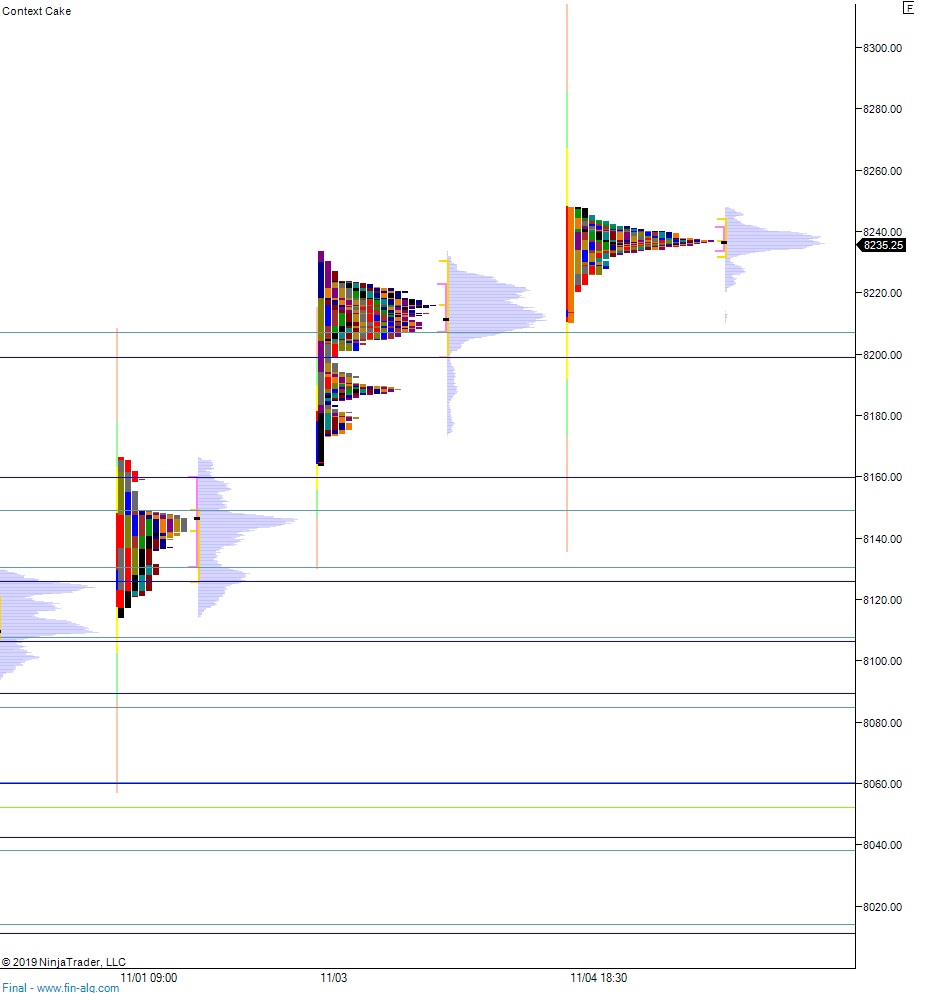

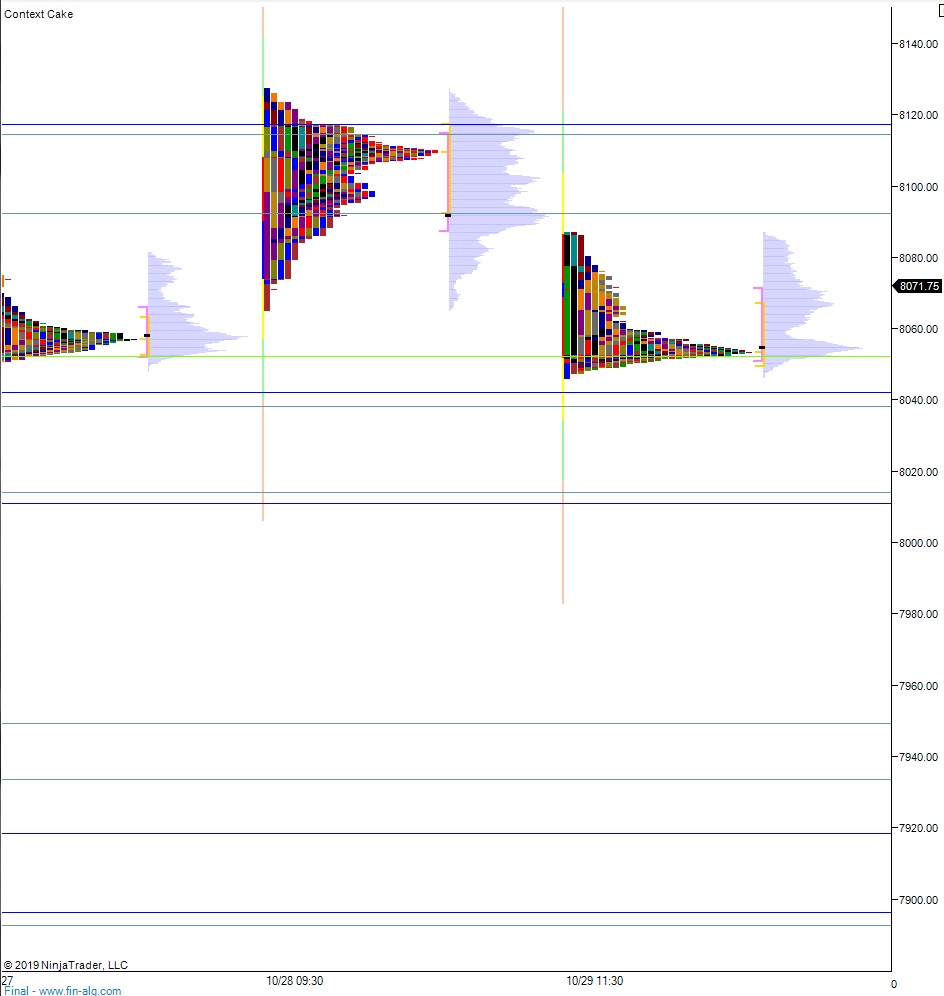

Yesterday we printed a normal variation up. The day began with a gap down that buyers slowly resolved higher. Price then took out overnight high by a few ticks before sellers stepped in and drove price lower. Said sellers were unable to press the futures into a neutral print, instead we rallied back up through the midpoint and saw buyers defending the mid into the bell.

Heading into today my primary expectation is for buyers to work into the overnight inventory, closing the gap up to 8266.50 then continuing up through overnight high 8285.50. Look for sellers up at 8300 and two way trade to ensue.

Hypo 2 stronger buyers trade up to 8336 before two way trade ensues.

Hypo 3 sellers press down through overnight low 8237.50 setting up a move down to 8200 before two way trade ensues.

Levels:

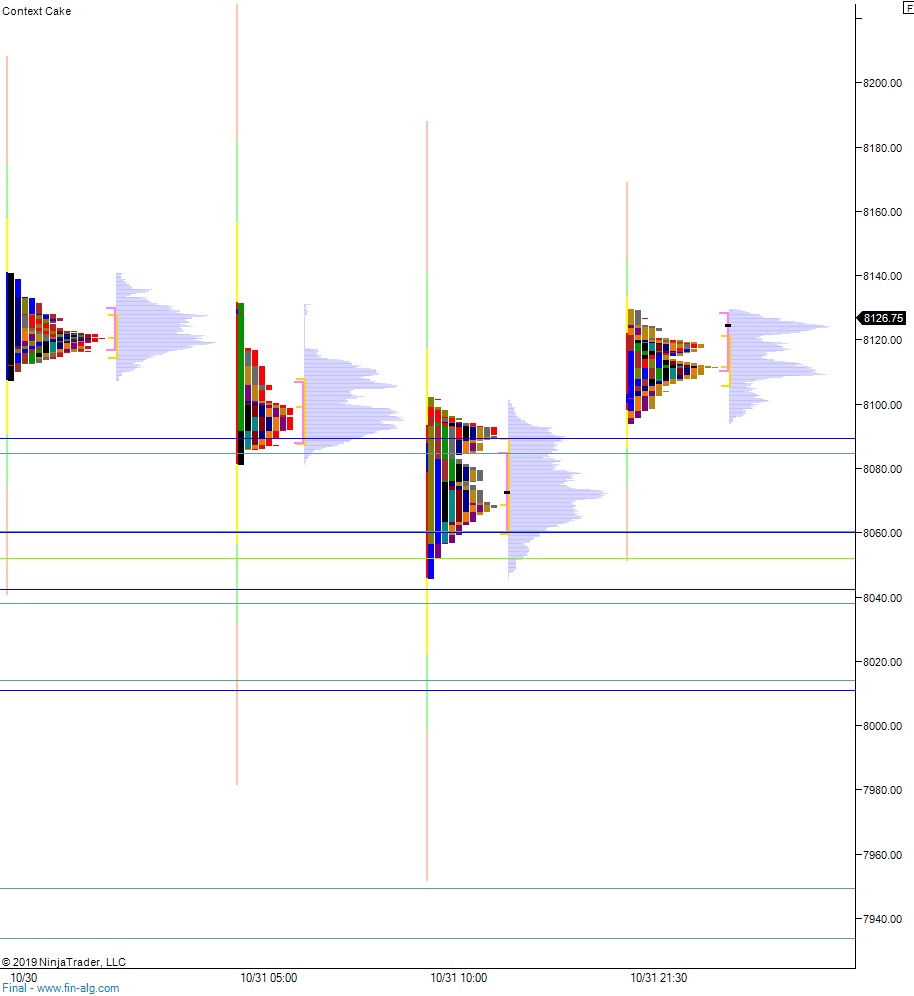

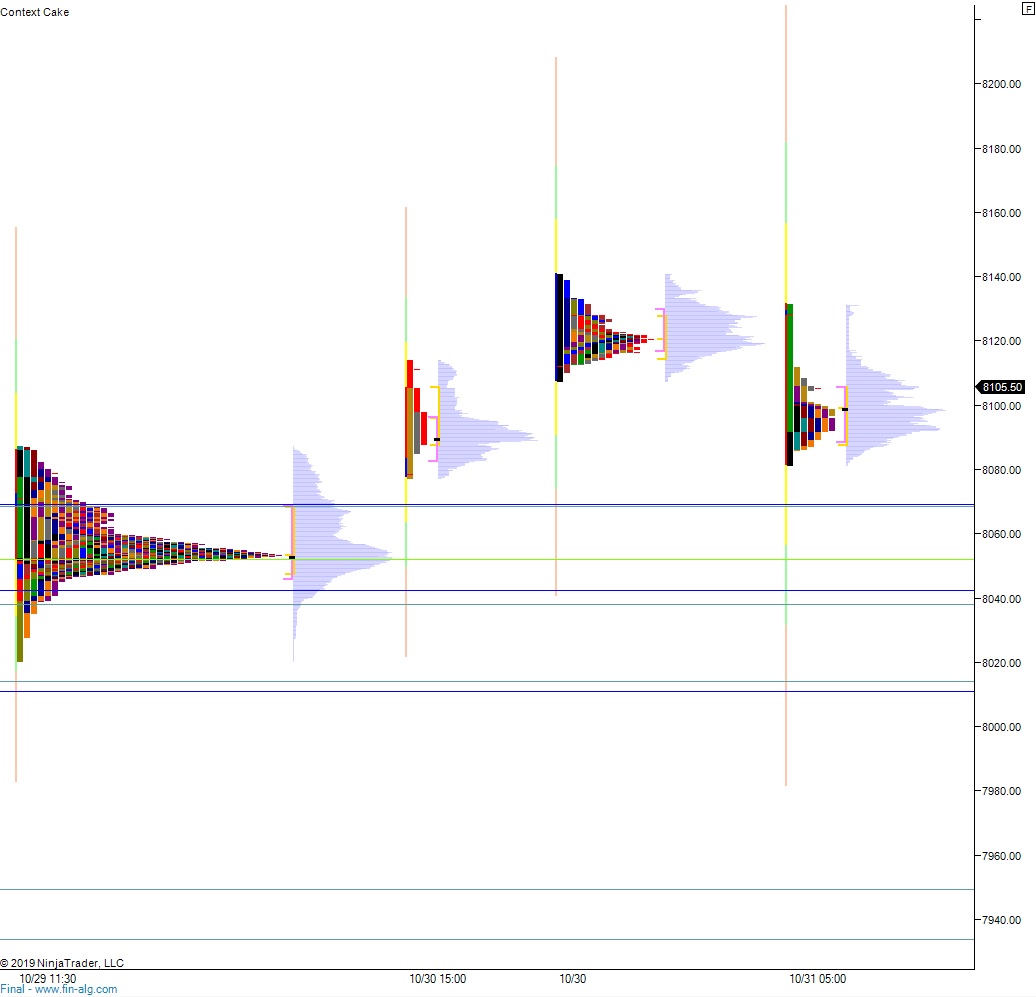

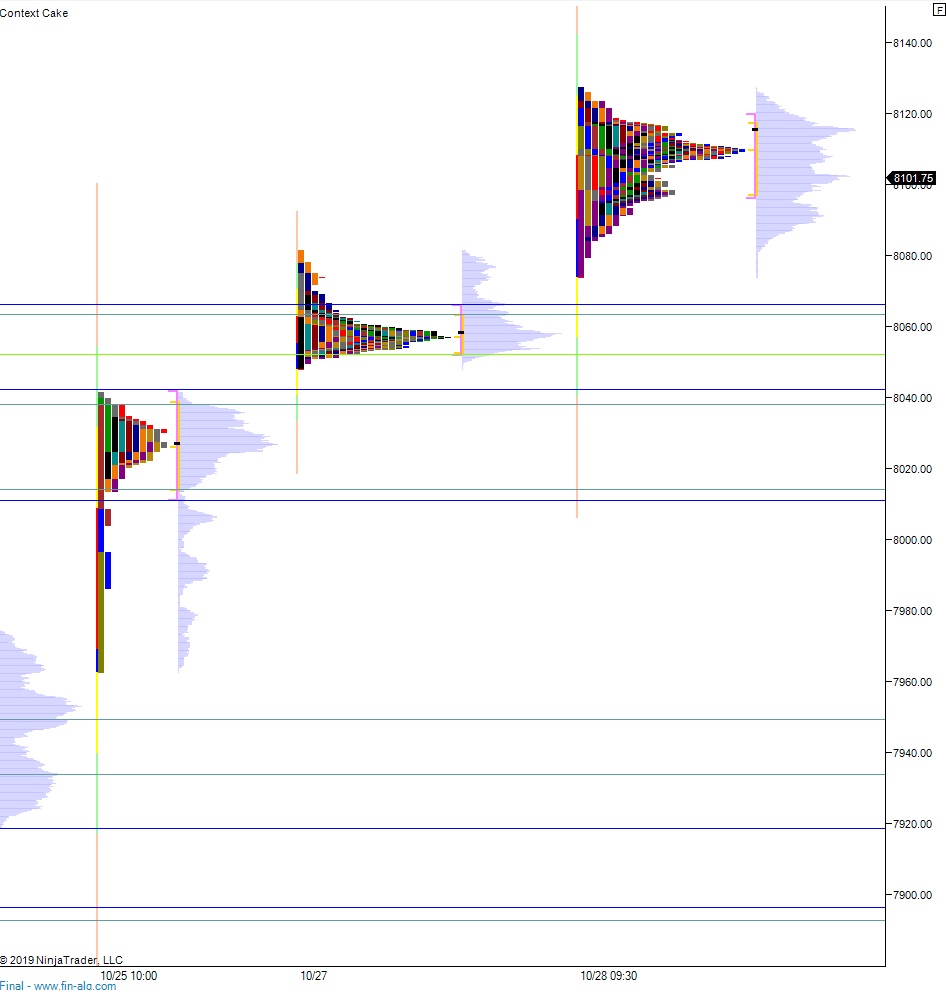

Volume profiles, gaps, and measured moves: