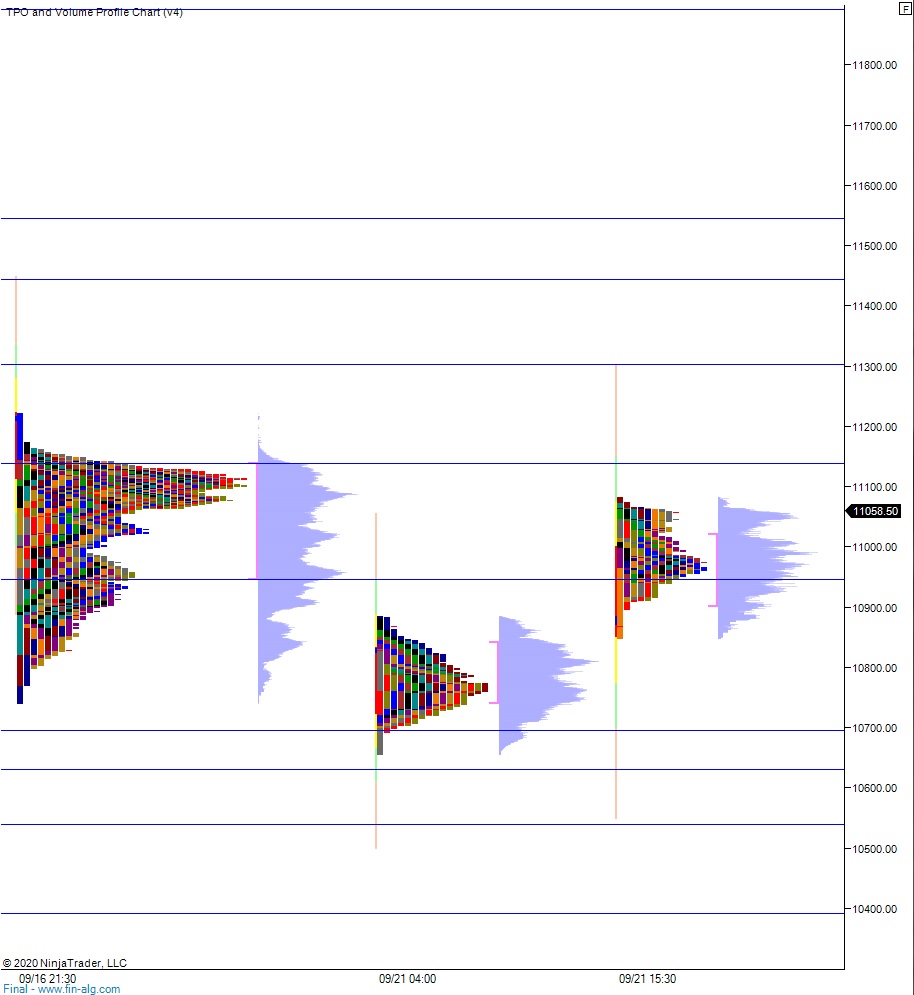

NASDAQ futures are up +100 ahead of opening bell after an overnight session featuring extreme range and volume. Price worked higher overnight, spiking up on the Globex open last night before stabilizing around 11pm New York along the bottom-side of Friday’s midpoint. Then around 3am buyers reclaimed the Friday mid, and as we approach cash open price is hovering right on the mid. At 8am Fed Chairman Jerome Powell discussed the role of the U. S. dollar as reserve currency and said the Fed is taking a closer look at issuing a digital currency. The announcement spiked bitcoin higher but equity markets are so far non-reactive.

Also on the economic calendar today we have housing market index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

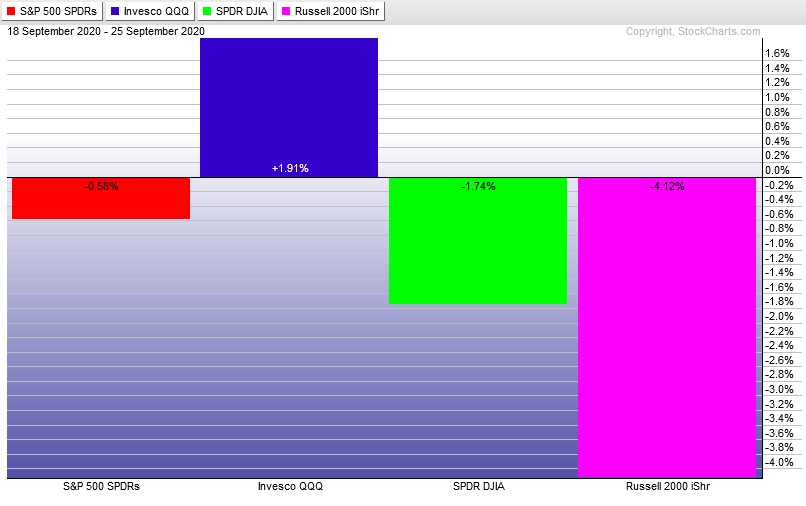

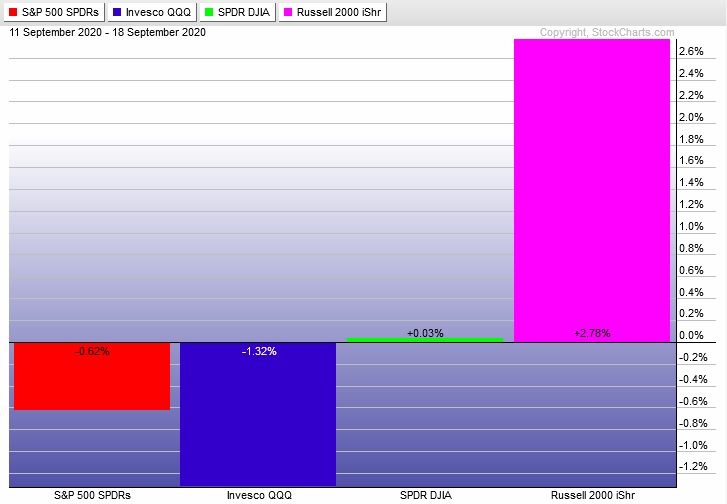

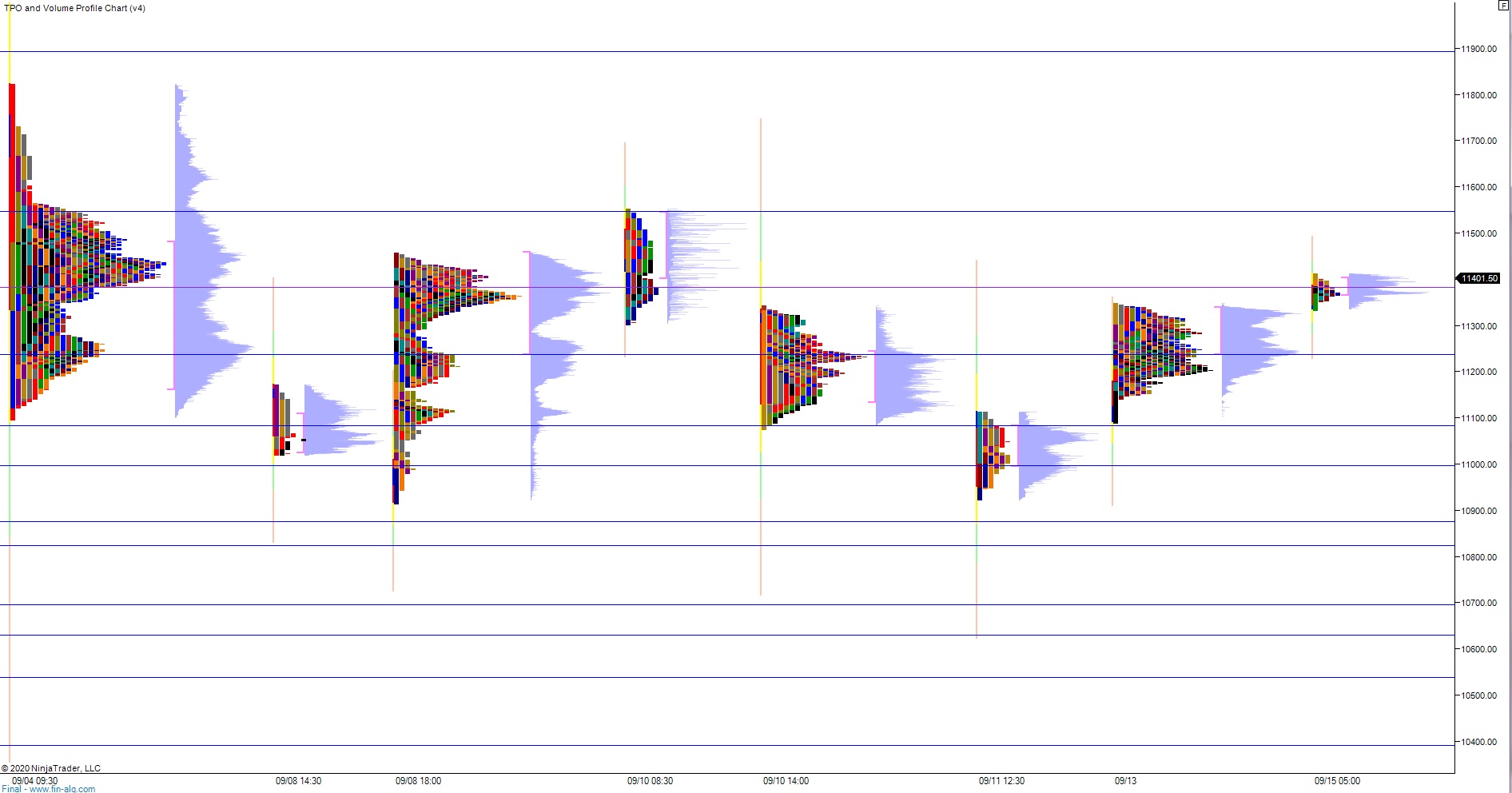

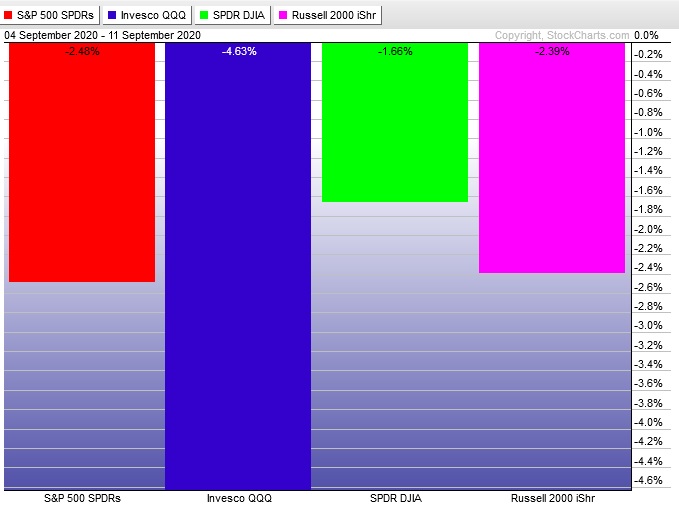

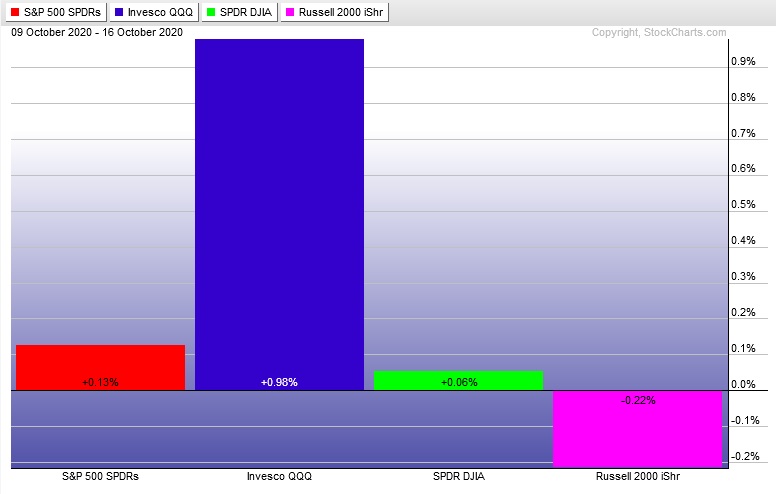

Last week kicked off with a choppy open, slight selling before a big Monday rally. Price consolidated the gains through Wednesday morning. Then selling pressure was seen into the second half of the week and into the weekend. The last week performance of each major index is shown below:

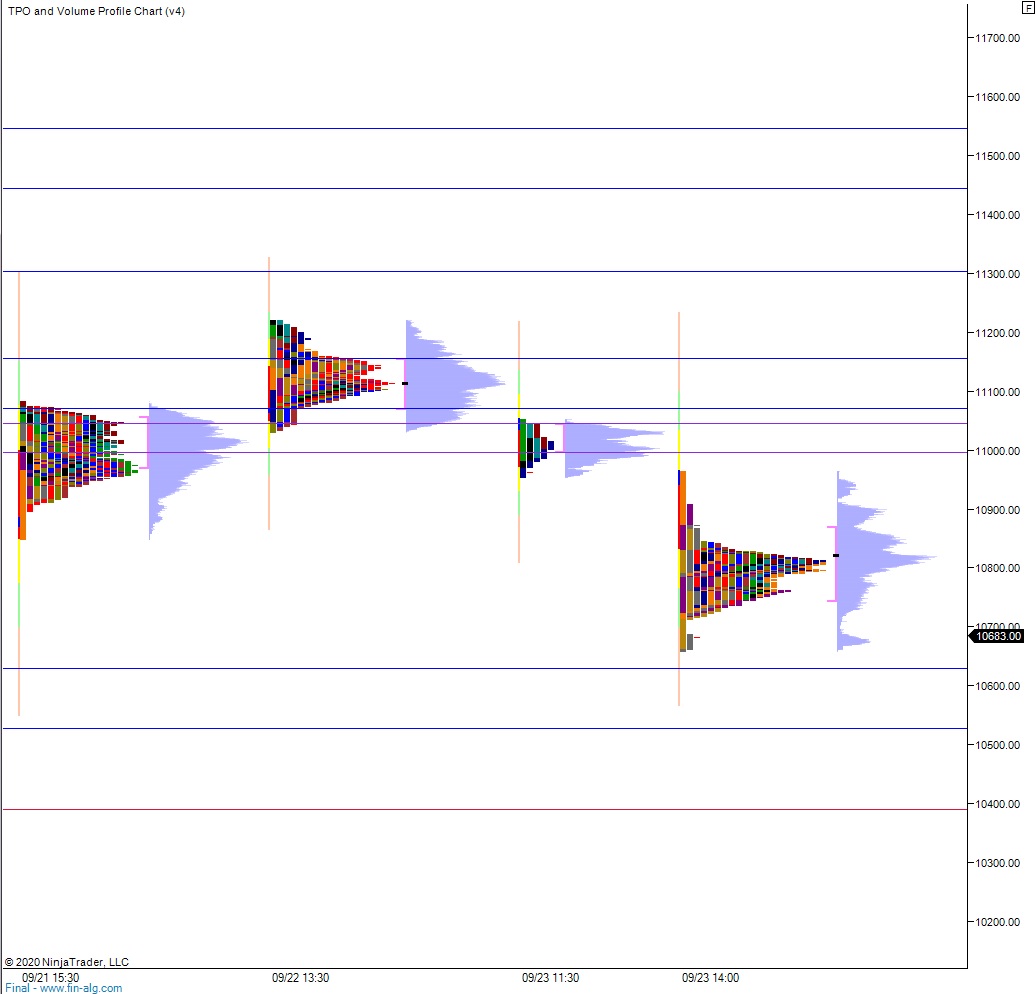

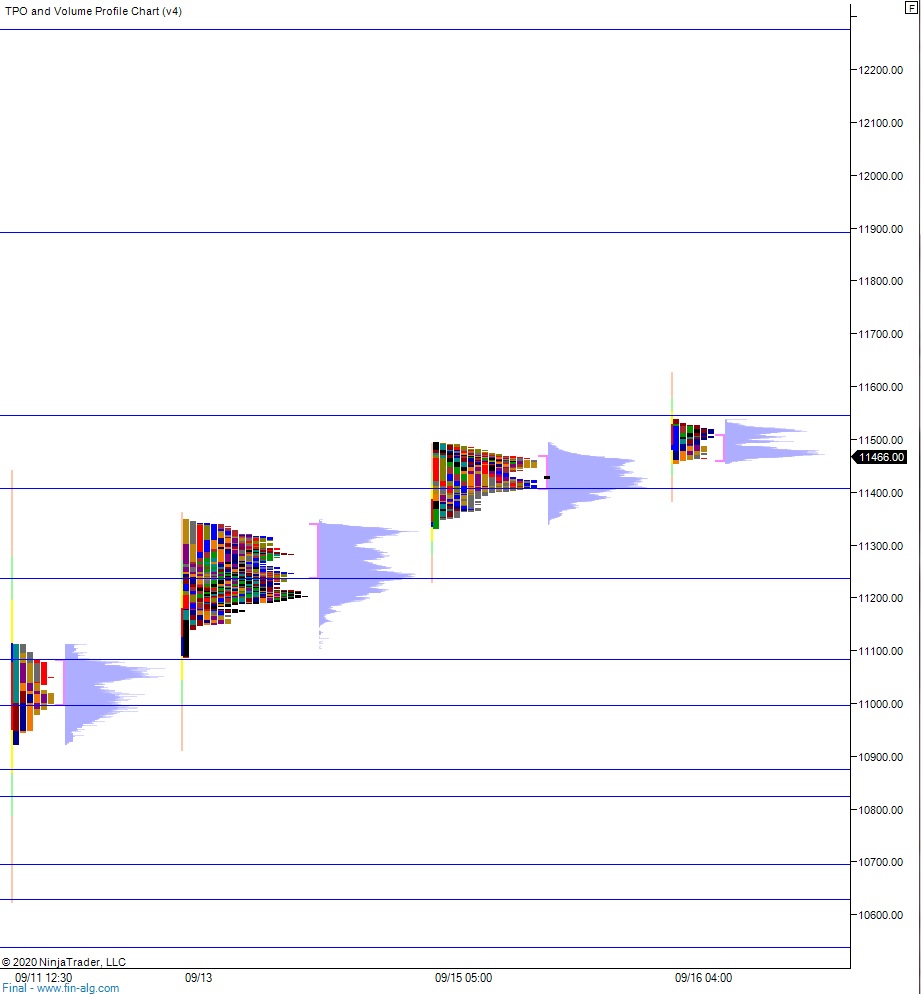

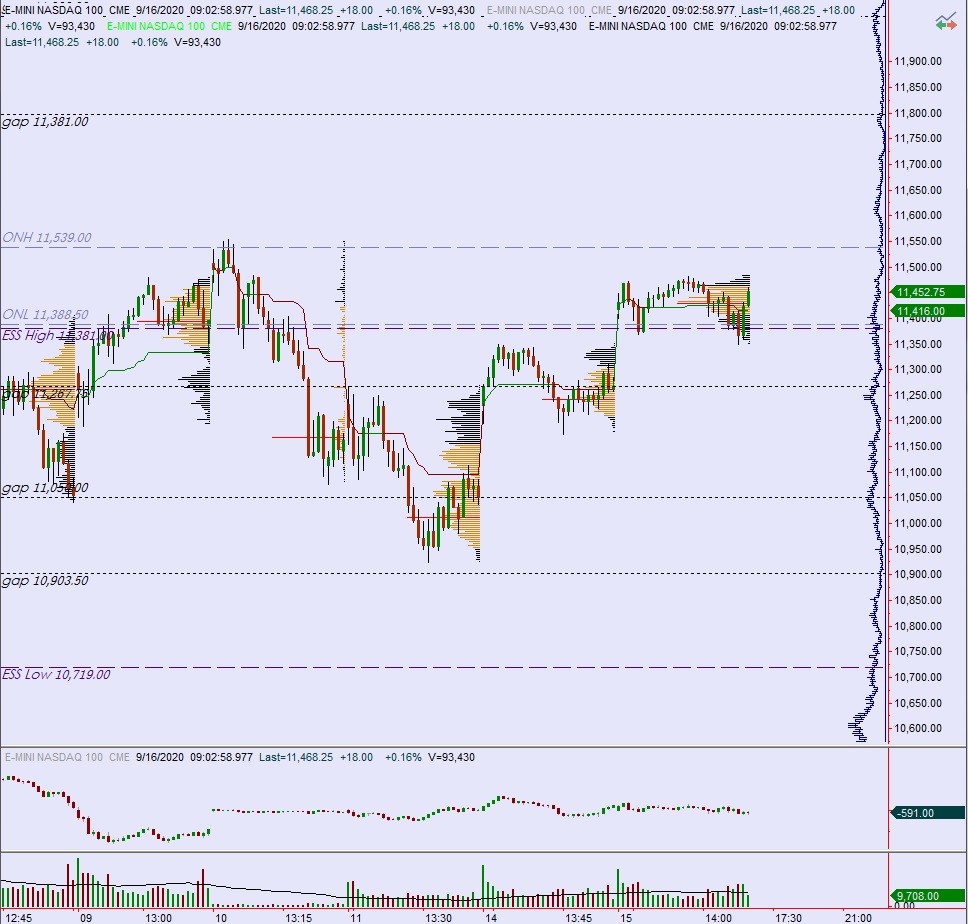

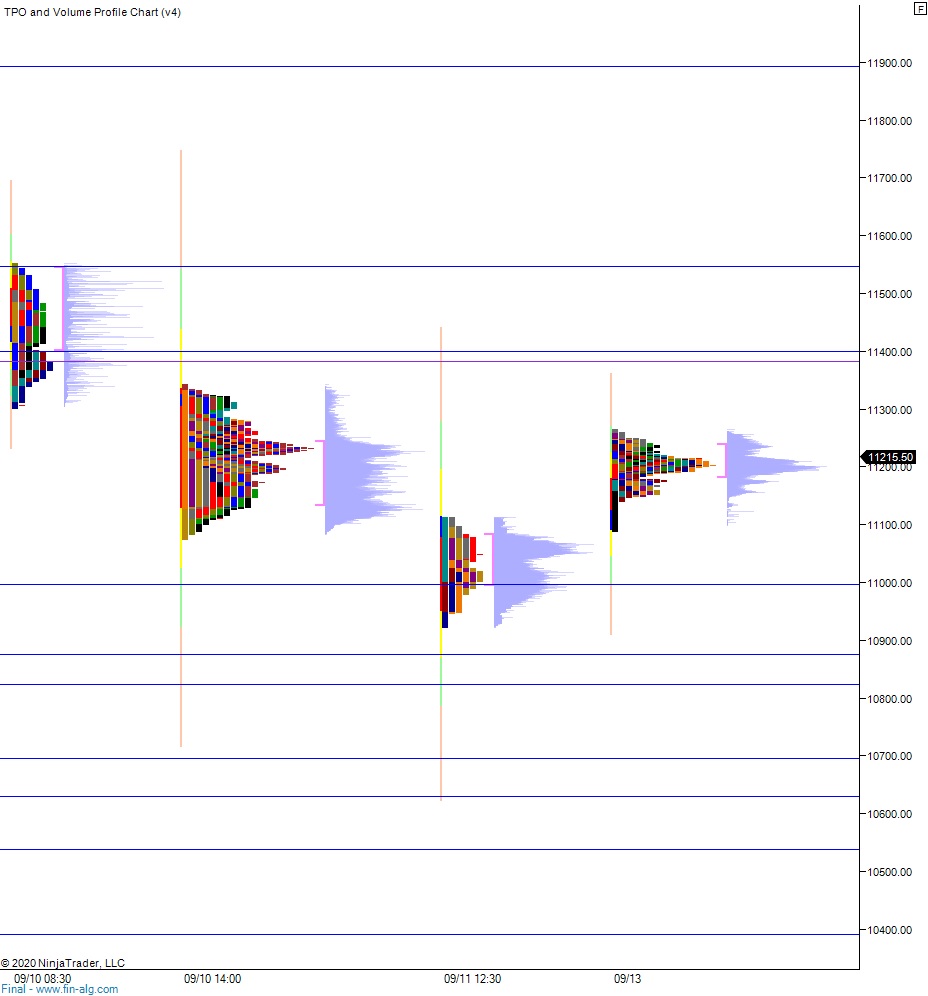

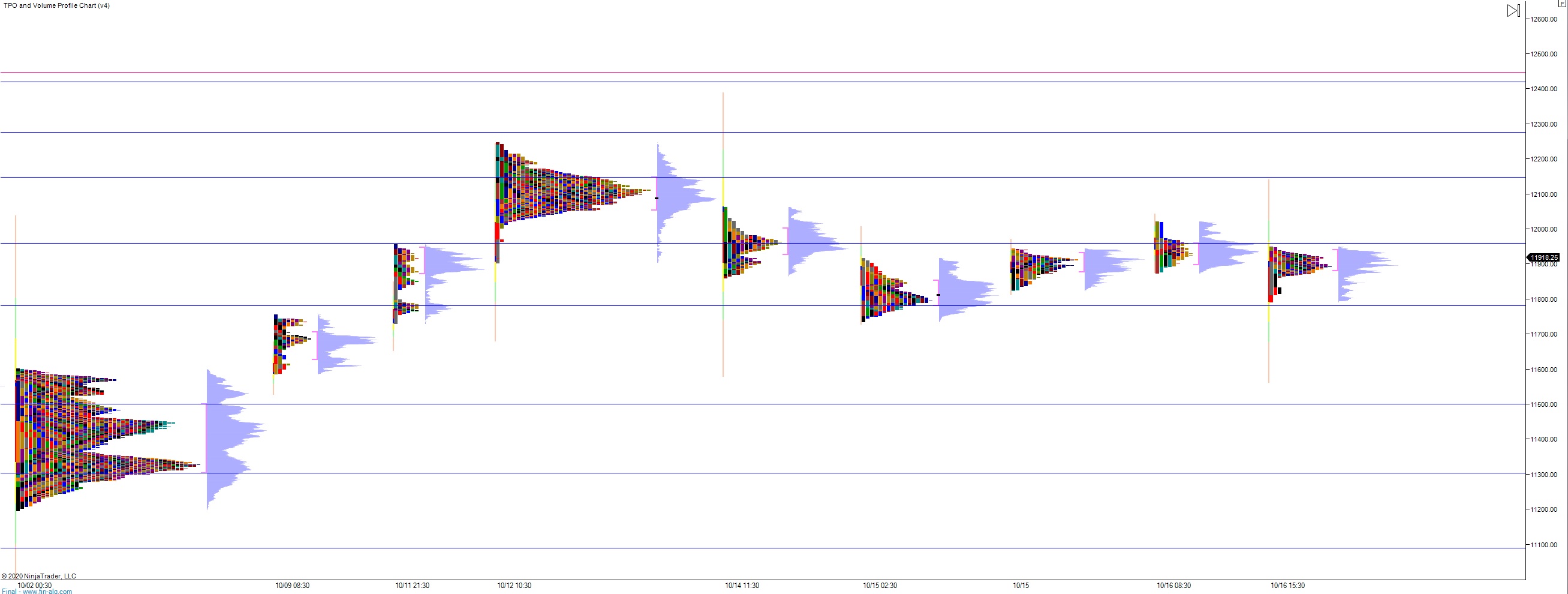

On Friday the NASDAQ printed a normal variation down. The day began with a gap up beyond the Thursday range. Buyers campaigned up into the Wednesday range, tagging the midpoint before 10:30am. Responsive sellers here overwhelmed the big and the auction reversed course—pressing range extension down on its way to closing the overnight gap. Price consolidated here, below the daily mid, for several hours. Then there was strong selling during the closing hour, pressing to to a new session low and tagging the Thursday naked VPOC.

Heading into today my primary expectation is for sellers to work into the overnight inventory and closing the gap down to 11797.75. Sellers continue lower, filling last Friday’s open gap down at 11,726.25 before two way trade ensues.

Hypo 2 buyers gap-and-go higher, taking out overnight high 11,949.25 on their way to tagging 12,000 before two way trade ensues.

Hypo 3 stronger buyers tag 12,037 before two way trade ensues.

Levels:

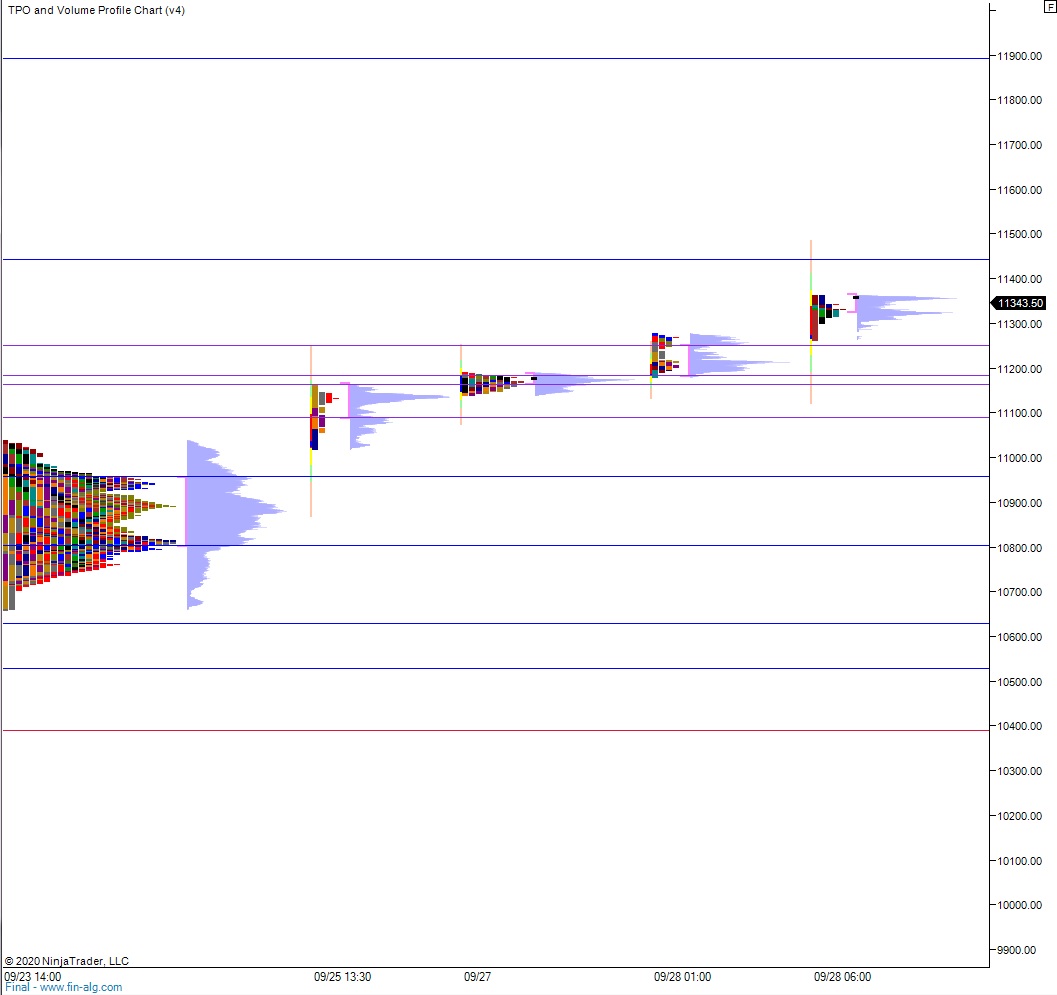

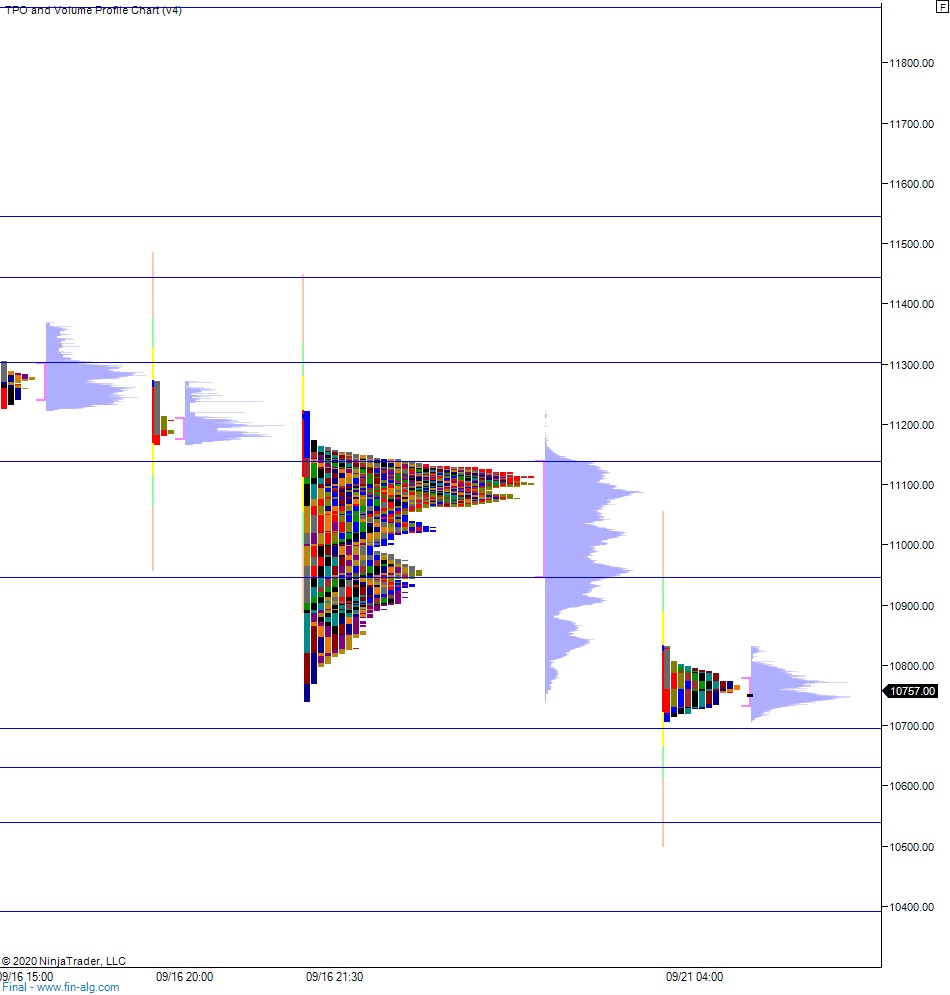

Volume profiles, gaps and measured moves:

gaps and measured moves:

gaps and measured moves: