NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price was balanced overnight, chopping along the Monday high until about 1am when sellers made an attempt lower. Said sellers reversed much of the late Monday afternoon ramp before discovering a strong responsive bid. Buyers took price back up and beyond the Globex high, and as we approach cash open price is hovering up near last Thursday’s high.

On the economic calendar today we have existing home sales at 10am, Fed Chairman Powell speaking at 10:30am and a 2-year note auction at 1pm.

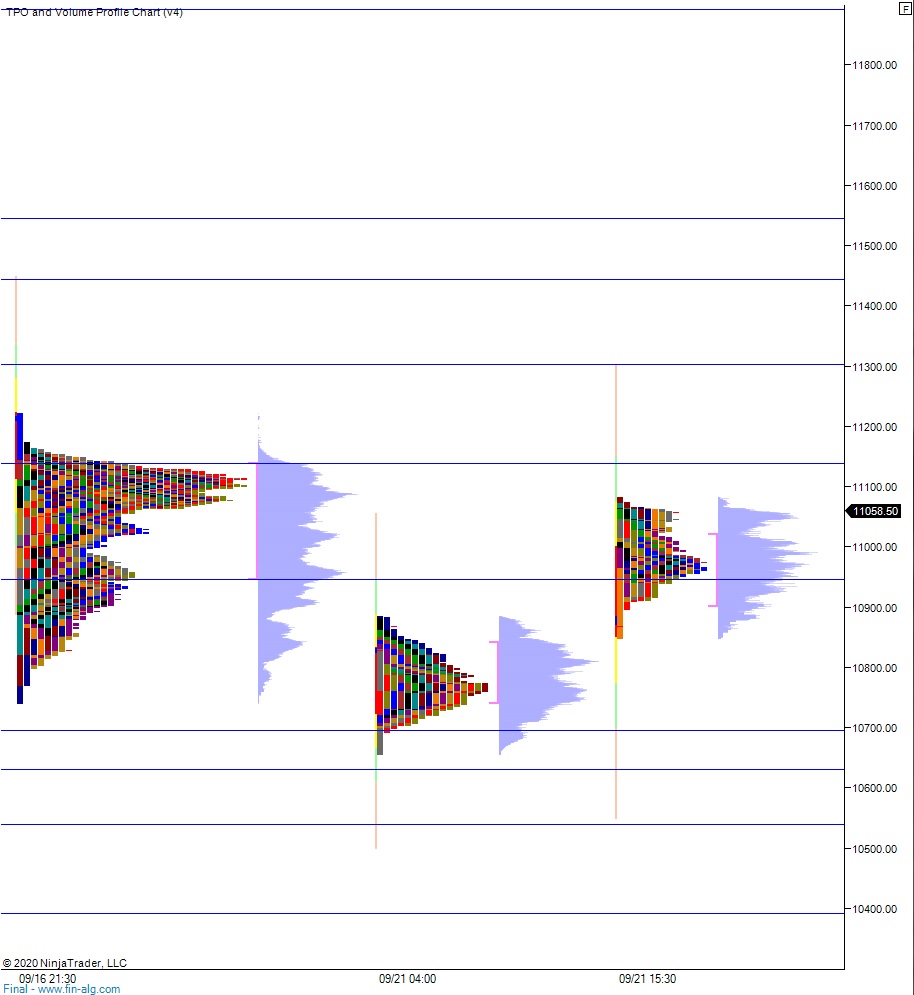

Yesterday we printed a neutral extreme up. The day began with a gap down in range and after a choppy open two-way auction sellers made a move on the lows. Sellers took out last week’s low, trading down into the July 30th range briefly before a strong responsive bid stepped in. There was a battle at the midpoint and we chopped over it a few times before buyers pushed away from it and into a neutral print. Around 3pm we worked back to the midpoint again, buyers defended, setting up a powerful ramp higher into the closing bell. The ramp saw price climb back above last Friday’s midpoint and we ended on session high.

Heading into today my primary expectation is for buyers to gap and go higher, squeezing up to 11,138.25 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 11,138.25 setting up a tag of 11,200 and a gap fill up to 11,252.75 before two way trad ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 10,989. Sellers continue lower, down through overnight low 10,89750 setting up a tag of the Monday VPOC 10,808 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: